CTE Academic Integration Lesson Planner

advertisement

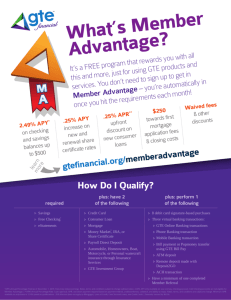

Lesson Title – Banking Course –Personal Finance Grade Level –9-12 Author – Kevin VanWormer School – Smoky Hill High School Length of Lesson -5 Blocks CTE Academic Integration Lesson Planner What do I want students to learn? Standards and Benchmarks Standards and Benchmarks NBEA Standards…or MarkEd Standards… or … ITEA Standards ACT College Readiness Standards Reading Demonstrate a basic knowledge of financial institutions. Evaluate services provided by financial deposit institutions to transfer funds. Distinguish between the different options provided by financial institutions for savings. Infer the main idea or purpose of straightforward paragraphs in uncomplicated literary narratives Understand the overall approach taken by the author or narrator (e.g. point of view, kinds of evidence used) in uncomplicated passages Math Solve routine two-step or three-step arithmetic problems, using percentages. Exhibit knowledge of elementary number concepts Evaluate algebraic expressions by substituting integers for unknown quantities. Solve routine first-degree equations Students will: Students will: •Know: (Content and Vocabulary) •Do: (Skills, Strategies, Processes and Literacy) How to identify available financial services How to distinguish among various types of savings options How to use a checking account effectively (deposits, checks, checkbook register, bank reconciliation) Identify and calculate different forms of interest Vocab: Simple/Compounding Interest, Principle, Liquidity, Risk, Rate of Return, Rule of 72 Read and discuss key concepts Discuss and analyze real-life examples Complete real-life simulations Guided practice Students will be able to distinguish between different savings and banking institutions. Students will demonstrate their understanding of the options provided for investing and saving within their banking institution. Students will calculate simple and compound interest. Students will determine rate of return on different savings options. Students will complete checking simulation, demonstrating proper use of checks, checkbook register, and bank reconciliation. Enduring Understandings (Big Ideas) For example… principles, themes, generalizations or macro-concepts Financial security is benefited through a proper relationship with a banking/savings institution. Understanding of the services/options provided by that institution will help one make better decisions in their day to day finances. Essential Questions Guiding, driving questions which lead to enduring understandings How do we provide ourselves with financial security when we choose to retire? How am I going to assess student learning? Assessments: Formative assessments and/or Summative assessments Formative Assessment Guided note taking activities Think/Pair/Share Activities Article readings/Activity Simulation packets Summative Assessment Unit Test: Multiple Choice, Problems, Short answer essay Instructional Plan Prerequisite Skills: Preparation What prior knowledge, skills and understanding do the students need? How will you assess their background knowledge and readiness? Students will have a variety of background knowledge based on individual banking experiences (i.e. checking, savings, etc..). I will evaluate this background knowledge through observation of the presentation from Junior Achievement on this topic during day 1. Student responses to the topic of checking and banking will help me determine individual readiness. Instruction and Activities: What procedure (sequence), teaching strategies, and student activities are used in this lesson? State the student roles, teacher roles, and grouping for this lesson. Student focused reading and comprehension activity (Got Money) Teacher directed exploratory discussion (Powerpoint: Banking Services) Group/exploratory activity/worksheet for First Bank Savings Options Teacher directed exploratory discussion (Powerpoint: Interest: Simple vs. Compound) Student Activity: Determine Simple and Compound Interest (Finding Rate of Return) Teacher directed exploratory discussion (How to Use Checking Accounts) Individual student simulation: First Bank Checking Simulation Lesson Title – Banking Course –Personal Finance Grade Level –9-12 Author – Kevin VanWormer School – Smoky Hill High School Length of Lesson -5 Blocks Academic Integration What core academic topics are integrated? What terminology is common? What terminology is different? Include specific examples to be used to introduce, teach, or review the topics. Algebraic Equations Find the best deal using one and two-step calculations and then comparing results Calculate using several steps of logic Decide what information, calculations, or unit conversions to use to solve problems Look up and use a single formulas Main Ideas and Supporting Details Understand main ideas, topic sentences, and the relationships among sentences in a paragraph Select important details to clarify meaning Identify the appropriate definition of words with multiple meanings based on context Specific ACT Readiness Examples: Reading Comprehension questions from reading activity “Got Money” 1. 2. 3. 4. 5. Which of the following statements best expresses the authors main message of the passage? a. Tips to cash your check b. Making informed decisions allows you to avoid fees and making financial mistakes with checks c. Everyone should have a checking account d. Identifying the differences between a bank and a credit union Which of the following is NOT answered by information in the passage? a. Why high school students don’t have checking accounts? b. What is the worst or most expensive way to cash a check? c. What hidden costs are associated with checking accounts? d. The advantages of a credit union? Which of the following best describes what the author means when she says, “It's just like driving-there are responsibilities that go with it, and you can have a wreck." a. If you are irresponsible you can get hurt b. By establishing a checking account at a younger age allows you to learn responsibilities that will help you in the long run. c. Cars and checking accounts are dangerous and one should avoid them unless necessary. d. Both accidents and checking accounts are expensive mistakes It can be logically inferred from the passage that the best option for you to turn your checks to cash is to? a. Cash checks at Wal-Mart b. Go to the closest bank to cash them c. Go to a bank that you have chosen based on your needs and costs associated d. Don’t except checks if you do not have a checking account As it is used in the 12th paragraph, the word diligent means a. Done with painstaking attention b. Taking charge of situations c. Defer action d. Neglect Math questions from Formative Assessment Students are asked to solve routine two-step or three-step arithmetic problems, using percentages. 1. What is the total dollar amount of simple interest earned on $50 at 6% for 2 years. a. $3 b. $4.50 c. $6.00 d. $7.50 2. How much interest will you earn in a year on a $750 investment that earns 5% interest compounded semiannually? a. $37.44 b. $37.50 c. $37.97 d. $38.23 3. Lisa deposited $2000 in a 2 year CD. At the end of the two years the CD will be worth $2044. What is the rate of return that Lisa will earn on her investment? a. 1.8% b. 2.2% c. 2.6% d. 2.8% 4. You receive $1000 for your 16th birthday and put $700 in a 2 year CD earning 4% interest compounded annually and $300 in a savings account earning 1% compounded annually. How much will your $1000 be worth on your 18th birthday? a. $1063.15 b. $1065.22 c. $1067.15 d. $1069.22 Lesson Title – Banking Course –Personal Finance Grade Level –9-12 Author – Kevin VanWormer School – Smoky Hill High School Length of Lesson -5 Blocks Resources What materials and resources are needed for this lesson? Describe the learning environment where this lesson will take place. First Bank Savings/Banking Simulation Booklet Junior Achievement guest speaker Practical Money Skills.com Efirstbank.com Wall Street Journal Classroom Edition o Got Money