OIO 64_JC_2011 - Central Excise

advertisement

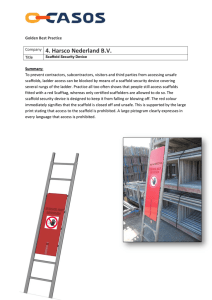

OIO No. 64/JC/2011 Dated 30.12.2011 lhek “kqYd ,oa dsUnzh; mRikn “kqYd vk;qDrky;] dsUnzh; mRikn “kqYd Hkou] jsl dkslZ] fjax jksM jktdksV-360001 OFFICE OF THE COMMISIONER OF CUSTOMS & CENTRAL EXCISE RACE COURSE RING ROAD, RAJKOT-360001 F.No V.ST/15-30279/Adj./2010 By RPAD/HAND DELIVERY Ekwy vkns”k Lka. Order in Original NO. 64/JC/2011 vkns”k dh frfFk 30.12.2011 Date of Order:06.01.2012 tkjh djus dh frfFk Date of Issue:- ,e- KkulqUnje vkns”kdrkZ dk uke : संयक् ु त आयक् ु त Passed by: ds lanHkZ esa : ds0 m-0 “kqYd vk;qDrky;] jktdksV M/s. Shreeji Enterprise Randal Krupa, Navi Bazar, Okha, Distt. Jamnagar dkj.k crkvksa uksfVl la- V.ST/AR-JMR/JC/262/2010 Dated : 18.10.2010 &frfFk Show Cause Notice No. & Date. In the matter of 1gSA 1. ;g izfrfyfi ml O;fDr dks futh mi;ksx ds fy, fu%'kqYd nh xbZ gSA ftls ;g tkjh fd;k x;k This copy of order is granted free of charges to the person to whom it is issued. 2bl vkns'k ls ;fn dksbZ O;fDr vlarq"V gS rks bl vkns'k ds fo:) fuEufyf[kr dks vihy dj ldrk gSA&vk;qDr ¼vihy½ lhek ,oa dsUnzh; mRikn 'kqYd] jsl dkslZ fjax jksM jktdksVA 2. Any person deeming himself aggrieved by this order may appeal against this order to the Commissioner (Appeals), Customs & Central Excise, Central Excise Bhavan, Race Course Ring Road, Rajkot. 3vihy dk QkeZ ,l-Vh-&4 nks izfr esa Hkjk tk, ,oa mlds lkFk fu.kZ; dh izfrfyfi ;k lsokdj fu;e] 1994 dh dye 8 esa fofufnZ"V vuqlkj vkns'k ds fo:) vihy dh izfrfyfi gksuh pkfg,A 3. The Appeal should be filed in form ST-4 as per Rule 8 of Service Tax Rules, 1994 and it shall be signed by the person as specified in Rule 3 (2) of the Central Excise (Appeals) Rules, 2001. 4ikVhZ }kjk bl vkns'k dks O;fDrxr izkIr fd, tkus dh rkjh[k ls ;k Mkd }kjk izkfIr dh rkjh[k ls rhu eghus ds vanj vihy Qkby dh tkuh pkfg,A 4. The appeal should be filed within three months from the date of receipt of this order. [Section 85 of the Finance Act, 1994]. 5. 5. blds lkFk fuEufyf[kr dkxtkr gksuh pkfg,A The appeal should be accompanied by: ¼v½ ,slk vkns'k dh izfrfyfi ;k nwljs dh d izfrfyfi ftl ij uhps n'kkZ, v?khu fu/kkZfjr dksVZ dh Qhl LVsEi gksuh pkfg,A (a) Copy of this order which should bear court fee stamp as prescribed under Schedule 1 of Article 6 of the Court Fee Stamp Act, 1870, as under: (i) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls de gks rks :i;s 00-25 gksA (i) If the amount or value of subject matter is rupees fifty or less, then Rs.0.25; Page 1 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 (ii) ;fn lCtsDV eSVj dh jde ;k ewY; ;k ewY; 50 :i; ;k 50 :i;s ls v/khd gks rks :i;s 00-50 gksA (ii) If such amount exceed Rs.50, then, Rs.0.50 paisa. ¼c½ vihy izfrfyfi ftl ij :i;s 2-50 dh dksVZ Qh LVsEi gksuh pkfg,A (b) A copy of the appeal should also bear a court fee stamp of Rs.2.50. 6. lsok dj ]naM ¼isuYVh½ vkfn ds Hkqxrku dk izek.k A Proof of payment of duty, penalty etc., should also be attached to the original form of appeal. Brief Facts of the Case: M/s. Shreeji Enterprise, (hereinafter referred to as “the noticee”) are having their office at Randal Krupa, Navi Bazar, Okha, Distt. Jamnagar, 2. During the course of Audit for the period 2005-06 to 2008-09 (upto December-2008), while scrutinizing the records of M/s. Tata Chemicals Ltd, Mithapur, Distt. Jamnagar, it was noticed that the noticee have provided services of “scaffolding works” in plant which appear to be taxable under the category of “Commercial or Industrial Construction Service” under the provisions of the Finance Act 1994 read with Service Tax Rules – 1994 as intimated by M/s. Tata Chemicals Ltd, Mithapur, vide their letter no. TCL/D&T/12/09 dated 19.03.2009. 3. Therefore, compliance was called for from the said noticee vide office letters no. JMN/S.Tax/FAR-I-22/08-09 dated 19.11.2008, 15.12.2008 and 21.01.2009. As the noticee failed to comply, a summon was issued vide letter dated 01.06.2010 to appear and produce required details for carrying out necessary investigations. The noticee did not appear for deposing statement or produce the records called for. It appeared that the noticee obtained Service Tax Registration bearing No. ABGFS5259LST001 only on 17.01.2007 for “Business Auxiliary Service” but have not applied or obtained registration under the category of “Construction Services in respect of Commercial or Industrial Buildings and Civil Structures” for the services that have been provided to M/s. Tata Chemicals Ltd, Mithapur, during the period from 2005-06 to 2008-09 (upto December-2008) and thereby they had not discharged Service Tax liability for the said period with a malafide intention to evade payment of Service Tax. 4. It appeared that the activity carried out by the said noticee falls under the category of “Construction Service” within the