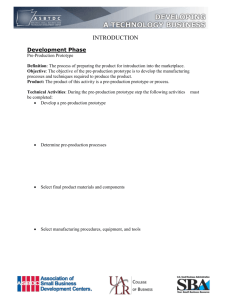

table 2: professional regulation of accounting for pre

advertisement

1 ACCOUNTING FOR PRE-PRODUCTION COSTS: EXTRACTING CONSENSUS! Peter G. Gerhardy Senior Lecturer in Accounting School of Commerce The Flinders University of South Australia SCHOOL OF COMMERCE RESEARCH PAPER SERIES: 98-1 ISSN 1441-3906 Accounting for the extractive industries has recently been added to the work program of the IASC, suggesting that the Australian standard setters will soon reconsider the relevant Australian Standards. The method to be used to account for pre-production costs is likely to be a major concern in these deliberations. This paper provides a timely re-examination of this issue, discussing the available alternative accounting methods, including the change in regulation that SAC 4 would suggest is required. The historical development of the existing standard is reviewed, and evidence of significant diversity in mining companies’ past and current accounting practices is presented. With this background in mind, the future of accounting regulation in the area is contemplated. INTRODUCTION The method to be used to account for pre-production costs in the extractive industries has attracted considerable attention in the past. The professional accounting literature in Australia provided the forum for a vigorous debate on the issue, particularly during the 1970s. Developments in the financial reporting arena suggest that the time is right for a re-examination of the issue. In 1989 the then Accounting Standards Review Board (ASRB) and the Australian Accounting Research Foundation (AARF) indicated (Release 419/ED 47, 1989, para. 3) that the whole area of accounting for the extractive industries was to be subject to extensive scrutiny prior to revision of the existing accounting standards on the topic, namely AAS 7 and AASB 1022, Accounting for the Extractive 2 Industries.1 While mooted almost a decade ago, such a review has not yet taken place. Interestingly, the September 1994 issue of the AARF & AASB Report (p. 16) included review of the extractive industries standard amongst a list of its high priority projects on the work program of the Public Sector Accounting Standards Board (PSASB) and the Australian Accounting Standards Board (AASB). The December 1996 issue of The Standard (p. 16) indicated that it remained a part of the PSASB work program at that time.2 More recently the International Accounting Standards Committee (IASC), at its April 1998 meeting, placed on its agenda a new project dealing with the Extractive Industries. A Steering Committee for the project was appointed in July, with the first major step in the process to be preparation and issue of a discussion paper by the end of 1998 (IASC, 1998). Given the current program to harmonise Australian and International accounting standards, this move by the IASC suggests that the Australian standard setters cannot delay for much longer their foreshadowed reconsideration of this country’s extractive industries standards. Possibly the most controversial aspect to be reviewed will be the method prescribed to account for pre-production costs. This issue therefore warrants fresh and detailed analysis. A closely related issue is the question of the impact, if any, of SAC 4, Definition and Recognition of the Elements of Financial Statements on the accounting treatment for pre-production costs. While the status of SAC 4 was downgraded from a mandatory requirement to that of guidance, it can still be regarded as “providing a significant stimulus for a major re-think of standards and practices” in general (Miller and Loftus, 1993, p. 9). These developments suggest that the issue of accounting for pre-production costs by companies involved in the extractive industries is back on the financial reporting agenda, and the time is right for a re-examination and re-evaluation of the issue. This paper briefly discusses the major alternative methods of accounting for pre-production costs in the extractive industries, including what has been regarded as the crucial issue – that of cost centre choice for accumulation of pre-production costs. Subsequently, a brief review is provided of the history of professional regulation on the matter in Australia. Together, these sections show that despite extensive consideration of the issue in this country, ultimately companies have been left with a choice of methods. Availability of such choice should not be regarded as undesirable per se. However, comparability has been identified as one of the qualitative characteristics financial 3 statements should possess (SAC 3, para. 49) if they are to fulfil the objective of decision usefulness identified in the Australian conceptual framework (SAC 2, para. 43). While comparability does not necessarily imply consistency (SAC 3, para. 34), if the availability of choice has been and continues to be exploited by Australian companies, it would follow that the comparability of financial statements will be diminished. This raises the issue of whether Australian companies have exploited the available choice. Evidence from surveys of practice is presented to suggest that diversity was and remains the rule, and possibly to a much greater extent than may have been expected given the existence of an accounting standard designed to regulate practice in Australia. THE ALTERNATIVES The fundamental issue distinguishing the different methods of accounting for pre-production costs in the extractive industries is the choice of cost centre to be used in accumulating such costs for external reporting purposes. There exist a large number of possible cost centres, varying greatly in their size, which could be used to accumulate pre-production costs. Lourens and Henderson (1972, p. 54) indicate that the cost centre can “be as small as an individual mineral deposit, mine, quarry, well, lease or reserve, or it can be as large as several leases, areas, a State, or an entire country”. The principal argument that has been used in efforts to determine the ‘best’ method of accounting for pre-production costs is one of which method best matches the costs incurred with the revenues generated by them. Assuming for the moment that such a criterion is appropriate for making this decision, the question becomes one of which cost centre provides the most fitting matching of revenues and expenses.3 Field (1969, p. 57) states that “Cost centers play an especially critical role in matching extractive expenditures with revenue from sale of minerals”. Similarly, Coutts (1963, p. 27) suggests that: rules or procedures have to be developed to provide a basis on which costs can be allocated to reserves. This involves making decisions regarding the size of the reserve unit which is to be used as the basis for cost accumulation and the extent to which particular items of pre-production cost can reasonably be allocated to each such unit. That is, the cost centre to be utilised must be determined. In a like vein, Lourens and Henderson (1972, p. 54) observe the “choice of cost centre can itself determine whether capitalised 4 preproduction expenditure is to be written off, and against what revenues it is to be matched”. Effectively, then, the choice of a different cost centre leads to the choice of a different method of accounting for pre-production costs. The numerous possible cost centres available to be chosen implies that there are equally numerous methods of accounting for pre-production costs which could be utilised by companies in the extractive industries. Historically, four major methods have been considered to form the pool of available alternatives in Australia. These are: the full cost method; the expense method; the successful efforts method; and the area of interest method. The main features of each of these methods are summarised in Table 1. TABLE 1: METHODS OF ACCOUNTIGN FOR PRE-PRODUCTION COSTS – MAIN FEATURES Method Full Cost Cost Centre Costs Capitalised Costs Written Off Reporting entity/Whole of firm All pre-production costs None Smallest possible None All pre-production costs Successful Methods Smaller than reporting entity/whole of firm Pre-production costs resulting directly in discovery of economically recoverable reserves ie. successful expenditures Pre-production costs not leading directly in discovery of economically recoverable reserves ie. unsuccessful expenditures Area of Interest Area of interest (AAS 7, 1979, para. 7) Pre-production costs for an area where there is a “reasonable probability of success in the area” (AAS 7, para. 16) Pre-production costs relating to areas which fail to produce economically recoverable reserves Expense 5 As suggested by the first two rows of the table, the full cost and expense methods represent the two extreme treatments of pre-production costs. Figure 1, which places the four methods on a continuum, illustrates the opposing nature of the proposed treatments of pre-production costs for the full cost and expense methods. FIGURE 1: CONTINUUM OF ACCOUNTING METHODS Method % Costs Capitalised Full Cost Area of Interest* Successful Efforts* Expense 