REVISED SCHEDULE VI- An Analysis Introduction From, a considerable

advertisement

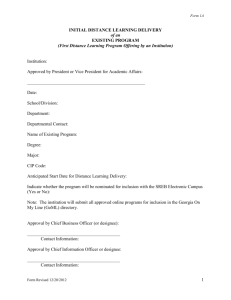

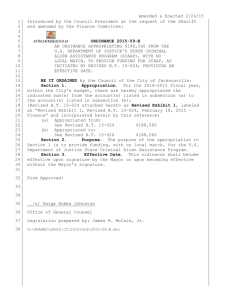

REVISED SCHEDULE VI- An Analysis Introduction From, a considerable time, it was felt by many professionals that Schedule VI of the Companies Act 1956 has become outdated. This deficiency of the Act has been felt time and again, particularly when new standards in respect of deferred Taxes, Intangibles, leases, consolidation etc were introduced. The big question before all of us was, how to fit the disclosures under these standards in the schedule VI format. More often it was like fixing a square peg in a round hole. Take an example here, deferred Tax or Tax liability is a non current asset item. Schedule VI does not prescribe any prescription on where and how to disclose Non current assets and liabilities. The fixed Assets are required to disclose in full but don’t have any separate line for Intangibles asset as he same is stacked with fixed assets line item, which is contrary to international practice. There was also a feeling that schedule VI is not flexible and can not cover all type of industries. Financial statements are predominantly for the benefit of investors and other stake holders. The stake holders do cover the suppliers, lenders and tax authorities. There were also many items which were irrelevant like Amount outstanding towards SSI, CIF value of Imports, Expenditure in foreign currency, capacity details etc. So by and large a strong voice was raised by investors that they are being fed by meaningless information. It w true to some extent as licensed capacities are the word of history for our industry, Foreign currency issue is no longer a burning issue. They were introduced when it was required for society but now become purposeless. One of the significant deficiencies of the Schedule VI was that it was not having any profit & loss format. Only items that need to be disclosed in the profit and loss account were set out. Thus it was possible for a company to follow easy format in place of usual profit and loss account and still be compliant with the act. So there was a need of the hour, that schedule VI be change and it should change openness so that future changes and coming up standards may get a right place in to it and it should carry the disclosures in full. Now , we would like to visit the birth place of Schedule VI. There is a section 211 in the companies Act which prescribes the form and content of Balance Sheet and profit and loss account.We should keep in mind that the violation attracts six months imprisonment. Lets share a small case of disclosure and violation of this section in the recent past.Section 293 A requires disclosure of contribution to political party. A company failed to disclose the same thus contravene the provision of section 293A (4). The ROC issued ashow cause notice that why a prosecution be not launched against them. The company sought compounding in their application. The ROC forwarded it to Regional Director who in turn forwarded to CLB as the offence is not compoundable by virtue of section 293A(5). CLB in its decision has compounded the offence under Section 629A. Section 293A(4) requires disclosure of the political contribution. Section 293A(5) contains the penal provision and states “if a company makes contribution in contravention of this section the company shall be punishable with fine which may extend to three times the amount so contributed, and every officer in default shall be punishable with imprisonment for a term which may extend up to 3 years and shall also be liable to fine….”. It was held that the penalty would apply only to contravention of the provisions relating to contribution and not to default in disclosure. Therefore, the contention of ROC that the offence of non-disclosure against the officers in default cannot be compounded in view of the penalty of fine and imprisonment cannot be sustained. For various reasons mentioned above, it is not advisable that presentation and disclosure requirements be legislated by way of a Schedule to the Act, rather it should be left to be legislated in the form of an Accounting Standard on the lines of International Accounting Standard (IAS) 1 – “Presentation of Financial Statements” which when read together with other IFRS’s would not only provide a true and fair view of financial statements across a wide variety of industries but would also be flexible enough to subject itself to quick changes from time to time. Another point in support of adopting an Indian Standard on the lines of IAS 1 is that it does not contain the deficiencies of Schedule VI. The process of revision started in Nov 2008 when a Memorandum of revision of Schedule VI was put on MCA site. The Ministry of Corporate Affairs (MCA) has issued a revised Schedule VI to the Companies Act 1956 on the 28th February 2011. The effective date is from Financial year commencing on or after 1st April,2011, vide S.O. No. 447(E), dated 28th February, 2011. . This Schedule will apply to all the companies registered with ROC for the financial statements to be prepared for the financial year 2011 - 2012 and onwards. It shall apply to all companies following non-converged Indian Accounting