2. Debits and Credits - Sun Yat

advertisement

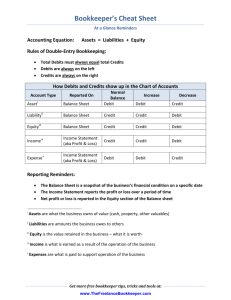

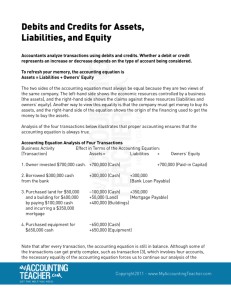

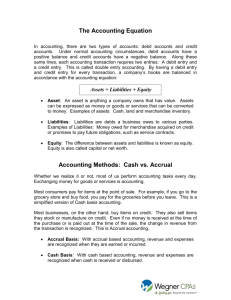

Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University Lesson notes Lesson 3: Analyzing and Recording Accounting Transactions Learning objectives 1. Provide the students with a background of the accounting process to better understand the numbers on the financial statements 2. Define the economic transactions and events that are included into our accounting considerations 3. Learn about the fundamental accounting system and its components 4. Understand the basic accounting equation and illustrate it with some examples of transactions and their impacts on the accounting Equation. Teaching hours Students major in accounting: 3 hours Others: 3 hours Teaching contents: What should we take into our consideration when we deal with the business activities as accountants? The exchanges of economic consideration between two parties shall be clearly defined: Transactions-external economic exchanges (or external transactions) occur between the organization and an outside party. On January 1, 20X2, Hanlin Bookstore sold 100 accounting textbooks to a class of accounting students at University X. Events-internal transactions occur within the organization. On June 30, 20X2, Hanlin Bookstore depreciate its fixed assets (those major furniture in the store) by the amount of 2,000 RMB. Accounts and Their Functions Accounts (also called general ledger accounts) are sub-classifications of accounting elements (e.g., cash is a sub-classification of assets). Each entity must create a custom list that adequately describes the items represented. Accounts are usually assigned account numbers in addition to titles. Typically, similar accounts are grouped together numerically in the order they will appear Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University on the balance sheet and income statement. In other words, a business would maintain an account for cash, another account for inventory, and so forth for every other financial statement element. All accounts collectively comprise a firm's general ledger. In a manual processing system, you could imagine the general ledger as nothing more than notebook, with a separate page for every account. A CASH account is demonstrated as follows: ACCOUNT: Cash Date Description Increase Decrease Running Balance Jan. 1, 20X2 Balance forward $50,000 Jan. 5, 20X2 Collected receivable Jan. 8, 20X2 Cash sale Jan. 11, 20X2 Paid rent $7,000 $58,000 Jan. 15, 20X2 Paid salary $3,000 $55,000 Jan. 18, 20X2 Cash sale Jan. 22, 20X2 Paid bills $2,000 $57,000 Jan. 25, 20X2 Paid tax $1,000 $56,000 Jan. 31, 20X2 Collected receivable $10,000 $60,000 $5,000 $65,000 $4,000 $7,000 $59,000 $63,000 This account reveals that cash has a balance of $63,000 as of January 31,2005. By examining the account, you can see the various transactions that caused increases and decreases to cash. If you were to prepare a balance sheet on January 31, you would include cash for the indicated amount (and, so forth for each of the other accounts comprising the financial statements.) Double-entry Accounting 1.History The double-entry system of accounting has been used in commerce for over 500 years. Although Luca Pacioli, a fifteenth-century monk, is often given credit for having developed the system in his 1494 book, Summa de Arithmetica, Geometria, Proportioni et Proportionalita, he actually only described an accounting practice that was already being used in commerce in Italy. Pacioli’s true contribution to modern accounting lies in the fact that his book was widely read throughout the Italian trading empire, and so the accounting method he wrote about was introduced to many within a relatively short period of time. Double-entry accounting seems to be a practice that simply evolved over time as the best way of keeping track of financial activity. It has retained this status through major changes in economic activity and technology. 2.Debits and Credits Debits (sometimes abbreviated "dr") and credits (sometimes abbreviated "cr") are unique accounting tools to describe the necessary change in a particular account that is necessitated by a Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University transaction. In other words, instead of saying that cash is "increased" or "decreased", we say that cash in "debited" or "credited." Why need we add this complexity? Well, the debit/credit process is actually quite brilliant, because every transaction can be described in its debit/credit form -- and in a way that debits = credits! This would not be true for an increase/decrease system. To mention a few examples, if you provided services to customers for cash, both cash and revenues are said to increase (but cash is said to be debited and revenue is said to be credited). When we pay an account payable causes a decrease in cash and a decrease in accounts payable (but cash is said to be credited and accounts payable is said to be debited). At first, this will seem somewhat confusing. However, the debit/credit rules are inherently logical. 3.Quicker Ways to Remember You can use some quicker ways to make it easier to remember the rules relating the debits and credits. You can use the diagram as follows: ACCOUNT INCREASED BY: DECREASED BY: NORMAL BALANCE: Assets Debits Credits Debit Liabilities Credits Debits Credit Equity Credits Debits Credit Revenue Credits Debits Credit Expense Debits Credits Debit Dividends Debits Credits Debit Or you can figure out some humors to help you remember, for instance, note that debits increase expenses, assets, and dividends (d-e-a-d) T-accounts T-accounts are an abbreviated form of a ledger account, used to help illustrate the effect of transactions. It should be made clear that, one would not use t-accounts for actually maintaining the accounts of a business. Instead, they are just a real quick and simple way to figure out how a set of transactions and events will impact a company. Importantly, t-accounts just roll up the journal and ledger into one quick demonstration; t-accounts work well to show what happens from a small number of transactions and events, but would quickly become unwieldy in an enlarged business setting. The physical shape of a t-account is a "T," and debits are on the left and credits on the right. The "balance" is the amount by which debits exceed credits (or vice versa). Below is the general format of a t-account: Account Name Debit entries Credit entries (left side) (right side) Dr Cr Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University Accounting Equation 1. History The accounting model we use today was developed over 500 years ago by Luca Pacioli, a Renaissance era monk who developed a method for tracking the success or failure of trading ventures of that day. The foundation of that system continues to serve the modern business world well, and is the entrenched corner stone of even the most elaborate computerized systems. 