J Taylor’s

WWW.MININGSTOCKS.COM

Gold

Energy & Tech Stocks

(Now in our 30th Year)

Weekly Hotline Message

February 25, 2011

New Buy Recommendation

Northern Gold Mining Inc.

Business: Exploration and development of gold mining

deposits in Ontario

Traded TSX:

NGM

US OTC:

NTGMF

Price 2/25/11:

US$0.496

Shares Outstanding:

88.6 Million

Market Capitalization:

$44 million

Fully Diluted:

132.7 Million

43-101 Gold Resource:

983,740 Oz.

Progress Rating:

A-3

Telephone:

416-366-7300

Web Site:

www.northerngold.ca

Northern Gold Mining Inc. is in the process of earning an 80% interest in two gold exploration properties in Ontario

that appear to have the potential to become world-class deposits on a very large block of claims known as the

Garrison Claims. The flagship property on the Garrison Claim Area is the Garrcon Property. The second property,

located adjacent to the Garrcon, is the Jonpol Property. Both of these properties are located along the prolific

Destor-Porcupine Fault System. Both are very promising properties.

However, the Garrcon Property is an open-pit bulk-mineable target that would definitely appear to have

multimillion-oz. potential. It has been chosen as the flagship property for this company because of the relative ease

of building ounces rather quickly. The Jonpol Property, on the other hand, is a high-grade underground target that

also appears to have great potential for becoming a prolific gold producing mine. However, as with most

underground mines, capital costs and mining costs would most likely be higher than for open pit mining and much

more expensive to prove up a deposit sufficiently large to justify capital costs to build a mine.

The Garrcon Property

So far, the Garrcon Property has a 43-101 resource of 674,000 ounces of gold contained in 22.3 million tonnes. The

indicated and inferred tonnage has an average grade of 0.94 grams/tonne. What causes me to be so excited about

this property is that fact that these ounces are contained within an area that measures 760 meters by 300 meters and

to a depth of only 200 meters. Historical holes have been drilled to 500 meters, where the hole was still in

mineralization at the bottom.

In other words, the thinking is that these ounces could be doubled or more at depth, which reminds me to tell you a

little about the geometry of this deposit.

The gold-bearing structure is not only at surface, but it is also raised above the surrounding topography so that there

TAYLOR HARD MONEY ADVISORS, INC.

PO Box 780555, Maspeth, NY 11378

(718) 457-1426

Feb. 25, 2011

2

will be zero waste to ore mined in the early years of mining the deposit. That should result in a low overall stripping

ratio for a mine, even if mined to a depth of 500 meters, as the depth of the open pit would be relatively shallow,

compared to the surrounding topography if/when mining occurs.

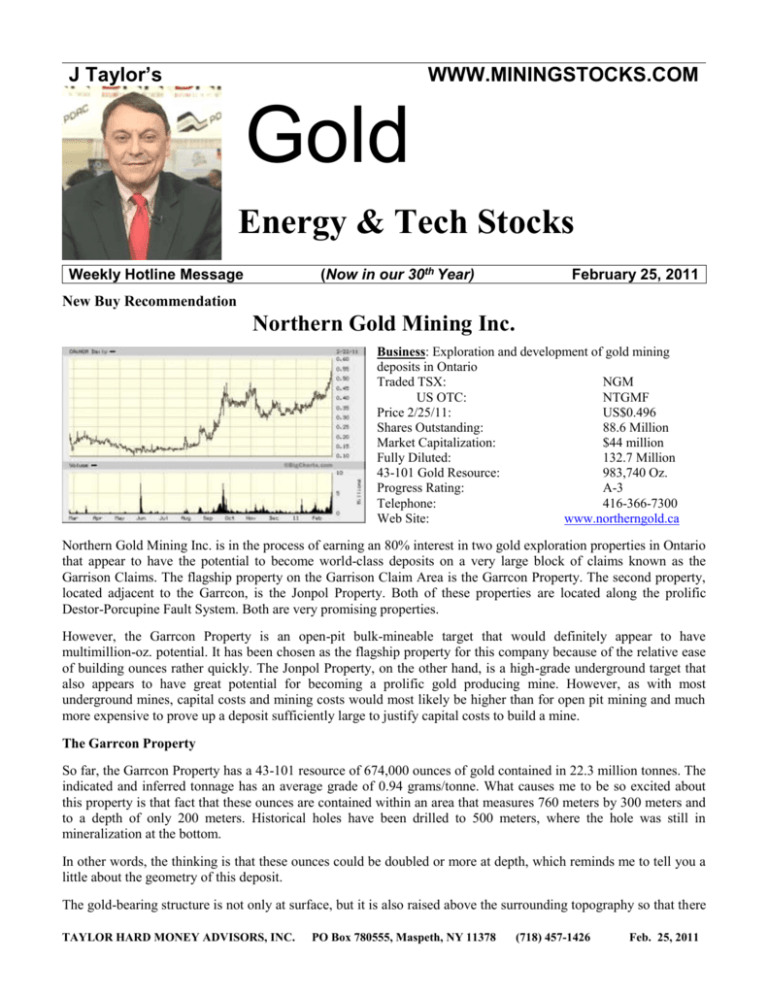

And because these

mineralized zones in

these gigantic fracture

zones tend to be

mineralized at great

depth, there is the

expectation that gold

mineralization

is

likely to exist at 500

meters and below.