100 0 * The positions of these methods on the continuum should not be taken as indications of specific values of the ‘% Costs Capitalised’. The basic argument put forward in favour of the full cost method is that all pre-production expenditures are a necessary prerequisite to the discovery of those areas that contain economically recoverable reserves. As such, it is appropriate to match the costs of all activities against the revenues earned from those which are ultimately shown to be successful. On the other hand, the expense method is justified on the basis of the high risk nature of pre-production activity in the extractive industries, particularly in the exploration and evaluation stages. As the third row of Table 1 and also Figure 1 indicate, the successful efforts method falls somewhere between the expense and full cost methods. Heazlewood (1987, p. 28) suggests that under this method “ expenditures known to be unsuccessful are written off as incurred, and where there is uncertainty about success, the expenditure is carried forward until such time as success or failure (abandonment) is determined”. The choice of cost centre to be used when adopting the successful efforts method will be the major determinant of the extent of costs to be carried forward. As Table 1 states, the cost centre must be something less than the entity as a whole, since this would implicitly lead to the adoption of the full cost method. Apart from this restriction, the possible cost centres are numerous. The justification for use of this method is, again, generally couched in terms of the matching principle. It is argued that only those costs that directly result in the discovery of economically viable deposits should be matched against the revenue generated from those deposits. 6 The method of accounting for pre-production costs known as the area of interest method has been prescribed by the Australian accounting profession in AAS 7 (formerly DS 12/308), and in AASB 1022. As indicated in Table 1, the cost centre adopted by this method is the ‘area of interest’, which has been defined as “an individual geological area which is considered to constitute a favourable environment for the presence of a mineral deposit or an oil or natural gas field, or has been proved to contain such a deposit or field” (AAS 7, 1979, para. 7). The definition is thus couched in very broad terms. As noted by Davison and Lourens (1978, p. 34), “the critical size of the area of interest was, unavoidably, left undefined in an operational manner, thus permitting a wide variety of options in practice” (emphasis added). It is difficult to see the difference between the successful efforts and area of interest methods outlined in Table 1. Heazlewood (1987, p. 29) suggests that “the AOI [area of interest] method is only distinguishable from successful efforts by the fact that it capitalises all exploration expenditures incurred in a designated area of interest even where the area has contracted in size following more extensive exploration activities whereas successful efforts would write off any capitalised expenditures shown to be unproductive at a later stage”. On this basis, Heazlewood (1987, p. 30) argues that “the AOI [area of interest] method [lies] between successful efforts and full cost for the AOI method (as defined) could result in more expenditures being capitalised than under the successful efforts method in any one given geological area”.4 This relationship is reflected in the continuum in Figure 1. While this may represent a valid difference in terms of the descriptions of the two methods as described in an early version of the accounting standard (AAS 7, 1977, paras. 10, 12), it could be argued that it is merely a refinement in terms of how a single method of accounting for pre-production costs is implemented in practice. This is the view expressed by Davison and Lourens (1978, p. 33) who agree that while it is “true in so far as it goes [that the accounting standard adopts an area of interest approach], the term is not mutually exclusive of other methods, as was implied [by the standard]”. This is also the view of Henderson and Peirson (1988, p. 772), who state that: AAS 7 is a little confusing because it treats the successful-methods method and the area of interest method as alternative methods It seems to make more sense if an area of interest is regarded as a definition of a cost centre for use in the successful-efforts 7 method. In other words paragraph 12 of AAS 7 [1977] should be regarded as an elaboration of paragraph 10, which includes the phrase ‘area of interest’. Similarly, Whittred, Zimmer and Taylor (1996, p. 395) believe that “the distinction between the SE [successful efforts] and AOI [area of interest] methods is far from obvious” and ultimately conclude “that the AOI method is a form of SE accounting which employs a relatively wide definition of cost centre”. While there appears to be support for this view in theory, accounting policy reviews undertaken in the past, and summarised below, indicate that in practice a distinction is often made between the area of interest and successful efforts methods on the basis of the initial treatment of pre-production costs. Under the former, costs are carried forward until proved successful or otherwise. In contrast, the successful efforts method, as it is adopted in practice, involves writing off pre-production costs until a decision is made to develop the area. Only costs incurred from this point are capitalised. This distinction is made for the purpose of the review of 1997 accounting practices reported later in the paper. SAC 4 and the Expense and Reinstate Method The methods of accounting for pre-production costs discussed so far vary along a spectrum from capitalising all such costs to expensing them as incurred. As indicated, much of the discussion of which is the most appropriate method to adopt to account for pre-production costs has historically been couched in terms of choosing the method which best matches expenses and revenue. Unfortunately, it appears that the alternatives may all be justified in a way that embraces the matching principle. The Australian conceptual framework effectively abandons the matching principle as the basis for selecting the most appropriate accounting treatment where a number of possibilities exist, adopting a different set of rules essentially based on the definitions and recognition criteria of the elements contained in SAC 4. In the view of this concept statement, the issue of whether or not expenditure should be capitalised or expensed is no longer a question of achieving the most appropriate matching of expenses with the revenue they generate, but is a question of whether or not expenditure meets the definition and recognition criteria of an asset as laid down in SAC 4.5 8 Initially proposed as mandatory (to be operative from 30 June 1995), the impact of this concept statement on the treatment of pre-production costs was potentially significant. Defining assets in paragraph 14 as “future economic benefits controlled by the entity as a result of past transactions or other past events” suggests that pre-production costs would generally be classed as assets. The three characteristics of assets identified in this definition, namely future economic benefits, control by the entity and occurrence of a past transaction or event, would generally be present in the case of costs incurred for exploration, evaluation, development and construction in the extractive industries. While it would seem ludicrous to suggest that preproduction costs are incurred for any reason other than in the hope of discovering a viable mineral deposit which represents future economic benefits, the high risk nature of such mining activity will often raise questions regarding the likelihood of the future economic benefits eventuating. This is where the recognition criteria contained in SAC 4 provide necessary guidance. Although pre-production costs appear to qualify as assets under the definition contained in SAC 4, to be recorded as such in the accounts, according to SAC 4 it must also be probable that the future benefits embodied in the asset will eventuate, and that there be a cost or value that can be reliably measured (para. 38). The ‘reliable measurement’ criterion poses little difficulty for preproduction costs in the extractive industries under the extant historical cost accounting system.6 However, the ‘probable’ criterion is a slightly more complex matter. SAC 4 (para. 40) states that the term ‘probable’ is to be interpreted as meaning “that the chance of the future economic benefits arising is more likely rather than less likely”, suggesting that a probability exceeding 50% is necessary for an asset to be recognised in the accounts. Thus if this probability criterion is met, then the pre-production costs should be recorded as assets in the accounts. However, the high risk nature of mining activities would suggest that for the early pre-production stages of exploration and evaluation in most, if not all cases, the criterion will not be met at the time the