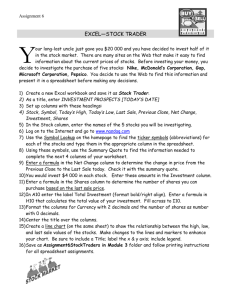

accomplishing goals

advertisement

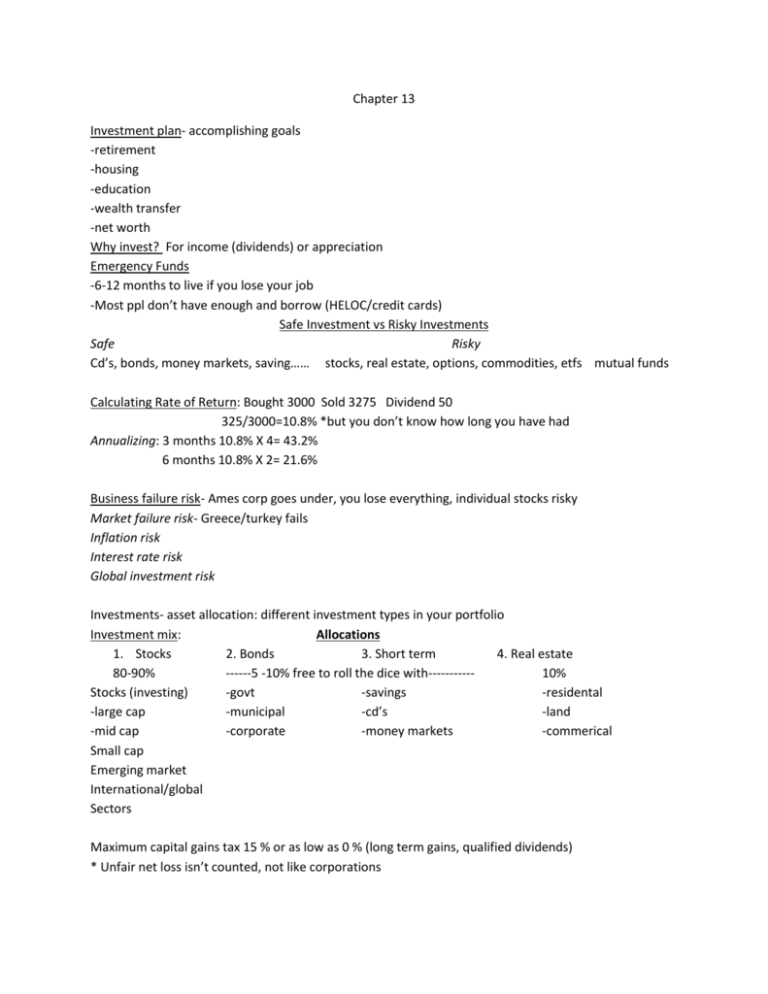

Chapter 13 Investment plan- accomplishing goals -retirement -housing -education -wealth transfer -net worth Why invest? For income (dividends) or appreciation Emergency Funds -6-12 months to live if you lose your job -Most ppl don’t have enough and borrow (HELOC/credit cards) Safe Investment vs Risky Investments Safe Risky Cd’s, bonds, money markets, saving…… stocks, real estate, options, commodities, etfs mutual funds Calculating Rate of Return: Bought 3000 Sold 3275 Dividend 50 325/3000=10.8% *but you don’t know how long you have had Annualizing: 3 months 10.8% X 4= 43.2% 6 months 10.8% X 2= 21.6% Business failure risk- Ames corp goes under, you lose everything, individual stocks risky Market failure risk- Greece/turkey fails Inflation risk Interest rate risk Global investment risk Investments- asset allocation: different investment types in your portfolio Investment mix: Allocations 1. Stocks 2. Bonds 3. Short term 4. Real estate 80-90% ------5 -10% free to roll the dice with----------10% Stocks (investing) -govt -savings -residental -large cap -municipal -cd’s -land -mid cap -corporate -money markets -commerical Small cap Emerging market International/global Sectors Maximum capital gains tax 15 % or as low as 0 % (long term gains, qualified dividends) * Unfair net loss isn’t counted, not like corporations Chapter 14 (1,2,10-14) Why stocks? Dividends and growth 9appreciation) -preferred shareholders get dividends b4 common share holders Stock Split- to attract investors Buy 1000 X $20 = $20,000 2:1 split Get 2000 shares X $10 = $20,000 Types of Stocks: Blue chip, cyclical, defensive, growth, income, large cap etc pg 452 Google/apple= growth stock Large cap>$10 billion mid cap $2-10 billion small cap $250- $2billion EPS= net income/ #shares outstanding Yield= dividend/ price PE ratio= Price/eps 25/2.34 microsoft pe= 10.7 (selling for 10x earnings) **Invest in basket of stocks not individual stocks; growth is factored in todays current price Market orders-buy and takes 30 seconds could change (don’t do it) Limit Order- Price= $50 buy limit $45 never goes down but goes up to 200 but you never bought it Sell limit- $55 stock goes from .10 to 50, never goes to 55 you may never end up selling it Stop limit- $50 price of stock… buy stop $55 you can do $5 over market price **once it goes through the stop it can be like a market order so$25 limit of $27 Sell stop- $50 sell stop at $45 or stock at 60 sell stop at 55 **investopedia good investing site Short term vs long term investing Long Term 1. Buy/hold- buying and holding stocks for 20 years 2. Dollar cost average $2000 $20 100 $2000 $25 80 $2000 10 200 $6000 15.80 380 3. Direct Investing- commission fees are nothing now (you pay around 5 dollars) ^^commission free trade 4. Dividend Reinvest Plan- put mutual fund dividend back in Short term (1-3 bad things very risky) 1. day trade- never own stock overnight, lose a lot gain a lot (don’t day trade) 2. buy on margin –double edge sword—x 2 what your up/down Ex. 1,000,000 cash 1,000,000 stocks 1,500,000 end 50 % 1,000,000 cash 1,000,000 margin 2,000,000 stocks 3,000,000 end 100% gain Down market- had to deposit money by certain time to meet fed margin rate(pay off $10,000) 3. selling short- your bet is stock goes down (don’t do this) selling stock you buy back make profit your loss is limitless 4. Options- 1 contract= 100,000 shares * call= right to buy stock (at a certain price) your betting stock goes up * putt= right to sell stock (price goes