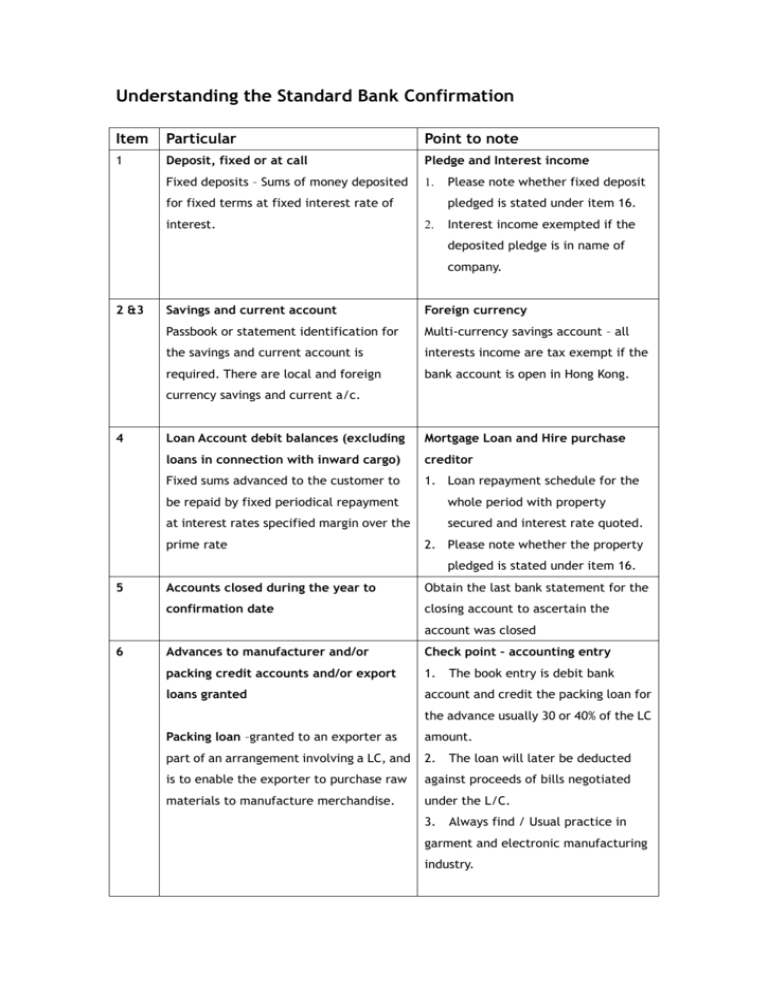

Understanding the Standard Bank Confirmation

advertisement

Understanding the Standard Bank Confirmation Item Particular Point to note 1 Deposit, fixed or at call Pledge and Interest income Fixed deposits – Sums of money deposited 1. for fixed terms at fixed interest rate of interest. Please note whether fixed deposit pledged is stated under item 16. 2. Interest income exempted if the deposited pledge is in name of company. 2 &3 Savings and current account Foreign currency Passbook or statement identification for Multi-currency savings account – all the savings and current account is interests income are tax exempt if the required. There are local and foreign bank account is open in Hong Kong. currency savings and current a/c. 4 Loan Account debit balances (excluding Mortgage Loan and Hire purchase loans in connection with inward cargo) creditor Fixed sums advanced to the customer to 1. Loan repayment schedule for the be repaid by fixed periodical repayment whole period with property at interest rates specified margin over the secured and interest rate quoted. prime rate 2. Please note whether the property pledged is stated under item 16. 5 Accounts closed during the year to Obtain the last bank statement for the confirmation date closing account to ascertain the account was closed 6 Advances to manufacturer and/or Check point – accounting entry packing credit accounts and/or export 1. loans granted account and credit the packing loan for The book entry is debit bank the advance usually 30 or 40% of the LC Packing loan –granted to an exporter as amount. part of an arrangement involving a LC, and 2. is to enable the exporter to purchase raw against proceeds of bills negotiated materials to manufacture merchandise. under the L/C. 3. The loan will later be deducted Always find / Usual practice in garment and electronic manufacturing industry. 7 Acceptances Outstanding Check point – accounting entry a. Bills Receivable by banker 1. - Bills of exchange accepted by the and credit to Bills payable upon the bill customer (importer) in favor of the of exchange is accepted by customer as banker. the goods imported to client. This kind The book entry is debit Purchase of bills settlement is normally under b. Goods released against trust respect D/P i.e. Document against Payment. of (a) - Bankers release document before the 2. In the case when goods released maturity of a bill of exchange against against trust receipt, the book entry is Trust Receipt but the customer is debit Purchase and credit to Trust required to undertake to hold the Receipt account. goods on behalf of the bank and to pay the proceeds of sale to the bank. Purchase and Payment cycle 3. The exporter from foreign company 8. c. Bills held by banker for collection e.g. USA exports goods to Hong Kong - Bills of exchange accepted by the client who is importer of the goods. customer (importer) in favor of the However, the client is not obliged to supplier (exporter) who has given pay unless the clients themselves instructions to the banker to collect accept the bill of exchange (i.e. D/A - the proceeds on his behalf. Document against Acceptance). Partial payment held by banker Please refer to item 7 point to note This represents a partial settlement of the bills of exchange in item 7(a) or (b) 9. Irrevocable letters of credit Irrevocable The term irrevocable is significant as A letter of credit (L/C) is an instrument the importer could not alter the letter issued by banker on behalf of customer, of credit once the L/C has been issued (importer) authorizing the exporter to to exporter. draw bills of exchange on the customer, It is a contingent liability of the client the banker or its corresponding banks for as they are obliged to fulfill the terms the account of the exporter, under certain