INVESTMENT PROPERTY LEDGER CARD (IPLC) INSTRUCTIONS

advertisement

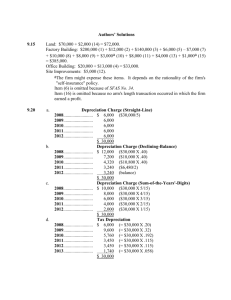

INVESTMENT PROPERTY LEDGER CARD (IPLC) INSTRUCTIONS A. The IPLC shall be maintained by the Accounting Division/Unit for each class of investment property. The Accounting Staff in charge of maintaining this ledger shall record promptly the acquisition, description, custody, estimated life, depreciation, impairment, disposal, repair history and other information about the property. It shall be prepared by fund cluster. B. This ledger shall be accomplished as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Entity Name – name of the agency/entity Fund Cluster – the fund cluster name/code in accordance with the UACS Investment Property – name of the investment property Description – description of the investment property UACS Object Code – object code in accordance with the UACS Estimated Useful Life – estimated period over which the investment property is expected to be available for use by the entity Rate of depreciation – rate of depreciation per month to be recorded in the books of accounts depending on the date of acquisition; that is during the month, if acquired on or before the 15th day of the month or ensuing month, if acquired after the 15th day of the month. It shall be computed using the straight-line method of depreciation. Date – date of acquisition, recognition of depreciation/impairment, or disposal Reference – reference document used as a basis in recording the acquisition, recognition of depreciation/impairment, or disposal of the investment property Acquisition-Qty. – quantity of the investment property received based on source documents Acquisition-Cost/Fair Value per Unit – cost/fair value per unit of the investment property Acquisition-Total Cost/Fair Value – total cost/fair value of the investment property (Qty. x Cost/Fair Value per Unit) Accumulated Depreciation – the amount of depreciation charged to the investment property Accumulated Impairment Loss – the amount of impairment loss charged to the investment property Carrying Amount – the difference between the total cost/fair value of the investment property less the accumulated depreciation, impairment loss or adjustments, if any Disposal – amount of investment property disposed Remarks – important information, observation or comment about the investment property C. The IPLC shall be reconciled with the inventory of the asset and the control accounts and any discrepancies shall be immediately verified and adjusted. 168