C2 Managing fixed income investments

advertisement

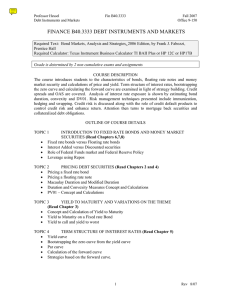

C2 Managing fixed income investments Seminar outline (4 ½ days) DAY ONE Morning: Bond structures: 1. Fixed income securities. 2. Basic principles of return calculations: a) time value of money; b) internal rate of return; c) yield to maturity. 3. Variant payment structures: a) zero coupon bonds; b) bonds with call and put features; c) sinking funds and purchase funds. 4. Calculation of returns with variant payment structures: a) yield to call; b) yield to average life. 5. Payment periodicity and quotation conventions. Afternoon: Risks and trading: 1. The yield curve: a) illustrative yield curves; b) basic analysis; c) constructing the zero curve; d) the yield curve as reference. 2. Sensitivity of bond prices to yield. 3. Risk in fixed income securities. 4. Rating agencies. 5. Evaluating non-interest rate risk in bonds. 6. Bond trading techniques: a) objectives; b) recognising value; c) switches; d) hedging; e) arbitrage. DAY TWO Morning: Short term derivatives: 1. Use of futures. 2. U.S. Treasury long bond future. Copyright © 2002 Egan Associates 3. 4. 5. 6. 7. 8. Basis risk and trading in futures. Futures users. Prospects for the futures markets. Interest rate options. Repurchase agreements. Role of CEDEL and Euroclear and other clearing systems. Afternoon: 1. Computer based simulation on fixed income products, futures and options. DAY THREE Morning: Options: 1. Peculiar risks of options. 2. Construction of options hedges: a) techniques; b) limitations. 3. Using the options pricing software: a) price analysis; b) price manipulation; 4. Review of options variants: a) principles of options variants; b) average rate options; c) knock-out options; d) lookback options; e) participating forward contracts; f) digital options; g) barrier options; h) other currency option products. Afternoon: Interest rate swaps: 1. The structure of interest rate swaps. 2. Interest rate swap risks. 3. Asset swaps and asset swap packages 4. Swaps mathematics and pricing using zero coupon curves 5. Marking swaps to market. DAY FOUR Morning: Currency swaps: 1. The structure of currency swaps. 2. Additional risks of currency swaps. Copyright © 2002 Egan Associates 3. Hedging interest rate swaps. 4. Trading and warehousing interest rate swaps. 5. Unwinding and assigning swaps. Afternoon: Interest rate options: 1. Basic concepts of interest rate options. 2. Interest rate guarantees: a) as options on forward rate agreements (“FRAs”); b) lender’s and borrower’s options. 3. Caps/floors/collars: a) zero cost products; b) comparison to swaps. 4. Interest rate risk management: techniques using product constructions. 5. Bond options. 6. Options on bond futures. 7. Dynamic management of derivatives portfolios. 8. IT and accounting issues. DAY FIVE Morning: Managing the risk: 1. Risk control and monitoring of credit risks. 2. Netting: a) by novation; b) bi-lateral; c) multilateral. 3. Credit risk analysis: a) traditional approach; b) from first principles. 4. Pricing techniques. 5. Default probability analysis. 6. Correlation analysis. 7. Default models. 8. The role of ratings agencies. 9. Utility of loss analysis. 10. Portfolio analysis. 11. Using credit derivative products. Copyright © 2002 Egan Associates