of settlement when the conditions conditions stipulated in the credit. stipulated in the L/C is met. Understanding the Standard Bank Confirmation Item Particular Point to note 10 Bills Receivable by customer Terms of settlement under Letter of a. Bills purchased by banker (and Credit outstanding at confirmation date) Usually the letter of credit has a D/P term Bills of exchange drawn on mentioned the mode of payment made importer by the client (customer after a specified period i.e. 30 days. Then, & exporter) and negotiated to the client (i.e. customer) negotiates with banker i.e. instead of collecting it the banker and sells it to the bankers so himself, the client (customer) that the client could receive money in sells it to the banker who may advance before the expired date. - have recourse against the client (customer). However, If the client could not fulfill the terms of letter of credit but the importer b. Bills held by banker for collection would settle the bill when the goods - Bills of exchange drawn on exported to the foreign importer, the importer by the client (customer banker would act as agent for the client to & exporter) and sent to banker for collect the bills from importer under the collection on behalf. instruction of the client (i.e. exporter). The banker acts as an agent only. 11 Marginal Deposit held by banker Normally, the banker would request the a. On account of item 7 client uses the property pledged as security (Acceptances outstanding) and or deposit advance etc as a gurantee in item 9 (Irrevocable letter of granting the bank facilities including letter credit) of credit and inwards bill acceptance b. On account of item 10 (Bills Receivable by customer) c. 12 Loans granted in connected with Normally, the import loan granted is part inward cargo of the bank facilities. This loan, payable is Import loans are very common when secured by the assets pledged to banker. the importer is required to pay at sight of shipping documents. It is a kind of loan arrangment. Understanding the Standard Bank Confirmation Item Particular Point to note 13 Guarantees Performance Bond a. Given by a banker on behalf of client a. Sometimes, the customer of i. Shipping gurantees – Sometimes when a the client company would shipment arrives via a short sea route, goods request the client to place a may be released to the importer under a Performance bond to the shipping gurantee given by the banker. customer’s bank. Others – In lieu of giving a utility deposit by The client then would request ii. 14 himself, the client may request the banker to the banker to issue gurantee for issue a guarantee in favor of the utility certain sum of money to the company. customer. b. Received by a banker on behalf of client b. The director may deposit or - The director of the client company may issue gurantee to the banker for issue a gurantee to the bank for the client’s the company in granting bank company facilities etc. Foreign exchange contracts outstanding HKAS32 – Financial Instrument A forward foreign exchange contract is HKAS 21 – The effect of foreign sometimes used by exporter/importer to hedge exchange rate against risks of exchange rate fluctuations. 15 Other direct or contingent liablities to banker Seldom happened in normal manufacturing or trading business. 16 Securities and other document of titles held Important note by banker 1. We should have the banking a. Against facilities granted – Title deeds of facilities letter to verfiy the property and motor car licence book etc securities pledged and facilities used as security given to the banker for bank granted. faciliies granted to the company.. b. For safe custody – share certificate and time deposit held by the banker on behalf of the customer for safe custody purpose. 2. Disclosure in notes to financial statement is required.