[X] January 2011

advertisement

![[X] January 2011](http://s3.studylib.net/store/data/008964276_1-a57440a0164c8106ff6046062de8f62c-768x994.png)

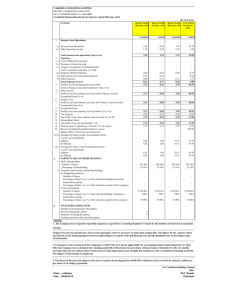

21 September 2011 Vatukoula Gold Mines plc ("Vatukoula" or "the Company") Operational Update for the Fourth Quarter and Twelve Months ended 31st August 2011 Vatukoula Gold Mines Plc (AIM:VGM), the AIM listed gold producer, is pleased to announce its unaudited preliminary operational results from its 100% owned Vatukoula Gold Mine in Fiji for the fourth quarter and year ended 31st August 2011 (‘Q4’). Highlights (unaudited) Gold produced (ounces) Gold sold (ounces) Average gold price received per ounce (US$) Mine (loss) / profit for the period (unaudited)* 3 months ended Aug 2011 (Q4) 10,670 12,066 1,636 £0.2 million 3 months ended May 2011 (Q3) 11,395 11,652 1,453 £(2.8)million 12 months ended Aug 2011 52,157 53,461 1,429 £(0.4) million 12 months ended Aug 2010 56,214 54,642 1,145 £9.7 million *Mine (loss) / profit for the period exclude any (losses) / gains from movements in unrealised foreign exchange rates. Operational Highlights Gold sold was approximately level at 12,066 ounces for Q4 and 53,461 for the year ended August 2011 Underground ore delivered increased by 40% compared to the previous year to 336,085 tonnes and increased to 91,753 tonnes in the Q4 as compared to Q3 2011 Underground development for the fourth quarter was 6,751 metres up from 6,349 metres achieved in the third quarter. The underground development for the year was 24,453 up from 8,720 metres achieved in the previous year. These significant increases are the result of our on-going development programme As a result of the continued development programme, roughly 42% of the ore mined in the quarter was sourced from development drives The total cost per ton of ore mined and milled reduced from US$166 / tonne in the third quarter to US$ 128 / tonne in the fourth quarter. For the year ended August 2011 the cost per tonne increased to US$144 / ton from US$101 / tonne in the previous year, reflecting an increase in underground tonnages mined and milled as a percentage of the total ore processed, and an increase in underground mining costs Over the quarter the Company sought increased efficiencies in the mine, including a split firing mining technique whereby the waste and ore are blasted and removed separately. David Paxton, CEO of Vatukoula Gold Mines, commented: “The last quarter of our financial year again highlighted our ongoing efforts to get the underground infrastructure up to the level required to achieve our near term production targets. Although we have achieved a much higher rate of development than that achieved last year, we still envisage that during the coming year we will again be focusing on underground development. I am nonetheless delighted to report that as a result of more efficient mining practices and some higher grade material currently being mined towards year end, production has improved substantially. Underground development will continue at the increased rate until we are in a position to sustain production at our targeted rate. We expect this increased rate of development to continue until Q2 2012. We expect to produce approximately 65,000 ounces of gold in the financial year ending August 2012. ” Introduction Over the quarter the mine shipped and sold 12,066 ounces of gold, drawing down from the gold in the circuit. For the twelve months a total of 53,461 ounces were shipped and sold, in line with the twelve months to end-August 2010. Production Summary 3 months ended August 2011 (Q4) 3 months ended May 2011 (Q3) 12 months ended August 2011 12 months ended August 2010 Underground Mining / Sulphide Processing Development (metres) 6,751 6,349 24,453 8,720 91,753 90,352 336,085 240,024 4.29 4.06 5.00 7.43 46,612 31,486 160,923 198,507 1.43 1.01 1.39 2.01 139,584 120,413 498,123 438,691 3.19 3.28 3.77 4.98 77.96% 79.09% 81.20% 84.66% Gold produced (ounces) 10,670 11,395 52,157 56,214 Gold shipped (ounces) 12,066 11,652 53,461 54,642 1,479 1,721 1,338 814 128 166 144 101 1,636 1,453 1,429 1,145 £0.2 million £(2.8)million £(0.5) million £9.6 million Sulphide Ore delivered (tonnes) Sulphide head grade (grams / tonne) Oxide Plant Ore delivered (tonnes) Oxide head grade (grams / tonne) Total (Sulphide + Oxide) Ore processed (tonnes) Average ore head grade (grams / tonne) Total Recovery (%) Cash Costs Total cash cost / shipped ounce*(US$) (unaudited) Total cash cost / tonne (US$) (unaudited) Average realised gold price (US$ / ounce) Mine (loss) / profit for the period (unaudited)** * ** excludes amortization and depreciation, unrealised foreign exchange rate movements and provisions Mine (loss) / profit for the period exclude any (losses) / gains from movements in unrealised foreign exchange. Underground Mining and Development Underground mining has continued to focus on development, which will provide the necessary infrastructure and access to