OIO 31_JC_2011 - Central Excise

advertisement

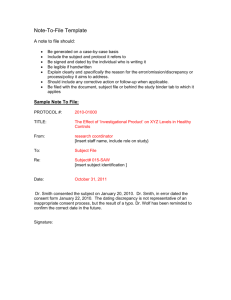

OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 lhek “kqYd ,oa dsUnzh; mRikn “kqYd vk;qDrky;] dsUnzh; mRikn “kqYd Hkou] jsl dkslZ] fjax jksM jktdksV-360001 OFFICE OF THE COMMISIONER OF CUSTOMS & CENTRAL EXCISE RACE COURSE RING ROAD, RAJKOT-360001 F.No V.ST/15-146/Adj./10 By RPAD/HAND DELIVERY Ekwy vkns”k Lka. Order in Original NO. 31/JC/2011 vkns”k dh frfFk 28.09.2011 Date of Order:03.10.2011 tkjh djus dh frfFk Date of Issue:- ,e- KkulqUnje vkns”kdrkZ dk uke : Passed by: ds lanHkZ esa : In the matter of संयक् ु त आयक् ु त ds0 m-0 “kqYd vk;qDrky;] jktdksV M/s. Navanagar Metcoke Ltd., At. Khiri, Jodia, Dist. Jamnagar. dkj.k crkvksa uksfVl la- V.ST/AR-JMR/JC/71/2010 Dated : 22.04.2010 &frfFk Show Cause Notice No. & Date. 1;g izfrfyfi ml O;fDr dks futh mi;ksx ds fy, fu%'kqYd nh xbZ gSA ftls ;g tkjh fd;k x;k gSA 1. This copy of order is granted free of charges to the person to whom it is issued. 2bl vkns'k ls ;fn dksbZ O;fDr vlarq"V gS rks bl vkns'k ds fo:) fuEufyf[kr dks vihy dj ldrk gSA&vk;qDr ¼vihy½ lhek ,oa dsUnzh; mRikn 'kqYd] jsl dkslZ fjax jksM jktdksVA 2. Any person deeming himself aggrieved by this order may appeal against this order to the Commissioner (Appeals), Customs & Central Excise, Central Excise Bhavan, Race Course Ring Road, Rajkot. 3vihy dk QkeZ ,l-Vh-&4 nks izfr esa Hkjk tk, ,oa mlds lkFk fu.kZ; dh izfrfyfi ;k lsokdj fu;e] 1994 dh dye 8 esa fofufnZ"V vuqlkj vkns'k ds fo:) vihy dh izfrfyfi gksuh pkfg,A 3. The Appeal should be filed in form ST-4 as per Rule 8 of Service Tax Rules, 1994 and it shall be signed by the person as specified in Rule 3 (2) of the Central Excise (Appeals) Rules, 2001. 4ikVhZ }kjk bl vkns'k dks O;fDrxr izkIr fd, tkus dh rkjh[k ls ;k Mkd }kjk izkfIr dh rkjh[k ls rhu eghus ds vanj vihy Qkby dh tkuh pkfg,A 4. The appeal should be filed within three months from the date of receipt of this order. [Section 85 of the Finance Act, 1994]. 5. 5. blds lkFk fuEufyf[kr dkxtkr gksuh pkfg,A The appeal should be accompanied by: ¼v½ ,slk vkns'k dh izfrfyfi ;k nwljs dh d izfrfyfi ftl ij uhps n'kkZ, v?khu fu/kkZfjr dksVZ dh Qhl LVsEi gksuh pkfg,A Page 1 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 (a) Copy of this order which should bear court fee stamp as prescribed under Schedule 1 of Article 6 of the Court Fee Stamp Act, 1870, as under: (i) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls de gks rks :i;s 00-25 gksA (i) If the amount or value of subject matter is rupees fifty or less, then Rs.0.25; (ii) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls v/khd gks rks :i;s 00-50 gksA (ii) If such amount exceed Rs.50, then, Rs.0.50 paisa. ¼c½ vihy izfrfyfi ftl ij :i;s 2-50 dh dksVZ Qh LVsEi gksuh pkfg,A (b) A copy of the appeal should also bear a court fee stamp of Rs.2.50. 6. lsok dj ]naM ¼isuYVh½ vkfn ds Hkqxrku dk izek.k A Proof of payment of duty, penalty etc., should also be attached to the original form of appeal. BRIEF FACTS OF THE CASE: On getting intelligence that M/s. Navanagar Metcoke Ltd., At. Khiri, Jodia, Dist. Jamnagar (hereinafter referred to as ‘noticee’) were receiving services in the category of ‘Transport of goods by road service’ and were not paying Service Tax on the appropriate value, an inquiry was conducted by the officers of Service Tax Division, Rajkot. During the process of inquiry, information was obtained regarding bill amounts raised by M/s. Shreeji Shipping, Jamnagar against the ‘noticee’ for the period from 2004-05 to 200708. As per letter dtd. 02-09-2009 of M/s. Shreeji Shipping, Jamnagar, they have raised bills for the above periods which are as under: YEAR 2004-05 2005-06 2006-07 2007-08 2. Amount Rs. 236150/5963326/960227/999428/- A reference was made to the ‘noticee’ vide letter No. F.No. V/6- 56/ST/08-09 dated 26-10-2009 to confirm the above bill amounts raised by M/s. Shreeji Shipping, Jamnagar against them for freight of import goods and its payment to M/s. Shreeji Shipping, Jamnagar. The noticee were also requested to send details of service tax paid on the above said amount with corroborative evidences. The noticee vide their letter dtd. 19-11-2009 furnished detailed chart of service tax payment and information about payment made to M/s. Shreeji Shipping, Jamnagar for transportation of their goods. They produced copies of challans showing service tax payment. On scrutiny of the above details, further clarifications were sought from them vide Page 2 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 letter F. No. V/6-56/ST/08-09 dated 09-12-2009 and again on 01-02-2010, which were clarified by them on 20-04-2010. 