down) betting stock goes down ****currently a lot of pppl playin options volatile market Price= $20 At the money option (strike price= $20) –intrinsically =0 time= $1.50 (your betting that the stock sells for more than $20 +1.50 =1.50 then you make money) In the money option ($15) –intrisnsically $5 time .20 Out of the money option ($25) – intrinsically = 0 time .20 ADVantages options: control a lot of shares DISadvantages options: time expiring on your 1000 shares @ 20 = 20000 1000 shares @ 30 = 30000 10,000 (50%) gain 1000 contracts X 20 =20,000 1000 contracts x 50= 500,000 480,000 profit (2400% if GE going up 50 %) Chapter 15 (1,3,4,5,8,9,12) Bond is debt -Invest in bonds for income, some are non taxable Interests rates go up bonds go down Interests rates go down bonds go up -market rate < stated rate 8% < 10% = Premium bond so it yields higher amount Market rate > stated rate 10 % > 8% =Discount bond yield is lower amt Value= interest income/ market rate (80/.1)= $800 value of bond -Bonds are less risky than stocks -Typical bond holder near/ or in retirement, primarily invested for income 3 types of bonds fed tax state tax Corporate yes yes Municipal no no(if same state) Treasury yes no Municipal bond B4 tax 6% Taxes After tax 6% vs corporate bond 7% 2.8% 4.2 % Chapter 16 (1,2,10-14) Mutual funds over 15000 More than 15000 ETF (exchanged traded funds) tracks an index Mutual funds=diverse Load fund-you pay a fee to get into the fund (3-5%) No load fund- no fee most are no load funds Sector fund- invest in particular industry Closed funds- not many (less than 10%) traded during the day market Open ended fund- most common: you don’t buy /sell during trading day. Not bought on the market its transaction btwn you and mutual fund. **traded by its net asset value ---Net asset value= (value –liability) / # of shares Chapter 17 Direct/ Indirect real estate investments (note * non recall state (cant go after people who defaulted and foreclose the difference is just wrote off as a lost to the bank) no shortfalls Direct -Home -Vacation home -Investment property (land/residential property/ commercial property) Indirect -Partnerships : General/ Limited- no say in mgt if your in a limited partnership -LLC (cant shelter yourself from everything malpractice) -Stocks -Mutual funds stocks/mutual (you only lose what you put in) Real estate Advantages/Disadvantages Advantages -hedge against inflation -easy entry (indirect) -limited liability (indirect) -No mgt concerns (indirect) -financial leverage ****************** -home ownership- tax benefits cash margin stocks 5yrs 100,000 100,000 200,000 240,000 profit 40 % Cash5yrs 200,000 real estate 10,000 240,000 profit 400% Disadvantages -illiquidity (direct) -declining property value -lack of diversification -lack of tax shelter ( cant deduct passive losses except deduct 25K real estate rental loss) ******* -Long depreciation period (27.5 yrs residential// 39 commerical) -management problems ***** 1986 rule W2 500,000 Limt part <500,000> TI 0 Tax 0 QUALIFIED PERSONAL RESIDENT TRUST – 5/30 lawyers know this Parent---------transfer home--qualified personal 10-25yr term (live atleast 10) <---resident trust -------remainder--children ^^if you die within term (10yrs) FMV (DOD)= Gross estate Ex.