INTERNATIONAL FINANCE

advertisement

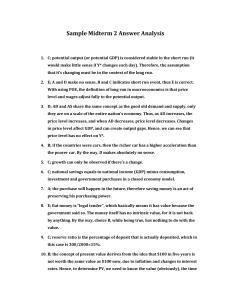

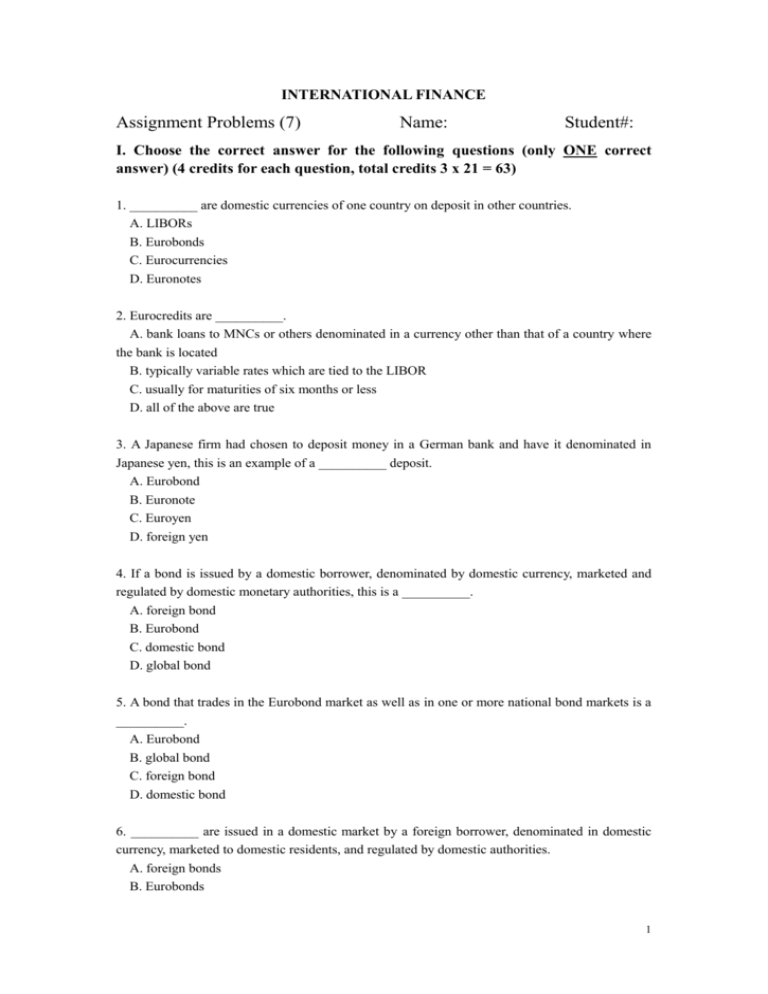

INTERNATIONAL FINANCE Assignment Problems (7) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (4 credits for each question, total credits 3 x 21 = 63) 1. __________ are domestic currencies of one country on deposit in other countries. A. LIBORs B. Eurobonds C. Eurocurrencies D. Euronotes 2. Eurocredits are __________. A. bank loans to MNCs or others denominated in a currency other than that of a country where the bank is located B. typically variable rates which are tied to the LIBOR C. usually for maturities of six months or less D. all of the above are true 3. A Japanese firm had chosen to deposit money in a German bank and have it denominated in Japanese yen, this is an example of a __________ deposit. A. Eurobond B. Euronote C. Euroyen D. foreign yen 4. If a bond is issued by a domestic borrower, denominated by domestic currency, marketed and regulated by domestic monetary authorities, this is a __________. A. foreign bond B. Eurobond C. domestic bond D. global bond 5. A bond that trades in the Eurobond market as well as in one or more national bond markets is a __________. A. Eurobond B. global bond C. foreign bond D. domestic bond 6. __________ are issued in a domestic market by a foreign borrower, denominated in domestic currency, marketed to domestic residents, and regulated by domestic authorities. A. foreign bonds B. Eurobonds 1 C. domestic bonds D. Yankee bonds 7. The Federal National Mortgage Association (Fannie Mae) issued a dollar-denominated bond with a 7.25% annual coupon and a maturity date in 2030 to non-U.S. investors in an external market. This bond is typically a __________. A. foreign bond B. Eurobond C. domestic bond D. Yankee bond 8. A euro-denominated loan is traded in Eurocurrency market. This loan is called __________. A. euro loan B. Euroeuro loan C. foreign euro loan D. none of the above 9. Which of the following is true for a Eurocurrency market? A. A Eurocurrency market is not subject to any countries’ interest rate regulations. B. A Eurocurrency market does not need to meet any countries’ reserve requirements. C. A Eurocurrency market enjoys the privilege of free flow of capitals D. All of the above must be true 10. Citigroup in Los Angeles borrows a Canadian dollar-denominated deposit from Union Bank of Switzerland (UBS) in Geneva. This is a __________ deposit. A. Euronote B. Euro-Swiss franc C. Euro-Canadian dollar D. Eurobond 11. Which of the following is NOT true about the original Eurodollar? A. The Soviet Union maintained dollar-denominated deposits in U.S. banks in the early 1950s. The Soviet government feared that U.S. might freeze those deposits because of the Cold War. B. The Soviet Union moved those dollars to banks in London. C. Since the dollars were in Europe, they were called “Eurodollars”. D. The Soviet Union worried that the U.S. would not convert the U.S. dollar into the gold as promised. 12. There are many ways to classify financial markets. The category of money market and capital market is made according to __________. A. whether or not they are regulated by a single country B. whether or not a financial intermediary stands between borrowers and savers C. the maturity of the financial assets and liabilities D. the participants of the markets 2 13. A __________ is an agreement in which a borrower sells his T-bills to a bank and promises to buy them back later at an agreed price. A. commercial paper B. repo C. banker’s acceptance D. negotiable certificate of deposit 14. Accepted drafts refer to those time drafts issued by __________ and promised to pay by __________ at maturity. A. an investor; a bank B. a firm; a bank C. a bank; a firm D. a bank; an investor 15. Which of the following did NOT contribute to the prosperity of the Eurodollar market? A. increased regulation of banking activities prevailed in 1960s in U.S. B. easy access to U.S. capital market by foreign investors C. huge dollar income of OPEC countries in 1970s D. tremendous growth of international trade and investment 16. The most frequent quoted rate on Eurocurrency market is the __________. A. U.S. T-bill rate B. Bank of England’s rate C. LIBOR D. Federal funds’ rate 17. Which of the following is NOT a feature of the Eurobond? A. Eurobonds are usually issued in bearer form. B. Eurobonds are “straight” bonds. C. Eurobonds usually have longer maturities than those on domestic markets. D. Eurobonds do not have withholding taxes. 