But depth potential

for

an

open-pit

operation is really a

minor part of the

story. The potential to

extend this deposit

out

laterally

is

enormous. To help

you

grasp

that

potential, check out

the illustration above,

which

displays

historical and recent

drill holes on the company’s claims. Notice the Garrcon Deposit outlined in red in the center and toward the bottom

of the illustration. The red outline is the area from which drilling has been concentrated to date. But it is only the

area within the green-outlined area from which the current 43-101 resource of 674,000 ounces was calculated. The

other areas require infill drilling to qualify for 43-101 resource status. We can say with some confidence that the

areas outside of the green boundary and within the red boundaries are likely to add significantly to the total ounces

within the red area, because mineralization continues to the eastern boundary of the red-outlined area and at the

southwestern boundary. Of course we will have to wait for further drill results and 43-101 calculations, but my

belief is that within this area and to a depth of 500 meters we could be looking at between 3 and 4 million ounces.

But wait! That’s still not the entire story! Take a look again at the map above. Note the larger black area, which is

the current boundary of the company’s claims. Note that there are mineralized drill holes lying outside of the current

boundary both northeast and southwest of the current boundary. These rocks are believed to be the same package

that hosts the Garrcon Deposit and not part of the Jonpol Deposit as previously believed. It is my understanding that

management has secured the land extending at least to the northwestern drill holes shown on the illustration above.

It is also my understanding that management is in the process of securing land beyond the southwestern corner of

the property as well.

Fewer drill holes have been put down to the west of the outline, but holes put down at the southwestern border were

mineralized. In other words, the exploration potential here is for several more thousand meters extending out to the

east and to the west of the existing calculation zone.

What this tells me is that the blue sky here suggests the potential for an Osisko-sized open-pit deposit. For those of

you who may not follow Osisko, it has an 11.67-million-ounce resource and is projected to produce an average of

463,000 ounces per year at a cash cost of $382 per ounce. Osisko’s market cap is around $5 billion, compared to a

market cap of less than $50 million for Northern Gold Mining.

TAYLOR HARD MONEY ADVISORS, INC.

PO Box 780555, Maspeth, NY 11378

(718) 457-1426

Copyright @ 2011 TAYLOR HARD MONEY ADVISORS, INC. ALL RIGHTS RESERVED

Feb. 25, 2011

3

Potential Economics Look Very Strong for the Garrcon Deposit

Within a few weeks, a preliminary economic assessment report (PEA) is expected to be made public. That will most

likely bolster the market’s confidence in this stock. And assuming the absence of any general stock market

meltdown (not something I automatically assume), we should see these shares rise with that report—which, by the

way, may also bring with it a larger resource. In the meantime, there are several aspects we know of with respect to

the Garrcon Deposit that appear to make this potentially a very profitable gold deposit.

As we noted before, at least in the early years of mining, the stripping ratio should be zero and quite low overall. An

early year stripping ratio of zero for the Garrcon compares to a 3:1 ratio for Osisko and 6:1 at Detour Lake.

Metallurgy is always an important issue when it comes to mining economics. Complicated metallurgy most often

will require more capital equipment to process the ore, and many times operating costs are adversely impacted by

higher energy costs. Of course with this mine previously in production, past reports do provide some metallurgical

information. It is my understanding that the ore on this property is largely free milling with the likelihood of getting

better than 90% recoveries, using simply gravity-flotation methods of separation.

Infrastructure is always a major consideration. Located in the prolific gold belt of Quebec and Ontario, and with

Highway 101 running right through the property, access is very easy and a power line is also there along the

highway, which could help reduce costs significantly over reliance on generated electricity. Water and labor are also

abundant and spare parts are quickly available, given the prominent mining activity that takes place from Val d’Or,

Quebec, up through Timmins in Ontario.

The Jonpol Deposit

While the Jonpol Deposit may take a back seat to Garrcon Deposit now, it is a very attractive underground gold

deposit. The chart above shows more drilling on the Jonpol, which makes sense, because when the price of gold was

low, you had to look for higher grades. The Jonpol has an indicated resource of 63,200 ounces grading 7.77

grams/tonne gold and an inferred resource of 246,540 ounces grading 4.93 grams gold/tonne. A 4.07-gram cutoff

was used in this calculation. It is my understanding that the current resource number can be increased without

putting more drill holes down, simply by using additional data from prior drill holes that have not been factored in

to current calculations.