expenditure is incurred, indicating that an asset should not be recognised in the accounts. Here, the costs should be written off immediately to the profit and loss account. It should however be noted that, as stated in SAC 4 (para. 42): 9 This does not imply that management’s intention in making the expenditure was other than to generate future economic benefits or that, in making the expenditure with this intention, management was misguided; nor indeed, does it imply that the item fails to satisfy the definition of an asset. The only implication is that, on the basis of the available evidence, the necessary degree of certainty for the item to be recognised as an asset does not exist. Flowing logically from this is the question: what if subsequently the probability of future benefits eventuating increases to greater than 50%, but the pre-production costs have already been expensed on the basis that such was not the case when the expenditure was incurred? SAC 4 is equally explicit on the action to be taken in this case. Paragraph 43 states that in such circumstances “The asset would qualify for recognition even though this may involve amounts that had previously been recognised as expenses by the entity”. It then provides the specific example of exploration costs previously written off as an illustration of when this procedure would be appropriate. Thus, SAC 4 effectively introduces a fifth specific method of accounting for pre-production costs, which could be referred to as the ‘expense and reinstate method’. Howieson (1993, p. 15) suggested that it is likely that had SAC 4 maintained its mandatory status, a number of existing accounting standards, including AAS 7, would have been subject to change. However, such change would probably not be in the immediate future, and probably not before an extensive review of the entire area of accounting concerned – in this case, accounting for the extractive industries. Assuming that the standard setters had adopted the concepts espoused in SAC 4, it appears from the above discussion that the expense and reinstate method would have ultimately replaced the existing requirements contained in AAS 7. In order to understand how regulation of accounting for pre-production costs has reached its current state of being, and precisely what that current state is, it is useful to consider briefly the history of professional regulation on the matter, and to examine companies’ practices over this time. This will then permit consideration of likely future developments in the area. DEVELOPMENT OF A STANDARD The Australian accounting profession first specifically considered the issue of accounting for pre-production costs in the early 1970s. Table 2 summarises the developments from that time to the 10 present. As a precursor to providing authoritative guidance on accounting practices in the extractive industries in general, and on accounting for pre-production costs in particular, the Western Australian Division of the then Australian Society of Accountants (ASA) sponsored a survey of the 11 TABLE 2: PROFESSIONAL REGULATION OF ACCOUNTING FOR PRE-PRODUCTION COSTS Date of Issue 1972 Document/ Pronou Status ncement Lourens & Henderson, Research/ Discu Survey of Reporting ssion Paper Practices Issuing Body ASA (WA Division) Requirements N/A Operative Comments Date N/A Objective was to provide a useful base for discussion and consideration of accounting practices 12 Feb 1973 Exposure Draft ED 3 Non-mandatory Comments requested by 31/5/73 ASA & ICA ‘Area of interest’ as cost centre Carry forward prospecting and investigation costs subject to two conditions: i. the existence of “economically recoverable reserves” in the area be indicated, and a “reasonable probability” of recovering costs carried forward from the area; or ii. prospecting and investigation must be continuing in the area. Otherwise to be written off or provided against in full. Development costs carried forward subject to condition (i) above. N/A Costs qualifying for capitalisation subsequent to being written off to be reinstated ie. expense and reinstate method permitted Construction costs relating to fixed assets subject to Statement D5 13 Oct 1976 DS12/308 Mandatory ASA & ICA Area of interest method adopted (para. 12). Exploration and evaluation costs to be written off except they may be carried forward where: i. costs expected to be recovered by successful development or sale of area; or ii. are not yet able to assess viability of area but significant operations are continuing (para. 14). Periods beginning 1/1/77 ie. periods ending 31/12/77 Construction costs relating to fixed assets subject to Statement DS5. Extensive explanatory material included Removed possibility of reinstating costs qualifying for capitalisation subsequent to being written off Two year limit on carry forward of exploration and evaluation costs. Removed possibility of providing for costs not meeting capitalisation criteria. Development costs carried forward subject to condition (i) above. Dec 1977 DS12/308 (amended) Mandatory ASA & ICA As for DS12/308 (1976), except for deletion of two year limit on carry forward of exploration and evaluation costs Terms ‘exploration’ and ‘evaluation’ replaced ‘prospecting’ and ‘investigation’ respectively Periods beginning 1/1/77 ie. periods ending 31/12/77 ie. no change Release of this amended version resulted in the original 1976 version never being operative 14 Aug 1979 AAS 7 Jan 1989 ASRB Release 416/ED 47 Change of designation only Invitation to comment ASRB & AARF N/A N/A Requested inter alia, comments on the “… optional treatment in respect of accounting for pre-production costs …”, due to “… their desire ultimately to eliminate alternatives” (para. 13) Mandatory for companies under legislation ASRB As for AAS 7 (1979) Periods ending 31/12/89 Adoption of substantive requirements of AAS 7 Mandatory for non-corporate reporting entities in the private sector and business undertakings in the public sector AARF Periods ending 31/12/89 No substantive changes in relation to accounting for pre-production costs Comments requested by 24/2/89 Oct 1989 ASRB 1022 (Redesignated AASB 1022 in July 1991) Nov 1989 AAS 7 (reissued) 15 financial reporting practices within the industry (Lourens and Henderson, 1972). The aim of the survey was to provide evidence of those practices actually in use by Australian mining companies at the time, with the further hope that it “might contribute something to the subsequent discussion” (Lourens and Henderson, 1972, p. 10). It did indeed provide the basis for consideration of the appropriate accounting methods to be adopted by companies in the extractive industries, the initial outcome of which was the release in February 1973 of Exposure Draft ED 3, Accounting for the Extractive Industries. The exposure draft aimed “to bring about greater uniformity by setting out a recommended treatment” for pre-production costs (para. 3). Five different phases of operations common to the extractive industries were identified and defined in the exposure draft (para. 8). These were prospecting, investigation, development, construction and production. Prospecting was defined (para. 8(a)) as “studies over wide areas” with the purpose of searching for a deposit or field, while investigation had the purpose of “determin[ing] the feasibility and commercial viability of a particular prospect”. Development was described (para. 8(c)) as “the activities of establishing access to the deposit or field for commercial production”, while the final pre-production phase of construction related to the facilities required for the “extraction, treatment and transportation of output” (para. 8(d)). As indicated in Table 2, the exposure draft adopted the ‘area of interest’ as the cost centre for the accumulation of costs, and recommended that “all expenditure during the prospecting, investigation and development of an area of interest should be carried forward for matching with revenue derived from the exploitation of reserves in that area” (para. 21). This would seem to describe the full cost method. However, this capitalisation requirement was modified for prospecting and investigation costs by two additional clauses. First, there was a requirement that to carry the costs forward there be an indication of the existence of “economically recoverable reserves” in the area, and that it be “reasonably probable” that the costs carried forward would be recovered out of revenues from the area (para. 22 (a)). Alternatively, if the existence of such reserves in the area could not yet be accurately assessed, but prospecting or investigation were continuing in the area, then the costs could be carried forward (para. 22 (b)). The area of interest method was thus prescribed for these costs. Where either of the two prerequisites for capitalisation 16 was not satisfied the costs “should be written off, or provided against in full, in the profit and loss account” (para. 24). This last class of cases was thus effectively dealt with by use of the expense method. Development costs were required to be carried forward where there existed a