user manual

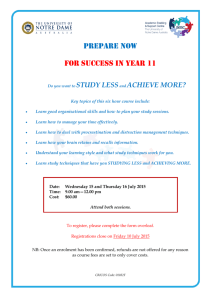

advertisement