definition of the Section 65 Page 2 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 of Finance Act, 1994 and subjected to levy of service tax. The relevant portion of Section 65 of the Finance Act, 1994 reads as under; “Commercial or industrial construction service” means — (a) Construction of a new building or a civil structure or a part thereof; or (b) Construction of pipeline or conduit; or (c) Completion and finishing services such as glazing, plastering, painting, floor and wall tiling, wall covering and wall papering, wood and metal joinery and carpentry, fencing and railing, construction of swimming pools, acoustic applications or fittings and other similar services, in relation to building or civil structure; or (d)repair, alteration, renovation or restoration of, or similar services in relation to, building or civil structure, pipeline or conduit, which is — (i) used, or to be used, primarily for; or (ii) occupied, or to be occupied, primarily with; or (iii) engaged, or to be engaged, primarily in, Commerce or industry, or work intended for commerce or industry, but does not include such services provided in respect of roads, airports, railways, transport terminals, bridges, tunnels and dams” 5. As elaborated above the noticee had rendered taxable service i.e. “Construction Service”, to M/s.Tata Chemicals Ltd, Mithapur and others, with effect from 2005-06 to 2008-09 (upto December-2008) as tabled below and had earned income to the tune of Rs.50,77,168/- through this service. However, no service tax was paid for the said services, therefore, the same was required to be recovered along-with interest under the provisions of Finance Act, 1994 and Service Tax Rules, 1994. The year wise value of taxable services provided by the said noticee and the service tax payable thereon is as follows:Year Value of taxable service Service S. Tax payable (Rs.) tax Rate (Rs.) 2005-06 Nil Nil Nil 2006-07 6,41,827 12.24 % 78,560 2007-08 23,41,965 12.36 % 2,89,467 2008-09(upto 20,93,376 12.36 % 2,58,741 50,77,168 - 6,26,768 December-2008) Total 6. As per the Section 69 of the Finance Act, 1994 read with Rule 4 of the Service Tax Rules, 1994 every person providing taxable service should obtained Service Tax Registration within prescribed time period, however, the noticee had not obtained the same within prescribed time limit. Page 3 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 7. It appeared that the noticee had suppressed the total taxable value of Rs. 50,77,168/-, as per the above table, and evaded service tax totally amounting to Rs. 6,26,768/-. Thus, it appeared the noticee by their acts and/ or omission, as detailed in Para supra, failed to obtain Service Tax Registration in the category “Construction Services”, within prescribed time limit and escaped the assessment of tax, failed to disclose wholly and truly all the material facts required and suppressed or concealed the taxable service with a willful intention to evade payment of service tax of Rs. 6,26,768/- for the period 2005-06 to 2008-09 (upto December-2008). Hence the extended period under proviso to Sub-Section (1) of Section 73 of the Finance Act, 1994 appeared to be invokable in this case for recovery of service tax. 8. It appeared that the noticee had contravened the provisions of Section 66 of the Finance Act, 1994 in as much as they had not discharged their service tax liabilities at applicable rate on the amount against said services provided by them; the provisions of Section 67 of the Finance Act, 1994 in as much as they had failed to make the correct valuation of services rendered by them and escaped the assessment of tax on the said services; the provisions of Section 68 of the Finance Act, 1994 read-with Rule 6 of the Service Tax Rules, 1994 in as much as they had failed to collect and deposit service tax into the account of the Government of India; the provisions of Section 69 of the Finance Act, 1994 in as much as they had failed to obtain to Service Tax registration within stipulated time period and to discharge their Service Tax liability and the provisions of Section 70 of the Finance Act, 1994 read with Rule 7 of the Service Tax Rules, 1994 in as much as they had failed to assess their tax liability and also failed to file returns. 