July 23, 2003 - The Malaysian Institute Of Certified Public Accountants

advertisement

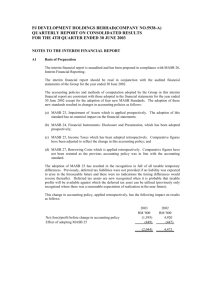

CIRCULAR TO MEMBERS The Malaysian Institute of Certified Public Accountants (3246-U) (Institut Akauntan Awam Bertauliah Malaysia) (3246-U) March 1, 2006 Circular No. TEC/002/03/2006/W FINANCIAL REPORTING STANDARDS AND PRIVATE ENTITY REPORTING STANDARDS ISSUED BY MALAYSIAN ACCOUNTING STANDARDS BOARD I. New / Revised MASB Approved Accounting Standards The Malaysian Accounting Standards Board (MASB) has recently issued the following new / revised approved accounting standards, which shall apply to annual periods beginning on or after October 1, 2006: FRS 117, Leases FRS 124, Related Party Disclosures FRS 139, Financial Instruments: Recognition and Measurement This is the second tranche of the set of 21 new / revised approved accounting standards announced by the MASB earlier. Members may purchase the 3 new / revised MASB Standards from the MICPA Secretariat at a special discounted price of RM5.00. The full set of 21 new / revised MASB Standards and IC Interpretations is available at RM30.00 per set. II. Private Entity Reporting Standards The MASB on February 22, 2006 announced that Financial Reporting Standards (FRS) are now optional for private companies. Two sets of approved accounting standards are now in place: Financial Reporting Standards (FRS) These standards are mandatory for all entities other than private entities. Public listed companies, their subsidiaries, associates, or companies jointly controlled by them are required to comply with FRS in the preparation of their financial statements. Private Entity Reporting Standards (PERS) These standards are applicable to private entities. A private entity is a private company incorporated under the Companies Act, 1965 that: - is not itself required to prepare or lodge any financial statements under any law administered by the Securities Commission or Bank Negara Malaysia; and - is not a subsidiary or associate of, or jointly controlled by, an entity which is required to prepare or lodge any financial statements under any law administered by the Securities Commission or Bank Negara Malaysia. Essentially, PERS are MASB Standards issued by the MASB prior to January 1, 2005 except for certain standards which have been removed. In addition, each PERS includes an amendment regarding the applicability and compliance with the standard effective January 1, 2006. The list of PERS is attached as per Annexure I. These standards, which carry the old MASB reference numbers, have been issued to members previously. Private entities are now given the option to use FRS, which are equivalent to International Financial Reporting Standards, or to use PERS. If an entity chooses to use FRS or PERS, it must comply with the full set of FRS or PERS respectively in their entirety. In the meantime, the MASB has embarked on a more comprehensive review of the reporting needs of private entities in line with the initiative undertaken by the International Accounting Standards Board (IASB) on accounting for small and medium-sized entities. The Institute had in October 2005 submitted a proposal to the MASB to defer the implementation of the new / revised FRS on SMEs pending the issuance of the SME accounting standard by the IASB, which is expected to be issued in 2007. The Institute highlighted that much of the complex measurement and disclosure requirements within the new / revised FRS are not relevant for decision making by users of SME financial statements, which means the cost of compliance far exceeds benefits. TAN SHOOK KHENG (Ms) Secretary TEC002.2006.MASB 2 Annexure I MASB Approved Accounting Standards for Private Entities The list of Private Entity Reporting Standards (PERS) are as follows: MASB 1 Presentation of Financial Statements MASB 2 Inventories MASB 3 Net Profit or Loss for the Period, Fundamental Errors and Changes in Accounting Policies MASB 4 Research and Development Costs MASB 5 Cash Flow Statements MASB 6 The Effects of Changes in Foreign Exchange Rates MASB 7 Construction Contracts MASB 9 Revenue MASB 10 Leases MASB 11 Consolidated Financial Statements and Investments in Subsidiaries MASB 12 Investments in Associates MASB 14 Depreciation Accounting MASB 15 Property, Plant and Equipment MASB 16 Financial Reporting of Interests in Joint Ventures MASB 19 Events after the Balance Sheet Date MASB 20 Provisions, Contingent Liabilities and Contingent Assets MASB 23 Impairment of Assets MASB 25 Income Taxes MASB 27 Borrowing Costs MASB 28 Discontinuing Operations MASB 29 Employee Benefits MASB 30 Accounting and Reporting by Retirement Benefit Plans MASB 31 Accounting for Government Grants and Disclosure of Government Assistance MASB 32 Property Development Activities IAS 25 Accounting for Investments IAS 29 Financial Reporting in Hyperinflationary Economies MAS 5 Accounting for Aquaculture IB-1 Preliminary and Pre-operating Expenditure 3