ore-bodies, in order for the mine to reach its targeted production levels in future years. During the last quarter we completed 6,751 meters of development, and for the year ended August 2011 we completed 24,453 metres of development. This was almost a threefold increase over the 8,720 meters development in the previous year. The increase in the development tonnages continued to have an adverse effect on the overall grade mined and gold delivered to the mill. In the fourth quarter approximately 42% of the ore delivered to the mill was from development. Once the development programme is completed we will be targeting a significantly lower figure for the development / stoping tonnage ratio. Mine management has initiated programs to reduce the dilution in both development and stoping, which include: i) ii) A reducing of the amount of dilution in the stopes by the use of better mining practices, and minimising waste from development with split firing techniques where this practice is suitable. Split firing is a technique whereby the waste is blasted first and removed, followed by the blasting of the ore portion. In addition to these programs we are introducing mining practices to reduce cost, increase recoveries and improve productivity which include: i) ii) iii) The introduction of truck chutes where applicable – so that ore from the mining sections are loaded directly into trucks, thereby reducing the need for underground loaders, and the introduction of water cannons in the underground stopes. The gold at Vatukoula can occur as fines, and we expect more of the fine material to be recovered with this technology, and the completion of a detailed ventilation program. This highlighted a number of initiatives that we are undertaking to improve the working conditions in the mine. We believe that once we have caught-up with development, the mine will be restated to our longer term forecast gold production, which will in turn reduce our operating cost on a per ounce basis, to targeted levels. Eighteen Level Decline To develop the eighteen level decline we are currently carrying out a drill sterilisation programme which will allow mine management to design the decline without impacting any potential ore bodies. We expect the drilling programme to be completed in Q1 2012. Surface Operations Production from the surface oxide process delivered 46,612 tonnes in the fourth quarter. This is an increase of 48% over the third quarter’s production. Additional oxide material has been mined from surface excavations in the near mine area. The grade delivered was 1.43 grams gold per tonne. Additional oxide material has been sourced from near mine areas. Oxide production for the year totalled 160,923 tonne at a grade of 1.39 grams gold per tonne. The oxide plant currently accounts for approximately 10% of the mine’s gold production. Milling Operations The Vatukoula Treatment Plant (“VTP”) continues to operate satisfactorily. During the quarter, the the VTP processed 139,584 tonnes of combined sulphide and oxide ores at an average grade of 3.19 g/t. Recoveries ran at 77.96% which was lower than the same period last quarter 79.09%. The lower recovery is attributable to the high sulphide content material delivered from open pit mining, which is less amenable to recovery in the surface oxide process. Financial Results and Operating Costs The Mine made a net profit (prior to unrealised foreign exchange gains) of £0.2 million (unaudited) in Q4 compared to a loss of £2.8 million (unaudited) during Q3. The increase in net profits and the movement into a profitable position is attributable primarily to lower cash costs per tonne. In Q4 total cash costs per tonne mined and processed were US$128 per tonne, down 23% as compared to Q3 costs of US$166 per tonne. This was a result of a decrease in the direct underground mining expenses. For the year ended August 2011 the cash costs per tonne increased from US$101 to US$144. The majority of this variance is attributable to the increase of underground ore mined and milled as a percentage of the total ore mined and milled. As underground ore is more expensive to mine and mill compared to surface ore, the change in percentage has had an adverse impact on our total cash costs per tonne. Total cash costs per ounce of gold produced for Q4 was US$ 1,479 down from US$ 1,721 in Q3. The decrease in the operating cost on a per ounce basis is attributable to a reduction in costs on a per ton basis. Compared to the previous year, cash costs per ounce for the year ended August 2011 increased from US$814 to US$1,338. Although a portion of this rise is a result of the increased production costs per tonne milled, it is mainly attributable to the development programme which results in lower grade ore being mined and processed and in turn reduced gold production. Exploration During the year ended August 2011, our drilling campaigns focused on the near surface potential at Vatukoula and on vertical and lateral extensions of the