reasonable probability that they would be recouped from revenues generated from the area in the future (para. 23). Otherwise such costs were to be written off or provided against in full, as for prospecting and investigation costs (para. 24). Construction expenditure, being expenditure of a capital nature on fixed assets, was subject to the requirements of a separate Standard on depreciation of such assets. The exposure draft required that where expenditure relating to an area of interest had been written off because it did not qualify for capitalisation under the requirements outlined above, but it was subsequently judged that the area of interest was capable of being developed as a viable mining operation, such expenditure was to be reinstated by writing it back to the profit and loss account. Thus, the exposure draft effectively prescribed use of the expense and reinstate method to account for costs related to these particular areas. Hence, the exposure draft contained elements of most of the methods discussed previously. Davies (1976, p. 550) reports that 90 replies were received in response to the call for comments on the exposure draft. These were duly considered by the joint project committee responsible for formulation of the final standard on the topic. Statement of Accounting Standards DS 12/308, Accounting for the Extractive Industries,7 was issued over three years later. A number of changes relevant to the treatment of pre-production costs were made to the requirements contained in the exposure draft prior to the issue of the standard in October 1976. The terms ‘exploration’ and ‘evaluation’ respectively (para. 5) replaced the terms ‘prospecting’ and ‘investigation’, used in the exposure draft to describe the initial pre-production stages. While slightly reworded, the definitions of the two phases of operations remained the same in basic content. Davies (1976, p. 550) gives as grounds for the change of nomenclature the extensive use in the extractive industries of the latter terms. The most significant changes to the standard’s requirements related to the decision of whether to carry forward or write off pre-production costs. Additionally, Davies (1976, p. 550) described this as “the most controversial section of the Statement, and the one which drew the widest response”. Paragraph 12 of the Statement explicitly stated that “The ‘area of interest’ 17 method is adopted for the purposes of this Statement”. This method, as detailed in the Statement, involved essentially the same requirements as were contained in the exposure draft, with two significant differences. First, while the exposure draft required the carrying forward of prospecting and investigation costs provided they met certain criteria, Statement DS 12/308 (1976) required that exploration and evaluation costs be written off except that they could be carried forward where they met certain criteria (para. 14). The tests in the two pronouncements for determining whether costs could be carried forward were essentially the same. The requirements of Statement DS 12/308 (1976) differed more significantly from those of the exposure draft due to the addition of a two year time limit on the carrying forward of exploration and evaluation costs in respect of an area of interest (para. 15). This time limit was “deemed advisable, on the grounds of prudence” (para. 12), which was in turn justified on the basis of “the risk and uncertainty of the outcome of operations” in the extractive industries (para 4). The requirements relating to development costs in Statement DS 12/308 (1976) were essentially similar to those contained in the exposure draft. Paragraph 16 of the Statement required that such costs be carried forward for an area of interest provided that they were expected to be recouped either by exploitation of the area or by its sale. The Statement (para. 17) also dealt with the treatment of construction costs. In similar vein to the exposure draft, where such costs were in the nature of expenditure on depreciable assets they were to be accounted for in accordance with the requirements of the relevant pronouncement dealing with depreciation of non-current assets. Those costs not related to depreciable assets were to be treated similarly to development costs. There were two other noteworthy changes from the exposure draft. First, the deletion of the possibility of reinstatement of costs previously written off where they subsequently qualified for capitalisation. While the “Costs written off and reinstated” method was described in paragraph 9 of DS 12/308, it was rejected in favour of the “area of interest method” (para. 12). The second was removal of the possibility that costs not meeting the requirements for capitalisation could be “provided against in full” as an alternative to writing them off. The original version of Statement DS 12/308, (October 1976) was to be operative for any accounting period beginning on or after 1 January 1977 (ie. periods ending on or after 31 December 1977). However, the statement was amended and reissued in December 1977, with the same 18 operative date. In effect this led to the original version of the standard never having to be implemented. The revisions to the Statement were made in light of comments received on a number of aspects of the original version. The most significant change involved the deletion of the limit of two years on the carry forward of exploration and evaluation costs, which was regarded as “not justifiable in view of the normal period of time which elapses between the commencement of exploration and the subsequent commitment to development and production”, and unnecessary given the prerequisites for capitalisation set down in the Statement (Anon, 1977, p. 13). As indicated in Table 2, no other major changes from the October 1976 version of the Statement have been made. Significantly, the Standard was given interim approval by the Accounting Standards Review Board (ASRB) on 30 October 1989 with the issue of ASRB 1022, Accounting for the Extractive Industries. The effect of the issue of ASRB 1022 was to give statutory backing to the accounting requirements in respect of companies in the extractive industries.8 The requirements in relation to the treatment of pre-production costs have, however, remained largely unchanged since December 1977. Voluntary Choice of an Accounting Policy The substantive requirements relating to accounting for costs incurred in the early pre-production phases are contained in paragraph 10 of AAS 7 (1979), and read as follows: 10 Costs arising from exploration and evaluation related to an area of interest shall be written off as incurred, except that they may be carried forward provided that rights to tenure of the area of interest are current and provided further that at least one of the following conditions is met: (a) such costs are expected to be recouped through successful development and exploration of the area of interest, or alternatively, by its sale; or (b) exploration and evaluation activities in the area of interest have not at reporting date reached a stage which permits a reasonable assessment of the existence or otherwise of economically recoverable reserves, and active and significant operations in, or in relation to, the area of interest are continuing. Paragraph 10 clearly provides a choice of accounting methods for exploration and evaluation costs. While stating that such costs “shall be written off as incurred”, apparently advocating the expense method, it goes on to add that “they may be carried forward” subject to the stated 19 conditions being met (emphasis added). Whittred, et al. (1996, p. 395) suggest that these conditions allow “the option of deferral even in those cases where the feasibility of operations … has not yet been established – all that is required is that rights to tenure of the area of interest are current and that actual and significant operations (not defined) are continuing in that area”. For exploration and evaluation costs the Statement allows a clear choice between the expense and area of interest methods. No such choice is provided for development costs, with the area of interest method prescribed (para. 11). Construction costs are generally subject to the requirements of another Standard (para. 12). As such, it is in the early stages of pre-production where a choice exists, and it is the treatment of costs incurred in these stages that will be the main focus of the remainder of this paper. The review of the history of regulation of accounting in the Australian extractive industries provided indicates that, despite a number of developments which at first glance appear significant, the ultimate effect of the profession’s pronouncements on managements’ decisions on how to account for pre-production costs has in reality been minimal. Prior to the release of the exposure draft in February 1973 there was no official position as to the most appropriate method, and companies in the industry could choose to treat pre-production costs as they wished. Similarly, an exposure draft is merely issued as a means of eliciting comment