Standards. The exemption is for Banking Companies, Insurance Companies, Electricity companies, and where format are given in their respective statute. This revised Schedule VI has nothing to do with the converged Indian Accounting Standards (IND AS) as notified by the Ministry earlier. The Schedule has been framed been framed as per the existing non-converged Indian Accounting Standards (AS) notified under the Companies (Accounting Standards) Rules, 2006. PART -1 FORM OF BALANCE SHEET Name of the company…………………………………………. Balance Sheet as at …………………………………………… (Rupees in…………) (Depiction of the liability side of balance sheet) Particulars Notes No. Reporting Period Figures as at Current Reporting Period I. EQUITIES & CAPITAL 1• Shareholders’ funds A– Share Capital B– Reserves and surpluses C– Share Warrants 2• Share application money pending allotment 3• Non current liabilities A– Long term borrowings B– Deferred tax liabilities (net) C– Other Long term liabilities D– Long-term provisions Figures as at Last 4• Current liabilities A– Short-term borrowings B– Trade payables C– Other current liabilities D– Short-term provisions TOTAL (Depiction of the asset side of the balance sheet) Particulars Notes No. Figures as at Current Reporting Period Reporting Period II. ASSETS 1. • Non-current assets A – Fixed assets • Tangible assets • Intangible assets • Capital work-in-progress • Intangible assets under development B – Non-current investments C– Deferred tax assets (net) D– Long-term loans and advances E – Other non-current assets 2• Current Assets A– Current investments B– Inventories C– Trade receivables D– Cash and cash equivalents E– Short-term loans and advances F – Other current assets TOTAL Format of Profit & loss Account I. Income from Operations II. Other income III. Total revenue i + ii IV. Expenses Cost of Material Consumed Purchase of Stock in Trade Changes in Inventories of Finished Stocks Work in Progress and Stock in Trade Employee Benefit Expenses Finance Cost Depreciation & Amortization Expenses Other Expenses Figures as at Last Total Expenses V. Profit Before exceptional and extra ordinary item & Tax iii-iv VI. Exceptional Items VII. Profit before Extraordinary Item & Tax VIII . Extraordinary Expenses IX. Profit before Tax VII-VIII X. TAX -Current Tax -Defered Tax XI. Profit /Loss from Continuing Operations XII. Profit /Loss from Discontinuing Operations XIII. Tax Expense from Discontinuing Operation. XIV. Profit /Loss from Discontinuing Operations after Tax xii-xiii XV. Profit /Loss for the Period xi + xiv XVI . Earning per Equity Share (1) Basic (2) Diluted An article by CA Himanshu Kishnadwala,BCAS Section 211(1) of the Companies Act, 1956 requires all companies to draw up the Balance Sheet and Statement of Profit and Loss account as per the form set out in Schedule VI. The pre-revised Schedule VI was introduced in 1976. As mentioned in the Foreword of the ICAI Guidance Note on Revised Schedule VI to the Companies Act, 1956 (ICAI GN), “to make Indian business and companies competitive and globally recognisable, a need was felt that format of Financial Statements of Indian corporates should be comparable with international format. Since most of the Indian Accounting Standards are being made at par with the international Accounting Standards, the changes to format of Financial Statements to align with the Accounting Standards will make Indian companies competitive on the global financial world. Taking cognisance of imperative situation and need, the Ministry of Corporate Affairs revised the existing Schedule VI to the Companies Act, 1956”. The ICAI GN issued in December 2011 gives detailed guidance on the Revised Schedule VI and the manner in which the various instructions contained in Revised Schedule VI are to be interpreted. The structure of Revised Schedule VI is as under: (a) General Instructions (b) Part I — Form of Balance Sheet (c) General Instructions for preparation of Balance Sheet (d) Part II —Form of Statement of Profit and Loss (e) General Instructions for preparation of Statement of Profit and Loss It should be noted that besides the format for preparation of Balance Sheet and Profit and Loss statement as notified by the Revised Schedule VI, there are other disclosure requirements also. These disclosures are: (a) Disclosures as per the notified Accounting Standards i.e., as per the Companies (Accounting Standards) Rules, 2006; (b) Disclosures under the Companies Act, 1956 (e.g., on buyback of shares — section 77, political contributions — section 293, etc.); (c) Disclosures under Statutes (e.g., as per the Micro, Small and Medium Enterprises Development Act, 2006); (d) Disclosures as per other ICAI pronouncements (e.g., disclosure on MTM exposure for derivatives); (e) In case of listed companies, disclosures under Clause 32 of the Listing Agreement ( e.g., Loans to associate companies, etc.) Applicability of the Revised Schedule VI As mentioned in the Notification dated 30th March 2011, financial statements for all companies have to be prepared using the format given by Revised Schedule VI for financial years commencing on or after 1st April 2011. A company having its financial year ending on, say, 30th June 2011, 30th September 2011 or 31st December 2011 cannot adopt the