final report_ 9th meeting of council of rctg

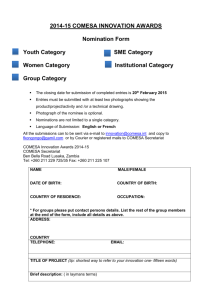

advertisement