25 September 2010

advertisement

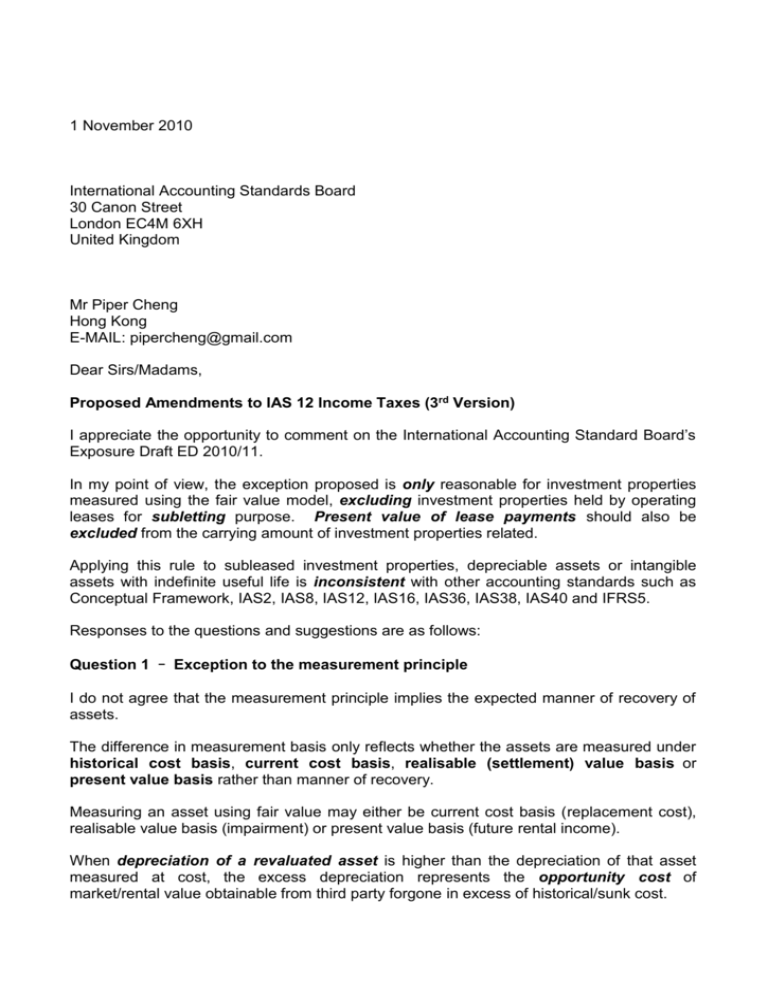

1 November 2010 International Accounting Standards Board 30 Canon Street London EC4M 6XH United Kingdom Mr Piper Cheng Hong Kong E-MAIL: pipercheng@gmail.com Dear Sirs/Madams, Proposed Amendments to IAS 12 Income Taxes (3rd Version) I appreciate the opportunity to comment on the International Accounting Standard Board’s Exposure Draft ED 2010/11. In my point of view, the exception proposed is only reasonable for investment properties measured using the fair value model, excluding investment properties held by operating leases for subletting purpose. Present value of lease payments should also be excluded from the carrying amount of investment properties related. Applying this rule to subleased investment properties, depreciable assets or intangible assets with indefinite useful life is inconsistent with other accounting standards such as Conceptual Framework, IAS2, IAS8, IAS12, IAS16, IAS36, IAS38, IAS40 and IFRS5. Responses to the questions and suggestions are as follows: Question 1 – Exception to the measurement principle I do not agree that the measurement principle implies the expected manner of recovery of assets. The difference in measurement basis only reflects whether the assets are measured under historical cost basis, current cost basis, realisable (settlement) value basis or present value basis rather than manner of recovery. Measuring an asset using fair value may either be current cost basis (replacement cost), realisable value basis (impairment) or present value basis (future rental income). When depreciation of a revaluated asset is higher than the depreciation of that asset measured at cost, the excess depreciation represents the opportunity cost of market/rental value obtainable from third party forgone in excess of historical/sunk cost. Question 1 – Exception to the measurement principle (Continued) Alternatively, if the measurement principle DOES imply the expected manner of recovery of assets, the following contradictions will be arose: 1) inventories measured at cost would imply the inventories would be consumed through use rather than sale; 2) property measured at cost with a residual value equal to the cost would imply the property would be consumed through use while no depreciation is booked; 3) impaired plant and equipment measured at fair value less cost to sale would imply that plant and equipment would be recovered through sales. Therefore, the expected manner of recovery of assets should be consistent with other accounting standards. Any change of expected manner, i.e. change from recovered through use to through sale, should be an indicator of change in accounting policies (e.g. IAS16 to IFRS5) or change in accounting estimates (e.g. useful life 10 years with nil residual value changed to useful life 3 years with residual value of $3million). However, I agree that the exception proposed is reasonable for investment properties measured under fair value model, excluding investment properties held by operating leases for subletting purpose. It will be explained further in the following paragraphs. Question 2 – Scope of the exception I agree that the exception proposed is reasonable ONLY for non-current assets held for sale and investment properties measured under fair value model, excluding investment properties held by operating leases for subletting purpose. It is because if an entity choose fair value model over cost model as a more appropriate accounting policy to measure investment properties, it implies that the company choose to recover the value of investment properties through sale rather than leasing out the properties. Under matching principle of Conceptual Framework, rental income can be matched with depreciation of investment properties if cost model is used. Fair value changes of properties are mainly influenced by the property market and may not reflect the present value of future rental income. For investment properties measured using the fair value model, investment properties held by operating leases for subletting purpose should be expected to be recovered through use rather through sale, unless the right of subletting is transferrable and the entity is able and willing to transferred the right. For property, plant and equipment measured under the revaluation model, the residual value represents the portion of assets recovered through sale. The rest of assets should be subject to depreciation and recovered through use. Different types of tax rates are applicable to different portion of assets. Question 2 – Scope of the exception (Continued) For properties under IAS16, if the property is immediately ready for sale, it may be classified as non-current assets held for sale under IFRS5. The whole amount is expected to be recovered through sale. If the property is not ready for sale, but the entity planned to sale the property after 5 years, it should estimate the residual value based on the property market for that type of age of property as at the reporting date. That residual value is expected to be recovered through sale. For the rest of the property, it is subject to depreciation. For intangible assets with definite useful life, the idea is the same. Only the residual value is expected to be recovered through sale. The rest of the intangible assets are expected to be recovered through use. There is no contradiction and is consistent with other accounting standards. For intangible assets with indefinite useful life, the case is complicated. According to IAS38 paragraph 88, “an intangible asset shall be regarded by the entity as having an indefinite useful life when, based on an analysis of all of the relevant factors, there is no foreseeable limit to the period over which the asset