Capitalism_Socialism_s11

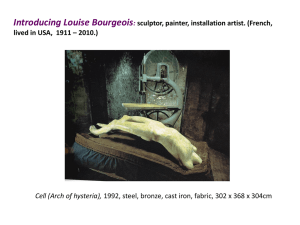

advertisement