3. Shri Ritesh K. Dudakia, Authorised signatory of the noticee appeared on 20.04.2010 before the Superintendent of Central Excise, Service Tax Division, Rajkot to give statement under Section 14 of the Central Excise Act, 1944 as made applicable to Service Tax matters as per Section 83 of the Finance Act, 1994. He produced a copy of letter of authority dtd. 14-04-2010 issued by the noticee, according to which he was authorized to act/appear/represent the matters pertaining to service tax proceedings. In his statement, he stated, inter alia, that he has been called upon to give oral evidence in connection with the inquiry against their company and M/s Shreeji Shipping, Jamnagar regarding short payment of Service Tax; that he has presented himself for giving verbal evidence and to produce the documents pertaining to transportation and payment of Service Tax paid by his company towards the services ‘Transport of goods by road service’ being a service receiver for the period from 01.01.2005 to 31.03.2008; that the said unit, i.e., M/s. Navanagar Metcoke Ltd. alongwith entire fixed assets was sold in February 2008 due to huge loss in business; that they had taken service tax registration bearing No. AABCN2542AST001 dtd. 28-01-2005 and produced a copy of the same; that one category, viz., ‘Goods Transport Agency’ was included in the above said Registration Certificate; that the transportation of their imported goods from port to plant was done by M/s. Shreeji Shipping, Jamnagar and produced a specimen invoice bearing No. 633 dtd. 23-03-2007 for information; that their company had made payment towards freight per MT fixed amount to truck owners/truck operators hired for the transportation and the said amount had been paid through M/s. Shreeji Shipping; that at the time of recording statement, he was not having records, hence, he did not know the freight rate fixed per MT; that M/s. Shreeji Shipping were their clearing and forwarding agent and handling their port related services; that they do not have any specific written agreement with them; that their company had not engaged other agencies for the purpose; that transportation of their imported goods from Port to plant had been done by truck owners/operators through M/s. Shreeji Shipping under invoices/challans as produced above. On being asked about the proof regarding nonavailment of CENVAT credit with reference to Notifications 32/2004-ST dtd. 03.12.04 and No. 1/2006-ST dt. 01.03.2006, according to which a declaration is Page 3 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 required to be produced regarding non-availment of CENVAT on inputs and capital goods, he stated that they had not furnished such proof/declarations as required under above said notifications because of non excisability of their product. On being pointed out about the difference in figures of expenditure towards transportation in the Audit Reports for the year 2004-05 to 2007-08 and ST-3 Returns for the year 2004-05 and 2005-06, he stated that he has seen the ST-3 Returns and Audit Reports and in token of having seen the same he put his dated signature on the relevant portion of audit reports. He confirmed the said ST-3 Return figures and Audit reports figures which read as under: FIGURES AS PER ST-3 RETURNS Year 2004-05 2005-06 2006-07 2007-08 Taxable value (Rs.) 77,77,102 69,36,039 NIL 28,58,077 FIGURES AS PER AUDIT REPORTS Exp. (Rs.) (inward transportation) Exp. (Rs.) (outward transportation) 41,19,073 43,45,360 1,08,992 43,11,907 --- --- 9,10,819 1,18,03,324 He further submitted that Rs. 9,10,810/- and Rs. 1,18,03,324/- shown as ‘Outward transportation’ during the year 2006-07 and 2007-08 respectively pertain to the transportation expenses, which they get reimbursed as per their debit note from the concerned parties to whom their goods were dispatched. He produced a copy of such debit note No.NML/07-08/SEP/022 and dt.29-09-2007 along with Lorry Receipt No. 588 dtd. 29-09-2007 for information and records and submitted that their company had made payment towards service tax @ 25% availing exemption notifications on regular basis. Further, he stated that in case of late payment, they have paid interest also and that from 2004-05 to 2007-08, they have paid Rs. 4,63, 430/towards service tax. 4. Rule 2 (1)(d)(v) of the Service Tax Rules, 1994 states that the liability of service tax in relation to taxable services provided by a goods transport agency, where the consignor or consignee of the said goods is,(a) any factory registered under or governed by the Factories Act, 1948 (63 of 1948); Page 4 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 (b) any company [formed or registered under] the Companies Act, 1956 (1 of 1956); (c) any corporation established by or under any law; (d) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law corresponding to that Act in force in any part of India; (e) any co-operative society established by or under any law; (f) any dealer of excisable goods, who is registered under the Central Excise Act, 1944 (1 of 1944) or the rules made thereunder; or (g) any body corporate established, or a partnership firm registered, by or under any law, would be on any person who pays or is liable to pay freight either himself or through his agent for the transportation of such goods by road in a goods carriage. 