on proposed standards, and does not have the backing required to influence accounting practices. In any case, the exposure draft was shown to contain elements of most of the commonly identified methods of accounting for preproduction costs. AAS 7 (initially issued as Statement DS 12/308, operative from 31 December 1977) was the first pronouncement with the potential to influence practice in this area. However, in neither this nor any of its reissued forms was this potential made reality. AAS 7 allows a choice of methods in accounting for pre-production costs. As indicated above, paragraph 10 allows an effective choice between use of the expense method and what it calls the area of interest method. In addition to this explicit choice, the ‘area of interest’ is so broadly defined in geological terms that a wide variety of possible cost centres may be adopted for the purpose of accumulating pre-production costs in the area. On this point AAS 7 (1979, para. 18) admits that during the earlier pre-production stages “an area may be difficult to delimit”. It may therefore be argued that the available treatments of pre-production costs in the Australian extractive industries is currently much broader than simply 20 a dichotomous choice between two methods. It could be concluded that the professional regulation of the issue of how to account for pre-production costs in the extractive industries in Australia has not been effective in eliminating the ability of companies to choose the treatment they wish to adopt. The next section briefly summarises the findings of prior surveys conducted in Australia of mining companies’ accounting method choices in relation to pre-production costs. Evidence is then provided from a more detailed analysis of the 1997 reporting practices of companies in the extractive industries that such companies continue to adopt disparate methods of accounting for preproduction costs, taking advantage of the choice available to them. PRIOR SURVEYS OF PRACTICE – EXPLOITATION OF CHOICE There have been a substantial number of surveys of the treatment of pre-production costs by companies in the Australian extractive industries (Lourens and Henderson, 1972; Heazlewood, 1971; Heazlewood, 1977; Ryan, Heazlewood and Andrew, 1977, 1980; Heazlewood and Chye, 1984; Gerhardy, 1991; Ryan, Andrew, Gaffikin and Heazlewood, 1991, 1993; Ryan and Heazlewood, 1995; 1997). They provide evidence that not only has a choice of alternative accounting treatments been available, but that the ability to choose from alternatives has been utilised by companies in practice. As would be expected, the surveys conducted prior to the issue of any authoritative guidance on the treatment of pre-production costs indicated practices varying across the spectrum of available alternatives (Lourens and Henderson, 1972; Heazlewood, 1971). A clear preference for some form of capitalisation of pre-production costs is evident in these surveys, with 33% of the 60 companies surveyed by Heazlewood (1971) adopting the full cost method in their 1968-69 annual reports. Heazlewood (1977) conducted a follow up survey of the 1973-75 practices of 47 of the original 60 companies from his previous study. This covered the period when exposure draft ED 3 was on issue. Notable was the significant reduction in incidence of the full cost method, with concomitant increases in the popularity of the expense and successful efforts methods. However, not surprisingly given the continued absence of mandatory authoritative guidance, cross-sectional variation in practices remains evident. Similarly, persistence of variation in the method adopted to account for pre-production costs in the absence of a standard is evident in the survey by Ryan, et al. 21 (1977, pp. 73-74) of the 1975 financial statements of 43 companies involved in the extractive industries. As these surveys were all conducted prior to the release of the Standard on extractive industries accounting in October 1976, this raises the question of whether the cross-sectional diversity evident in the treatment of pre-production costs persisted following the issue of the Standard. A review of the surveys conducted since the operative date of the Standard (Ryan, et al., 1980; Heazlewood and Chye, 1984; Gerhardy, 1991; Ryan, et al., 1991, 1993; Ryan and Heazlewood, 1995; 1997) illustrate the following significant facts: The majority of companies surveyed chose to use the area of interest method, as specified in the Standard. Evidence of companies choosing to use other methods, including some which would appear to be outside the Standard’s allowed alternatives, persists. A trend towards use of a method, which could be described as ‘Capitalise/Area of interest with a provision’, has emerged. This method is discussed further below. The surveys show that while the degree of cross-sectional variation in the methods used to account for pre-production costs by Australian companies in the extractive industries appears to have diminished over the past two decades, it continues to persist to some degree. They suggest that even after the release of a Standard by the professional bodies in 1976 companies continued to take advantage of the ability to choose from the alternative methods allowed therein. Indeed, it appears that some companies chose to disregard the Standard’s requirements by adopting methods effectively banned by it; for instance, the full cost method is not permitted by the standard but its use is evident in some of the survey findings. It is possible that these prior surveys have understated the degree to of diversity in the treatment of pre-production costs. With the exception of Lourens and Henderson’s (1972) questionnaire survey, which involved 129 companies, the sample sizes of the studies have been relatively small. The largest sample of annual reports surveyed in the studies was in that of Ryan et al. (1991), which for one year examined a total of 62 annual reports. A further limitation of these studies is possibly that in all cases the surveys have divided the treatments into a number of discrete categories, ranging from two to six depending on the survey. The results of a survey of the 22 accounting treatment for pre-production costs adopted by a large cross-section of listed companies involved in the extractive industries in 1997 are provided in the next section. In addition to categorising the accounting treatments adopted into discrete groups, discussion of the accounting methods used suggests that such categorisation does indeed understate the degree of variation in practice. The implications of the findings for standard setters are then discussed. 1997 – PERSISTENCE OF AN EXPLOITED CHOICE The companies surveyed in this study were drawn from the 1997 Connect 4 Annual Report Collection, which includes a selection of annual reports of companies listed on the Australian Stock Exchange. All companies included in the collection with mining/exploration operations, and therefore needing to account for pre-production costs, were identified via keyword searches.9 In this manner a sample of 128 relevant companies was identified.10 As indicated previously, AAS 7 allows companies to choose between the expense method and the area of interest method to account for exploration and evaluation costs. Thus, it appears that the survey should result in a finding of an accounting choice that is dichotomous in nature, with companies choosing to use either one or the other of the two permitted methods. This proved not to be the case. Table 3 indicates the number of sample companies adopting the different methods of accounting for pre-production costs. Initially, the accounting treatments of the sample companies were classified into five categories; however, the closer analysis which follows suggests that the diversity is much greater than suggested by the initial review of accounting policies. The determination of which method a company has adopted involved a careful examination of the statement of accounting policies provided by each company in the notes to the financial statements. In addition, an examination of the treatment of pre-production costs in the accounts was used to confirm the description provided. Area of Interest As can be seen from Table 3, 63% of companies in the sample adopted the area of interest method to account for pre-production costs. For most of these 81 companies the statement of accounting 23 policies reproduced, sometimes with minor changes in wording or style, the description of the area of interest method provided in AAS 7/AASB 1022. For all cases included in this category the actual TABLE 3: ACCOUNTING METHOD FOR PRE-PRODUCTION COSTS No. % Area of interest 81 63 Area of interest with provision 33 26 Successful efforts 12 9 Area of interest with expensed amounts reinstated 1 1 Other 1 1 Total 128 100 disclosures in the balance sheet and notes thereto were consistent with the application of the policy. Of significance is the fact that the other companies in the sample, accounting for more than one third of the total, adopted some other method, or at least a variation of the area