Policies and Procedures

Insider Lending/Regulation O Policy and Procedures

PURPOSE

The purpose of this policy is to ensure that the bank fully complies with the requirements and restrictions imposed on extensions of credit to bank insiders. These requirements and restrictions are contained in the

Federal Reserve Board’s Regulation O (12 CFR 215).

The intent of Regulation O is to prevent excessive lending to insiders and to prevent bank insiders from taking unfair advantage of their positions in obtaining extensions of credit from the bank.

It is the responsibility of the board of directors to oversee the bank’s lending to insiders. Violation of

Regulation O can result in substantial personal liability to board members, and for this reason, compliance with this policy and Regulation O will receive the highest priority. This policy establishes the framework for insider lending and the bank’s procedures for ensuring compliance. Because this policy makes numerous references to particular provisions of Regulation O, it is important that the board of directors and bank management be familiar with this regulation and refer to it regularly when administering this policy.

This policy and Regulation O apply to all extensions of credit to insiders of the bank and to only a portion of the insiders of affiliates of the bank. Under Regulation O, an “affiliate” is any parent holding company of the bank and any subsidiary of a parent. An “extension of credit” under Regulation O is very broadly defined and includes guarantees and a number of other items in addition to direct loans to an insider.

Loans to third parties can also be considered extensions of credit subject to Regulation O if an insider receives a “tangible economic benefit” from the extension, unless the loan meets all of the criteria established as an exception to this rule. It is crucial that persons responsible for administering extensions of credit to insiders be familiar with the Regulation O definition of extension of credit.

The bank will keep records necessary for compliance with the requirements of Regulation O.

PERSONS SUBJECT TO REGULATION O (12 CFR 215)

This policy and Regulation O affect, to varying degrees, extensions of credit to insiders of the bank and, in some instances, insiders of any affiliate of the bank. As used in this policy and in Regulation O, an

“insider” of the bank or of an affiliate is any one of the following persons:

• Directors

• Executive officers

• Principal shareholders

• Related interests of a director, executive officer, or principal shareholder

However, extensions of credit to insiders of an affiliate will not be subject to this policy if:

• The affiliate’s total assets do not account for more than 10 percent of the consolidated assets of the holding company.

• The insider does not participate and cannot participate in the major policy-making functions of the bank itself.

The term affiliate as well as each of these insiders is specifically defined in Regulation O. (See Appendix

A for a copy of these definitions to use as a reference.)

To ensure identification of all insiders, the bank will maintain a list of the following:

• All affiliates of the bank

• All directors of the bank and bank affiliates

• All executive officers of the bank and bank affiliates

• All principal shareholders of the bank and bank affiliates

• All related interests of directors, executive officers, and principal shareholders of the bank and bank affiliates

This list will be made available to all bank personnel responsible for extensions of credit.

At least annually, the board of directors of the bank and its affiliates will obtain a survey from each director, executive officer, and principal shareholder disclosing their related interests. (12 CFR 215.8)

At least annually, the board of directors of the bank will adopt resolutions that positively identify, by title, those individuals within the bank and the bank’s affiliates who will be considered authorized to participate in the major policy-making functions of the bank.

All persons positively identified will be considered subject to the provisions of the regulation.

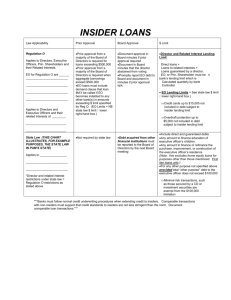

PRIOR APPROVAL OF INSIDER LOANS

All extensions of credit to insiders of the bank and insiders of bank affiliates (who are considered insiders of the bank as defined earlier) will receive the prior approval of the bank’s board of directors. All lines of credit to insiders of the bank and insiders of bank affiliates (who are considered insiders of the bank, as defined earlier) will be approved by the board of directors at least annually. or

[ Alternative paragraph :

All extensions of credit to insiders of the bank and insiders of bank affiliates (who are considered insiders of the bank, as defined earlier) will receive the prior approval of the bank’s board of directors if the extension of credit, when aggregated with the amount of all other extensions of credit to that person and to all related interests of that person, exceeds the higher of:

• $25,000, or

• 5 percent of the bank’s unimpaired capital and unimpaired surplus (up to $500,000)

The board of directors will approve all lines of credit to insiders of the bank and insiders of bank affiliates at least annually.]

