FEASIBILITY ANALYSIS

advertisement

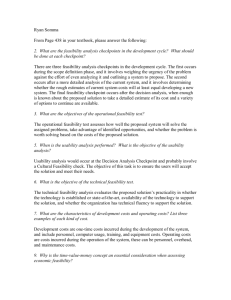

FEASIBILITY ANALYSIS A fter identifying the business requirements and desired system the next step is to understand the feasibility of those requirements. Feasibility analysis is used to determine that whether to proceed the project also establishes a high-level view of the intended project and determines its goals. Additionally, feasibility analysis also discusses the important risks associated with the project that must be identified. There are 3 techniques in feasibility analysis; 1. Technical Feasibility: Familiarity with Application Familiarity with Technology Project Size Compatibility 2. Economic Feasibility: Development costs Annual operating costs Annual Benefits (Cost savings and revenues) Intangible cost and benefits 3. Organizational Feasibility: Project champions Senior management Users Other stake holders Is the project strategically aligned with business? T echnical Feasibility: Determines whether a proposed solution for project can be implemented with available hardware, software, and technical resources. If familiarity with application and technology are less then the project will face higher risk. If project size is large and compatibility is harder then the project will face higher risk as well. In our case the familiarity is moderate because some of the employees in IT department have knowledge of the application and technology that are going to use. Compatibility and project size may be the disadvantages of the project because the company has a paper-based (traditional) system and the project covers all the stores as well as headquarter around Texas. Conclusion of this technical feasibility leads us that hence the project has moderate risk the technical aspect is feasible to establish the system to our company. O rganizational Feasibility: The 2nd technique used for feasibility analysis is to assess the organizational feasibility of the system. Organizational feasibility means the ability, desire, and willingness of the stakeholders to use, support, and operate the proposed computer information system. The stakeholders include management, employees, customers, and suppliers. The stakeholders are interested in systems that are easy to operate, make few, if any, errors, produce the desired information, and fall within the objectives of the organization. In our case this project has a moderate risk. The objective of the system, which is to have control on our inventory (database) and to increase sales, is aligned well with the senior management’s goal of increasing sales of the company. Additionally the establishment of the e-commerce service also will help to our marketing department’s goal to reach more customers and expand the sales. E conomical (or Financial) Feasibility: For a business entity, this is by far the most important kind of feasibility. This feasibility is done to evaluate the financial viability of the proposed project or changes in the existing systems. Expected financial benefits are matched against expected cost and if the former outweigh the latter, depending upon other conditions and constraints, the project is adopted In case of Champion Toys, a feasibility analysis was carried out which resulted in the favorable indication for the project. This is detailed in the following section 2006 2007 2008 Increased Sales $180,000 $210,000 Cost Savings $ 30,000 Total Cash Inflow 2009 2010 Total $250,000 $270,000 $910,000 $ 30,000 $ 30,000 $30,000 $120,000 $210,000 $240,000 $280,000 $300,000 $1,030,000 0 0 0 0 0 Hardware $22,000 $22,000 $22,000 $22,000 $88,000 Software $13,000 $13,000 $13,000 $13,000 $52,000 Maintenance /labor $45,000 $45,000 $45,000 $45,000 $180,000 Total Operation cost $80,000 $80,000 $80,000 $80,000 $320,000 Net Cash flow ($500,000) $130,000 $160,000 $200,000 $220,000 $210,000 ($471,698) $122,641 $142,399 $167,923 $174,260 $135,525 Cash Inflow Cash Outflow Developmental Cost Hardware $155,000 Software-Licenses $ 25,000 Labor $320,000 Total $500,000 Operational Cost Net Present Value Net Cash inflow: (1,030,000 – 820,000) = $210,000 Return on Investment (ROI): 210,000/820,000 = 25.61% Payback Period: = 3 years and 4 months Net Present Value = $135,000 Average return on investment is about 6.4% per annum. The viability of this rate of return depends upon the rates on other investment opportunity available and its overall effect on the economic health of the business i.e. it should also be considered if this project is not adopted, will it cause any impairment to business sales and growth in short and long run? Also timing of return is very important. The sooner the big amount of cash inflow is, the better it is. In this case discounting all net cash flows at 6%, net cash flow results in positive amount of $ 135,000 which is commendable at this project size. Payback period is relatively longer i.e. 3 years and 4 months which should be considered along with other factors in a scenario of 4 years. All of the above measures are quantitative and should be evaluated in combination with other factors specially risk factors must be considered because this in an investment in technology, the ever-changing mode technology should be given proper consideration Moreover, consideration should also be given on market trends in the industry. Even in the presence of a healthy information system, change in the market trend can play havoc with the business and information system alone can not come to rescue.