new format since their financial years have not commenced on or after 1st April 2011. Since the format of Revised Schedule VI is a statutory format, a company cannot decide to follow the same even on a voluntary basis. However, if a company decides to prepare its financial statements from 1st April 2011 to 31st December 2011 (i.e., for a period of 9 months), it will have to prepare the same using the format of Revised Schedule VI. All companies registered under the Companies Act, 1956 have to prepare their financial statements using Revised Schedule VI. However, proviso to section 211 exempts banking companies, insurance companies and companies engaged in generation or supply of electricity from following the said format since these are governed by their respective statutes. However, since the Electricity Act 2003 and the Rules thereunder do not prescribe any format for preparing financial statements, such companies will have to follow the format laid down by the Revised Schedule VI till a separate format is prescribed. Listed companies require to publish information on quarterly and annual basis in the prescribed format in terms of clauses 41(l)(ea) and 41(l)(eaa) of the Listing Agreement. These formats are inconsistent with formats under the Revised Schedule VI. However, since the formats are statutory formats as per the Listing Agreement, the same will have to be followed till the time a new format is prescribed under Clause 41 of the Listing Agreement. Companies which are in the process of making an issue of shares (IPO/FPO) have to file ‘offer documents’ containing among other details, financial information of the last 5 years. The formats of Balance Sheet and Statement of Profit and Loss prescribed under the SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2009 (‘ICDR Regulations’) are inconsistent with the format of the Balance Sheet/Statement of Profit and Loss in the Revised Schedule VI. However, since the formats of Balance Sheet and Statement of Profit and Loss under ICDR Regulations are only illustrative, to make the data comparable and meaningful for users, companies will be required to use the Revised Schedule VI format to present the restated financial information for inclusion in the offer document. It may also be noted that the MCA had vide General Circular No. 62/2011, dated 5th September 2011 has clarified that ‘the presentation of Financial Statements for the limited purpose of IPO/FPO during the financial year 2011-12 may be made in the format of the pre-revised Schedule VI under the Companies Act, 1956. However, for period beyond 31st March 2012, they would prepare only in the new format as prescribed by the present Schedule VI of the Companies Act, 1956’. Revised Schedule VI requires that except in the case of the first financial statements (i.e., for the first year after incorporation), the corresponding amounts for the immediately preceding period are to be disclosed in the Financial Statements including the Notes to Accounts. Accordingly, corresponding information will have to be presented starting from the first year of application of the Revised Schedule VI. Thus, for the Financial Statements for the financial year 2011-12 corresponding amounts need to be given for the financial year 2010-11. This will require all companies to take an extra effort to compile the corresponding amounts for 2010-11 for disclosing in Revised Schedule VI prepared for the financial year 2011-12. All companies whether private or public, whether listed or unlisted, and irrespective of their size in terms of turnover, assets, etc. (other than those mentioned in para 9 above) will have to adhere to the new format of financial statements from 2011-12 onwards. Many small or familyowned companies which are run as an extension of partnerships will have difficulties in adopting the new formats since they may not have the necessary trained manpower or infrastructure for such changeover. Major principles as per Revised Schedule VI Revised Schedule VI has eliminated the concept of ‘Schedules’. Such information will now have to be provided in the ‘Notes to accounts’. Accordingly, the manner of cross-referencing to various other information contained in financial statements will also be changed to ‘Note number’ as against ‘Schedule number’ in pre-revised Schedule VI. As per general instructions contained in the Revised Schedule VI, the terms used shall carry the meanings as per the applicable Accounting Standards (AS). As per the ICAI GN, the applicable AS for this purpose shall mean the AS notified by the Companies (Accounting Standards) Rules, 2006. Revised Schedule VI requires that if compliance with the requirements of the Companies Act, 1956 (Act) and/or AS requires a change in the treatment or disclosure in the financial statements, the requirements of the Act and/or AS will prevail over Revised Schedule VI. As per preface to the AS issued by ICAI, if a particular AS is not in conformity with law, the provisions of the said law or statute will prevail. Using this principle, disclosure requirements of existing Schedule VI were considered to prevail over AS. However, since the Revised Schedule VI gives specific overriding status to the requirements of AS notified by the Companies (Accounting Standards) Rules, 