AssessmentDancinMusi..

advertisement

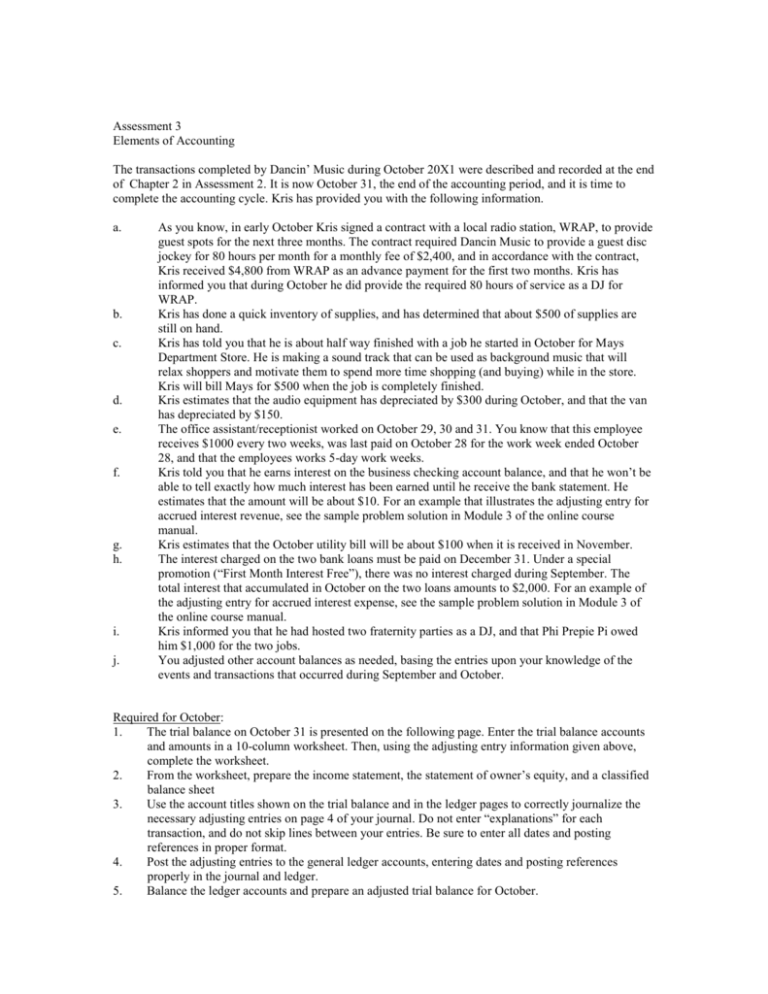

Assessment 3 Elements of Accounting The transactions completed by Dancin’ Music during October 20X1 were described and recorded at the end of Chapter 2 in Assessment 2. It is now October 31, the end of the accounting period, and it is time to complete the accounting cycle. Kris has provided you with the following information. a. b. c. d. e. f. g. h. i. j. As you know, in early October Kris signed a contract with a local radio station, WRAP, to provide guest spots for the next three months. The contract required Dancin Music to provide a guest disc jockey for 80 hours per month for a monthly fee of $2,400, and in accordance with the contract, Kris received $4,800 from WRAP as an advance payment for the first two months. Kris has informed you that during October he did provide the required 80 hours of service as a DJ for WRAP. Kris has done a quick inventory of supplies, and has determined that about $500 of supplies are still on hand. Kris has told you that he is about half way finished with a job he started in October for Mays Department Store. He is making a sound track that can be used as background music that will relax shoppers and motivate them to spend more time shopping (and buying) while in the store. Kris will bill Mays for $500 when the job is completely finished. Kris estimates that the audio equipment has depreciated by $300 during October, and that the van has depreciated by $150. The office assistant/receptionist worked on October 29, 30 and 31. You know that this employee receives $1000 every two weeks, was last paid on October 28 for the work week ended October 28, and that the employees works 5-day work weeks. Kris told you that he earns interest on the business checking account balance, and that he won’t be able to tell exactly how much interest has been earned until he receive the bank statement. He estimates that the amount will be about $10. For an example that illustrates the adjusting entry for accrued interest revenue, see the sample problem solution in Module 3 of the online course manual. Kris estimates that the October utility bill will be about $100 when it is received in November. The interest charged on the two bank loans must be paid on December 31. Under a special promotion (“First Month Interest Free”), there was no interest charged during September. The total interest that accumulated in October on the two loans amounts to $2,000. For an example of the adjusting entry for accrued interest expense, see the sample problem solution in Module 3 of the online course manual. Kris informed you that he had hosted two fraternity parties as a DJ, and that Phi Prepie Pi owed him $1,000 for the two jobs. You adjusted other account balances as needed, basing the entries upon your knowledge of the events and transactions that occurred during September and October. Required for October: 1. The trial balance on October 31 is presented on the following page. Enter the trial balance accounts and amounts in a 10-column worksheet. Then, using the adjusting entry information given above, complete the worksheet. 2. From the worksheet, prepare the income statement, the statement of owner’s equity, and a classified balance sheet 3. Use the account titles shown on the trial balance and in the ledger pages to correctly journalize the necessary adjusting entries on page 4 of your journal. Do not enter “explanations” for each transaction, and do not skip lines between your entries. Be sure to enter all dates and posting references in proper format. 4. Post the adjusting entries to the general ledger accounts, entering dates and posting references properly in the journal and ledger. 5. Balance the ledger accounts and prepare an adjusted trial balance for October. 6. 7. 8. Write a business memorandum to your client, Kris, regarding the condition of the business. You should discuss the business’ profitability and credit-worthiness in your memo, calculating and including the amount of working capital and the current ratio in your discussion. Save this file. Journalize the closing entries on page 5 of your journal, and post to the general ledger accounts. Balance the accounts and prepare a post-closing trial balance. This trial balance should be neatly typed and printed. Save your work in a backup file, and then send it to your instructor as an email attachment. The following is the unadjusted trial balance from October 31, 20X1: Unadjusted Trial Balance October 31, 20X1 Cash Interest Receivable Accounts Receivable Supplies Prepaid Insurance Music Library Audio Equipment Accumulated Depreciation - Equip Van Accumulated Depreciation - Van Interest Payable Wages Payable Utilities Payable Accounts Payable Unearned Service Revenue Notes Payable Kris Payne, Capital Kris Payne Drawing DJ Services Revenue Music Sales Revenue Music Expense Advertising Expense Supplies Expense Utilities Expense Gas & Oil Expense Wages Expense Rent Expense Accounting Services Expense Insurance Expense Depreciation Expense - Audio Depreciation Expense - Van Miscellaneous Expense Interest Revenue Interest Expense Total 45 0 5,900 920 7,500 4,000 11,200 0 20,000 0 0 0 0 7,900 4,800 26,000 14,430 5,000 9,050 250 1,225 980 0 560 750 2,000 1,600 300 0 0 0 450 0 0 62,430 62,430 Scoring will be based upon the following grading rubric: Assessment III Scoring Sheet Student’s Name: Maximum Points Adjustments correctly identified and entered on worksheet. Adjusting and closing entries properly recorded and correctly posted to ledger. Accounts balanced correctly. Sum of asset accounts equals sum of liability and owner’s equity accounts. Amounts recorded agree with figures reported on the financial statements. Worksheet and formal income statement, statement of owner’s equity, and balance sheet properly formatted with correct heading, dates, and content. Balances agree with those in the general ledger. Memo to owner correctly analyzes the business’ financial condition and provides the owner with helpful management suggestions. Total Points Earned 4 4 4 4 16 .