9. Therefore, M/s. Shreeji Enterprise, Randal Krupa, Navi Bazar, Okha, Dist. Jamnagar Distt. Jamnagar was vide show cause notice no. V.ST/ARJMR/JC/262/2010 dated 18.10.2010 called upon to show cause to the Joint Commissioner, Central Excise Rajkot, as to why:(i) Service Tax along with Education Cess totally amounting to Rs. 6,26,768/-(Rs. Six Lakhs Twenty-six thousands Seven Hundred Sixty-Eight only) should not be recovered from them under proviso to Section 73(1) of the Finance Act, 1994. Page 4 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 (ii) Interest at the applicable rate on the above amount should not be recovered from them under Section 75 of the Finance Act, 1994. (iii) Penalty should not be imposed on them under Section 76 of the Finance Act, 1994; (iv) Penalty should not be imposed on them under Section 77 of the Finance Act, 1994; (v) Penalty should not be imposed on them under Section 78 of the Finance Act, 1994; DEFENCE SUBMISSION AND PERSONAL HEARING: 10. The noticee submitted written reply to the show cause notice vide their submission dated 02.11.2011, wherein it is, inter alia contended that: (i) The amount of Rs.50,77,168/- received by them from M/s Tata Chemicals Ltd. (hereinafter referred as ‘the company’) was only for providing scaffolding material to them. A ‘scaffold’ is a temporary arrangement erected around a building for convenience of workers. As per rules of the company, any repair or maintenance work is required to be done above height of Eight (8) feet, use of scaffold is compulsory and for this purpose, the company has asked them to provide scaffold at their various sites. Accordingly, by using pipes, clamps and other materials, the noticee set up scaffold at the various places. After the structure is in place, their role ceases and all further activities by using the scaffold are carried out by the company or any other person appointed or authorized by the company in this regard. Further, as per the instruction of the company, they dismantle their scaffolds and take the same back. The noticee have also provided photographs of the scaffold supplied by them. (ii) The noticee are not carrying out any construction activity, whether of a new building, a civil structure or a part thereof, pipeline or conduit or any repair, alteration, renovation or restoration of or any similar services in relation to building or civil structure, pipeline or conduit. (iii) Mere supply of scaffold does not tantamount to rendering any service that can be charged to Service tax under the category Page 5 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 “Commercial or Industrial Construction Service” defined under Section 65(25b) of the Finance Act,1994, as amended. Hence, the impugned show cause notice is liable to be withdrawn in toto. (iv) The show cause notice is also not sustainable on account of the fact that out of various sub-clauses, i.e. (a), (b), (c) and (d) of Section 65(25b) of the Finance Act, 1994, it nowhere seeks to specify the sub-clause under which supply of scaffold is covered for the purpose of charging Service tax under the category of “Commercial or Industrial Construction Service”. (v) Supply of scaffold does not amount to construction of a new building or a civil structure or a part thereof as laid out in sub clause (a) on account of the fact that there is no construction at all and this is further corroborated by the fact that no new building or civil structure is coming into existence by the activities undertaken by the noticee. It also does not amount to construction of pipeline or conduit as laid out in sub clause (b). It also cannot be equated with completion or finishing services in relation to building or civil structure as laid out in sub clause (c). Finally, it cannot fall under the category repair, alteration, renovation or restoration of, or similar services in relation to building or civil structure, pipeline or conduit as laid out in sub clause (d) as the noticee are not doing any sort of repair, alteration, renovation or restoration activity. Thus, it was imperative that before issuing the impugned notice, the activity of supplying scaffold carried out by them is to be classified under one or the other sub-clauses of the definition of “Commercial or Industrial Construction Service” given in Section 65(25b) of the Finance Act, 1994, as amended, from time to time. As no classification is proposed, the impugned notice suffers from an incorrigible defect and therefore, the same is liable to be withdrawn, in toto. (vi) The show cause notice is mis-directed inasmuch as it ought to have been directed against the persons who provided one or the other service to the company by using noticee’s scaffolds. (vii) The noticee were under a bona fide belief that supply of scaffold was not liable to service tax and hence, they did not charge any service tax from the company M/s. Tata Chemicals Ltd. Further, the company is a part of a leading business conglomerate of the Page 6 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 country having the benefit of top-notch tax experts at their disposal. Therefore, had it been a case where service tax was chargeable on the scaffolds taken by the company from the noticee during the period under consideration, they would have surely advised the noticee to charge service tax for the same, for which