2006, the same would prevail over the Revised Schedule VI. There are several instances of conflict between provisions of the Revised Schedule VI and the notified AS e.g., definition of Current Investments as per the Revised Schedule VI and AS-11, definition of Cash and Cash Equivalents as per the Revised Schedule VI and AS-3, treatment of proposed dividend as per the Revised Schedule VI and AS-4, etc. In all such cases, provisions of the AS will prevail over the Revised Schedule VI. The nomenclature for the Profit and Loss account is now changed to ‘Statement of Profit and Loss’. Also, only the vertical format is prescribed for both Balance Sheet and the Statement of Profit and Loss. The format of the Statement of Profit and Loss as per the Revised Schedule VI does not contain disclosure of appropriations like transfer to reserves, proposed dividend, etc. These are now to be disclosed in the Balance Sheet as part of adjustments in ‘Surplus in Statement of Profit and Loss’ contained in ‘Reserves and Surplus’. Further, debit balance of ‘profit and loss account’, if any, is to be disclosed as a reduction from ‘Reserves and Surplus’ (even if the final figure of Reserves and Surplus becomes negative). It is clarified by the Revised Schedule VI that the requirements mentioned therein are minimum requirements. Thus, additional line items, sub-line items and sub-totals can be presented as an addition or substitution on the face of the financial statements if the company finds them necessary or relevant for understanding of the company’s financial position. Also, in preparing the financial statements, a balance will have to be maintained between providing excessive detail that may not assist users of the financial statements and not providing important information as a result of too much aggregation. Revised Schedule VI requires use of the same unit of measurement uniformly throughout the financial statements and ‘Notes to Accounts’. Rounding off requirements, if opted, are to be followed uniformly throughout the financial statements and ‘Notes to Accounts’. The rounding off requirements as per prerevised Schedule VI and as per the Revised Schedule VI are summarised in the following table: Pre-revised Schedule VI Revised Schedule VI Turnover less than Rs.100 crore Turnover < Rs.100 crore Round off to the nearest hundreds, Round off to the nearest hundreds, thousands, lakhs or millions or thousands or decimal thereof decimalthereof. Turnover Rs.100 to 500 crore Turnover over Rs.100 crore Round off to the nearest hundreds, Round off to the nearest lakhs, thousands, lakhs or millions or millions or crores, or decimal decimalthereof thereof. Turnover over Rs.500 crore Round off to the nearest hundreds, thousands, lakhs, millions or crores, or decimal thereof. Some disclosures no longer required in the Revised Schedule VI The disclosure requirements as per the Revised Schedule VI do not contain several disclosures which were required by pre-revised Schedule VI. Some of these are: (a) Disclosures relating to managerial remuneration and computation of net profits for calculation of commission; (b) Information relating to licensed capacity, installed capacity and production; (c) Information on investments purchased and sold during the year; (d) Investments, sundry debtors and loans & advances pertaining to companies under the same management; (e) Maximum amounts due on account of loans and advances from directors or officers of the company; (f) Commission, brokerage and non-trade discounts; and (g) Information as required under Part IV of pre-revised Schedule VI. Major changes in the format of Balance Sheet Equity and Liabilities A new disclosure requirement regarding details of number of shares held by each shareholder holding more than 5% shares in the company is inserted by the Revised Schedule VI. The ICAI GN has clarified that in the absence of any specific indication of the date of holding, such information should be based on shares held as on the Balance Sheet date. For this disclosure, the names of the shareholders would be normally available from the Register of Members required to be maintained by every company. Details pertaining to number of shares issued as bonus shares, shares bought back and those allotted for consideration other than cash needs to be disclosed only for a period of five years immediately preceding the Balance Sheet date including the current year. Under the pre-revised Schedule VI requirement is to disclose such items at all times. In case of listed companies, share warrants are issued to promoters and others in terms of SEBI guidelines. Since such warrants are effectively and ultimately intended to become part of capital, Revised Schedule VI requires that the same be disclosed as part of the Shareholders’ funds as a separate line-item —‘Money received against share warrants.’ In case the said warrants are forfeited, the amount already paid up would be transferred to ‘Capital Reserve’ and disclosed as part of ‘Reserves and Surplus’. There are specific disclosures required by the Revised Schedule VI for ‘Share Application money pending allotment’. It has been also stated that share application money not exceeding the issued capital and only to the extent not refundable is to be included under ‘Equity’ and share application money to the extent refundable is to be separately shown under ‘Other current liabilities’. Disclosures required regarding share application, whether included under ‘Equity’ or under ‘Other current liabilities’ are as under: (a) terms and conditions; (b) number of shares proposed to be issued; (c) the amount of premium, if any; (d) the period before which shares are to be allotted; (e) whether the company has sufficient authorised share capital to cover the share capital amount on allotment of shares out of share application money; (f) Interest accrued on amount due for refund; (g) The period for which the share application money has been pending beyond the period for allotment as mentioned in the share application form along with the reasons for such share application money being pending. A major change in the format of balance sheet as per the Revised Schedule VI is the classification of all items of liabilities and assets into Current and Non-Current. The terms ‘Current’ and ‘NonCurrent’ are defined by Revised Schedule VI as under: (a) A liability is classified as Current if it satisfies any of the following criteria: (i) it is expected to be settled in the company’s normal operating cycle; (ii) it is held primarily for the purpose of being traded; (iii) it is due to be settled within 12 months after the reporting date; or (iv) The company does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting date. All other liabilities shall be classified as non-current. (b) An asset shall be classified as current when it satisfies any of the following criteria: (i) It is expected to be realised in, or is intended for sale or consumption in the company’s normal operating cycle; (ii) It is held primarily for the purpose of being traded; (iii) It is expected to be realised within 12 months after the reporting date; or (iv) It is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least 12 months after reporting period date. All other assets shall be classified as non-current. (c) ‘Operating Cycle’ is defined by Revised Schedule VI as “An operating cycle is the time between the acquisition of assets for processing and their realisation in cash or cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have duration of twelve months”. (d) Thus, all companies will need to bifurcate balances in respect of all liabilities and assets into ‘current’ and ‘non-current’. The definitions contain four conditions out of which even if one is satisfied, the said liability or asset would be classified as ‘current’. If none of the conditions are satisfied the said liability or asset will be classified as ‘non-current’. The four conditions are quite subjective since they use phrases like ‘expected’, ‘held primarily’, ‘due to be settled’, etc. (e) As per the definition, current liabilities would include items such as trade payables, employee salaries and other operating costs that are expected to be settled in the company’s normal operating cycle or due to be settled within twelve months from the reporting date. Thus, liabilities that are normally payable within the normal operating cycle of a company, are classified as current even if they are due to be settled more than twelve months after the end of the balance sheet date. (f) Similarly, as per the definition, current assets would include assets like raw materials, stores, consumable tools, etc. which are intended for consumption or sale in the course of the company’s normal operating cycle. Such items of inventory are to be classified as current even if the same are not actually consumed or realised within twelve months after the balance sheet date. Current assets would also include inventory of finished goods since they are held primarily for the purpose of being traded. They would also include trade receivables which are expected to be realised within twelve months from the balance sheet date. (g) A company can have multiple operating cycles in case they are manufacturing/dealing in different products. In such cases, the bifurcation into ‘current’ and ‘non-current’ can become difficult. (h) Companies will also need to bifurcate all their borrowings into ‘current’ and ‘non-current’. It is possible that the same borrowing will be classified into two components depending on the portion repayable within/after twelve months from the balance sheet date. Other details in respect of borrowings such as whether secured (with terms of security) or unsecured, whether guaranteed or not, details of repayment of loans, details of redemption in case of debentures, etc. are also required to be disclosed. (i) Since the format of the balance sheet mentions Deferred Tax Liability (DTL)/Deferred Tax Asset (DTA) as a non-current liability/asset, the same is to be always classified as non-current and cannot be classified as ‘current’ even if the deferred tax liability/asset would become payable or receivable within twelve months of the balance sheet date. It should be also noted that such DTL/DTA is always disclosed on a net basis as required by AS-22. (j) For several items of liabilities/assets, the aforesaid classification exercise can become quite cumbersome and time-consuming for companies especially since the same is also required to be done for 