current ore bodies. Both of these programmes have completed the first phase of drilling with results expected in October 2011. In the coming year we will focus the drilling on resource and reserve definition. We anticipate that we will be drilling between 25,000 and 30,000 metres in the coming year from 3 surface and 3 underground rigs. Power An updated full Bankable Feasibility Study by the Fiji Sugar Corporation (“FSC”) is in the process of completion. Initial plans are for a 32MW power station of which Vatukoula Gold Mines will require between 10MW and 15MW. The FSC have stated that discussions are underway with potential financing partners. Vatukoula is in discussions with the FSC to assit in this aspect and we envisage partnering in the project as an equity partner. If we are unable to partner in this manner we will simply enter into an off take agreement for our requirements. Qualified Person Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the information contained in this announcement. Kiran holds a Bachelor of Engineering (Industrial Geology) from the Camborne School of Mines and an MBA (Finance) from CASS Business School. Kiran is the Finance Director of VGM. Enquiries Vatukoula Gold Mines plc David Paxton Kiran Morzaria W.H. Ireland Limited + 44 (0)20 7440 0643 James Joyce + 44 (0)20 7220 1666 Pelham Bell Pottinger +44 (0)20 7861 3232 Philippe Polman Notes to the Editor To align itself with general market practices the Company, during the period adopted the Gold Institutes recommended methodology in the calculation of Total Cash Costs on a per ounce basis. The basis of the calculation is outlined below: Per ounce of Gold (1) Gold Institute Production Cost Standard Direct mining expenses (2) xxx Stripping and mine development adjustments (3) xxx (4) (xxx) xxx Third-party smelting, refining and transportation costs By-product credits Other xxx Cash Operating Costs xxx Royalties xxx (5) xxx Total Cash Costs (1) Per ounce of gold sold (shipped) in accordance with each company's own reporting practices. (2) Direct mining expenses include all expenditures incurred at the site, including inventory changes, site specific corporate charges (e.g. insurance, computer services, etc.) and in-mine drilling expenditures that are production related (e.g. in-fill drilling, grade control, etc.). Exploration expenditures are not included in direct mining expenses. In case of a joint venture or partnership, management or overhead fees charged by that operation's operator, that are in addition to site-specific corporate charges, should be included in each company's mine-site cash expenditures. (3) These adjustments include normalization of stripping costs at open-pit operations and normalization of costs associated with developing and accessing new production areas in underground operations, Footnote disclosure of the total amount of these adjustments is encouraged. (4) Information with respect to by-product credits, on an operation-by-operation basis, should be disclosed in each company's external reporting documents. (5) Information with respect to royalties, on an operation-by-operation basis, should be disclosed in each company's external reporting documents. Historical Quarterly Data Based Gold Institute production Cost Standards Quarter ended Aug 2011 (Q4) Quarter ended May 2011 (Q3) Quarter ended Feb 2011 (Q2) Quarter ended Nov 2011 (Q1) Quarter ended Aug 2010 (Q4) Quarter ended May 2010 (Q3) Quarter ended Feb 2010 (Q2) Quarter ended Nov 2010 (Q1) Underground Mining / Sulphide Processing Development (metres) Sulphide Ore delivered (tonnes) 6,751 6,349 5,610 5,744 2,650 2,371 2,036 1,663 91,733 90,352 73,086 80,914 72,444 65,944 58,230 43,406 Sulphide head grade (grams / tonne) 4.29 4.06 5.40 6.48 8.81 5.87 6.60 8.63 46,612 31,486 30,143 52,682 54,279 56,856 43,472 43,900 1.43 1.01 1.30 1.64 2.24 1.87 1.99 1.92 Ore processed (tonnes) Average ore head grade (grams / tonnes) 139,584 120,413 103,480 134,646 126,688 123,372 102,302 86,329 3.19 3.28 4.19 4.53 5.99 4.07 4.64 5.29 84.28% Total Recovery (%) 77.96% 79.09% 81.87% 84.47% 86.54% 82.43% 84.38% Gold produced (ounces) 10,670 11,395 11,442 18,650 20,092 11,913 14,787 9,422 Gold shipped (ounces) 12,066 11,652 11,687 18,055 19,251 11,299 15,267 8,826 1,479 1,721 1,530 876 807 816 718 982 128 166 173 117 123 75 107 100 1,636 £0.2 million 1,453 £(2.8) million 1,365 £(2.0) million 1,308 £4.2 million 1,193 £ 4.2 million 1,155 £ 2.0 million 1,099 £ 3.1 million 1,091 £ 0.3 million Oxide Plant Ore delivered (tonnes) Oxide head grade (grams / tonnes) Total (Sulphide + Oxide) Cash Costs Total cash cost / shipped ounce*(US$) (unaudited) Total cash cost / tonne (US$) (unaudited) Average realised gold price (US$ / ounce) Mine (loss) / profit for the period (unaudited)** * ** excludes amortization and depreciation, unrealised foreign exchange rate movements and provisions Mine (loss) / profit for the period exclude any (losses) / gains from movements in unrealised foreign exchange.