FinMan_Managerial_12e_TM_Ch16(1)

advertisement

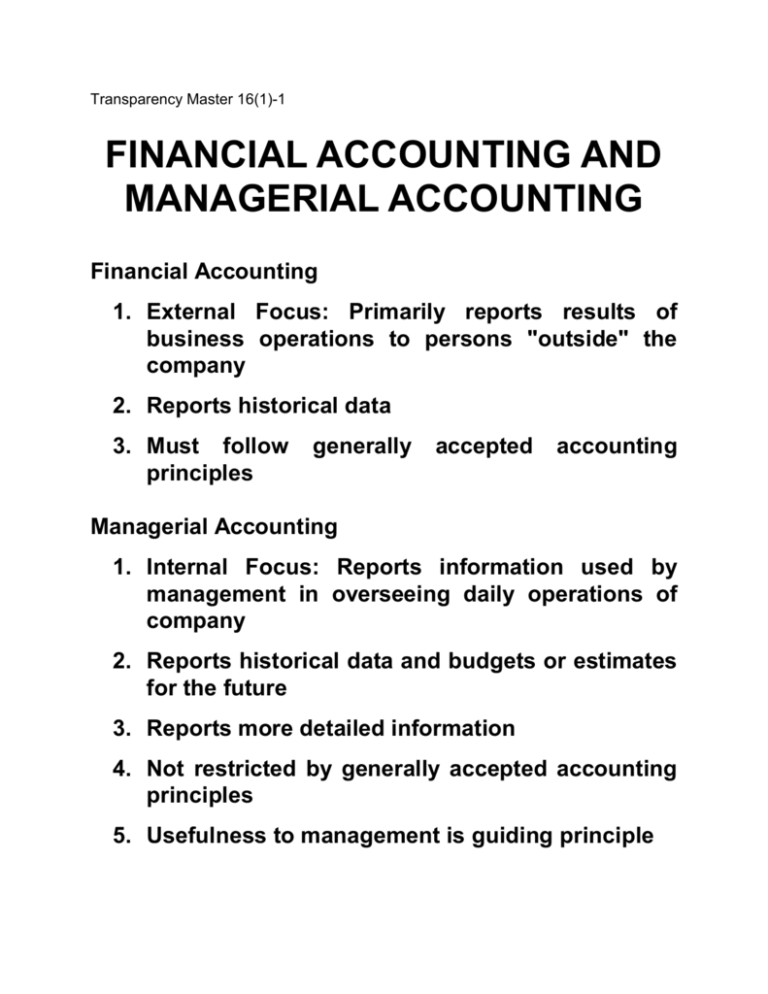

Transparency Master 16(1)-1 FINANCIAL ACCOUNTING AND MANAGERIAL ACCOUNTING Financial Accounting 1. External Focus: Primarily reports results of business operations to persons "outside" the company 2. Reports historical data 3. Must follow principles generally accepted accounting Managerial Accounting 1. Internal Focus: Reports information used by management in overseeing daily operations of company 2. Reports historical data and budgets or estimates for the future 3. Reports more detailed information 4. Not restricted by generally accepted accounting principles 5. Usefulness to management is guiding principle Transparency Master 16(1)-2 WRITING EXERCISE Why is it permissible to violate generally accepted accounting principles when preparing reports used strictly by company management? Transparency Master 16(1)-3 CERTIFICATE IN MANAGEMENT ACCOUNTING (CMA) Professional credential available to management accountants with a bachelor's degree and 2 years of work experience in managerial accounting. An accountant with an associate’s degree may take the CMA exam by earning a score of 50% or better on the Graduate Records Examination (GRE). Must complete a 2-day examination covering the following: 1. Economics, finance, and management 2. Financial accounting and reporting 3. Management reporting, analysis, and behavioral issues 4. Decision analysis and information systems Must earn 30 hours of continuing professional education credit every year to maintain certificate. Transparency Master 16(1)-4 MANUFACTURING COSTS Direct Materials—materials and component parts that become an integral part of the final product. These materials can be traced directly to a finished unit of product. Direct Labor—cost of wages paid to employees who work directly on the product. Factory Overhead—all other costs incurred in making the product. These costs include the following: 1. General manufacturing costs that cannot be traced directly to the product: Utilities (heating, lighting) Depreciation on machines Property taxes Insurance 2. Indirect Labor—wages/salaries paid to workers who are necessary to keep the factory running, but do not work directly on the product: Maintenance workers Janitorial staff Factory personnel department Plant manager and supervisors 3. Indirect Materials—materials used in the manufacturing process that do not end up in the final product: Materials used to test machines Lubrication used on machines NOTE: Direct materials and direct labor costs may be treated as factory overhead costs if they are insignificant. Transparency Master 16(1)-5 MANUFACTURING COSTS Product Costs Direct Materials Prime Costs Direct Labor Factory Overhead Conversion Costs Transparency Master 16(1)-6 COSTS INCURRED BY A MANUFACTURING COMPANY Product Costs Direct Materials Direct Labor Factory Overhead Prime Costs Conversion Costs Period Costs Selling Expenses Administrative Expenses Transparency Master 16(1)-7 Statement of Cost of Goods Manufactured Beginning work in process inventory $XXX Direct materials: Beginning materials inventory Purchases Cost of materials available for use Less ending materials inventory $XXX XXX $XXX XX Cost of direct materials used $XXX Direct labor XXX Factory overhead: Indirect labor $XXX Depreciation on factory equipment XXX Factory supplies and utility costs XXX Total factory overhead Total manufacturing costs incurredd Total manufacturing costs Less ending work in process inventory Cost of goods manufactured XXX XXX $XXX XX $XXX Transparency Master 16(1)-8 Income Statement Sales $XXX Cost of goods sold: Finished goods inventory, beginning $XXX Cost of goods manufactured XXX Cost of finished goods available for sale XXX Less finished goods inventory, ending XXX Cost of goods sold XXX Gross profit $XXX Operating expenses: Selling expenses Administrative expenses Total operating expenses Net income $XXX XXX XXX $XXX