In 1997, a 50,400-ton bulk sample was mined. From that, 13,564 ounces of gold were produced, which equates to

an average recovery grade of 8.37 grams/tonne.

MANAGEMENT

Martin R. Shefsky, President and Chief Executive Officer

B.A. Political Science and Psychology, Pepperdine University, Malibu, California

Over twenty years’ management experience with existing and startup companies in Canada and the United

States

Founder and director 1997 to 2005 of Regis Resources Inc., Buckhorn, Ontario

Background in development, sales, and marketing

Experience in wide spectrum of commercial ventures, including exploration of natural resources, financial

consulting, stock trading, and portfolio management

Eric E. V. Szustak, B.A., C.A., Chief Financial Officer

B.A. Honors Chartered Accountant Studies and Economics, University of Waterloo

Chartered Accountancy Designation 1985

Principle in private accountancy practice 1987 to 1993

Private investment advisor 1993 to 2000

Investment advisor BMO Nesbitt Burns Inc. 2000 to 2007

Chief Financial Officer Castle Resources 2007 to present

Chief Financial Officer James Bay Resources 2008 to present

TAYLOR HARD MONEY ADVISORS, INC.

PO Box 780555, Maspeth, NY 11378

(718) 457-1426

Copyright @ 2011 TAYLOR HARD MONEY ADVISORS, INC. ALL RIGHTS RESERVED

Feb. 25, 2011

4

Michael P. Gross, M.S., P. Geology, Vice President of Exploration

More than 40 years of professional experience in all facets of mineral exploration and mine development

Experienced at both surface and underground gold mining and has toured Northern Gold’s Jonpol underground

mine when operated by Hillsborough Resources Limited

Designed and implemented exploration programs resulting in discovery and recovery of resources facilitating

the growth of mining companies like Hecla, Exall, and Royal Oak Mines

Holds a masters’ degree in economic geology and several awards for excellence in mining

Jennifer Ta, C.A., Controller

C.A. with Specialized Honours in Accounting, York University, Toronto

Over eight years of experience with public accounting firms

Former audit team leader, planned and executed assurance agreements for mining and other public companies

Former Senior Accountant/Auditor at Collins Barrow Toronto LLP

Over two years’ experience in controllership position in the mining industry

Controller of Morumbi (TSX-V:MOU), Castle Resources (TSX-V:CRI), Jamesbay Resources (TSX-V:JBR)

SUMMARY & CONCLUSION

I believe the upside potential for this company’s shares from their current price level is very significant, given (a)

the company’s current share price; (b) the company’s current resource; and (c) most importantly, the high likelihood

of outlining a very major open-pit gold resource in an area where political risks are minimal and where

infrastructure is as good as it gets.

Of course my optimism is premised on the view that this gold bull market has at least several more years to go and

that gold mining economics will remain strong. If I am wrong about either of those views, there would be less room

for optimism longer term. It all boils down to gold mining economics for the big producers. They will be looking

for new junior gold mining firms that prove up the next 5 million plus deposits. In the many years I have been

following junior gold exploration stocks, it’s hard to think of many that have a better shot than Northern Gold does

at this point in time at coming up big and generating huge investment gains.

J Taylor’s Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.:

(718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for

presentation in JTGTS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is

the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research

and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is

not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to

change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position

in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the

shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of

$500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.

To Subscribe to J Taylor’s Gold, Energy & Tech Stocks Visit: http://www.miningstocks.com/select/gold

Receive J Taylor’s Gold, Energy & Tech Stocks monthly newsletter and weekly email messages for the period of your choice (U.S. and Canada). For

foreign postal delivery contact us at email below. Return to: PO Box 778555, Maspeth, NY 11378, USA. Phone or Fax: 718-457-1426, E-mail:

questions@miningstocks.com. (Make Check Payable in US$ to Taylor Hard Money Advisors, Inc.)

Please Select Subscription:

Name

Address

City

Telephone

Primary E-mail:

_____3 Years US$477.00

_____6-Months US$120.00

_____2 Years US$360.00

_____3-Months US$69.00

State/Prov.

_____1 Year US$198.00

Zip/Postal Code

Fax

Secondary E-Mail:

Check

Card Number

Signature

Visa

MasterCard

Discover

Exp.

3-digit Code

(Last 3 digits of the number found on the

back of your credit card, below your signature)

TAYLOR HARD MONEY ADVISORS, INC.

PO Box 780555, Maspeth, NY 11378

(718) 457-1426

Copyright @ 2011 TAYLOR HARD MONEY ADVISORS, INC. ALL RIGHTS RESERVED

Feb. 25, 2011