18. A Samurai bond is __________. A. a yen bond issued in the United States by an institution residing in Japan B. a yen bond issued in Japan by an institution residing outside of Japan C. a non-yen bond issued in Japan by an institution residing outside Japan D. none of the above are Samurai bond 19. If IBM issues registered bond in New York Stock Exchange, the __________ needs to keep the records of the owners of its bonds. A. IBM B. New York Stock Exchange C. IRS (Internal Revenue Service) D. U.S. Treasury Department 3 20. If the interest rates decline, one can expect that __________. A. prices of the bonds will usually be up B. prices of the bonds will usually be down. C. prices of the bonds will usually remain the same. D. prices of the bonds may be up or may be down, because the price of bond has no relation with the interest rate. 21. Eurobanks are __________. A. banks where Eurocurrencies are deposited B. major world banks that conduct a Eurocurrency business in addition to normal banking activities C. financial intermediaries that simultaneously bid for time deposits in and make loans in a currency other than that of the currency of where it is located D. all of the above are descriptions of a Eurobank. II. Problems (17 Credits) 1. Which of the following are Eurodollars and which are not? (1 credit for each question, total credits 1 x 10 = 10) a. A U.S. dollar deposit owned by a German corporation and held in Barclay’s Bank in London. b. A U.S. dollar deposit owned by German corporation and held in Bank of America’s office in London. c. A U.S. dollar deposit owned by German corporation and held in Sumitomo Bank in Tokyo. d. A U.S. dollar deposit owned by German corporation and held in Citibank in New York. e. A U.S. dollar deposit owned by German corporation and held in the New York branch of Deutsche Bank. f. A U.S. dollar deposit owned by a U.S. resident and held in Overseas Banking Corporation in Singapore g. A U.S. dollar deposit owned by German corporation and held in the Berlin branch of Deutsche Bank. h. A deposit of euros in Paribas Bank in Paris. i. A deposit of euros in Citibank in New York. j. A deposit of Australian dollars in Paribas Bank in Paris. 2. AireAsia, headquartered in Kunming, China, needs US$5,000,000 for one year to finance working capital. The airline has two alternatives for borrowing: (7 credits) a. Borrow US$5,000,000 in Eurodollars in London at 7.250% per annum. b. Borrow HK$39,000,000 in China Hong Kong at 7.00% per annum, and exchange these Hong Kong dollars at the present exchange rate of HK$7.8/US$ for U.S. dollar. At what ending exchange rate would AireAsia be indifferent between borrowing U.S. dollars and borrowing Hong Kong dollars? 4 III. True or False (2 credits for each question, total credits 2 x 10 = 20) 1. Eurocurrency markets are outside the jurisdiction of any single regulatory authority. 2. Banker’s acceptance means that the draft issuer promises to pay the draft when it is due. 3. Domestic bonds are denominated in domestic currency by any borrower. 4. Most Eurobonds are issued in registered form in order to track the holder of the bonds. 5. The Eurocurrency market continues to thrive because it is a large international money market relatively free of government regulation and interference. 6. One of the attractive features of a bond is that it is free of withholding tax. 7. T-bill dealers purchases T-bills from an investor and later sells him at a higher price. This agreement is called a repo. 8. Syndicated credit is a loan by several lenders led by a lead manager to provide funds for several borrowers. 9. IET requires U.S. residents who hold foreign bonds should pay taxes to the federal government. 10. Eurocurrencies are not the same as the euro developed for the common European currency. 5 Answers to Assignment (7) I. Choice questions (63 credits) 1. C 2. D 3. C 4.C 5. B 6. A 7. B 8. B 13. B 14. B 15. B 16. C 17. C 18. B 19. A 9. D 20. A 10. C 21. D 11. D 12. C II. Problems (17 credits) 1. a. yes b. yes c. yes d. no e. no f. yes g. yes h. no i. no j. no 2. If borrowing dollar, obligation: 5,000,000 x (1 + 7.25%) = $5,362,500 If borrowing HK dollar, obligation 39,000,000 x (1 + 7%) = HK$41,730,000 Ending exchange rate x 5,362,500 = 41,730,000 So, 41,730,000 / 5,362,500 = HK$7.7818/$ III. True or False (20 credits) 1. true 2. false 3. false 4. false 5. true 6. false 7. false 8. false 9. true 10. true 6