TERMS AND CREDITWORTHINESS OF INSIDER LOANS

All loans to insiders of the bank and insiders of affiliates of the bank (who are considered insiders of the bank, as defined earlier) will be made on substantially the same terms (including interest rates and collateral) as, and following credit underwriting procedures that are not less stringent than, those prevailing at the time for comparable transactions by the bank with other persons who are not covered by

Regulation O and who are not employed by the bank and must not involve more than the usual risk of repayment or present other unfavorable features.

However, due to amendments to the statute and subsequent amendments to 12 CFR 215.4(a) of

Regulation O, insiders can obtain preferential loan terms if they are made pursuant to a benefit or compensation program that has both of these characteristics:

• The program is widely available to employees of the bank, and in the case of insiders of affiliates of the bank, the program is widely available to employees of the affiliate at which the person is an insider.

• The program does not give preference to any insider of the bank over other employees of the bank, and in the case of an insider of an affiliate, the program does not give preference to any insiders of the affiliate over other employees of the affiliate.

INSIDER LENDING LIMITS

Individual Insider Lending Limit (12 USC 371c – 12 USC 371c-1)

An extension of credit to an insider of the bank or an insider of an affiliate of the bank (who are considered insiders of the bank, as defined earlier) is prohibited if the extension of credit, when aggregated with the amount of all other extensions of credit by the bank to that person and to all related interests of that person, exceeds 15 percent of the bank’s unimpaired capital and unimpaired surplus as measured by Regulation O. Exceptions to this limit permitted by Regulation O will also be permitted under this policy.

This prohibition does not apply to an extension of credit by the bank to a company of which the bank is a subsidiary or to any other subsidiary of that company. These extensions of credit are subject to separate restrictions contained in sections 23A and 23B of the Federal Reserve Act.

Aggregate Insider Lending Limit

An extension of credit to an insider of the bank or an insider of an affiliate of the bank (who are considered insiders of the bank, as defined earlier) is prohibited if the extension of credit, when aggregated with the amount of all outstanding extensions of credit by the bank to all of its insiders, would exceed the amount of the bank’s unimpaired capital and unimpaired surplus as defined in Regulation O.

Exceptions to this limit permitted by Regulation O will also be permitted under this policy.

[ Additional language for banks with deposits of less than $100 million, if desired :

The board of directors may, by resolution, increase this aggregate limit up to 200 percent of the bank’s unimpaired capital and unimpaired surplus. Any aggregate insider lending limit in excess of 100 percent of the bank’s unimpaired capital and unimpaired surplus can only be implemented after:

• The board of directors determines that the higher limit is consistent with prudent, safe, and sound banking practices in light of the bank’s experience in lending to its insiders and is necessary to attract or retain directors or to prevent restricting the availability of credit in small communities.

• The resolution sets forth the facts and reasoning on which the board of directors bases the finding, including the amount of the bank’s lending to its insiders as a percentage of the bank’s unimpaired capital and unimpaired surplus as of the date of the resolution.

• The bank meets or exceeds, on a fully phased-in basis, all applicable capital requirements established by the appropriate federal banking agency.

• The bank received a satisfactory composite rating in its most recent report of examination.

If the bank has adopted a resolution authorizing a higher aggregate limit and subsequently fails to meet the requirements of the last two items above, the bank will not extend any additional credit (including a renewal of any existing extension of credit) to any insider of the bank or its affiliates unless such extension or renewal is consistent with the general aggregate limit of 100 percent of the bank’s unimpaired capital and unimpaired surplus.]

Additional Lending Limit for Executive Officers (12 CFR 215.4, 12 CFR 215.5(c))

In addition to the above lending limits, executive officers of the bank are subject to an additional lending limit under 12 CFR 215.5(c) of Regulation O. Under this provision, and subject to the individual and aggregate lending limits specified above, the bank can extend credit to any executive officer of the bank:

• In any amount to finance the education of the executive officer’s children.

• In any amount to finance or refinance the purchase, construction, maintenance, or improvement of a residence of the executive officer. These loans must be secured by a first lien on the residence, and the residence must be owned (or expected to be owned after the extension of credit) by the executive officer. In the case of a refinancing, only the amount used to repay the original extension of credit, together with the closing costs of the refinancing, and any additional amount thereof used for any of the allowed purposes qualify for this exception.

• In any amount, if the extension of credit is secured in a manner described in paragraphs

(d)(3)(i)(A) through (d)(3)(i)(C) of 12 CFR 215.4 of Regulation O.

