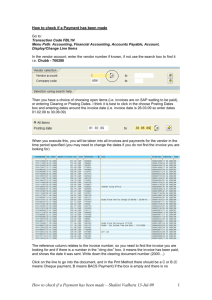

user manual

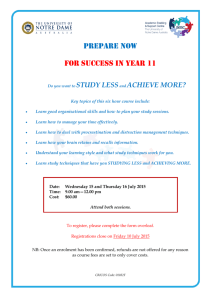

advertisement