5. The noticee appeared to be a company formed or registered under the Companies Act, 1956 (1 of 1956) falling under clause (b) of rule 2(1)(d)(v) and has paid freight for the outward as well as inward transportation by road and in view of the provisions under rule 2(1)(d)(v) of the Service Tax Rules, 1994, they appeared liable to pay the service tax on such freight for transportation by road. Therefore, it appeared that the noticee were required to discharge service tax liability on the said transportation of goods under Section 68(2) of the Finance Act, 1994, wherein it is provided that the liability to pay the service tax is upon: (1) Every person providing taxable service to any person at the rate specified in section 66 in such manner and within such period as may be prescribed. (2) Notwithstanding any thing contained in sub section (1), in respect of any taxable service notified by the Central Government in the Official Gazette, the service tax thereon shall be paid by such person and in such manner as may be prescribed at the rate specified in section 66 and all the provisions of this chapter shall apply to such person as if he is the person liable for paying the service tax in relation to such service. 6. It appeared that the noticee was the recipient of the services rendered by the Goods Transport Agencies and was, therefore, required to pay Service Tax under Section 68(2) of the Finance Act, 1994 read with Rule 6 of the Page 5 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 Service Tax Rules, 1994. It further appeared that consignee and consignor of the imported goods are the noticee themselves and that the noticee have made freight payment through their agent M/s. Shreeji Shipping for transportation of their imported goods. 7. As per the Explanation to Notification No. 35/2004-ST dtd. 03-12-2004, consignment note should contain following details: ‘Consignment note’ means a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of goods transported, details of place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency.’ 8. It appeared that the noticee had hired trucks through their agents M/s. Shreeji Shipping. As the imported goods were meant for their factory, for transportation of the said goods from the Port, i.e. originating place to their factory, the noticee had received the imported goods through invoice issued by M/s. Shreeji Shipping, Jamnagar. A specimen copy of such Invoice No. 633 dtd. 23-03-2007 produced by the noticee contains details like name of the party, name of the vessel, name of the port, period, particulars of coal transportation – Bedi to Khiri, qty., rate, amount etc. However, the said invoice/challan does not show details of ‘person liable for paying service tax whether consignor, consignee or the goods transport agency’. Hence, it appeared that the said challans produced by the noticee could not be equated with the consignment note prescribed under Rule 4B of the Service Tax Rules, 1994, which is a mandatory document for the service rendered by GTA. 9. It appeared that the noticee were liable to pay service tax as recipient of services as discussed in paras supra. Shri Ritesh Dudakia, Authorised Signatory of the noticee admitted in his statement dtd. 20-04-2010 that transportation had been done by the truck owners/operators under the above said document and further stated that they have made total service tax payment of Rs. 4,63,630/- during the period from 2004-05 to 2007-08. It Page 6 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 appeared from the challan No. 633, dtd.27-03-2007 furnished by Shri Ritesh Dudakia, Authorized Signatory that the same was issued by M/s. Shreeji Shipping, Jamnagar for transportation of their imported goods by engaging and paying freight charges through M/s. Shreeji Shipping . The same was admitted by Shri Ritesh Dudakia, Authorized Signatory in his statement recorded on 20-04-2010. 