Vancouver Island University Faculty of Management – Business

advertisement

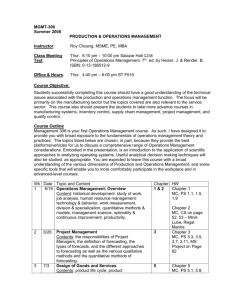

Vancouver Island University Faculty of Management – Business – http://www.viu.ca/management Accounting 100: Financial Accounting I Fall 2012 Faculty Gordon Holyer Office: Building 250, Room 426 Email Website Office Hours gordon.holyer@viu.ca http://web.viu.ca/holyerg WF 10:00 – 11:30 Phone: Fax: 250-753-3245 local 2539 250-740-6551 Prerequisite Min. "C+" in one of Principles of Math 11, Applications of Math 11, or Foundations of Math 11, and min. "C" in English 12. Course Overview This course will provide the student with an introduction, from a user perspective, to the principles and procedures of financial accounting. Topics include the objectives and users of accounting information, the mechanics of accounting including the accounting equation, transactions, the accounting cycle and the preparation of financial statements. Learning Outcomes General Understand economic and industry issues, and the role of accounting within that environment. Describe key features and characteristics of financial statements. Describe accounting concepts, Canadian Generally Accepted Accounting Principles (GAAP), standards, and processes. Technical Demonstrate understanding of the accounting cycle, and apply this knowledge in preparing basic financial statements. Critical Thinking And Problem Solving Demonstrate an understanding of how the business environment and industry affect the choice of accounting policies in an organization. Demonstrate and describe the effect of accounting policy choices on the users from different stakeholder groups. Analyze financial information and describe the effects of different accounting methods on financial statements. Professional Integrity Use personal and ethical frameworks to respond to ethical dilemmas. Required Resources Fundamentals of Financial Accounting, Phillips, Libby, Libby, Mackintosh. Third Canadian Edition, 2012. McGraw-Hill Ryerson. Supplemental Moodle Website: http://moodle.viuonline.ca Methods of Evaluation Assignment 1. Quizzes 2. Term tests (two tests) 3. Comprehensive final exam Grading Scale Grades will be assigned according to the following scale. A+ 90 – 100% C+ 64 – 67 A 85 – 89 C 60 – 63 A80 – 84 C55 – 59 B+ 76 – 79 D 50 - 54 B 72 – 75 F < 50 Value 15% 45% 40% (December 6 - 17) References B68 – 71 The Business Faculty requires the Harvard style of referencing for academic papers. Please see Quote, Unquote Referencing, and a Speedy Guide to Harvard Referencing at http://www.viu.ca/business/resources.asp, English Standards Assignments must be free of spelling, punctuation and grammatical errors. containing such errors will be penalized (i.e. mark deductions). Assignments Accommodation Students with documented disabilities requiring academic and/or exam accommodation should contact Disability Services in Building 200. Academic Misconduct Academic misconduct includes, but is not limited to, giving and receiving information during any test or exam, using unauthorized sources of information during any test; plagiarizing; fabrication, cheating, and, misrepresenting the work of another person as your own, facilitation of academic misconduct, and under certain conditions, non-attendance. Plagiarism will not be tolerated. You must reference your work and acknowledge sources with in-text citations and a complete list of references. This includes direct and indirect quotes, diagrams, charts, figures, pictures and written material. For group projects, the responsibility for academic integrity, which can result in academic misconduct and its resulting penalties, rests with each person in the group and sanctions would be bourn by each member. No electronic dictionaries, cell phones or other electronic devices will be allowed in exams/ tests/quizzes. Only the following approved calculators may be used in exams/ tests/quizzes. No other materials will be allowed on the desktop apart from a pen/pencil unless specifically approved by the faculty member. Texas Instrument BAII Plus, BAII, BA35: Sharp EL-733A: Hewlett Packard 10B Assignments QUIZZES There will be online quizzes on the course website. These quizzes will be based on the assigned chapter material. Due dates will be discussed in class and will be available online and in the course updates course information. Late quizzes will not be accepted. The best ten of twelve quizzes will be used to determine the quiz mark. Pre-assigned problems – For each chapter, there will be pre-assigned problems specified on the course website. These problems will be reviewed in seminar/class. While these problems will not be collected for evaluation, your ability to complete them yourself will be critical to success on the quizzes, tests and examination. You must be able to complete these problems independently. Solutions