$300,000 FMV residence 10 yr remainder interest, $117,000 gift -if you out live the term FMV (DOD) =/= Gross Estate Chapter 10 (1,2,3,5,6,7) *** always fight speeding tickets ***Gasoline summer= $5.00 currently 4.30 premium 2 weeks gonna be 4.50 INSURANCE Your Personal Insurance Program 1. Set insurance goals 2. Develop a plan to reach your goals 3. Put your plan into action 4. Check your results Life Insurance- if your asset go down, get more life insurance 2011 500,000 <500,000> 0 150,000 (30%) Home Owner Insurance House and other structures: garage/shed/gazebo Personal Property: 55-70% of insurance Rider/Personal Property floater-jewelry/computers Additional Living expenses- if damage house, pays for the cost of living expense temporarily Liability Insurance- incase ppl get hurt at your house Umbrella Policy- supplementary personal liability coverage (additional money) Renters Insurance: Personal property/liability Insurance ***CONSIDER group insurance ( homeowners/automobiles/life insurance through groups (Bryant)) Significantly less group 16k single 24 K AUTO INSURANCE Pg326 Automobile chart- You cant buy enough automobile insurance that you need, get umbrella policy Bodily injury liability- when you hurt someone in car accident etc 3 #s X/X/X 100/300/50------ 100-most 1 single person can get from you…300-most the group can get from you… property damnage liability(damage car)…. However if the judgement is 600 for 4 ppl… everyone gets 75K then have to go after you personally to sue you. Property damage liability- someones elses property is damaged Collision insurance-pays for damage to your car whether at fault or not Comprehensive physical insurance- hailstorm, tree fall etc Health Insurance Employers will give plans, A/B/C a being the best b good c average you pick how much you wnana pay Itemize deduction tax deduction Medical exp 3000 -AGI (7.5%) 4000 =deduction 0 you’re never going to get a medical deduction Self Employed people- 100% premium (don’t need to itemize) subtract 24K deduction for AGI (congress helps them out, cuz if they worked for corp theyd pay 4K) 2 Plans: HMO or PPO HMO Health Maintenance Organization need to see primary care physican for referral to see specialist PPO Preferred Provided organization- directly go to a specialist Long term Health care Insurance –Nursing home/ long term nurse needed around 24 hrs a day -Most states cost above 100K for 1 year in nursing home, ct 160K ri 100K Insurance cost 10X amount for someone in their 60’s compared to 20’s -statistically if you go into nursing home you will die quick NEED TO GET—DISABILITY INSURANCE *** Tax free if you pay the premium * you need to pay premium If company pays premium its not taxed free money Self employed costpremium cost 20 yr old 5K a month 240 a yr cost for insurance *50 yr old more than 50% men have been disabled for 1 year continuous *1/3 working Americans will have ST disability by 65 *once person is disable for 90 days they can be out for 2.5 yrs Chapter 12 Life Insurance **bear etf going up 21% last 4 days Life Insurance has 100 products only 2 types 1. Term- pure insurance ( 1 year term if you die w/in year you get 1,000,000) 30 yr old= 1,000,000 life insurance @ 350 bucks a year 55-59 @ 3500 bucks a year 65-69 @ 11,000 bucks 2. Permanent/ whole life insurancePay Premium life insurance ^ ^cash surrender value (saving account) Estimating Life insurance requirements Easy method- (yearly income X 7 X .7) terrible doesn’t take into account anything DINK method- (debt X .50) dual income no kids doesn’t take into account savings “Non working” spouse- ($40,000 yr X # of yrs till youngest reaches 18) “Family need” method- income replacement (10-20yrs) ie. 200K x 15 yrs= 3 million Funeral exp 20,000 Debt payoff 500,000 mortgage Nondaily exp (college) 500,000 =4,020,000 Subtract net worth -3,000,000 Need life insurance 1,020,000 Beneficiary (tax free no income tax) -primary----spouse Contingent----children