10. Sub clause (zzp) inserted vide Finance (No.2) Act, 2004 in clause 105 of Section 65 of the Finance Act, 1994 defines “taxable service” as any service provided or to be provided, to any person, by a goods transport agency, in relation to transport of goods by road in a goods carriage. Further service provided by the ‘Goods Transport Agency’/’Transport of goods by road services’ is taxable with effect from 01.01.2005. Notification No. 35/2004-ST dated 03.12.2004 prescribes that person making payment towards freight would be liable to pay service tax, in case consignor or consignee, of the goods transported, is a factory, company, corporation, co-operative society, dealer or partnership firm. Notification No. 32/2004-ST dated 03.12.2004 (effective from 01.01.2005) exempts the taxable service provided by Goods Transport Agency to a customer in relation to ‘transport of goods by road in a goods carriage’ from so much of service tax leviable thereon as in excess of the service tax calculated on a value which is equivalent to twenty five (25%) percent of the gross amount charged from the customer by such transport agency for providing the said taxable service. The exemption of 75% from gross amount will be available subject to the conditions that: The assessee does not avail Cenvat credit on inputs or capital goods used for providing such services and, The assessee has not availed the benefit under Notification No. 12/2003-ST dtd.20.06.2003 11. Therefore, from the above it appeared that the said noticee are the recipients of the services rendered by the ‘Goods Transport Agencies’ and are liable to pay Service Tax under section 68(2) of the Finance Act, 1994 read with rule 2(1)(d)(v) and rule 6 of Service Tax Rules, 1994, with effect from 1/1/2005. The Central Board of Excise and Customs, too, vide Order No. 5/1/2007-ST dtd.12.03.2007 has clarified that any person who is made liable to pay service tax, while discharging service tax liability on such service is entitled to avail the benefit of exemption in terms of Notifications No. 32/2004- Page 7 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 ST dated 03.12.04 and No. 1/2006-ST dated 01.03.2006 subject to a declaration by the service provider in all such cases, on the consignment note, to the effect that the condition of the aforesaid exemption notification has been satisfied. 12. It appeared that the noticee had failed to obtain/provide a declaration of the service provider regarding non-availment of Cenvat credit of duty paid on inputs and capital goods used in providing such services under the Cenvat Credit Rules, 2004, thereby contravening the provisions of Notification No. 32/2004-ST dated 03.12.2004 inasmuch as they had not paid the service tax on the full taxable value of ‘Goods Transport Agency’ services received by them. Shri Ritesh Dudakia, Authorised Signatory of the noticee admitted in his statement dtd. 20-04-2010 that they had not furnished such proof/declarations as required under above said notifications. Therefore, it appeared that the noticee are required to discharge service tax liability on 100 % of taxable value, i.e., Rs. 36,17,408/- including education cess and higher/secondary education cess for the period from January-2005 to March 2008 along with interest till the date of payment. 13. It also appeared that although the noticee were well aware of the fact that service tax is leviable on ‘‘Transport of goods by road services’ since 01.01.2005, they deliberately and willfully suppressed the fact of receiving the said service and short paid service tax on the services received by them for the period from 01.01.2005 to 31.03.2008, as discussed hereinabove. Therefore, it appeared that the noticee had evaded full payment of service tax by suppressing the facts with an clear intention to evade payment of service tax and, therefore, the said short payment of service tax was required to be demanded and recovered from them under the proviso to Section 73(1) of the Finance Act, 1994, as amended by invoking extended period of limitation of five years. 14. It further appeared that the noticee, by their aforesaid acts and/or omission(s) had also contravened the provisions of Section 68 and 70 of the said Act read with Rule 6 and 7 of the Service Tax Rules, 1994 inasmuch as they failed to make payment of Service Tax within prescribed time limit and carried out aforesaid activities without furnishing the prescribed returns within Page 8 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 the stipulated time limit. All these acts of contravention of the provisions of Sec. 68 and 70 of the Finance Act, 1994, as amended read with Rules 6 and 7 of the Service Tax Rules, 1994 appeared to be punishable under the provisions of Sec. 76, 77, & 78 of the Finance Act, 1994 as amended from time to time.. Therefore, the service tax so evaded was liable to be recovered from the noticee by invoking extended period of limitation under proviso to Section 73 of the Act along with interest under Section 75 and consequential penalties under Section 76 for non payment of service tax under Section 77 for incorrect filing of returns within the stipulated time limit and penalty under Section 78 of the Finance Act, 1994 for suppressing the taxable amount. 