of interest method, to account for pre-production costs. While the number of methods listed in Table 3 seems small, as the discussion below indicates, the variation within some of these categories is quite substantial. Area of Interest with Provision A particular variation of the area of interest method adopted by 33 companies, or 26% of the sample, was to create a provision against the costs carried forward in case of future abandonment or diminution in value. It is possible to argue that under a strict interpretation of the Standard’s requirements such costs should be written off as incurred (para. 10) rather than provided for. Certainly nowhere in the Standard is the possibility of providing against costs carried forward explicitly mentioned. Even putting this aside, a close analysis of the accounting policies included under this classification indicates that the extent of provisions made and the criteria used to determine which costs to provide for vary considerably. For instance, Allgas Energy Ltd indicated 24 that “Where reserves have not been established, a provision equal to the accumulated expenditure carried forward is shown in the accounts” (Note 1(viii)). That is, such expenditure is provided for in full, the net effect being as if the expenditure had been written off as incurred. A number of companies established full provisions against all exploration and evaluation expenditure incurred, with the exception of expenditure to acquire mining and exploration tenements (see for instance Ashton Mining Ltd, Note 1(h) and North Ltd, Note 1 (d)). Many of the companies included in this category indicated explicitly that provisions would be reversed if a decision to develop an area were made. Comalco Ltd provides a fairly typical example of this in Note 1(j) to its financial statements, which states: All expenditure associated with these projects is capitalised and at the same time a provision of equal amount is created against each project by means of a charge to the profit and loss account. This full provision remains until such time as the economic viability of the project is determined. (emphasis added) Variations on the criteria for reversal of the provision are many. For instance, Petroz NL (Note 1) indicates that “… costs written off, or provided against, are reinstated when recoupment out of revenue to be derived from the relevant area of interest is assured” (emphasis added). It is interesting to note that the net effect of this policy on the company’s assets and equity will be the same as if they had adopted the ‘expense and reinstate’ method, a method not prescribed by the Standard. Other interesting policies in this category include that of Aberfoyle Ltd, which indicates that “… a provision is raised against exploration expenditures incurred more than three years prior to balance date unless, based on known mineralisation, it is reasonable to conclude that mining operations may eventuate …”. No explanation is provided of why a limit of three years is used. Normandy Mining Ltd adopts one of the more complex variations of this method. Note 1(i) to their accounts indicates: A provision for unsuccessful exploration and evaluation is created against each area of interest by means of a charge to the profit and loss account. The expenditure incurred in areas of interest located around existing milling facilities is provided for over the life of the milling facilities. Expenditure on all other areas of interest is fully provided for as the expenditure is incurred other than for exploration assets acquired, which are initially recorded at cost. 25 It is worthwhile noting that a number of companies included in this category in fact described the area of interest method in their statement of accounting policies, but examination of their financial statements clearly indicated that the ‘area of interest with provision’ method was in fact being used. Such an inconsistency would not represent an intention to deceive. It therefore appears that in the minds of at least these companies the two methods are one and the same, and that while making a provision against costs carried forward is not mentioned in the Standard, neither is it specifically proscribed. They would presumably argue that it is an allowable variation on the ‘pure’ area of interest method. The reason for using this method is likely to be a pragmatic one. It would be easier, both in practical terms, and in terms of justifying the method under the standard, to reverse a provision where a viable deposit is found, than it would be to reinstate costs that have previously been written off directly to the profit and loss account. This latter method is discussed further in the next section. A number of companies in the sample changed their methods of accounting for preproduction costs in 1997. Two such companies, Central Norseman Gold Corporation Ltd and WMC Ltd, both changed from a policy of providing in full for costs carried forward to the strict area of interest method. They are therefore included in the first category in Table 3. What are of particular interest are the reasons given for making the changes. In the former case it was stated that “… the practice of making and reversing provisions could cause profit fluctuations not related to current activities” (Note 1(b)), suggesting a profit smoothing motive. WMC Ltd indicated that it changed policy because “… the previous policy was not consistent with the practice generally adopted in the industry” (Note 1(e)). In fact, the evidence from this survey suggests that use of a provision against pre-production expenditure carried forward is not an uncommon practice in the industry. It is evident from the above that it would be an oversimplification to say that the area of interest method represents a single standard method of accounting for pre-production costs in the extractive industries. Many companies appear to have developed their own interpretations of the appropriate way to implement the method in practice. Successful Efforts Method 26 Of the 126 companies included in the study, none strictly used the expense method, where all preproduction costs are written off as incurred. However, as indicated in Table 3, 12 companies (9% of the sample) adopted a policy described in the annual report that essentially meets the description of the successful efforts method. In all these cases, the companies essentially wrote off pre-production costs up to the point where some criterion relating to the existence of a viable mineral deposit was fulfilled or the decision to develop an area was made. From this time costs incurred were capitalised, to be amortised from the commencement of production. The criteria used to determine the point at which to commence capitalisation of pre-production costs varied amongst the companies included in this category. For instance, Consolidated Rutile Ltd (Note 1(j)) and Cudgen RZ Ltd (Note 1(j), emphasis added) both indicate that: Expenditure incurred during exploration and the early stages of evaluation of new areas of interest, or associated with existing mining operations is written off as incurred. Expenditure is carried forward when there are economically recoverable reserves … Gold Mines of Australia Ltd (Note 1(i)) indicates that costs are carried forward once “a geological resource has been identified”. Goldfields Ltd (Note 1(h)), Pancontinental Mining Ltd (Note 1(H)) and RGC Ltd (Note 1(h)) all indicate that “Expenditure is carried forward when incurred in areas where economic mineralisation is indicated …”. 11 While these companies use criteria related to geological conditions, other companies carry forward costs incurred after the point where the decision to develop is made. For instance, Hargraves Resources NL states (Note 1(g)): All exploration and evaluation expenditure is expensed as incurred until a development decision is made by the directors which shows that development expenditure will be recouped through successful development and exploitation of the area or alternatively by its sale. All expenditure incurred after that determination is to be carried forward … The criteria used by Kidston Gold Mines Ltd is somewhat more vague, indicating that such expenditure “… is charged against earnings as incurred until it has been established that an area of interest has development potential” (Note 1(i)). A slightly different criterion again is used by Pasminco Ltd (Note 1(i)), which commences to carry forward the costs “… when a project reaches the stage where such expenditure is considered to be capable of being recouped through development or sale …”. Two companies distinguish costs to be written off as incurred from those 27 to be carried forward on the basis of the phase of operations in which they are incurred. For instance QCT Resources Ltd (Note 1) indicates that: Mineral exploration costs are expensed. Costs subsequently incurred in the evaluation of mineral resources in each area of interest are carried forward …12 While these criteria might all seem reasonable bases on which to decide to commence carrying forward pre-production costs in the