Strategic Trade Policy in Practice

advertisement

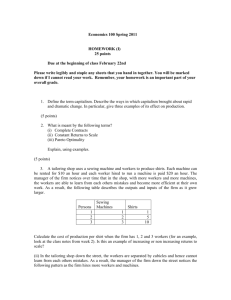

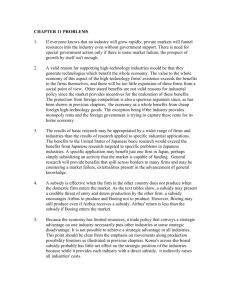

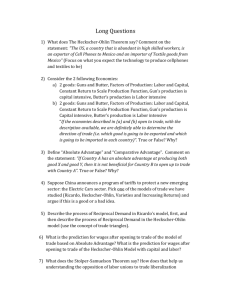

Chapter 11 – Strategic Trade Policy Can a country improve its economic performance? Is there any scope for strategic trade policies? There is a notion (Thurow) that the world economy is characterized by “win-lose competitiveness”. In this view, the success of one country comes at the expense of others. Supposing that this is actually the case, how would we determine which sectors are more crucial than others? Three criteria are popular among policy makers who advocate strategic trade policies. 1) high value added/worker 2) high wages 3) high tech Are these reasonable? 1) high value-added/worker Table 11-1 Value added per worker (USA 1995) Industry Apparel Electronics Aircraft Automobiles Petroleum refining All manufacturing Value added/worker 41.6 113.4 106.3 131.5 372.8 91.2 Actually, industries with high value added mainly reflect capital intensiveness. Note the very high value added for oil refining. If capital is a scarce resource, capital-intensive industries may not be optimal. In the absence of a market failure, markets will maximize the value of national output. Thus, this is a dubious criterion. 2) high wages The number of high-wage manufacturing jobs have declined as US has experienced deindustrialization: % of US work force employed in manufacturing 1970 27% 1995 16% Is this a problem? Is trade to blame? Well, first of all, this is the wage-differentials argument revisited. Again, this is only justifiable if there are domestic distortions Meanwhile, there is generally a movement away from the manufacturing sector and into the service sector, as technological advancement has been more prevalent in goods production. The text claims that only 1% of the 11% decline actually is attributable to trade. Further, the wage differential is only about 10%. This calls into question the importance of this issue. 3) high tech definition: rapid innovations in product characteristics &/or production processes e.g. telecommunications, biotechnology, microelectronics This is the best criterion of the 3, since technological spillovers may be quite important to the rest of the economy (positive production externalities; learning by doing) so argument for protection of industries with technological spillovers. Is there a better policy? Strategic trade policy and imperfect competition Two problems: 1) Externalities here suggest subsidization of R&D, to compensate for the appropriability problem. 2) There are monopoly (or oligopoly) profits in highly concentrated industries. Suppose that there is a market failure. How can it be identified? Can it be specified well enough to make a sensible policy? First of all, recall that ideally we would like to target the specific problem, here the generation of knowledge that firms cannot appropriate for themselves. It isn’t easy to find the right specification. In addition, note that the U.S. does already subsidize R&D (tax policies). Is this insufficient? We would need to know how much subsidy is justified. One big problem with externalities is that they are inherently difficult to measure. Also, what about the issue of spillovers across national borders? Still, this is the best argument for an active industrial policy. Here’s a simplified version of the Brander-Spencer model. In principle, there may be excess returns in a concentrated industry, so that a government could conceivably shift these to domestic firms. But this may not be so easy (Tables 11-2, 11-3, 11-4, and 11-5) small number of competitors positive long run profits set up costs large only make profits if one firm operates In Table 11-2, there are two equilibria – in one, Boeing produces and Airbus doesn’t; in the other, Airbus produces and Boeing doesn’t. One can argue that this is a matter of who gets there first. Now suppose that Europe provides an operating subsidy to Airbus of $25 million. What happens? In Table 11-3, we now see that the only equilibrium is for Airbus to produce and for Boeing to not produce. Why? Well, Airbus always does better by producing, so Boeing should take this into account. If Airbus produces, Boeing is better off not producing. So by giving a subsidy of 25, profits of 125 go to the domestic industry. 125 –25 = 100 surplus, so this is an effective subsidy. However, it may be difficult to know the right subsidy. This will depend on what the exact game is, and this is not necessarily clear. In Table 11-4, we assume that Boeing has some underlying advantage, so that even if Airbus produces, it is still profitable for Boeing to produce. Yet Airbus cannot profitably produce if Boeing does. Now there is only one equilibria: Boeing produces, and Airbus does not. Suppose we have a subsidy of 25 in this case, yielding Table 11-5. Now Airbus will always produce. But Boeing will also always produce. This gives profits of 5 to each. So the subsidy to Airbus cost 25, but only resulted in a gain of 5 to Airbus. 5 – 25 = -20, so this is an ineffective subsidy. Despite what the text says, this is not exactly a case of beggar-thy-neighbor policies, as this is actually a coordination game, rather than a prisoner’s dilemma. There is a cooperative mutual strategy in Table 11-2, which results in both firms earning positive profits. Can you see it? Read case study pp. 291-2 to see which was true outcome in Boeing/Airbus case. Strategic Trade Policy in Practice Japan In the 1950s and 1960s, Japan had great success with expanding heavy industries such as steel and textiles. This coincided with heavy government intervention (credit rationing, tariffs, import restrictions). This success was touted as the reason to have strategic trade policies. However, on closer examination, it is quite plausible that this same thing would have happened even without the trade policy. Japan has a very high savings rate, a high level of available capital, etc. Later Japanese trade policy (since 1975 or so) has tried to target high-technology industries. But this hasn’t been very effective. The main engines of Japan’s export success have been automobiles and consumer electronics, and this has little to do with the strategic trade policy. France France tries to promote “national champions” to compete internationally. There is a fear that the U.S. will dominate world technology, and France will be left out in the cold. France’s economy has done well as a whole, but the targeted industries have not done well. “Few would regard France’s strategic policy as the key to its economic growth.” Discuss case studies on flat-panel TVs, Japanese targeting of steel, and Japanese targeting of the semiconductor industry. The general conclusion of the chapter is that “an examination of some major examples of strategic trade policy is not very encouraging about the track record of governments in their targeting.”