2010-11. In case of loans taken by a company, Revised Schedule VI requires specific disclosure of period and amount of continuing default as on the balance sheet date in repayment of loans and interest to be specified separately in each case. Revised Schedule VI requires disclosure of loans and advances taken from related parties. ‘Related Parties’ for this purpose would mean those parties as defined by AS-18. Revised Schedule VI requires disclosure of ‘Trade Payables’ as part of ‘other non-current liabilities’ or ‘current liabilities’. A payable can be classified as ‘trade payable’ if it is in respect of amount due on account of goods purchased or services received in the normal course of business. As per the prerevised Schedule VI, the term used was ‘Sundry Creditors’ which included amounts due in respect of goods purchased or services received as well as in respect of other contractual obligations. Since amounts due under contractual obligations can no longer be included within ‘trade payables’, items like dues payables in respect of statutory obligations like contribution to provident fund, purchase of fixed assets, contractually reimbursable expenses, interest accrued on trade payables, etc. will need to be classified as ‘others’. Assets As per Revised Schedule VI, the disclosure for fixed assets is to be segregated into: (a) Tangible assets; (b) Intangible assets; (c) Capital work-in-progress; and (d) Intangible assets under development The classification of tangible assets is similar to the one under pre-revised Schedule VI, but has a separate item for ‘Office Equipment’. Besides, ‘Plant and Machinery’ is now renamed as ‘Plant and Equipment’. Classification of intangible assets as a separate item of Fixed Assets is introduced by Revised Schedule VI. It is also required to classify ‘Computer Software’ separately within ‘Intangible Assets’. It is also necessary to separately disclose, a reconciliation of the gross and net carrying amounts of each class of assets at the beginning and end of the reporting period showing additions, disposals, acquisitions through businesscombinations ( i.e., on account of amalgamations/demergers, etc.) and other adjustments (like capitalisation of borrowing costs as per AS-16) and the related depreciation/amortisation and impairment losses/reversals. Since Revised Schedule VI specifically requires capital advances to be included under long-term loans and advances, the same cannot be included under capital work-in-progress. The same also cannot be therefore included within current assets. There is also a specific requirement to include ‘assets given/taken on lease’, both tangible and intangible under each of the items of fixed assets. As per Revised Schedule VI, all Investments are to be bifurcated into ‘current’ and ‘non-current’. They also further need to be classified (as in the pre-revised Schedule VI) into trade/non-trade and quoted/unquoted. The classification of investments is to be done as under: (a) Investment property; (b) Investments in Equity Instruments; (c) Investments in preference shares; (d) Investments in Government or trust securities; (e) Investments in debentures or bonds; (f) Investments in Mutual Funds; (g) Investments in partnership firms; and (h) Other investments (specifying nature thereof). Revised Schedule VI also requires that under each classification, details need to be given of names of bodies corporate indicating separately whether they are: (a) subsidiaries, (b) associates, (c) joint ventures, or (d) controlled special purpose entities. In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) need to be given. It is possible that the partnership firm maintains both ‘capital’ and ‘current’ accounts of its partners. In that case, the balance in ‘capital’ account will be classified as a ‘non-current’ investment in the balance sheet of the company, whereas the balance in ‘current’ account is classified as ‘current' investment. In case the company has an investment in a ‘Limited Liability Partnership’ (LLP), the disclosure norms of ‘partnership firm’ (as discussed in para 41 above) will not apply since an LLP is considered as a ‘body corporate’. As per Revised Schedule VI, all loans and deposits, deposits, etc. given by a company are to be classified into ‘current’ and ‘non-current’. Revised Schedule VI requires disclosure of loans and advances given to related parties. ‘Related Parties’ for this purpose would mean those parties as defined by AS-18. Revised Schedule VI requires disclosure of ‘Trade Receivables’ as part of ‘other non-current assets’ or ‘current assets’. A receivable shall be classified as ‘trade receivable’ if it is in respect of the amount due on account of goods sold or services rendered in the normal course of business. As per the prerevised Schedule VI, the term ‘sundry debtors’ included amounts due in respect of goods sold or services rendered or in respect of other contractual obligations as well. Since, amounts due under contractual obligations cannot be included within ‘Trade Receivables’, items like dues in respect of insurance claims, sale of fixed assets, contractually reimbursable expenses, interest accrued on trade receivables, etc. will need to be classified within ‘others’. The pre-revised Schedule VI required