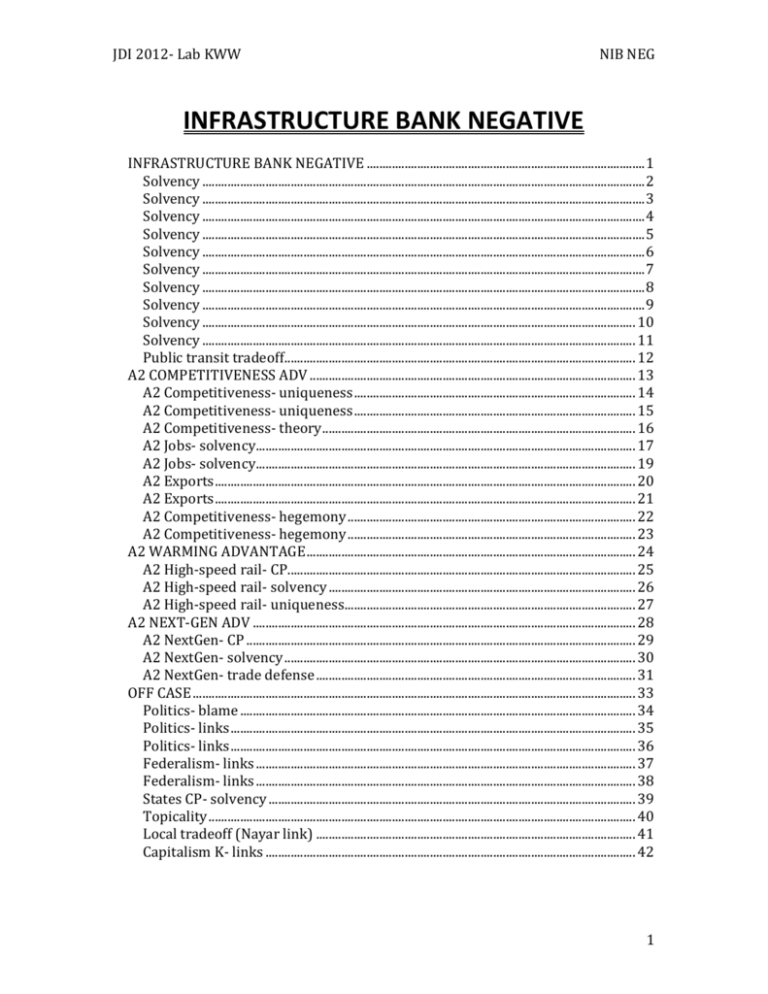

kww bank NEG paper

advertisement