Business-Personal Finance - North Arlington School District

advertisement

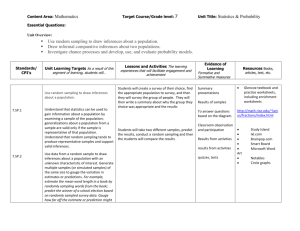

Content Area Business Education Personal Finance/Grade 11-12 Unit Title Personal Taxes Essential Questions How does the government collect revenue? Unit Overview Students will gain understanding of why we have a tax system in our country. Students will learn to prepare to complete a individual tax return Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… Lessons and Activities The learning experiences that will facilitate engagement and achievement 8.1.8.A.10,1 2 8.1.8.B.4, 6 A. Analyze the balance between the rights and responsibilities of citizens, and apply the analysis to understanding issues facing society in the United States. Students will view a PowerPoint presentation, “Your Role as a Taxpayer” and discuss the outcome. B. Identify Income Tax systems Teacher directed lecture on the tax systems that are used around the world Fixed Tax Concept Progressive Tax System Tax Brackets Tax Tables C. Identify the types and uses of payroll taxes. Students will follow and discuss the Fact Sheet –Payroll Taxes and Federal Income Tax Withholding, Form W-4 available on the website. Students will examine Government Expenditures by Function to understand where our tax money goes. Evidence of Learning Formative and Summative measures Resources Books, articles, text, etc. Teacher observation of class participation in discussion and activity www.irs.gov/app/unde rstandingTaxes/ Teacher prepared quiz Tax for Teens, 2010 U.S. Government Annual Report (annually published) Completion of Form W-4 Students will complete an actual Form W-4. North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Personal Taxes Essential Questions How does the government collect revenue? Unit Overview Students will gain understanding in how the tax system in our country works. Students will learn to complete a individual tax return . Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… 8.1.8.A.10,1 2 8.1.8.B.4, 6 D. Identify and navigate through a Form W-2 (Wage and Tax Statement) Lessons and Activities The learning experiences that will facilitate engagement and achievement Students will view the Form W-2 and be able to identify all parts of the form. Teacher directed lecture of how Form W-2 is calculated in relation to the periodic paycheck calculations. Study “Wahoo Fish Tacos” example. E. Identify taxable interest income and nontaxable interest income. Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity Students will view the Form 1099-Int and be able to identify all parts of the form. Teacher prepared quiz Teacher directed lecture of how Form 1099INT is calculated in relation to taxable and nontaxable interest and dividends. Assessment – Interest Income Resources Books, articles, text, etc. www.irs.gov/app/unde rstandingTaxes/ U.S. Department of the Treasury, Publication 15 – Circular E Employer’s Tax Guide Fact Sheet – Interest Income Schedule B – Interest & Dividend Income F. Explain what a dependent is and apply the five dependency tests to determine whether a person can be claimed as a dependent. Fact Sheet – Dependents Online activity – Simulation 4A complete and discuss topics Completion of Form 1099-INT Assessment – Dependents North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Personal Taxes Essential Questions What is reportable to the government for income and expenses of individuals? Unit Overview Students will gain understanding in how the tax system in our country works. Students will learn to complete a individual tax return Standards/ CPI’s 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 Unit Learning Targets As a result of this segment of learning, students will… G. List the five filing statuses and determine the best filing status for the taxpayer Lessons and Activities The learning experiences that will facilitate engagement and achievement Teacher lecture and listing of the 5 filing statuses and their requirements. Students will navigate through the Tutorial – Filing Status and work through Simulation 5 – Identifying Filing Status and Dependents. H. Explain how exemptions affect income that is subject to tax and determine the number of exemptions to claim on a tax return I. Complete a Federal Form 1040EZ Students will examine the Fact Sheet: Exemptions and discuss the various types of exemptions: Personal Dependency Teacher directed lecture of the filing requirements for a taxpayer. Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity Resources Books, articles, text, etc. www.irs.gov/app/unde rstandingTaxes/ Teacher prepared quiz Teacher prepared simulations for 1040 EZ completion Students will follow the Federal Form 1040 EZ simulations prepared by the teacher and complete the forms North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Personal Taxes Essential Questions What is reportable to the government for income and expenses of individuals? Unit Overview Students will gain understanding in how the tax system in our country works. Students will learn to complete a individual tax return Standards/ CPI’s 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 Unit Learning Targets As a result of this segment of learning, students will… J. Explain how the standard deduction affects income that is subject to tax and the factors that determine the amount of standard deduction. Lessons and Activities The learning experiences that will facilitate engagement and achievement Students will examine the Fact Sheet – Standard Deduction and work through Simulation 7A and 7B. Upon completion students will take the online Assessment – Standard Deductions. K. Complete a Federal Form 1040 Teacher directed lecture of the filing requirements for a taxpayer. Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity Resources Books, articles, text, etc. www.irs.gov/app/unde rstandingTaxes/ Teacher prepared quizzes/tests Students will follow the Federal Form 1040 simulations prepared by the teacher and complete the forms. L. Explain how the itemized deduction affects income that is subject to tax and the factors that determine the amount of standard deduction. Students will learn to complete Schedule A – Itemized Deductions- all lines and deductions. Teacher prepared simulations for 1040 completion North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Planning a Wedding: Budgeting Essential Questions How can I prepare for adult life? Unit Overview Students will be preparing a budget and comparing the budget vs. actual numbers while utilizing the internet to plan a wedding. Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… A. Prepare a budget in an Excel spreadsheet 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 B. Accumulate and tabulate actual 9.2.12.A.1-3 expenditures for the wedding simulation. Lessons and Activities The learning experiences that will facilitate engagement and achievement Based upon a specific scenario – students will prepare a budget, using Excel, for a wedding. Using on-line and print sources, students will research, accumulate and calculate all aspects of an actual wedding. Research includes comparison shopping and staying within budget for all expenditures. Evidence of Learning Formative and Summative measures Completion of the budgeted expenditures on an Excel spreadsheet Resources Books, articles, text, etc. www.theknot.com www.theweddingchan nel.com Project rubric The Wedding Project Portfolio from data file Multimedia project will include (but not be limited to): Registering for shower gifts Finding a Banquet hall Travel Tickets Accommodations Favors DJ and Video Wedding Attire Invitation design North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Buying/Leasing a Car Essential Questions Should I purchase or lease a vehicle? Unit Overview Students will utilize the internet and various resources to decide whether to buy or lease a vehicle. Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… A. Determine disposable income 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 Lessons and Activities The learning experiences that will facilitate engagement and achievement Teacher directed discussion of fixed and variable expenses to determine disposable income. Students completion of handout to calculate disposable income. Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity Verbal quiz B. Determine the real costs of a new car Teacher directed discussion including topics: Initial Expenses Annual Expenses Students will research (using online sources) the current costs of such expenses and discuss the prices fluctuation. Research will be presented in the form of an Excel spreadsheet. Resources Books, articles, text, etc. www.kbb.com msn autos website www.consumer reports.com Motor Trend Magazine Project rubric Consumer Reports Magazine Current Newspapers C. Understand the seller’s plan Students will view the handout, “Dealers Plan of Action” to familiarize themselves with the car buying process. Teacher prepared quiz North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Buying/Leasing a Car Essential Questions Should I purchase or lease a vehicle? Unit Overview Students will utilize the internet and various resources to decide whether to buy or lease a car. They will identify the pros and cons of both buying and leasing. Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 C. Understand the seller’s plan (continued) Lessons and Activities The learning experiences that will facilitate engagement and achievement Students may go on a trip to a local car dealership to discuss the process with actual salespeople. Students will explore the costs of the dealer including: Dealer Invoice Rebates Adjustments Dealer Costs D. Identify different ways to pay for the car E. Define and identify ways to make a down payment for a car Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity www.kbb.com www.consumer reports.com Motor Trend Magazine Students will list and discuss the ways of paying for an automobile, including: cash, financing and leasing. Consumer Reports Magazine Class discussion regarding paying a cash down payment or financing and acquisition fees. Other topics discussed include: MSRP Purchase Price Down Payment Loan Terms Interest Resources Books, articles, text, etc. Current Newspapers Teacher prepared quiz North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Buying/Leasing a Car Essential Questions How is the value of a car affected over time? Unit Overview Students will gain understanding of the leasing process and how the value of the car depreciates over time . Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 F. Define leasing and identify the different aspects of leasing as an option to a new car Lessons and Activities The learning experiences that will facilitate engagement and achievement Students will follow the handout, “Leasing an Automobile”. They will follow online the Kelley Blue Book site to familiarize themselves with the costs involved. Topics covered: Value of the car Depreciation Residual Value Acquisition Fees Licensing Fees Sales Tax Leasing Terms Interest Rates Gap Insurance Evidence of Learning Formative and Summative measures Teacher observation of class participation in discussion and activity Resources Books, articles, text, etc. www.kbb.com www.consumer reports.com Motor Trend Magazine Project rubric Consumer Reports Magazine Current Newspapers G. Create a multimedia project determining whether buying or leasing is the best option for them In a PowerPoint project students will use print and online sources to choose an automobile, determine the costs of buying or leasing, calculate the difference and determine which option is best for them. Teacher prepared test North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Credit Essential Questions Should I pay cash or credit? Unit Overview Students will gain understanding of the world of credit, borrowing money and paying for the use of money Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 A. Define credit Lessons and Activities The learning experiences that will facilitate engagement and achievement Students will participate in a role play activity that demonstrates what a promise is and how credit is extended based upon those promises. Evidence of Learning Formative and Summative measures Class participation in discussions and activities Resources Books, articles, text, etc. Lifetime Learning Systems, Inc., Credit Drives America Using overhead transparencies students will define credit and understand how credit is a series of promises. B. Identify common types of credit C. Fill-out a credit application and proceed through the Credit Approval Process Topics for discussion include: Revolving Credit Purchase Financing Secured Financing Unsecured Financing Verbal quiz Students will complete a credit application. Completion of assignment Student handout and discussion on the “Three C’s of Credit” Students will view a sample credit report and define its parts. The will be able to identify the top credit reporting agencies and request their own credit report. Teacher prepared test North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Essential Questions What is the true cost of credit? Unit Overview Students will establish credit history and Unit Title Credit the responsibility of their financial actions. Students will study what is takes to create a positive background. Standards/ CPI’s 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 Unit Learning Targets As a result of this segment of learning, students will… D.Identify the terms of a Finance Agreement Lessons and Activities The learning experiences that will facilitate engagement and achievement Evidence of Learning Formative and Summative measures Students will view and discuss a Finance Agreement including the legal requirements and terms. Class participation in discussions and activities Students will complete the activity, “Know your Credit Card” Parts I & II Students will view the presentation, Credit Superhero E. Establish and maintain credit Students will discuss credit history and the importance of it, responsibility for their financial actions, and what it takes to create a positive financial background. Resources Books, articles, text, etc. Lifetime Learning Systems, Inc., Credit Drives America “What is Your Money I.Q.?” “Credit Wise Quiz” Teacher prepared test Transparencies and student handouts will provide discussion and reference material. North Arlington Public Schools Content Area Business Education Personal Finance/Grade 11-12 Unit Title Getting a Job Essential Questions How can I prepare myself for the interview process? Unit Overview Students will learn to compile a resume, write effective cover letters and experience . Standards/ CPI’s Unit Learning Targets As a result of this segment of learning, students will… 8.1.12.B.112 8.2.8.A.1-5 8.2.12.A.3 9.1.12.B.3 9.2.8.A.1, 5 9.2.12.A.1-3 9.2.12.E.1, 2 9.2.12.B.2, 3 A. Prepare a resume B. Prepare a cover letter C. Identify the parts of a portfolio D. Complete an interview for a job Lessons and Activities The learning experiences that will facilitate engagement and achievement Teacher directed preparation of a resume. Students will view samples of resumes and prepare their own. Teacher directed preparation of an effective cover letter. Students will view samples of cover letters and prepare their own. Evidence of Learning Formative and Summative measures Participation and Project rubric Interview notes from Interviewer Resources Books, articles, text, etc. The Job Hunting Handbook www.usdepartmentofl abor.gov Teacher directed preparation of an effective job portfolios. Students will view samples of job portfolios. After completing all the above parts students will complete mock interviews with various members of the faculty and administration to fully appreciate the job interview process. North Arlington Public Schools