problem set 4 - Shepherd Webpages

advertisement

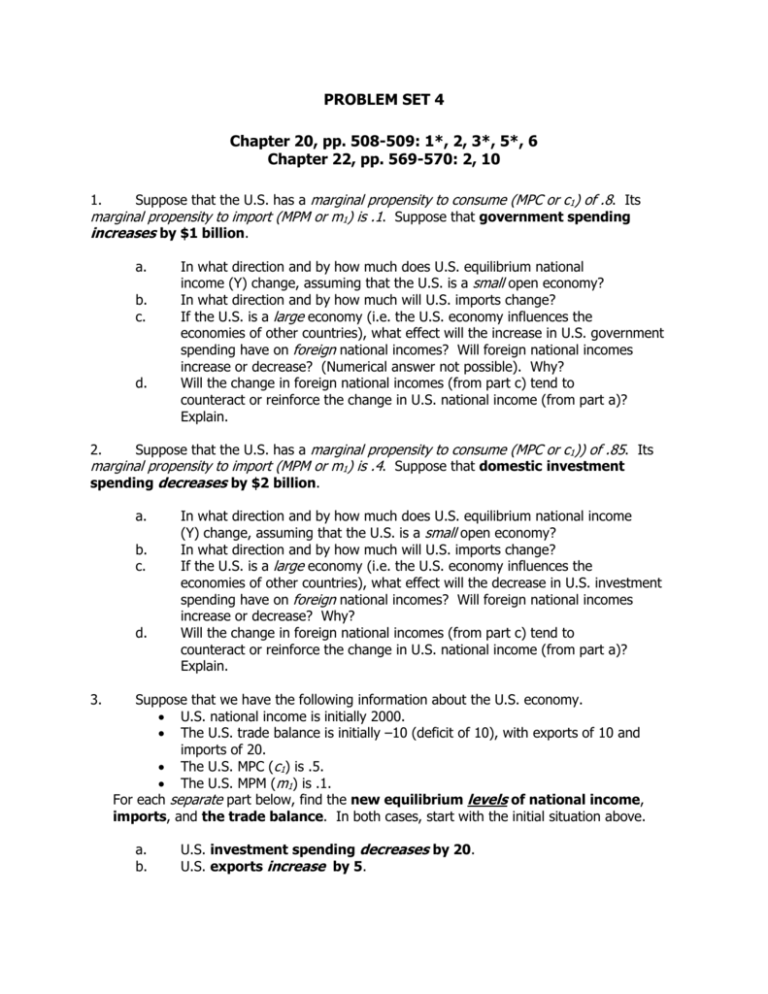

PROBLEM SET 4 Chapter 20, pp. 508-509: 1*, 2, 3*, 5*, 6 Chapter 22, pp. 569-570: 2, 10 Suppose that the U.S. has a marginal propensity to consume (MPC or c1) of .8. Its marginal propensity to import (MPM or m1) is .1. Suppose that government spending increases by $1 billion. 1. a. b. c. d. In what direction and by how much does U.S. equilibrium national income (Y) change, assuming that the U.S. is a small open economy? In what direction and by how much will U.S. imports change? If the U.S. is a large economy (i.e. the U.S. economy influences the economies of other countries), what effect will the increase in U.S. government spending have on foreign national incomes? Will foreign national incomes increase or decrease? (Numerical answer not possible). Why? Will the change in foreign national incomes (from part c) tend to counteract or reinforce the change in U.S. national income (from part a)? Explain. Suppose that the U.S. has a marginal propensity to consume (MPC or c1)) of .85. Its marginal propensity to import (MPM or m1) is .4. Suppose that domestic investment spending decreases by $2 billion. 2. a. b. c. d. 3. In what direction and by how much does U.S. equilibrium national income (Y) change, assuming that the U.S. is a small open economy? In what direction and by how much will U.S. imports change? If the U.S. is a large economy (i.e. the U.S. economy influences the economies of other countries), what effect will the decrease in U.S. investment spending have on foreign national incomes? Will foreign national incomes increase or decrease? Why? Will the change in foreign national incomes (from part c) tend to counteract or reinforce the change in U.S. national income (from part a)? Explain. Suppose that we have the following information about the U.S. economy. U.S. national income is initially 2000. The U.S. trade balance is initially –10 (deficit of 10), with exports of 10 and imports of 20. The U.S. MPC (c1) is .5. The U.S. MPM (m1) is .1. For each separate part below, find the new equilibrium levels of national income, imports, and the trade balance. In both cases, start with the initial situation above. a. b. U.S. investment spending decreases by 20. U.S. exports increase by 5. 2 4. a. Beginning from a position of equilibrium in the diagram below and a zero trade balance, what is the effect of a decrease in government spending on: i. The equilibrium level of national income? ii. The trade balance in goods and services? AD AD A 45o Y1 Y XGS, MGS MGS X1=M1 A XGS 0 Y1 b. c. d. Y Answer part (a) for a decrease in the interest rate. Answer part (a) for a decrease in exports. Answer part (a) for an increase in foreign national income. 3 SELECTED ANSWERS (Be careful! I put this problem set together really quickly. If you think anything is wrong, let me know.) TEXTBOOK, p. 508 #2: An adjustable peg means that the government only changes the par value when there is a “fundamental” or permanent disequilibrium. The par value presumably will not change very often. A crawling peg means that the government changes the par value often according to a set of macroeconomic indicators. TEXTBOOK, p. 508 #6: epnuts per $1 S$ 3.5 pnuts per $1 3.0 pnuts per $1 PAR Value D$ QS$ a. b. c. QD$ #$ Since there is private excess demand for dollars at par, the Pugelovian government could sell the desired dollars out of its official reserve asset holdings. Since QS$ (see graph) are being earned by Pugelovian exporters at par, the government could require