the company would have earned Cenvat Credit. In any case, no personal gain would have accrued to the noticee. Therefore, there was no mala fide intention on noticee’s part in not collecting and paying the Service tax. Hence, in the facts and circumstances, proviso to Section 73(1) of the Finance Act, 1994, for the purpose of demanding Service tax after expiry of one year, is not invokable in the present case. They refer to the decisions of Hon. Supreme Court in case of Gopal Zarda Udyog v CCE 2005 (188) ELT 251 (S.C.) and CCE v/s Chemphar Drugs & Liniments, 1989 (40) ELT 276 (S.C.) to support their submission. (viii) Service tax liability is computed on the basis of figures provided by the company. However, the noticee have not collected any service tax from the company. When no tax is collected separately, the gross amount has to be adopted to quantify the tax liability treating it as value of taxable service plus service tax payable. They rely upon the decision of Tribunal in case of CCE, Patna v/s Advantage Media Consultant [2008 (10) S.T.R. 449 (Tri.-Kolkata)] which has been maintained by the Supreme Court of India [2009(14) S.T.R. J49 (S.C.)]. They also rely upon the decision of Tribunal in case of Gem Star Enterprises (P) Ltd. v/s CCE, Calicut [2007 (7) S.T.R. 342 (Tri.-Bang.)] and the Supreme Court of India judgement in Maruti Udyog Ltd. [2002 (141) ELT 3 (S.C.)]. The noticee have submitted that taxable amount, to be computed if any, may be re-computed by deducting the element of service tax payable. (ix) Services provided under construction service are eligible for abatement of 67% and hence, tax to be charged, if any, should be charged only on 33% of the total amount, as per Notification No. 1/2006-S.T. dated 1.3.2006. (x) Non-payment of service tax preceded by non-collection of the tax from the recipient was solely on account of noticee’s bona fide belief that mere supply of scaffold is outside the purview of service tax levy. Therefore, they request to extend the provisions of Section 80 of the Finance Act, 1994 and exonerate Page 7 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 them from the penal action proposed against them in the show cause notice. They also submit that as per the provisions of Section 78, as amended by Finance Act, 2008 with effect from 10.5.2008, if the penalty is payable under Section 78, the provisions of Section 76 shall not apply. Therefore, simultaneous penalty under Section 76 and 78 is unwarranted. In view of above, the noticee have reiterated their position that the activity of supplying scaffold is not covered by “Commercial or Industrial Construction Service” as defined in Section 65(25b) of the Finance Act, 1994, as amended and hence, they are not liable for payment of Service tax and requested to withdraw the SCN, in toto. A Personal hearing was held on 02..11.2011 which was attended by the authorised representative shri Ravindra manek of the noticee, who briefed the defence reply dated 2.11.2011 and stated that the scaffolding supplied is a temporary arrangement and hence cannot be treated as a construction activity like setting up of a new building, civil structure etc. He requested to decide the case based on the defence reply. DISCUSSION AND FINDINGS 11. I have carefully gone through the entire case records, SCN issued, defense put forth by the noticee in written submission as well as contentions raised during personal hearing. I find that the main issue to be decided in the present case is whether the noticee is liable to pay service tax on ‘scaffolding work’ under the category of ‘Commercial or Industrial Construction Service” as defined under Section 65(25b) of the Finance Act, 1994. 12. The noticee has contended the levy of service tax mainly on ground that ‘Scaffold’ supplied by them to M/s Tata Chemicals Ltd., Mithapur is a temporary arrangement erected around a building for convenience of worker for any repair or maintenance work required to be done above height of eight (8) feet and that mere supply of scaffold does not tantamount to rendering any service that can be charged to service tax under the category “Commercial or Industrial Construction Service” as defined under Section 65(25b) of the Finance Act, 1994. Page 8 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 13. To appreciate the issue better, I give below the definition of “Commercial or industrial construction services” as defined under Section 65(25b) of the Finance Act, 1994 and under Section 65(105)(zzq) of the Finance Act, 1994 which is effective from 16.6.2005. “Commercial or industrial construction services” as defined under Section 65(25b) of the Finance Act, 1994 means — (a) Construction of a new building or a civil structure or a part thereof; or (b) Construction of pipeline or conduit; or (c) Completion