ACC 151-2016 Jan - Courses and Sections

advertisement

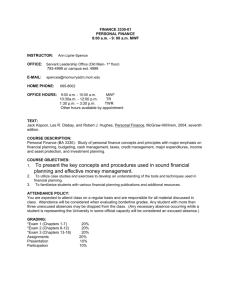

FINANCIAL ACCOUNTING ACC 151- Section: [Insert] [Insert other course information (optional): blended, honors] Credit Hours: 3.00 Lab Hours: 0.00 Lecture Hours: 3.00 IAI Core: IAI Majors: BUS903 Semester: [Insert] Course Begins: [Insert] Course Ends: [Insert] Days: [Insert] Times: [Insert] Room: [Insert] Instructor: [Insert] Email: [Insert your @mchenry.edu email address or LMS information] Phone: [Insert] Student Conference Hours: [Insert] Office Location: [Insert] Other Contact Information: [Insert] Website (optional): [Insert] Required Course Materials: Textbook and Textbook Supplement and Lab Manual: Fundamentals of Financial Accounting – 5th Edition o Phillips, Libby, and Libby o McGraw Hill-Irwin o ISBN 978-0-07-802591-4 Connect (Homework Assistant) License o Purchase from Bookstore, or o Purchase from Publisher on the first day of class Note on Textbook/Connect and E-Book Options. Students can purchase the E-Book, and not the printed version of the Textbook. The E-book comes with the Connect License. Lab Manual, available only at the MCC Bookstore Course Description: Financial Accounting is a foundation course for accounting and other business disciplines. Accounting is an information system that produces summary financial data primarily for external stakeholders. Students study the common transactions entered into by service and merchandising businesses. The emphasis is on understanding and applying basic accounting principles including inventory systems, depreciation methods, analysis of receivables and payables, analysis of the cash account and other concepts that guide the reporting of the effect of transactions on the financial position and operating results of a business. How to prepare, analyze and interpret historical financial statements and period-end adjustments, as well, and the limitations of using these in making forward-looking business decisions, is included. The primary content emphasis will be accounting for, the balance sheet, current assets and liabilities, long-term assets and liabilities and the stockholder’s equity section. (1.1-Articulated) [IAI Major Course Equivalent: BUS903] Course Note: This course requires advanced reading, basic writing and basic math. Section Notes: [Insert if applicable] Course Objectives: Revised 3/8/2016 Page 1 of 8 Upon completion of this course, the student will be able to: 1. State the three basic elements of the Accounting Equation. 2. Illustrate how all business transactions affect the three elements of the accounting equation. 3. Describe the financial statements of a business enterprise. 4. State the general rules of debit and credit including normal account balance sides. 5. Demonstrate the use of journals. 6. Demonstrate the use of accounts. 7. Demonstrate the posting of transactions to the General Ledger. 8. Prepare a trial balance and utilize it in the discovery of errors. 9. Explain the cash basis and the accrual basis of accounting. 10. Demonstrate basic procedures for adjusting entries. 11. Prepare and utilize a worksheet for use in preparing financial statements. 12. Prepare records for use in accumulating data for the following accounting period (closing entries). 13. Prepare financial statements, including Income Statement, Statement of Retained Earnings, Balance Sheet, and Statement of Cash Flows. 14. Illustrate accounting procedures for merchandising transactions. O. Describe the two principal types of merchandise inventory systems. 15. Illustrate the various methods of determining inventory cost. 16. Demonstrate procedures for correcting errors in accounting records. 17. Explain the use of a bank account for controlling cash. 18. Demonstrate an understanding of internal controls for cash receipts and cash payments. 19. Prepare bank statement reconciliation. 20. Describe the common classifications of receivables and the basic principles of internal control. 21. Describe and illustrate the basic concepts of accounting for uncollectible receivables. 22. Demonstrate the accounting for cash disbursements and purchase transactions. 23. Demonstrate the accounting for the acquisition of plant assets and their depreciation using various methods. 24. Demonstrate the accounting for the disposal of assets. 25. Describe the accounting for depletions, amortization and the distinction between capital and expenditures. 26. Prepare payroll records including the payroll register and employee’s earnings records. 27. Demonstrate the accounting for payroll and payroll taxes. 28. Demonstrate the accounting for short-term notes payable. 29. Demonstrate an understanding of the accounting for long-term liabilities and use of present-value tables. 30. Illustrate the accounting procedures for recording and reporting corporate equity. 