context of the successful efforts method, two important facts remain. First, a number of different criteria are used, none of which are clearly defined, leading to inconsistent application of the method between the companies applying it. Second, and most significantly, the method itself can be argued to be inconsistent with the Standard’s requirements, which in prescribing the area of interest method favours capitalisation rather than expensing of such early pre-production costs, until the decision to develop or abandon is made. Other Methods Two companies in the sample adopted methods of accounting for pre-production costs which did not fit well into any of the three categories discussed so far. As indicated in Table 3, one company, Bendigo Mining NL, outlined the area of interest method in its statement of accounting policies (Note 1(d)), with the additional statement that “It is intended to reinstate the value of mining tenements into the accounts when they are commercially exploited and amortise such a value over the estimated life of recoverable reserves”. Thus, aspects of the expense and reinstate method have been combined with the area of interest method. The company classified as ‘Other’ in Table 3 gave little detail of how it accounted for pre-production cost, apart from being capitalised at the lower of cost and net realisable value. The above accounting policy analysis on the choice of method to account for pre-production costs suggests that to describe the choice as dichotomous would be incorrect. To even try to classify the policy choices into a discreet number of categories, as in Table 3, is to understate the possible variations in how the categories of policies are implemented in practice. A further factor adding to the diversity is that the method prescribed by the Standard relies upon use of a cost centre described as the ‘area of interest’, which it has been pointed out is difficult to delineate and may vary in nature and size from company to company. Essentially, companies have a great deal of latitude in the 28 amount of pre-production costs to be expensed and/or capitalised in any year, ranging from expensing of all such costs to capitalising them under the area of interest method, on the grounds that exploration and evaluation have not yet reached the stage where the existence or otherwise of recoverable reserves in the area(s) of interest can be ascertained (AAS 7, 1979, para. 10(b)). Under the current regulatory requirements in relation to accounting for pre-production costs, companies are able to choose from a wide range of possible treatments along a continuum, from the expense method to what amounts to the full cost method (under the guise of the ‘area of interest method’). Miller and Loftus (1993, p. 3) suggest that: An expectation has developed that standard-setters will prescribe or proscribe approaches where there is no single obviously correct accounting method, thus curtailing the scope for individualistic or self-interested decisions in the preparation of financial statements. Accounting for pre-production costs would appear to be an example of a case where this expectation has not been met. Diversity appears to flourish under the current regulatory requirements. This then raises the question of what, if anything, should be done in response to such a finding. SAC 4 – A GUIDING LIGHT IN A MAZE OF DIVERSITY? Howieson (1993), prior to the removal of the mandatory status of Statements of Accounting Concepts, suggested that SAC 4 possessed the potential to introduce significant changes to existing accounting standards, such as AAS 7, where the existing requirements were in conflict with those suggested by the definitions and recognition criteria contained therein. It was suggested above that SAC 4 implies that the extant requirements for accounting for pre-production costs are inappropriate within the context of the Australian conceptual framework project, and that the current choice between the expense and area of interest methods should be replaced by sole use of the expense and reinstate method. Reduction in the number of available ‘accounting methods’ from two to one does not imply in this case that diversity will be eliminated. Even under the expense and reinstate method, the fundamental issue of the cost centre to be used in accumulating those costs which are subsequently ‘reinstated’ must still be addressed. Even designating the single cost centre to be used, such as the ‘area of interest’, leaves substantial scope for variation, since it is virtually impossible to 29 define it in terms precise enough to eliminate entirely differences of interpretation and application between (or indeed within) entities. In addition, further scope for diversity exists in relation to the judgement required to implement the ‘probable’ asset recognition criterion. As indicated by Howieson (1993, p. 14), this criterion “does not change the fact that preparers and auditors of financial reports will still have to exercise their professional judgement (and may legitimately reach different conclusions)”. Specifically, the exercise of judgement in this case is likely to lead to diverse interpretations of whether and when pre-production costs previously written off are to be reinstated. While it is clear that SAC 4 could not lead to the complete removal of diversity in the accounting treatment of pre-production costs, its potential to provided a framework within which to review current regulation and current practice is obvious. Henderson (1993, p. 13) describes as “regrettable” the removal of the mandatory status of SAC 4. This will certainly be the case if this relegation to the status of guidance signals a down-grading in the eyes of standard setters in terms of, first, the need to review existing standards, such as AAS 7, and second, the degree to which the concepts espoused therein will in fact be taken into account if such a review does take place. The current program of harmonisation with international standards suggests the first concern is unlikely to be significant. The IASC’s recent addition of the issue to its agenda implies the issue is likely to be taken up by the Australian standard setters in the near future. It is however more difficult to speculate as to the likely outcome of the review and the influence of SAC 4 on that outcome. Specific issues relating to accounting for pre-production costs which should be addressed by any such review include: the appropriateness of continuing to allow alternative treatments to account for exploration and evaluation costs; whether a single mandated method to account for such costs would produce more comparable financial statements, and thus more useful information for statement users; whether the expense and reinstate method, which is consistent with the guidance provided in SAC 4, is the method which would provide the most relevant and reliable information; and whether more specific guidance on implementation of the mandated method(s) should be provided. This might encompass the definition of the ‘area of interest’, if use of this cost centre 30 is to be maintained, and further guidance on the criteria to be used in the decision to expense or capitalise pre-production costs. The time is ripe for reconsideration of the extractive industries standard in relation to preproduction costs. An opportunity has been presented to address the appropriateness of the Standard’s current requirements, particularly with regard to the level of diversity in practice that it currently permits. As demonstrated by the accounting policy review presented above, if improved comparability of financial reports within the mining industry is desired then as a minimum there needs to be some clarity provided on the interpretation of the criteria used to decided when costs are to be written off vis-à-vis when they are to be carried forward. Without this, an opportunity to extract some degree of consensus on accounting for pre-production costs, and thereby to improve the usefulness to decision makers of mining companies’ financial statements, will have been missed. REFERENCES AARF and AASB, 1994, AARF &AASB Report, No. 22, September. AARF and AASB, 1995, AARF &AASB Report, No. 25, July. AARF and AASB, 1996, The Standard, No. 3, December. AARF and AASB, 1997, The Standard, No. 4, May. Accounting Standards Review Board, 1989, Approved Accounting Standard AASB 1022, “Accounting for the Extractive Industries”, October. Accounting Standards Review Board and Australian Accounting Research Foundation, 1989, Release 416/Exposure Draft 47 Invitation to Comment, “Consideration by the Accounting Standards Review Board of Accounting Standards AAS 1,, 2, 3, 4 and 7 for Interim Approval and Consideration of Proposed Amendments to such Standards”, January. Anon, 1977, “Amendment to Statement of Accounting Standards DS 12/308 Accounting for the Extractive Industries”, The Chartered Accountant in Australia, Vol. 48, No. 6, December, p. 13. Australian Accounting Research Foundation, 1989, Australian Accounting Standard AAS 7, “Accounting for the Extractive Industries”, November. Australian Accounting Research Foundation and Australian Accounting Standards Board, 1990, Statement of Accounting Concepts SAC 2, “Objective of General Purpose Financial Reports”, August. 