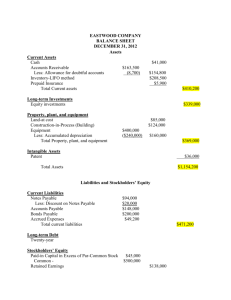

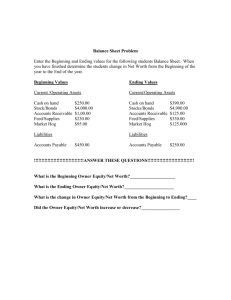

Balance Sheet & Cash Flow Assignment Table

advertisement