will be posted on the course website which you should be sure to review relative to your solution. TERM TESTS Term tests will be scheduled at the completion of a given set of chapters. Test dates in this course outline are approximate only – any changes to these test dates will be posted on Moodle. Students are responsible for knowing the correct test date. Term tests could consist of multiple choice, short answer questions, and problems. If a scheduled term test is missed for any reason, it will be assigned a grade of zero. You will be able to replace the mark obtained on one of the term tests if the mark received on your final examination is higher than that received on the term test. COMPREHENSIVE FINAL The comprehensive final will be three hours in length and will be held during the regularly scheduled exam period (December 6 - 17). The final will consist of multiple choice, short essay answer questions, and problems. The final examination is not optional and must be written as scheduled. NO TRAVEL PLANS SHOULD BE MADE DURING THE FINAL EXAM PERIOD Students completing ACCT 100 should be able to address the following questions or situations at a foundation level as found in the following chapters: Date Readings Exclusions or Additions Sept 4 Sept 6 Introduction Chapter 1 – Business Decisions and Financial Accounting Chapter 1 Additions: None Exclusions: None Sept 11& 13 Chapter 2 – Reporting Investing and Financing Results on the Balance Sheet Sept 18 & 20 Chapter 3 – Reporting Operating Results on the Income Statement Sept 25 & 27 Chapter 4 –Adjustments, Financial Statements, and Financial Results Chapter 2 Additions: None Define and explain the differences between operating, investing, and financing activities Identify and explain the content and reporting objectives of the four basic financial statements. Explain how the four financial statements are linked together. Identify and explain the users of financial statements and their primary goals. Describe the key features and characteristics of common balance sheet accounts. Identify and classify common balance sheet accounts. Exclusions: None Describe and show how business transactions affect the balance sheet Explain what determines whether an item is reported on the balance sheet and how it is valued. Chapter 3 Describe the key features and characteristics of Additions: None common income statement accounts. Identify and classify common income statement Exclusions: None accounts. Describe and show how business transactions affect the income statement. Explain the underlying principles that determine what is reported on the income statement and how it is measured. Be able to explain the difference between the cash basis and accrual basis of accounting Chapter 4 Explain what goals are achieved with period end Additions: Use “Income Summary” for closing adjusting entries. entries (this will be discussed in class as it differs Describe the typical adjusting entries needed at the from the direct entry closing approach illustrated end of the accounting period, what accounts are on pp. 156-157) Exclusions: None Oct 2 Oct 4 &9 Test Chapter 12 – Reporting and Interpreting the Statement of Cash Flows Chapters 1 - 4 Chapter 12 Additions: Supplement 12A (Reporting Sales of Property, Plant and Equipment (Indirect Method)); pp. 524-525 Exclusions: Supplement 12B (Spreadsheet Approach (Indirect Method); pp. 525-527 Oct 11 Chapter 5 –Financial Reporting and Analysis Chapter 5 Additions: None Exclusions: None affected and what accounts are never affected. Explain how adjustments affect information quality. Explain the purpose behind the closing process and the effect it has on the financial statements. Explain why the cash flow statement is important. Explain the purpose of a cash flow statement. Analyze and explain the financial results and financial performance of an organization using the cash flow statement. Prepare basic cash flow statements using the indirect method for operating activities Predict expected cash flow patterns for companies at a few basic stages (i.e. start-up, expansion, retraction, maturity, etc.). Identify the potential users of financial statements and describe how each of those users will make decisions from the information provided in financial statements. Explain how and why financial information might be deliberately misrepresented. Analyze and interpret the financial performance of an organization using the results of common ratios. Oct 16 & 18 Chapter 6 – Internal Controls and Financial Reporting for Cash and Merchandise Sales Chapter 6 Additions: None Exclusions: None continued on next page Identify and assess the usefulness of sources of financial information other than financial statements. Explain how financial statement users can protect themselves against misinformation. Explain the purpose of internal controls