FINA 2200 - Metropolitan Community College

advertisement

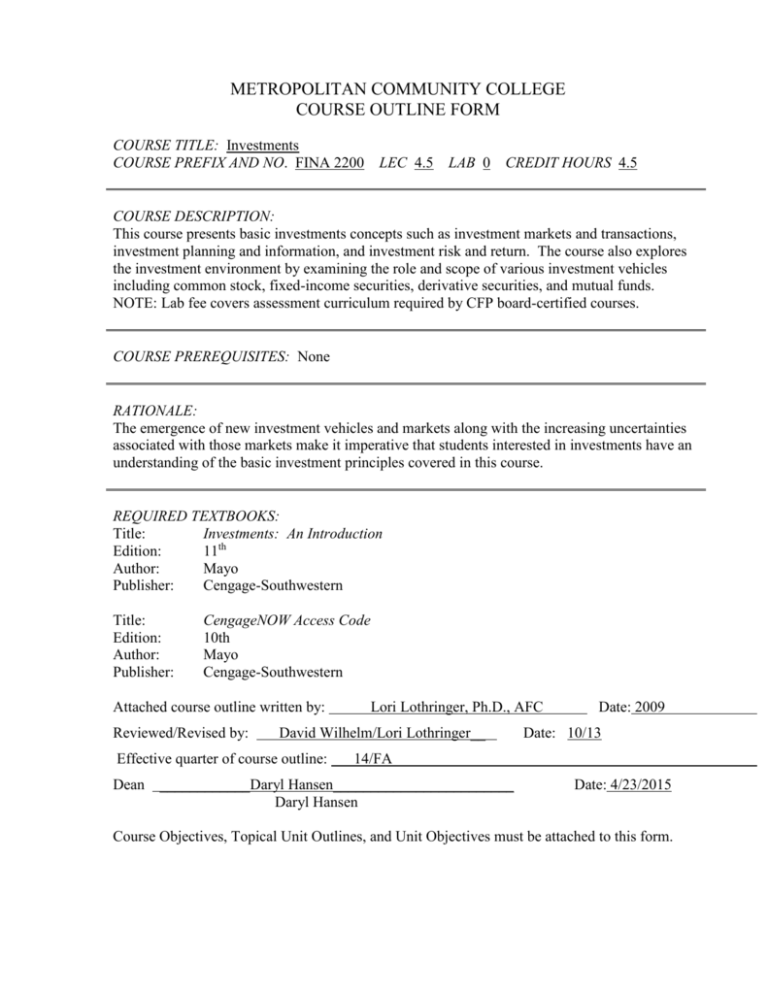

METROPOLITAN COMMUNITY COLLEGE COURSE OUTLINE FORM COURSE TITLE: Investments COURSE PREFIX AND NO. FINA 2200 LEC 4.5 LAB 0 CREDIT HOURS 4.5 COURSE DESCRIPTION: This course presents basic investments concepts such as investment markets and transactions, investment planning and information, and investment risk and return. The course also explores the investment environment by examining the role and scope of various investment vehicles including common stock, fixed-income securities, derivative securities, and mutual funds. NOTE: Lab fee covers assessment curriculum required by CFP board-certified courses. COURSE PREREQUISITES: None RATIONALE: The emergence of new investment vehicles and markets along with the increasing uncertainties associated with those markets make it imperative that students interested in investments have an understanding of the basic investment principles covered in this course. REQUIRED TEXTBOOKS: Title: Investments: An Introduction Edition: 11th Author: Mayo Publisher: Cengage-Southwestern Title: Edition: Author: Publisher: CengageNOW Access Code 10th Mayo Cengage-Southwestern Attached course outline written by: Reviewed/Revised by: Lori Lothringer, Ph.D., AFC David Wilhelm/Lori Lothringer__ Effective quarter of course outline: Date: 2009 Date: 10/13 14/FA Dean ____________Daryl Hansen________________________ Daryl Hansen Date: 4/23/2015 Course Objectives, Topical Unit Outlines, and Unit Objectives must be attached to this form. COURSE OBJECTIVES/TOPICALUNIT OUTLINE/UNIT OBJECTIVES TITLE: Investments PREFIX/NO. FINA 2200 NOTE: You may want to consider including this disclaimer in your syllabi. It has been reviewed by the college lawyers. Your instructor in this class will be a teacher and facilitator. Your instructor will help you gain knowledge in you quest to become an informed and possibly skilled investor. However your instructor WILL NOT act as a financial or investment counselor or advisor. While numerous investment techniques and philosophies will be discussed and analyzed in the course, your instructor will not make specific investment suggestions or offer investment advice to students. Nothing your instructor may say or do should be interpreted as making an investment recommendation. Neither your instructor nor the College are or will be responsible for nay investment decisions you may make during or after the completion of your attendance in the course. You assume any and all risks regarding any investment decisions you may make. COURSE OBJECTIVES: I. Analyze the current investment environment. II. Review various investment conceptual tools. III. Evaluate the basic features of common stock investments and explain how these vehicles are used in the investment process. IV. Evaluate the basic features of fixed-income securities and explain how these vehicles are used in the investment process. V. Compare and contrast the tools and techniques used to manage and administer a successful investment portfolio. VI. Evaluate the basic features of derivative securities and explain how these vehicles are used in the investment process. TOPICAL UNIT OUTLINE/UNIT OBJECTIVES: UNIT I. Current Investment Environment A. Investigate various investment vehicles (explaining specific advantages, disadvantages, and use of each), and discuss their role in the investment process. B. Describe the purpose and process of establishing an investment plan. C. Discuss the function, purpose, and regulation of financial markets, financial institutions, and the financial services industry. D. Discuss specific aspect of business law as it relates to the investment process (e.g. insider trading, etc.). E. Explain the growing importance of the globalization of various markets. F. Analyze the availability and value of investment information and discuss effective utilization of Internet investment resources. UNIT II. A. B. C. D. E. UNIT III. A. B. C. D. E. F. UNIT IV. A. B. C. D. E. F. Important Conceptual Tools Identify the components of return and discuss various techniques utilized to measure investment returns. Isolate