• For any other purpose not specified above, if the aggregate amount of these extensions of credit to the executive officer does not exceed at any one time the higher of (a) 2.5 percent of the bank’s unimpaired capital and unimpaired surplus up to $100,000, or (b) $25,000. Included in this amount is the full amount of any outstanding loans to any partnership in which one or more of the bank’s executive officers are partners and, either individually or together, holds a majority interest.

All extensions of credit by the bank to any of its executive officers must be:

• Promptly reported to the board of directors

• Preceded by the submission of a detailed current financial statement of the executive officer

• Made subject to a written demand clause stating that the extension of credit will, at the option of the bank, become due and payable at any time the officer is indebted to any other bank or banks in an aggregate amount greater than the amount specified for a category of credit in paragraph

215.5(c) of Regulation O

OVERDRAFTS OF INSIDERS (12 CFR 215.4(E))

In accordance with 12 CFR 215.4(e) of Regulation O, the bank may not pay an overdraft of an executive officer or director of the bank or of an affiliate of the bank, on an account at the bank, unless either:

• The payment of funds is made in accordance with a written, preauthorized, interest-bearing extension of credit plan that specifies a method of repayment, or a written, preauthorized transfer of funds from another account of the account holder at the bank.

• The payment is of an inadvertent overdraft on an account in an aggregate amount of $1,000 or less, provided the account is not overdrawn for more than five business days, and the bank charges the executive officer or director the same fee charged to any other customer of the bank in similar circumstances.

PROHIBITION AGAINST KNOWINGLY RECEIVING UNAUTHORIZED EXTENSION OF

CREDIT (12 CFR 215.6)

Under 12 CFR 215.6 of Regulation O, no executive officer, director, or principal shareholder of the bank or any of its affiliates will knowingly receive (or knowingly permit any of that person’s related interests to receive) from the bank, directly or indirectly, any extension of credit that is not authorized under

Regulation O.

DISCLOSURE OF INSIDER CREDIT (12 CFR 215.9)

As required by 12 CFR 215.9 of Regulation O, on receipt of a written request from the public, the bank will make available the names of each of its executive officers and each of its principal shareholders to whom, or to whose related interests, the bank had outstanding as of the end of the latest previous quarter of the year an extension of credit that, when aggregated with all other outstanding extensions of credit at such time from the bank to such person and to all related interests of such person, equaled or exceeded 5 percent of the bank’s capital and unimpaired surplus or $500,000, whichever amount is less. However, no disclosure is required if the aggregate amount of all extensions of credit outstanding at such time from the bank to the executive officer or principal shareholder and to all related interests of such person does not exceed $25,000. Also, the bank is not required to disclose the specific amounts of individual extensions of credit.

The bank will maintain records of all of these requests as well as the disposition of such requests for a period of at least two years.

[ Additional clause required only for banks whose shares are not publicly traded :

REPORTING OF INSIDER LOANS SECURED BY BANK STOCK

Each executive officer and director of the bank will report annually to the board of directors the outstanding amount of any credit that was extended to the executive officer or director and that is secured by shares of the bank.]

RESTRICTIONS ON CORRESPONDENT BANKING

Banks Subject to Correspondent Restrictions

A correspondent bank subject to these restrictions is any bank that maintains one or more correspondent accounts for this bank during a calendar year that in the aggregate exceed an average daily balance during that year of $100,000 or 0.5 percent of this bank’s total deposits (as reported in its first consolidated report of condition during that calendar year), whichever amount is smaller.

A correspondent account is an account that is maintained by a bank with another bank for the deposit or placement of funds. However, a correspondent account does not include time deposits at prevailing market rates, or an account maintained in the ordinary course of business solely for the purpose of effecting federal funds transactions at prevailing market rates or making Eurodollar placements at prevailing market rates.

Restrictions on Lending

All loans to executive officers, directors, and principal shareholders of a correspondent bank will be made on substantially the same terms (including interest rates and collateral) as, and following credit underwriting procedures that are not less stringent than, those prevailing at the time for comparable transactions by the bank with other persons who are not covered by Regulation O and who are not employed by the bank and must not involve more than the usual risk of repayment or present other unfavorable features.