and provide examples. Analyze and reconcile internal cash accounts to external bank statements, comment on any differences and prepare any necessary journal entries. Oct 23 & 25 Chapter 7 – Reporting and Interpreting Inventories and Cost of Goods Sold Chapter 7 Additions: Supplement 7C (The Effects of Errors in Ending Inventory); pp. 304-305 Supplement 7D (Recording Inventory Transactions in a Periodic System); pp. 305-306 Exclusions: Supplement 7A (Recording Inventory Transactions Using Last-In, First-Out (LIFO)); pp. 300-302 Supplement 7B (FIFO, LIFO, and Weighted Average in a Perpetual Inventory System); pp. 302-304 Oct 30 & Nov 1 Chapter 8 – Reporting and Interpreting Receivables, Bad Debt Expense and Interest Revenue Chapter 8 Additions: Supplement 8A (Direct Write-off Method), pp. 343-344 Exclusions: Notes Receivable and Interest Revenue; pp. 337-340 Explain the impact of operating cycles on financial results. Describe perpetual versus periodic inventory records Understand the values that make up the cost of inventory. Evaluate and compare the results of merchandising organizations. Understand inventory management goals. Explain the types of inventory and the related accounts on the balance sheet and income statement. Identify, explain and contrast the 3 (three) inventory costing methods. Explain perpetual versus periodic inventory records. Compare the effect of cost flow assumptions on financial statements under a few basic scenarios (i.e. rising prices and declining prices). Apply the lower of cost or market valuation rule. Evaluate and interpret inventory management practices and information. Understand the pros/cons of extending credit to customers. Explain how receivables are reported on financial statements (i.e. net of allowances) and differences between accounts receivable and notes receivable. Explain the two common methods of valuing net receivables. Understand the direct write-off method, including why it is not GAAP and why a small company might consider using it anyway. Evaluate receivables management practices based on uncollectible accounts and provide recommendations. Interpret the effect of recording allowances on net income and receivables turnover ratios. Nov. 6 Nov 8 & 13 Test Chapter 9 – Reporting and Interpreting Long-Lived Tangible and Intangible Assets Chapters 12 & 5 - 8 Chapter 9 Additions: None Exclusions: Supplement 9A (Natural Resources); pp. 387-388 Nov 15 Chapter 10 – Reporting and & 20 Interpreting Liabilities Chapter 10 Additions: None Exclusions: Accounting for Bond Issue; pp. 423-428 Supplement 10A (Straight-Line Method of Amortization); pp. 431-432 Supplement 10B (Effective-Interest Method of Amortization); pp. 433-437 Supplement 10C (Simplified Effective-Interest Amortization); pp. 437-440 Nov 22 Chapter 11 – Reporting and & 27 Interpreting Shareholders’ Equity Chapter 11 Additions: None Define, classify and explain nature of long lived assets, including the distinction between capitalizing items rather than expensing them. Identify and explain the different methods of acquiring assets and accounting for the acquisition. Identify, explain and contrast the 3 common methods of amortization. Explain the effect of impairment on asset values. Explain how to account for the disposal of long lived assets. Explain the concept, acquisition and use of long lived intangible assets. Evaluate the management of investment in long lived assets and other methods of acquiring assets. Explain and analyze the effect of changes in amortization estimates Explain the nature of a liability and what it means to an organization. Identify the differences between short and long-term debt and explain why it is important to differentiate between the two. Explain the role of debt in financing an organization. Describe what information potential creditors would be interested in. Evaluate and interpret financial performance using the current ratio and times-interest-earned ratio. Explain how user decisions can be affected by unrecorded liabilities Exclusions: Supplement A (Owners’ Equity for Other Forms of Business); pp. 477-481 Explain the nature of the retained earnings account, how it is created, increased, and decreased. Explain the importance of a dividend policy and describe how dividends affect the financial performance of an organization. Nov 29 Chapter 13 – Measuring and Evaluating Financial Performance Chapter 13 Additions: None Exclusions: None Understand the different characteristics of common shares and preferred shares. Describe the effects of stock dividends and stock splits. Analyze and interpret the financial performance of an organization using EPS and ROE ratios. Describe the advantages and disadvantages of equity financing versus debt financing. Horizontal, vertical, and ratio analyses Interpreting horizontal and vertical analyses Interpreting ratio analyses