31 Australian Accounting Research Foundation and Australian Accounting Standards Board, 1990, Statement of Accounting Concepts SAC 3, “Qualitative Characteristics of Financial Information”, August. Australian Accounting Research Foundation and Australian Accounting Standards Board, 1995, Statement of Accounting Concepts SAC 4, “Definition and Recognition of the Elements of Financial Statements”, March. Australian Society of Accountants and the Institute of Chartered Accountants in Australia, 1973, Exposure Draft ED 3: Proposed Statement of Accounting Practice, “Accounting for the Extractive Industries”, February. Australian Society of Accountants and the Institute of Chartered Accountants in Australia, 1976, Statement of Accounting Standards DS 12/308, “Accounting for the Extractive Industries”, October. Australian Society of Accountants and the Institute of Chartered Accountants in Australia, 1977, Statement of Accounting Standards DS 12/308, “Accounting for the Extractive Industries”, December. Australian Society of Accountants and the Institute of Chartered Accountants in Australia, 1979, Statement of Accounting Standards AAS 7, “Accounting for the Extractive Industries”, August. Coutts, W.B., 1963, Accounting Problems in the Oil and Gas Industry: A Research Study, Canadian Institute of Chartered Accountants, Toronto. Davies, B.J., 1976, “Accounting for the Extractive Industries”, The Australian Accountant, Vol. 46, No. 9, October, pp. 549-555. Davison, A.G., 1979, “Mining Companies’ Financial Statements – of What Use?”, The Chartered Accountant in Australia, Vol. 50, No. 2, August, pp. 22-26. Davison, A.G. and Lourens, R.M.C., 1978, “Compliance with DS 12”, The Chartered Accountant in Australia, Vol. 48, No. 10, May, pp. 33-36. Field, R.E., 1969, Financial Reporting in the Extractive Industries, Accounting Research Study No. 11, American Institute of Certified Public Accountants, New York. Gerhardy, P.G., 1991, “Accounting for Exploration and Evaluation Costs in the Australian Mining Industry: An Application of Economic Consequences Theory”, Accounting Forum, Vol. 15, No. 1, June, pp. 30-60. Heazlewood, C.T., 1971, “Accounting for Exploration and Related Expenditure”, The Australian Accountant, Vol. 41, No. 3, April, pp. 137-138. Heazlewood, C.T., 1977, “Accounting for Exploration and Related (Development) Expenditure”, The Chartered Accountant in Australia, Vol. 48, No. 3, September, pp. 12-17. Heazlewood, C.T., 1987, Financial Accounting and Reporting in the Oil and Gas Industry, The Institute of Chartered Accountants in England and Wales, London. 32 Heazlewood, T. and Chye, M., 1984, “An Empirical Study of Extractive Industry Financial Reporting Practices in Australia, Malaysia and New Zealand”, Journal of Extractive Industries Accounting, Fall, pp. 99-122. Henderson, S., 1993, “Financial Accounting in Australia: Retrospect and Prospect”, Accounting Forum, Vol. 17, No. 2, September, pp. 4-18. Henderson, S. and Peirson, G., 1988, Issues in Financial Accounting, 4th edition, Longman Cheshire, Melbourne. Howieson, B., 1993, “SAC 4: A Source of Accounting Change”, Australian Accounting Review, Vol. 3, No. 1, May, pp. 11-19. IASC, 1998, Current Projects – Extractive Industries. [Online, accessed 21 July 1998] URL:http://www.iasc.org.uk/frame/cen3_24.htm. Johnson, L.T., 1985, “The Conceptual Framework: A Retrospective”, The Chartered Accountant in Australia, Vol. 56, No. 3, September, pp. 23-24. Lourens, R. and Henderson, S., 1972, Financial Reporting in the Extractive Industries: An Australian Survey, Australian Society of Accountants, Melbourne. Miller, M.C. and Loftus, J.A., 1993, “SAC 4 and the Challenge to the Mandatory Status of Concepts Statements”, Australian Accounting Review, Vol. 3. No. 1, May, pp. 2-10. Ryan, J.B., Andrew, B.H., Gaffikin, M. J. and Heazlewood, C.T., 1991, Australian Company Financial Reporting: 1990, Accounting Research Study No. 11, Australian Accounting Research Foundation, Caulfield. Ryan, J.B., Andrew, B.H., Gaffikin, M. J. and Heazlewood, C.T., 1993, Australian Company Financial Reporting: 1993, Accounting Research Study No. 12, Australian Accounting Research Foundation, Caulfield. Ryan, J.B. and Heazlewood, C.T. (eds), 1995, Australian Company Financial Reporting: 1995, Accounting Research Study No. 13, Australian Company Accounting Practices (ACAP) Inc. Ryan, J.B. and Heazlewood, C.T. (eds), 1997, Australian Company Financial Reporting: 1997, Accounting Research Study No. 14, Australian Company Accounting Practices (ACAP) Inc. Ryan, J.B., Heazlewood, C.T. and Andrew, B.H., 1977, Australian Company Financial Reporting: 1975, Accounting Research Study No. 7, Australian Accounting Research Foundation, Melbourne. Ryan, J.B., Heazlewood, C.T. and Andrew, B.H., 1980, Australian Company Financial Reporting: 1980, Accounting Research Study No. 9, Australian Accounting Research Foundation, Melbourne. Whittred, G.P., 1978, “Accounting for the Extractive Industries: Use or Abuse of the Matching Principle?”, Abacus, Vol. 14, No. 2, pp. 154-159. Whittred, G.P., Zimmer, I. and Taylor, S., 1996, Financial Accounting: Incentive Effects and Economic Consequences, 4th edition, Harcourt Brace, Sydney. Wise, T.D. and Wise, V.J., 1988, “AAS No 7 Requires Disclosure Exposure”, The Chartered Accountant in Australia, Vol. 58, No. 11, June, pp. 30-32. 33 34 NOTES 1 Since the requirements of AAS 7 and AASB 1022 are in substance the same, reference in this paper will be made only to the professional standard, AAS 7, unless specifically necessary to the discussion. In addition, various versions of AAS 7 have been issued since it was first released in October 1976. Different versions are distinguished in this paper by their date of issue. Full references are provided in the reference list. 2 The work program of the PSASB published in the July 1995 AARF & AASB Report (p. 12) and the AASB work program published in the May 1997 issue of The Standard both fail to mention the review of the extractive industries standard. 3 Whittred (1978, p. 157) suggested that the nature of the matching principle is such that it does not provide a useful means of choosing between different methods of accounting for pre-production costs, since it is “open to varying interpretations”. Despite this criticism of the matching principle, the most recently released version of AAS 7 (issued in November 1989) justifies the method prescribed by the standard on the basis that it will “achieve as far as possible a proper matching of revenue and related expenses” (para. 16). The appropriateness of the matching principle as a means of solving the capitalise versus expense decision, in light of the definitions and recognition criteria adopted by SAC 4, is considered later in the paper. 4 Similarly, Davison (1979, pp. 22-23) described the area of interest method as “a hybrid of ‘Successful Efforts’ and the ‘Full Cost’ methods”, but gave no explanation of this statement. Wise and Wise (1988, p. 30) were of a similar view. 5 This essentially amounts to SAC 4 taking an asset-liability approach rather than a revenueexpense approach to defining the elements of financial reporting. For a fuller discussion of this issue see Johnson (1985). Also, Miller and Loftus (1993) discuss the impact of these alternative orientations upon performance reporting. 6 Frequent use of directors’ and independent valuations of pre-production costs carried forward, including some using present value techniques, was evident in the accounting policy review reported in this paper. This suggests that the issue of measurement of preproduction costs, while beyond the scope of this paper, is one that could usefully be included in any impending review of the Standard. 7 At this time the Institute and the Society used separate designations for Statements of Accounting Standards, the DS series being used by the Institute and the 300 series by the Society. 8 This is by virtue of Section 298 of the Australian Corporations Legislation and previously Section 269(8A), (8B) of the Companies Code. 9 A search of the database on the keyword ‘exploration’ was used to identify relevant companies. A total of 182 companies were identified in this way, of which 54 were either not actively involved in the mining industry, or were excluded as they were foreign companies expressing their financial statements in a foreign currency and/or adopting 35 accounting principles mandated by another jurisdiction. A second search on the keyword ‘mining’ was used as a check of the first search. No further relevant companies were identified. 10 A list of the companies included in the survey is available from the author on request. 11 It is worth noting that Consolidated Rutile Ltd, Cudgen RZ Ltd, Goldfields Ltd, Pancontinental Mining Ltd and RGC Ltd are part of the same economic entity. 12 Effectively this company uses the expense method for exploration costs and the area of interest method for evaluation costs.