Restrictions on Opening Correspondent Accounts

The bank will not establish a correspondent account relationship with any bank to which the bank has outstanding extensions of credit to that bank’s executive officers, directors, or principal shareholders that are not made on substantially the same terms (including interest rates and collateral) as, and following credit underwriting procedures that are not less stringent than, those prevailing at the time for comparable transactions by the bank with other persons who are not covered by Regulation O and who are not employed by the bank, or if the extensions of credit involve more than the usual risk of repayment or present other unfavorable features.

The board of directors approved and adopted this policy on _________________.

APPENDIXES

Appendix A

REGULATION O DEFINITIONS

Affiliate . An affiliate is any parent holding company of the bank and any subsidiary of a parent holding company.

Company . Company means any corporation, partnership, trust (business or otherwise), association, joint venture, pool syndicate, sole proprietorship, unincorporated organization, or any other form of business entity not specifically listed herein. However, the term does not include an insured depository institution or a corporation of which the majority of the shares are owned by the United States or any state.

Control . Control of a company or bank means that a person directly or indirectly, or acting through or in concert with one or more persons:

• Owns, controls, or has the power to vote 25 percent or more of any class of voting securities of the company or bank

• Controls in any manner the election of a majority of the directors of the company or bank

• Has the power to exercise a controlling influence over the management or policies of the company or bank

A person is presumed to have control of a company or bank, including the power to exercise a controlling influence over the management or policies, if either:

• The person is an executive officer or director of the company or bank and directly or indirectly owns, controls, or has the power to vote more than 10 percent of any class of voting securities of the company or bank.

• The person directly or indirectly owns, controls, or has the power to vote more than 10 percent of any class of voting securities of the company or bank, and no other person owns, controls, or has the power to vote a greater percentage of that class of voting securities.

An individual is not considered to have control, including the power to exercise a controlling influence over the management or policies of a company or bank, solely by virtue of the individual’s position as an officer or director of the company or bank.

A person may rebut a presumption of control established by these rules by submitting to [ insert the name of the appropriate federal banking agency ] written materials that, in the agency’s judgment, demonstrate an absence of control.

Director . Director of a company or bank means any director of the company or bank, regardless of whether he or she is receiving compensation. An advisory director is not considered a director if the advisory director:

• Is not elected by the shareholders of the company or bank

• Is not authorized to vote on matters before the board of directors

• Provides solely general policy advice to the board of directors

Executive officer . Executive officer of a company or bank means a person who participates or has authority to participate (other than in the capacity of a director) in major policy-making functions of the company or bank, regardless of whether the officer has an official title, the title designates the officer as an assistant, or the officer is serving without salary or other compensation. The chairman of the board, the president, every vice-president, the cashier, the secretary, and the treasurer of a company or bank are considered executive officers, unless the officer is excluded, by resolution of the board of directors or by the bylaws of the bank or company, from participation (other than in the capacity of a director) in major policy-making functions of the bank or company, and the officer does not actually participate therein.

The term “executive officer” is not intended to include persons who may have official titles and may exercise a certain measure of discretion in the performance of their duties, including discretion in the making of loans, but who do not participate in making major policies of the bank or company and whose decisions are limited by policy standards fixed by the senior management of the bank or company. For example, the term does not include a manager or assistant manager of a branch of a bank unless that individual participates, or is authorized to participate, in major policy-making functions of the bank or company.

Extensions of credit to an executive officer of an affiliate (who are considered insiders of the bank, as defined earlier) of a member bank (other than a company that controls the bank) will not be subject to 12

CFR 215.4, 12 CFR 215.6, and 12 CFR 215.8 of this part, provided:

• The executive officer of the affiliate has been affirmatively identified (by name or by title) as eligible to participate in major policy-making functions of the member bank by resolution of the board of directors of the member bank.

• The executive officer is not otherwise subject to such requirements as a director or principal shareholder.

Immediate family . Immediate family means the spouse of an individual, the individual’s minor children, and any of the individual’s children (including adults) residing in the individual’s home.

Insider . Insider means an executive officer, director, or principal shareholder and includes any related interest of such a person.

Principal shareholder . Principal shareholder means a person (other than an insured bank) that directly or indirectly, or acting through or in concert with one or more persons, owns, controls, or has the power to vote more than 10 percent of any class of voting securities of a member bank or company. Shares owned or controlled by a member of an individual’s immediate family are considered to be held by the individual. A principal shareholder of a member bank does not include a company of which a member bank is a subsidiary.

Related interest . Related interest of a person means:

• A company that is controlled by that person, or

• A political or campaign committee that is controlled by that person or the funds or services of which will benefit that person