and finishing services such as glazing, plastering, painting, floor and wall tiling, wall covering and wall papering, wood and metal joinery and carpentry, fencing and railing, construction of swimming pools, acoustic applications or fittings and other similar services, in relation to building or civil structure; or (d) repair, alteration, renovation or restoration of, or similar services in relation to, building or civil structure, pipeline or conduit, which is — (i) used, or to be used, primarily for; or (ii) occupied, or to be occupied, primarily with; or (iii) engaged, or to be engaged, primarily in, Commerce or industry, or work intended for commerce or industry, but does not include such services provided in respect of roads, airports, railways, transport terminals, bridges, tunnels and dams” “Commercial or industrial construction services” as defined under 65(105)(zzq) of the Finance Act, 1994 means“Taxable services means any service provided or to be provided to any person, by any other person, in relation to commercial or industrial construction service.” From the plain reading of the above definition, it is clear that the same is exhaustive and covers construction activities of all kinds meant for use for commerce and industries. The above definition also includes repair, restoration or alteration or similar services in relation to building or civil structure. It also include post construction completion and finishing services Page 9 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 such as glazing, plastering, painting, floor and wall tiling, wall papering and wall coverings, wood and metal joinery and carpentry, if undertaken as isolated or stand alone contract. Further, construction of pipe line or conduit including repairs, restoration, renovation or alteration has been included in the above definition. The word “construction” is defined as follows - the building of something ,typically a large structure(as per New Oxford Dictionary of English) -To make or form by combining or arranging parts or elements (as per Websters Ninth new collegiate dictionary) -The act or process of constructing (Chambers dictionary) Hence it is seen that the definition nowhere provides that such structure shall be built only with the help of cement, sand, stone etc. Such structure can be built with iron and steel, plywood etc. Thus the meaning of the word “construction” is wide enough to cover also the structures which are built with the help of any metal and other materials. Hence any structure that has been built even for a temporary period will fall under the category of construction and any services provided for the same will be deemed to fall under commercial or industrial construction service. 14. In the present case on hand, the noticee have provided ‘scaffold’ services to M/s Tata Chemical Ltd., Mithapur. I have gone through the definition of ‘Scaffold’ as given in ‘Free Online Dictionary, Thesaurus and Encycloped’ By Farlex reproduced below: “Scaffold : - (Miscellaneous Technologies / Building) a temporary metal or wooden framework that is used to support workmen and materials during the erection, repair, etc. of a building or other construction. - A temporary arrangement erected around a building for convenience of workers” - A temporary platform used to elevate and support workers and materials during work on a structure or machine. It consists of one or more wooden planks and is supported by either a timber or a tubular steel or aluminum frame; bamboo is used in parts of Asia. Scaffolding may be raised and lowered by means of cables controlled by a ratchet or electric motor.” I find that the noticee in their defense submission have also stated that a ‘scaffold’ is a temporary arrangement erected around a building for Page 10 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 convenience of workers. Hence as per the discussion in the previous para the scaffolding is a construction and any service provided for the same will fall under “Commercial or industrial construction service”. 15. Further, with reference to this office letters F. No. V.ST/15-302/Adj/10 dated 2.11.2011 and dated 21.12.2011, the Superintendent, Service Tax Range-Jamnagar vide his letter F. No. JMN/S.Tax/FAR-I-22/2009-10 dated 26.12.2011 submitted that “the noticee is engaged in arranging a temporary platform of pipes, on which workers sit or stand when performing tasks at height above the ground for convenience and safety of workers while construction of new buildings within the plant or renovation of the existing civil structures including repairing of plant and this type of work termed by them as “Scaffolding works”. 