is expected to generate net cash inflows for the entity”. This implies that, if an entity expects to recover all or part of the intangible assets through sale, the period of contribution of net cash inflows would be ended on the date of disposal of the intangible assets. In this case, whether there would be ultimate disposal is the relevant factor, and this factor indicates that there is a foreseeable limit – the date of disposal. Therefore, intangible assets with indefinite useful life should only be recovered through use. If there is change of manner of recovery, the entity should either review its useful life to definite (change in accounting estimate) or if it is ready for sale and meet the requirements under IFRS5, classify the intangible assets as non-current assets held for sale. The residual values or the amounts of non-current assets held for sale are expected to be recovered through sale. Question 3 – Measurement basis used in the exception I do not agree to this measurement basis. This rebuttable presumption ignores the effect of non-cancellable lease signed between an entity (property owner) and a tenant, if any. If the entity signed a ten-year non-cancellable tenancy agreement with the tenant, then significant part of the property would be recovered through use (rental income). Question 3 – Measurement basis used in the exception (Continued) Also, this presumption also contradicts the Exposure Draft of Lease that to recognise a future operating lease receivable (whether non-cancellable or cancellable), the entity will be either deduct the carrying amount of property or recognise an obligation to lease out the property. Besides, investment properties under operating leases for subletting purpose and owneroccupied properties under operating leases under the new IAS17 measured using fair value model can always rebut the presumption. It is better only to apply this measurement basis to investment properties measured under fair value model, excluding investment properties held by operating leases for subletting purpose. And the present value of lease payments should be excluded from the carrying amount of the investment properties too. Classifying present value of lease payments or future minimum lease payments receivable as portion of investment properties recovered through use is objective and practical for accounting and consistent with future or current accounting standards for leases. Refer to Basis of Conclusions paragraph 24 of the Exposure Draft, SIC Interpretation 21 is withdrew as this would imply an investment property held for both rental income (through use) and capital gain (through sales) measured using fair value model would become nondepreciable assets if rebuttable presumption of recovery through sales is applied. The above approach is consistent with SIC interpretation 21 and should be deemed as additional guidance on expected manner of recovery for investment properties under fair value model. Question 4 – Transition Change in expected manner of recovery of assets is no doubt a change in accounting estimate. The application guidance above should be consistent with current standards. This question is very similar to those raised in Basis of Conclusions paragraphs 90 to 100 of IAS38. According to the Board’s conclusions made in 2004, change in accounting estimates should be applied prospectively. It would be inconsistent to IAS8 to apply this amendment retrospectively. Early adoption of this amendment should be allowed similar to the reason for IAS38 and apply this amendment retrospectively only when the amendment is early adopted. However, according to IAS8, change of an accounting estimate can be applied retrospectively only if it is related to error or mistake happened in prior periods, i.e. the expected manner of recovery of assets has already been changed while there was no relevant change(s) in useful life, residual value or applicable tax rate, etc. Question 5 – Other comments In conclusion, this amendment is inappropriate and inconsistent with the existing accounting standards and framework. The basis of conclusions of SIC Interpretation 21 should be further clarified instead of being replaced. Measurement principle, at fair value or at cost, only reflects whether the assets are measured under current/opportunity cost basis or historical cost basis, but not the manner of recovery. Intangible assets with indefinite useful life can only be recovered through use according to its definition per IAS38 paragraph 88. For other intangible assets and property, plant and equipment, residual value represents amount of asset to be recovered through sale. Depreciable amount represents portion to be recovered through use. The exception and rebuttable presumption proposed are only reasonable for investment properties measured using the fair value model, excluding investment properties held by operating leases for subletting purpose. Present value of lease payments should also be excluded from the carrying amount of investment properties related. Accounting policy (IAS16/38 or IFRS5) or accounting estimates (useful life and residual value) chosen by the entity should be sufficient enough to dictate the manner of recovery of assets except for the above investment properties. Change in expected manner of recovery of assets is an indicator of change in accounting estimate. Amendment due to change in manner of recovery, which is an accounting estimate, should be applied prospectively rather than retrospectively unless the change is resulted from prior period error made or an early adoption is made. I am looking forward to seeing the reply and feedback from the Board. Thank you for your kind attention. Yours faithfully, Mr. Piper Cheng (B.S.Sc. (Hon) Economics, Registered Student of HKICPA)