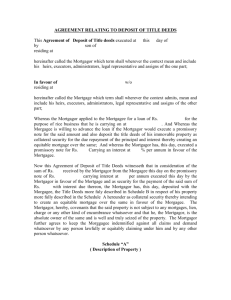

(24.05.2002) KS(OCBC1)-MOM.9 MML 1 Ver 1 THE LAND TITLES

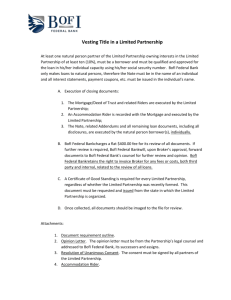

advertisement