various types of risk as they relate to investment alternatives and explain how these measures of risk are quantified. Explain the time value of money and utilize time-value calculations to select among various investment alternatives. Utilize the capital asset pricing model (CAPM) to estimate return. Discuss how economic information and concepts should be integrated with the investment process. Investing in Common Stocks Explain the basic features and characteristics of common stock investments. Discuss the types and uses of common stock investments. Explain the analytical dimensions of stock selection including: security analysis; economic analysis; industry analysis; and fundamental analysis. Apply various quantitative stock valuation models and methods when determining how a stock should be valued. Explain the role of technical analysis. Describe the application and reliance on random walk and efficient markets hypothesizes. Investing in Fixed-Income Securities Explain the basic features and characteristics of fixed-income securities. Discuss the types and uses of fixed-income securities. Explain the behavior of market interest rates and the pricing of bonds. Utilize various quantitative measures when assessing bond yields and returns. Explain the basic features and characteristics of preferred stocks and convertible securities. Discuss the types and uses of preferred stocks and convertible securities. UNIT V. A. B. C. D. E. F. UNIT VI. A. B. C. D. E. F. Portfolio Management Discuss the principles of portfolio planning including management and measurement concepts. Compare and contrast traditional versus modern portfolio theory. Describe how an individual investor formulates a portfolio plan and determine the role of a professional portfolio manager. Describe how an individual investor assesses portfolio performance and determines when to make portfolio changes. Explain the application of asset allocation and portfolio diversification in portfolio management. Explore various investment strategies as they relate to the investment process and portfolio management. The Role of Mutual Funds and Derivative Securities Discuss the various types and uses of mutual funds explaining basic features and characteristics. Explain the basic features and characteristics of put and call options. Discuss various hedging and options strategies. Analyze the risk and return potential associated with put and call options. Explain the basic features and characteristics of warrants and discuss how warrants are utilized by investors. Analyze the risk and return potential associated with warrants. COURSE OBJECTIVES/ASSESSMENT MEASURES COURSE OBJECTIVES Explore the current investment environment. Review various investment conceptual tools. Describe the basic features of common stock investments and explain how these vehicles are used in the investment process. Describe the basic features of fixedincome securities and explain how these vehicles are used in the investment process. Explain the tools and techniques used to manage and administer a successful investment portfolio. Describe the basic features of derivative securities and explain how these vehicles are used in the investment process. ASSESSMENT MEASURES Online Homework Assignments Investment Case Analysis Quiz, Tests Online Homework Assignments Investment Case Analysis Quiz, Tests Online Homework Assignments Investment Case Analysis Quiz, Tests Online Homework Assignments Investment Case Analysis Quiz, Tests Online Homework Assignments Investment Case Analysis Quiz, Tests Online Homework Assignments Investment Case Analysis Quiz, Tests Technology Tool: Students will utilize Internet resources to explore basic investment information regarding the current economic environment, basic conceptual tools, common stock investments, fixed income securities, portfolio management, and derivative securities. International Dimension: Students will investigate various international investment issues and topics related to global investing. Ethical Breadth: Students will explore ethical issues regarding the treatment of assorted investment issues in various cultures and countries.