separate presentation of debtors for those outstanding for a period exceeding six months (based on billing date) and ‘other debtors’. However, for the ‘current’ portion of ‘Trade Receivables’, the Revised Schedule VI requires separate disclosure of ‘Trade Receivables outstanding for a period exceeding six months from the date they became due for payment’. This requirement can result in a lot of work for companies since it would mean modifying their accounting systems to compile the amounts exceeding six months based on the due date. Giving corresponding data for 2010-11 would also result in added work for most companies. The requirement for classifying ‘loans and advances’ and ‘trade receivables’ into secured/unsecured and good/doubtful also continues in Revised Schedule VI. The Revised Schedule VI does not contain any specific disclosure requirement for the unamortised portion of expense items such as share issue expenses, ancillary borrowing costs and discount or premium relating to borrowings. These items were included under the head ‘Miscellaneous Expenditure’ as per the pre-revised Schedule VI. Though, Revised Schedule VI does not mention disclosure of any such item, since additional line items can be added on the face or in the notes, unamortised portion of such items can be disclosed (both ‘current’ as well as ‘non-current’ portion), under the head ‘other current/non-current assets’ depending on whether the amount will be amortised in the next 12 months or thereafter. The term ‘cash and bank balances’ existing in the pre-revised Schedule VI is replaced under Revised Schedule VI by ‘Cash and Cash Equivalents’. These are to be classified into: (a) Balances with banks; (b) Cheques, drafts on hand; (c) Cash on hand; and (d) Others (specify nature). For ‘Cash and Cash Equivalents’, disclosure is also separately required as per Revised Schedule VI for: (a) Earmarked balances with banks (for example, for unpaid dividend); (b) Balances with banks to the extent held as margin money or security against the borrowings, guarantees, other commitments; (c) Repatriation restrictions, if any, in respect of cash and bank balances shall be separately stated; (d) Bank deposits with more than twelve months maturity shall be disclosed separately. Major changes in the format of Statement of Profit and Loss Revised Schedule VI requires disclosure of ‘Revenue from Operations’ on the face of the statement of profit and loss. In the case of a company other than a finance company, such ‘Revenue from Operations’ is to be disclosed as: (a) Sale of products (b) Sale of services (c) Other operating revenues (d) Less: Excise duty Though Revised Schedule VI specifically requires disclosure of Sale of Products on ‘gross of excise’ basis, there is no mention of whether Sales Tax/VAT and Service Tax is also to be included or not in sale of products or sale of services, respectively. Though not entirely free of doubt, the ICAI GN has stated that “Whether revenue should be presented gross or net of taxes should depend on whether the company is acting as a principal and hence responsible for paying tax on its own account or, whether it is acting as an agent i.e., simply collecting and paying tax on behalf of government authorities. In the former case, revenue should also be grossed up for the tax billed to the customer and the tax payable should be shown as an expense. However, in cases, where a company collects tax only as an intermediary, revenue should be presented net of taxes.” (Also refer BCAJ February 2012 ‘Gaps in GAAP’ for a discussion on whether taxes should be disclosed gross or net). In addition to Revenue from Operations, Revised Schedule VI also requires disclosure of ‘Other Operating Revenue’ as well as ‘Other Income’. The term ‘Other Operating Revenue’ is not defined by Revised Schedule VI. The ICAI GN has however clarified that “this would include revenue arising from a company’s operating activities, i.e., either its principal or ancillary revenuegenerating activities, but which is not revenue arising from the sale of products or rendering of services. Whether a particular income constitutes ‘other operating revenue’ or ‘other income’ is to be decided based on the facts of each case and detailed understanding of the company’s activities. The classification of income would also depend on the purpose for which the particular asset is acquired or held”. In respect of a finance company, Revised Schedule VI requires ‘Revenue from Operations’ to include revenue from: (a) Interest and (b) Other financial services. Though the term ‘finance company’ is not defined by Revised Schedule VI, the ICAI GN states that “the same should be taken to include all companies carrying on activities which are in the nature of ‘business of non-banking financial institution’ as defined in section 45I(f) of the Reserve Bank of India Act, 1935”. In case of all companies, Revised Schedule VI requires ‘Other income’ to be disclosed on the face of the statement of profit and loss. For this purpose ‘Other Income’ is to be classified as: (a) Interest Income (in case of a company other than a finance company); (b) Dividend Income; (c) Net gain/loss on sale of Investments; (d) Other non-operating income (net of expenses directly attributable to such