16. From the definition of “Commercial or industrial construction service” as provided under Section 65(25b) of the Finance Act, 1994 and under Section 65(105)(zzq) of the Finance Act, 1994, definition of “Scaffold” as given in ‘Free Online Dictionary, Thesaurus and Encycloped By Farlex, the noticee’s contention and verification report of Range Superintendent, I hold that the ‘Scaffold’ service provided by the noticee to M/s Tata Chemicals Ltd. is classifiable under the definition of “Commercial or industrial construction service”. The noticee has argued that there was no malafide intention on their part to evade payment of tax and that their client being a top notch company would have advised them if any tax liability was there in the present matter. The reasoning given by the noticee cannot be accepted as an excuse for non payment of tax. As a service provider the liability to pay tax vests with the noticee and he cannot take umbrage that they were not briefed by the service recipient. The act of non payment of tax would not have been noticed if the audit of the service recipient had not taken place. Hence the only conclusion that can be arrived at is that there was a suppression of facts by the noticee and the extended proviso has been rightly invoked in this case. For substantiating my reasoning for upholding the invocation of extended proviso I rely upon the following case laws. a) Commissioner of central excise, Surat -1 Vs Neminath fabrics- 2010(256)ELT 369 HC b) Commissioner of central excise ,Vishakapatnam Vs Mehta $Co 2011-TIOL -17-SC-CX Page 11 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 c) M/s Rajasthan spinning mills 2009(238) ELT3(S.C) The noticee has also argued that the cum tax benefit has to be given if the amount of demand is confirmed. Cum tax benefit cannot be granted in cases involving fraud, collusion, willful mis statement and suppression of facts with an intent to evade payment of tax. I rely upon the decision of the Tribunal in the case of Dhillon cooldrinks&Bevarages Ltd Vs CCE Jalandhar 2011(263)ELT 241(Tri –Del) which has placed reliance on the decision of the Honble supreme court in case of Amrit agro industries Vs CCE Ghaziabad 2007(210)ELT 183(SC).As already discussed above since this is a case of suppression of facts with a intent to evade payment of tax no cum tax benefit can be given. The noticee has argued that penalties under section 76 and section 78 cannot be imposed simultaneously in view of amendment made in the Finance act in the year 2008. I find that the period pertaining to the demand is from 2005-06 t0 2008-09 .Mensrea has been proved in this case. As the amendment to the act has been made subsequent to the demand period I rule that penalties under both secton 76 and 78 are imposable in this case. My stand is supported by the decision of the High court of Kerala in the case of Assistant commissioner of central excise Vs Krishna poduval 2006(1)S.T.R 185(KER) and Commissioner of central excise ,Chandigarh Vs Grewal trading company -2010(18) STR 350(Tr-Del).The noticee is also liable for imposition of penalty under section 77 for non registration with the department even though he was providing taxable services. 17. In view of my findings above, I pass the following order :: ORDER :: (i) I confirm the demand of service tax amounting to Rs. 6,26,768/not paid by the noticee, M/s Shreeji Enterprise under section 73 (1) of the Finance Act, 1994; (ii) I demand payment of interest at appropriate rate on the aboveconfirmed demand under section 75 of the Finance Act, 1994; (iii) I impose a penalty of Rs.200/- per day or two percent per month whichever is higher on the noticee, under the provisions of sections Page 12 of 13 OIO No. 64/JC/2011 Dated 30.12.2011 76 of the Finance Act, 1994; starting with the first day after the due date till the date of actual payment of service tax, provided that the total amount of the penalty payable in terms on this account shall not exceed the service tax payable as confirmed at sl no (i). (iv) I impose a penalty Rs.5000/- on the noticee, under the provisions of Section 77 of the Finance Act, 1994. (v) I impose a penalty of Rs 6,26,768/- on the noticee, under the provisions of Section 78 of the Finance Act, 1994. If the demand and interest as confirmed at Sr.No. (i)and (ii) is paid within thirty days from the date of communication of this order, then the amount of penalty liable to be paid under Section 78 shall be twenty five percent of the service tax so determined provided the reduced penalty is also paid within 30 days of communication of the order. (M. GNANASUNDARAM) JOINT COMMISSIONER, F. No. V.ST/15-302/Adj./10 By Regd. Post A.D. To, M/s. Shreeji Enterprise Randal Krupa, Navi Bazar, Okha, Distt. Jamnagar. Copy to: 1. The Assistant Commissioner (RRA), Central Excise, Rajkot. 2. The Deputy Commissioner, Service Tax Division-Rajkot. 3. The Superintendent, Service Tax Range, Jamnagar. 4. Guard file. Page 13 of 13