2. Nucleus of Accounting Equation A business entity can be described as a collection of assets and the corresponding claims against those assets. The claims can be divided into the claims of creditors and owners (i.e., liabilities and owners' equity). This gives rise to the fundamental accounting equation: Assets = liabilities + owners' equity. 3. Further Issues Relating the Accounting Equation Accounting elements ASSETS: Assets are the economic resources of the entity presumed to entail probable future economic benefits to the owner. LIABILITIES: Liabilities are amounts owed to others relating to loans, extensions of credit, and other obligations arising in the course of business. OWNERS' EQUITY: Owners' equity is the owner's "interest" in the business. It is sometimes called net assets, Some important rules of Accounting Equation (1) After increases and decreases in an account are recorded, the amount remaining in the account is its balance. (2) Account balances are computed by adding the beginning balance and the increases, and subtracting the decreases. (3) The balance equals the difference between total debit entries and total credit entries. 4. The Accounting Equation in Reality As you will soon discover, the fundamental accounting equation is the backbone of the accounting and reporting system. At this point, however, you are probably prepared to understand the fundamental accounting equation in relation to the following example statement of financial position (more commonly called the "balance sheet"): Example Corporation Balance Sheet December 31, 20X2 Assets Cash $ 25,000 Liabilities Accounts payable $ 50,000 Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University Accounts receivable Inventories Land Buildings Equipment 35,000 125,000 400,000 250,000 Other assets 10,000 Total assets 50,000 $895,000 Loans payable Total liabilities Stockholders' equity Capital stock Retained earnings Total stockholders' equity Total Liabilities and equity 125,000 $175,000 $120,000 600,000 720,000 $895,000 Examples: Business Transactions and Accounting Equation Economic transactions of a business will impact various asset, liability, and/or equity accounts; but, they will not disturb the equality of the accounting equation. Consider the following transactions for Example Corporation, noting carefully how the individual asset, liability, and equity accounts change from illustration to illustration, without upsetting the basic equality: 1. Example Corporation purchased supplies for cash (Increase and decrease on one side of the equation keeps the equation in balance. + Asset (Supplies) = - Asset (Cash) 2. Example Corporation purchased furniture and supplies on credit (Increase on both sides of equation keeps equation in balance) +Asset (Supplies)+Asset(Furniture) = + Liability (Account Payable) 3. Example Corporation Rendered services for cash (Revenue earned increase on both sides of equation keeps equation in balance) + Asset (Cash) = + Owner’s Equity(Owner’s Name, Capital) 4. Example Corporation paid its expenses in cash (Expense incurred decrease on both sides of equation keeps equation in balance) - Asset (Cash) = - Owner’s Equity(Owner’s Name, Capital) 5. Example Corporation signed a service contract with one of its clients. (No effect on accounting equation as no transactions has yet occurred.) 6. Example Corporation received cash on account (Increase and decrease on one side of the equation keeps the equation in balance.) + Asset (Cash) = - Asset (Accounts Receivable) 7. Example Corporation paid an accounts payable Task Team of FUNDAMENTAL ACCOUNTING Business School, Sun Yat-sen University (Decrease on both sides of equation keeps equation in balance.) - Asset (Cash) = - Liability (Accounts Payable) 8. One owner of Example Corporation withdrew cash (Withdrawal: decrease on both sides of equation keeps equation in balance.) - Asset (Cash) = - O E (Owner’s Name, Capital) Summary 1. Accounts are used to appropriately categorize transactions. 2. In the double-entry accounting system, at least two accounts are always affected by a transaction. After a transaction is recorded, the equation: Assets = Liabilities + Stockholders' Equity must remain in balance. 3. T-accounts are a simplified version of those used in practice. 4. Economic transactions of a business will impact various asset, liability, and/or equity accounts; but, they will not disturb the equality of the accounting equation. Case for Open Discussion Debits/Credits versus Pluses/Minuses In order for all accounts to look the same, and to simultaneously make sure that the accounting equation stays in balance with double-entry bookkeeping, the debit and credit system was devised. Luca Pacioli first described it in 1494, and the basic system is so sound and efficient, we still use it today. Tradition aside, we would not still be using this ancient system if it didn’t work extremely well and efficiently. One could set up a system with pluses and minuses, but it would not be as efficient at generating the data needed for financial statements while making sure that the accounting equation was still in balance. One is more likely to make mistakes in entering data with plus and minus signs, although this is a secondary concern to the issues of uniformity and efficiency. Why use debits and credits rather than pluses and minuses?