that they turn in those dollars to the government and the government could decide who will get to use those dollars. The government could increase domestic interest rates. This raises the rate of return on domestic (Pugelovian) assets relative to foreign assets. International investors will want to buy more Pugelovian assets and will sell more dollars on the foreign exchange market. This increases the supply of dollars, shifting the supply curve (in graph above) to the right. At the same time, the demand for dollars will decrease since $assets will be less attractive. This shifts the demand curve to the left. Both of these will bring the market exchange rate closer to par value. TEXTBOOK, p. 569 #2: Disagree. The recession in the U.S. reduces U.S. national income, so U.S. residents reduce spending on all kinds of things, including spending on imports. The decrease in U.S. imports is a decrease in the exports of other countries, 4 including those of Europe. The reduction in European exports reduces production and incomes in Europe so the growth of real GDP in Europe declines. TEXTBOOK, p. 570 #10: a. Our country’s imports increase, due to the marginal propensity to import; exports stay the same. b. Our country’s exports decrease; Imports also decrease because lower exports will lower our incomes. c. The real exchange rate ((Pf x e)/P) decreases when P increases. This means that foreign products become relatively cheap (or our products become relatively expensive). Thus, our exports decrease and our imports increase. d. The real exchange rate ((Pf x e)/P) increases when Pf increases more than P. This means that foreign products become relatively expensive (or our products become relatively cheap). Thus, our exports increase and our imports decrease. ANSWERS TO ADDITIONAL PROBLEMS 1. a. Multiplier is 1/(1-.8+.1) = 3.3 Output/income increases by $3.3 billion. b. Imports increase by .1 x $3.3 billion = $0.33 billion c. Foreign national incomes will increase because an increase in US imports increases foreign exports. d. The increase in foreign incomes will reinforce the increase in U.S. incomes because foreigners will buy more U.S. products, increasing U.S. exports and thus increasing U.S. incomes more than the initial increase in U.S. government spending. 2. a. Multiplier is 1/(1-.85+.4) = 1.82 Output/income decreases by $3.64 billion ($2 billion x 1.82). b. Imports decrease by .4 x $3.64 billion = $1.46 billion c. Foreign national incomes will decrease because a decrease in US imports decreases foreign exports. d. The decrease in foreign incomes will reinforce the decrease in U.S. incomes because foreigners will buy fewer U.S. products, decreasing U.S. exports and thus decreasing U.S. incomes more than the initial decrease in U.S. investment spending. 3. NOTE: The multiplier = 1/(1-.5+.1) = 1.67 a. Y (2000 – (20 x 1.67)) = 1966.6; M (20 – 3.34) = 16.67; Trade Balance (10 – 16.67) = -6.66. b. Y (2000 + (5 x 1.67)) = 2008.35; M (20 +.835) = 20.835; Trade Balance (10 – 20.835) = -10.835. 5 4. a. AD AD A 45o Y1 Y XGS, MGS MGS X1=M1 A XGS Surplus Y 6 b. A decrease in the interest rate increases investment spending. AD AD A 45o Y1 Y XGS, MGS MGS Deficit X1=M1 A XGS Y 7 c. A decrease in exports decreases AD. AD AD A 45o Y1 Y XGS, MGS MGS X1=M1 A XGS Deficit d. An increase in foreign national income will increase the exports of the nation in question. This increases the nation’s aggregate demand and equilibrium income. The increase in exports will produce a trade surplus. Graphically, everything is the opposite of the graph in part c.