31. Work productively as a team member in analyzing and solving various accounting problems. Course Outline: I. II. III. IV. V. VI. Business Decisions and Financial Accounting The Balance Sheet; including construct, interpret and analyze The Income Statement; including construct, interpret and analyze for a service business and merchandising business Adjustments, Financial Statements and Financial results; including analyze period-end adjustments- accruals and deferrals. Financial Reporting and Analysis; including GAAP/IFRS, including benchmarks and ratio analysis Internal Control, interpret and analyze Cash, Merchandise Sales and formulate an accurate policy Revised 3/8/2016 Page 2 of 8 for future business decisions. Inventories and Cost of Goods Sold; including construct, interpret and analyze various periodic and perpetual merchandise inventory methods. VIII. Receivables; including interpret and analyze, formulate an accurate policy for future business decisions, Bad Debt Expense and Interest Revenue IX. Long Lived Tangible and Intangible Assets; including interpret, analyze and construct a depreciation policy for long-term-assets. X. Liabilities; including interpret, analyze liabilities (short-term, long term and contingent). XI. Stockholders Equity; including construct, interpret and analyze the stockholders equity section of corporations. XII. Statement of Cash Flow; including construct, interpret and analyze direct and indirect methods XIII. Measuring and Evaluating Financial Performance; including construct, interpret and analyze financial ratios in making future business decisions. VII. Assignments and Grading Criteria Homework and LearnSmart (LS): Homework is assigned for each chapter. The homework exercises and problems are to be completed by each student. Students have unlimited tries at the homework, however, students can use the “check my work” option only two times per homework question, per submission. Homework tries build on previous attempt(s), students do not restart from scratch. If students have questions about the assignments or readings, please ask in the discussion thread for the chapter in Canvas “Canvas/Modules/ Chapter #/Discussion;” or discuss in class. See policy on late submissions. LearnSmart (LS) assignments must be fully completed in order for any points to be awarded. In other words, LS points are all or nothing, there are no partial points earned. Quizzes: There will be twelve (12) chapter quizzes. The quizzes are in electronic format on Connect (see above). Each quiz has questions that may include Multiple Choice, True False, and Problem formats. Students have 50 minutes for each quiz. Students have one try per quiz question, i.e. no re-takes. Weight given to quizzes, in computing final grades, is shown in the grade section of the syllabus. Note: Students should bring their own calculators to class on quiz days. Calculators cannot be shared nor can any electronic device (e.g. cellphones) be used during the quiz. See policy on late submissions. Exams: There will be four (4) exams during the semester Each exam will cover the content to date of the exam, and will be administered after Chapters 4, 7, 9, and 12. The exams are in electronic format on Connect (see above). Exams are cumulative. Each exam has 15 (fifteen) questions that may include Multiple Choice, True/False, and Problem formats. Students have 75 minutes for each exam. Students have one try per exam question, i.e. no re-takes. Weight given to exams, in computing final grades, is shown in the grade section of the syllabus. Note: Students should bring their own calculators to class on exam days. Calculators cannot be shared nor can any electronic device (e.g. cellphones) be used during the exams. Makeup exams may be given under extenuating circumstances. The instructor must be notified, in advance, (or as soon as possible – when prior notification would not be practical) for instructor consideration. Lab Manual: An Accounting Lab Manual is provided to help students with the more common problem areas for each chapter. The Project is graded, can be completed in teams, and can be used to satisfy Revised 3/8/2016 Page 3 of 8 students’ project for the E-Portfolio that is part of MCC’s graduation policy. This Lab Manual can be used to satisfy the “critical thinking” educational goal “identify, define, analyze, synthesize, interpret and evaluate ideas.” Revised 3/8/2016 Page 4 of 8 Points Possible Connect Homework/LS 12 Chapters Connect Quizzes 12 Chapters Exams 4 Exams Lab Manual 12 Chapters Total Points Extra Credit Opportunities 250 125 500 125 1000 Your instructor can offer chapter 13 as extra credit. Chapter 13 extra credits, if provided, may be worth up to 40 points. There are no other extra credit opportunities. However, a student who has fully participated and who has a grade within 1% of the next higher grade may, at the instructor’s discretion, be awarded the higher letter grade. Letter Grade: A ≥ 90% and above; B ≥ 80% and above; C ≥ 70% and above; D ≥ 60% and above; F ≤ 59% Policies Attendance policy: To facilitate the learning process a variety of means, including lecture, discussion, assignments, projects, and testing, will be employed. Only by attending class (in person and/or online) can a student take advantage of these learning opportunities. Late work/make-up policy: Assignments must be started BEFORE the due date in order to be eligible for the reduced points when submitted late. In other words, students must start timely, even if they don’t finish timely. Late assignments have reduced points available. Each day late results in 10% fewer points awarded. After 10 days late, no points will be awarded. See special provisions for exams under the Exam section of the syllabus. No late points awarded for LearnSmart activities, i.e. LearnSmart MUST BE started and submitted timely. Revised 3/8/2016 Page 5 of 8 Weekly Course Schedule (All Assignments are to be completed in Connect, except for Lab Manual) Due Date/Time Chapter 1 – Business Decisions and Financial Accounting Chapter 2 – Reporting Investing and Financial Results on the Balance Sheet Chapter 3 – Reporting Operating Results on the Income Statement Chapter 4 – Adjustments, Financial Statements, and the Quality of Financial Reporting Exam Number 1 – Chapters 1 through 4 Chapter 5 – Corporate Financial Reporting and Analysis Chapter 6 – Internal Control and Financial Reporting for Cash and Merchandising Operations Chapter 7 – Reporting and Interpreting Inventories and Cost of Goods Sold Exam