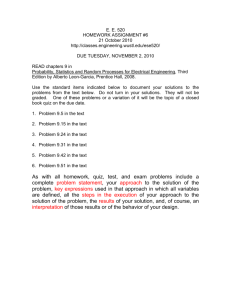

Day 20 Quiz 5 Review Sheet

advertisement

BM418 Review Sheet – Quiz #5 Financial Planning Sudweeks Spring 2012 *This list is not all-inclusive, but is a great starting point in your preparation for your first Quiz. Remember my goal is to share principles and tools so you can apply these things in your daily lives. This is the only document that can be open when you are taking your Quiz—it is a closed book closed notes Quiz. Format: The exam will consist of multiple choice and work out problems. We anticipate it will take 3/4 to an hour to complete, but you will be given 2 hours (international students are allowed another ½ hour). The Exam will cover discussion from Day 1 to 3 and from Chapters 1 through 3 of the book. It is due before the next class. Recommended actions for every Day: Review your notes. The best starting point is the notes that you took in class. Review them first before anything else. Review the chapters. This is the foundation material for the discussions. Skim what you have already read, read through the Summary of each chapter Review the Class Summaries. These are good discussions of what the objectives are for the class and how the activities we performed supported those activities Review the PowerPoints and Other Materials. Additional Information to know specific to this Exam: Day 16: Investments 5: Stock Basics; Investments 7: Building Your Portfolio (Chapters 21 and 23) Be able to calculate before- and after-tax returns for equity investments Understand and be able to explain the “Priority of Money” Understand and be able to explain the “Investment Hourglass” Day 17: Investments 6: Mutual Funds Basics; Investments 7: Building Your Portfolio (Chapters 22 and 24) Be able to calculate mutual fund returns in a weighted portfolio (Note: remember tax implications of different types of investments) Understand the basics behind picking mutual funds Day 18: Investments 9: Performance Reporting and Rebalancing; (Chapter 25) Investments 10: Behavioral Finance (No chapter associated with this topic) Understand and be able to explain rebalancing techniques Be able to evaluate the performance of a fund against the market using the Sharpe, Treynor and Jensen performance measures. Day 19: Investments 11: Investments Wrap Up and Q & A (No chapter associated with this topic) Page | 1 This is mostly a review of previous chapters. Therefore, there are no specific bullet points for this topic. However, I would still go over the PowerPoints to pick up important information. Quiz Review Formulas Total Return [Pend – Pbegin + Distributions] / Pbegin OR Before-Tax: [NAVend – NAVbegin + Distributions] / NAVbegin Total Return After-Taxes: Distributions * (1 – tax rate) Sharpe: (rp – rf) / sp Treynor: (rp – rf) / βp Jensen: rp – [ rf + βp (rm – rf) ] IMPORTANT NOTE: For this quiz, questions 14 and 15 incorrectly ask you to find the Jensen performance measure. Please find the Treynor performance measure for these two questions. Thank you. Page | 2