15. Therefore a show casue notice was issued to M/s. Navanagar Metcoke Ltd., Vill. Khiri asking them to show cause to the Joint Commissioner, Central Excise, Rajkot having his office at 6th floor, Central Excise Bhavan, Race Course Ring Road, Rajkot within 30 days of receipt of this notice, as to why : i) Service tax amounting to Rs.36,17,408/- (Rupees thirty six lakh seventeen thousand four hundred and eight only) including education cess and higher & secondary higher education cess, should not be demanded and recovered from them under the provisions of Section 73 of the Finance Act, 1994. Since the noticee have already paid service tax Rs. 4,63,430/-, they were also asked to show cause as to why it should not be appropriated against the above said demand of service tax. ii) Interest at appropriate rate should not be charged in terms of Section 75 of the Finance Act, 1994. As the noticee have paid Rs. 17383/- towards interest for the period 2004-05 and 2005-06, they were also asked to show cause as to why it should not be appropriated. iii) Penalty under Section 76 of the Finance Act, 1994 should not be imposed upon them as they have failed to pay service tax within the stipulated time frame; iv) Penalty under Section 77 of the Finance Act, 1994 should not be imposed upon them for not filing the prescribed ST-3 returns within Page 9 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 the stipulated time in terms of the provisions of Rule 7C of the Service Tax Rules, 1994 ; Penalty under Section 78 of the Finance Act, 1994 should not be v) imposed upon them for suppressing and not disclosing the value of the said taxable service provided by them; DEFENCE REPLY & PERSONAL HEARING: 16. The noticee have not furnished any defence reply. They were given opportunities for appearing for a personal hearing vide letter F.No. V.ST/15146/Adj/10 dt. 10.02.11 intimating the dates on 22.02.11, 23.02.11, and again on 28.04.11, and again on 02.06.11, 03.06.11, and again on dates 13.07.11 14.07.11 15.07.11, and again on 26.07.11,27.07.11, 28.07.11and again on 16.08.11, 17.08.11 and 18.08.11. Hence it is seen that they were given opportunities to come for a personal hearing on six different occasions but they have not utilized the same. Hence I am deciding the case based on the records available on file. DISCUSSIONS & FINDINGS: 17. I have carefully gone through the facts of the case on record. 18. I find that the Noticee were receiving services in the category of ‘Transport of goods by road service’ since F.Y. 2004-05 to 2007-08 and were having Service Tax Registration No. AABCN2542AST001 dtd. 28-01-2005. They were receiving transportation service through their Clearing & Forwarding Agent M/s Shreeji Shipping, Jamnagar who were arranging inward/outward transportation of the goods on their behalf and raising Invoices to the noticee. 19. I find that the noticee is a company [formed or registered under] the Companies Act, 1956 and hence liable to pay service tax in terms of Rule 2 (1)(d)(v) of the Service Tax Rules, 1994. Page 10 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 20. From the ST-3 returns and Challans, and vide their letter dt. 19.11.09 furnishing detailed chart for service tax payment and payments made to M/s Shreeji Shipping, Jamnagar for the service “Transportation of goods by road service” from 01.01.05 to 31.03.08, I find that there are differences in the figures of taxable value mentioned in the ST-3 returns and what has been actually paid. The reason for the same is that they have paid Service Tax only on 25% of value of transportation charges by claiming benefit under exemption Notn. No. 32/2004-ST dtd. 03.12.04 and No.1/2006-ST dt. 01.03.2006. 21. I find that benefit of exemption 32/2004-ST dtd. 03.12.04 and No. 1/2006-ST dt. 01.03.2006 can be availed subject to the following conditions: i) the credit of duty paid on inputs or capital goods used for providing such taxable service has not been taken. ii)the goods transport agency has not availed the benefit under the notification 12/2003 ST dated 20.6.2003. The CBEC Vide order 37B ORDER No 5/1/2007 –ST dated 12.3.2007 has clarified the procedure for complying with the conditions prescribed in Notifications 32/2004-ST dtd. 03.12.04 and No. 1/2006-ST dtd. 01.03.2006. It states that if a declaration is produced from the service provider in all such cases on the consignment note to the effect that the conditions of the aforesaid exemption notification have been satisfied would be sufficient for availing the benefit under the said notifications. It is seen that the same has not been complied with by the noticee and this fact has also been accepted by the authorized signatory Shri Ritesh K. Dudakia in his statement dtd. 20.04.2010. Hence I decide that the benefit of exemption notifications 32/2004-ST dtd. 03.12.04 and No. 1/2006-ST dt. 01.03.2006 cannot be granted to them. 22. I also find that as per explanation to Notification 35/2004-ST dtd. 03-122004, consignment note should contain following details: ‘Consignment note’ means a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of goods transported, details of place of origin and destination, Page 11 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 person liable for paying service tax whether consignor, consignee or the goods transport agency.’ From the specimen copy of an Invoice No. 633 dtd. 23-03-2007 produced by the noticee I find that it contains details like name of the party, name of the vessel, name of the port, period, particulars of coal transportation – Bedi to Khiri, qty., rate, amount etc. However, the said invoice/challan does not show details of ‘person liable for paying service tax whether consignor, consignee or the goods transport agency’. Hence, it appears that the said challans produced by the noticee cannot be equated with the consignment note prescribed under Rule 4B of the Service Tax Rules, 1994, which is a mandatory document for the service rendered by GTA. Therefore on this ground also the benefit of service tax payment on 25% of gross amount charged for transportation cannot be allowed. 23. It is seen that the noticee were well aware of the fact that service tax is liable to be paid on the services of goods transport agency and they have also paid part of their liability by claiming the benefit of an exemption notification. This shows that they were well aware of the law and procedures regarding discharging their tax liability. However they have tried to evade payment of tax by claiming that they have fulfilled the conditions prescribed in the exemption notifications. As already discussed above it is seen that they have not fulfilled the conditions and therefore the only conclusion that can be arrived is that they have suppressed the facts of non fulfillment of conditions with an intent to evade payment of appropriate service tax and hence are liable for imposition of penalty under Section 78 of the Finance act 1994. The noticee are also liable for imposition of penalty under Section 76 as there is a short payment of tax. It automatically follows that whenever there is a short payment of tax the same should be paid along with interest and hence as per the provisions of Section 75 of the Finance Act 1994, the noticee is liable for payment of interest. The Noticee have not maintained the consignment note as prescribed in the statute and hence they are also liable for imposition of penalty under Section 77 of the Finance Act 1994. 24. In view of the above discussion, I pass the following order: ORDER Page 12 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 (i) I confirm the demand of service tax of Rs. 3617408/- (Rupees Thirty Six lakh Seventeen Thousand four Hundred and Eight only) under Section 73(1) of the Finance Act, 1994 and appropriate the amount of Rs. 463430/- already paid by them in this regard. (ii) I demand interest on the above confirmed amount under Section 75 of the Finance Act, 1994 and appropriate the amount of interest Rs. 17383/already paid by them. (iii) I impose a penalty of Rs.200/- per day or two percent per month whichever is higher on the noticee, under the provisions of Section 76 of the Finance Act, 1994 starting with the first day after the due date till the date of actual payment of service tax, provided that the total amount of the penalty payable in terms on this account shall not exceed the service tax payable. (iv) I impose a penalty of Rs1000/- on the noticee under the provisions of Section 77of the Finance Act 1994. (v) I impose a penalty of Rs. 3617408/- (Rupees Thirty Six Lakh Seventeen Thousand Four Hundred and Eight only) on the noticee under the provisions of Section 78 of the Finance Act, 1994. If the amount as determined under Sr. No. (i) above is paid within 30 days from the receipt of the order alongwith the interest payable then as per proviso to Section 78 the penalty will be only 25% of the service tax determined at Sl. No. (i) above. The benefit of reduced penalty shall be available only if the amount of penalty so determined has also been paid within the period of thirty days from the receipt of the order. (M. GNANASUNDARAM) JOINT COMMISSIONER F.No. V.ST/15-146/Adj./10 To, M/s. Navanagar Metcoke Ltd., Page 13 of 14 OIO No. 31/JC/2011 Dated : 28.09/03.10/2011 At. Khiri, Jodia, Dist. Jamnagar. Copy to: (1) The Deputy Commissioner(RRA), CCE, HQ., Rajkot. (2) The Assistant Commissioner, Service Tax Division, Rajkot (3) The Superintendent, AR-Gandhidham, Service Tax, Rajkot. (4) Guard File. Page 14 of 14