Number 2 – Chapters 1 through 7 Chapter 8 – Reporting and Interpreting Receivable, Bad Debt Expense, and Interest Revenue Chapter 9 – Reporting and Interpreting Long-Lived Tangible and Intangible Assets Exam Number 3 – Chapters 1 through 9 Chapter 10 Reporting and Interpreting Liabilities Chapter 11 Reporting and Interpreting Stockholders’ Equity Chapter 12 Statement of Cash Flow Exam Number 4 – Chapters 1 through 12 Chapter 13 – Extra Credit Opportunity (If provided by instructor) Measuring and Evaluating Financial Performance Revised 3/8/2016 Page 6 of 8 Remember: Assignments must be started BEFORE the due date in order to be eligible for the reduced points if submitted late. In other words, students must start timely, even if they don’t finish timely. Late assignments have reduced points available. Each day late results in 10% fewer points awarded. After 10 days late, no points will be awarded. For any work that is due on the last day of class, no late submissions are permitted. Note # 1: See special provisions for exams under the Exam section of the syllabus. Note # 2: There are no late points awarded for LearnSmart activities, i.e. LearnSmart must be started and submitted timely. Teaching Schedule The scheduling of the activities and teaching strategies on this syllabus, but not the objectives or content, may be altered at any time at the discretion of the instructor. Withdrawals: The last day to drop this course is [Insert date according to Important Class Dates for term https://catalog.mchenry.edu/syllabi/Pages/default.aspx]. Failure to attend class does not constitute official withdrawal. If students are considering a withdrawal, they should consult directly with the instructor and an academic advisor. Students may withdraw from a class through the Registration Office, either in person or by fax: (815) 455-3766. In their request, students should include their name, student ID number, course prefix, number and section, course title, instructor, reason for withdrawing, and their signature. Withdrawal from a course will not be accepted over the telephone. Academic Support for Special Populations Students Students with Disabilities: It is the policy and practice of McHenry County College to create inclusive learning environments. If you are a student with a disability that qualifies under the American with Disabilities Act – Amended (ADAA) and require accommodations, please contact the Access and Disability Services office for information on appropriate policies and procedures for receiving accommodations and support. Disabilities covered by ADAA may include learning, psychiatric, and physical disabilities, or chronic health disorders. Students should contact the Access and Disability Services office if they are not certain whether a medical condition/disability qualifies. To receive accommodations, students must make a formal request and must supply documentation from a qualified professional to support that request. However, you do not need to have your documentation in hand for our first meeting. Students who believe they qualify must contact the Access and Disability Services office to begin the accommodation Revised 3/8/2016 Page 7 of 8 process. All discussions remain confidential. The Access and Disability Services office is located in Room A260 in A Building in the Atrium. To schedule an appointment to speak with the manager, please call (815) 455-8766. Information about disabilities services at MCC can be found at: www.mchenry.edu/access Students in Career/Technical Programs As a student enrolled in a career or technical education program at McHenry County College, you may be eligible for services and assistance under the Carl D. Perkins III Grant. Grant funds are used, in part, to assist students who are at risk of not succeeding in their educational pursuits. The traits that often prevent students from succeeding are: economic disadvantage, academic disadvantage, disability/disabilities, single parent, displaced homemaker, enrollment in a program in which their gender is under represented, and limited English proficiency (LEP). The definitions of each trait are available in the Access and Disability Services office. Students with one or more of these traits are referred to as Perkins Special Populations Students. If you would like to know if you are eligible for services at any time during the semester, please do not hesitate to contact the Manager, Access and Disability Services. The office is Room A260, and phone number is (815) 455-8676. Additional syllabus information and resources can be found at www.mchenry.edu/syllabusinfo. STUDENTS ARE RESPONSIBLE FOR KNOWING ALL SYLLABUS INFORMATION. Sage Learning Center The Sage Learning Center (SLC), a general tutoring and learning facility located in A247 near the Atrium entrance, offers students currently enrolled in credit academic courses free assistance in a variety of subject areas. Comprehensive support is provided in math and writing. Assistance is also provided, whenever possible, in many other disciplines. The SLC is staffed by professional and peer tutors who work on a scheduled drop-in and appointment basis with individuals and small groups. Computer-assisted instruction, study groups, assorted handouts, CDs, and DVDs are also available. Accounting tutoring hours vary by semester. Please contact Sage for current schedule. The tutors in the Sage Learning Center can guide you with the chapter homework, but cannot assist with the chapter quizzes, pre-post tests, or exams. For the Lab Manual, students may see the accounting tutor for clarification of the chapter assignment, but the tutor may not assist with the completion. Revised 3/8/2016 Page 8 of 8