income). As can be seen from the above, in the case of all company (including a finance company) Dividend income and Net gain/loss on sale on investments will be always classified as ‘Other Income’. ‘Other Income’ will also include share of profits/ losses in a partnership firm. Though there is no specific requirement mentioned for the same in the Revised Schedule VI, the ICAI GN mentions that the same should be separately disclosed. The ICAI GN also requires that in case the financial statements of the partnership firm are not drawn up to the same date as that of the company, adjustments should be made for effects of significant transactions and events that occur between the two dates and in any case, the difference between the two reporting dates should not be more than six months. Revised Schedule VI requires the aggregate of the following expenses to be disclosed on the face of the Statement of Profit and Loss: (a) Cost of materials consumed (b) Purchases of stock-in-trade (c) Changes in inventories of finished goods, work in progress and stock in trade (d) Employee benefits expense (e) Finance costs (f) Depreciation and amortisation expense (g) Other expenses. The ICAI GN mentions that for the purpose of disclosure, ‘Cost of materials consumed’, should be based on ‘actual consumption’ rather than ‘derived consumption’. In such a case, excesses/ shortages should be separately disclosed rather than included in the amount of ‘cost of materials consumed’. This requirement was also contained in the ICAI pronouncements on the pre-revised Schedule VI. As per Revised Schedule VI separate disclosure is also required for the following items which are classified under ‘Other Expenses’: (a) Consumption of stores and spare parts; (b) Power and fuel; (c) Rent; (d) Repairs to buildings; (e) Repairs to machinery; (f) Insurance; (g) Rates and taxes, excluding taxes on income; (h) Miscellaneous expenses. The threshold for disclosure of ‘Miscellaneous Expenses’ is changed to those that exceed ‘1% of revenue from operations or Rs.100,000 whichever is higher’ as against the requirement of prerevised Schedule VI of ‘1% of total revenue or Rs.5,000 whichever is higher’. The format of Statement of Profit and Loss in Revised Schedule VI also requires specific disclosures of ‘Exceptional’, ‘Extraordinary’, items and ‘Discontinuing Operations’. These terms are defined by AS-4, AS-5 and AS-24, respectively and disclosures should be done in accordance with these definitions. Disclosures by way of Notes Besides the above disclosures, Revised Schedule VI also requires disclosures by way of Notes attached to the financial statements. Some of the major requirements are as under: (a) For manufacturing companies: raw materials consumed and goods purchased under broad heads; (b) For trading companies: purchases of goods traded under broad heads; (c) For companies rendering services: gross income derived from services rendered under broad heads. Revised Schedule VI does not require disclosure of quantitative details for any of the above categories of companies. The same is also clearly mentioned in para 10.7 of the ICAI GN. The ICAI GN also mentions that ‘broad heads’ for the purpose of the disclosure in para 62 above are to be decided taking into account the concept of materiality and presentation of ‘True and Fair’ view of financial statements. The said GN also mentions that normally 10% of the total value of sales/services, purchases of trading goods and consumption of raw materials is considered as an acceptable threshold for determination of broad heads. Revised Schedule VI requires disclosures of ‘Contingent liabilities and commitments’. For this purpose, besides others, ‘other commitments’ are also to be disclosed. Such disclosure of ‘other commitments’ was not required as per pre-revised Schedule VI. There is no explanation of what would be covered as part of ‘other commitments’ in Revised Schedule VI. The ICAI GN has however clarified that disclosures required to be made for ‘other commitments’ should include ‘only those non-cancellable contractual commitments (cancellation of which will result in a penalty disproportionate to the benefits involved) based on the professional judgment of the management which are material and relevant in understanding the financial statements of the company and impact the decision making of the users of financial statements. Examples may include commitments in the nature of buyback arrangements, commitments to fund subsidiaries and associates, non-disposal of investments in subsidiaries and undertakings, derivative related commitments, etc.’ Most of the other disclosure requirements as per Revised Schedule VI in Notes are similar to the requirements of pre-revised Schedule VI. Implementation of Revised Schedule VI As can be seen from the above, disclosure requirements of Revised Schedule VI are quite different from those existing in the pre-revised Schedule VI. Many of these disclosures and concepts (like ‘current’, non-current’) are similar to terms and concepts used in IFRS. Unless, companies gear up well in time to adhere to these new requirements for 2011-12 (and corresponding figures for 2010-11), it will be difficult for them to meet the reporting deadlines of the Companies Act, 1956.