Lesson Plan Grade 11 CIE3M Canada and the Global

advertisement

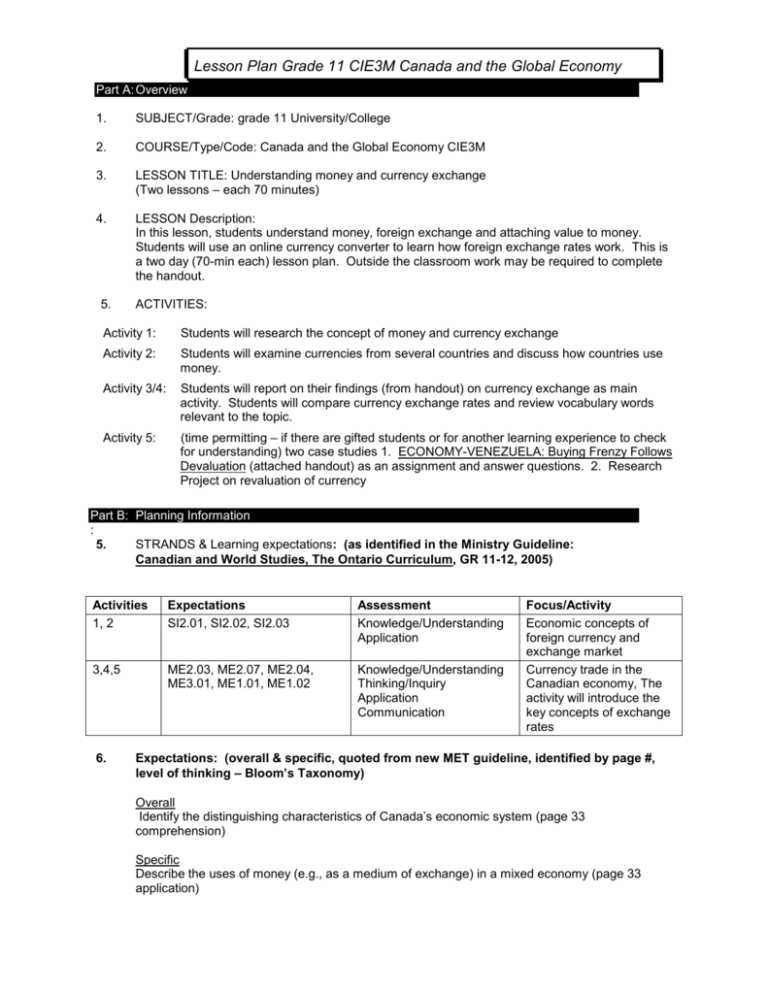

Lesson Plan Grade 11 CIE3M Canada and the Global Economy Part A: Overview 1. SUBJECT/Grade: grade 11 University/College 2. COURSE/Type/Code: Canada and the Global Economy CIE3M 3. LESSON TITLE: Understanding money and currency exchange (Two lessons – each 70 minutes) 4. LESSON Description: In this lesson, students understand money, foreign exchange and attaching value to money. Students will use an online currency converter to learn how foreign exchange rates work. This is a two day (70-min each) lesson plan. Outside the classroom work may be required to complete the handout. 5. ACTIVITIES: Activity 1: Students will research the concept of money and currency exchange Activity 2: Students will examine currencies from several countries and discuss how countries use money. Activity 3/4: Students will report on their findings (from handout) on currency exchange as main activity. Students will compare currency exchange rates and review vocabulary words relevant to the topic. Activity 5: (time permitting – if there are gifted students or for another learning experience to check for understanding) two case studies 1. ECONOMY-VENEZUELA: Buying Frenzy Follows Devaluation (attached handout) as an assignment and answer questions. 2. Research Project on revaluation of currency Part B: Planning Information : 5. STRANDS & Learning expectations: (as identified in the Ministry Guideline: Canadian and World Studies, The Ontario Curriculum, GR 11-12, 2005) Activities 1, 2 Expectations SI2.01, SI2.02, SI2.03 Assessment Knowledge/Understanding Application 3,4,5 ME2.03, ME2.07, ME2.04, ME3.01, ME1.01, ME1.02 Knowledge/Understanding Thinking/Inquiry Application Communication 6. Focus/Activity Economic concepts of foreign currency and exchange market Currency trade in the Canadian economy, The activity will introduce the key concepts of exchange rates Expectations: (overall & specific, quoted from new MET guideline, identified by page #, level of thinking – Bloom’s Taxonomy) Overall Identify the distinguishing characteristics of Canada’s economic system (page 33 comprehension) Specific Describe the uses of money (e.g., as a medium of exchange) in a mixed economy (page 33 application) 7. Prior Knowledge and Skills: 8. 9. Thexton, Made in Canada – Economics for Canadians Ch. 12 – Money and Banking (Textbook) The students should already be aware of the course expectations for each class. Students should be familiar with the Kagan booklet . Classroom Management routines already established Students are familiar with Co-operative learning strategies, norms, and skills. Students should use your knowledge of business and economics Resources: http://ipsnews.net/news.asp?idnews=49952 XE Universal Currency Converter http://www.newyorkfed.org/education/fx/foreign.html http://www.microsoft.com/education/currentcurrencies.aspx Class set of Text: Thexton, Made in Canada – Economics for Canadians, 2nd Edition http://www.econedlink.org/lessons/index.php?lesson=342&page=teacher http://www.crayola.com/lesson-plans/detail/international-currency-exchange-lesson-plan/ "XE Currency Table" The XE.com Currency Exchange Table provides exchange rate data for more than 75 currencies and precious metals, from 1995 to the present www.xe.com/ict/ Agenda: (to be listed on blackboard, in student language) 1. 2. 3. 4. 5. 6. Introduction: Activity #1: Activity #2: Activity #3: Activity #4: Activity #5 Understanding Money and the Current Currency exchange Foreign Currency Exchange Game Attaching value to Money discussion Vocabulary Words Review Worksheet Understanding currency exchange (Main Activity) (2) Case Studies: VENEZUELA: Buying Frenzy and Research Project **may not want to put activity #5 on the blackboard until later Part C: Teaching-Learning Sequence and Strategies: Note: See Appendix for Teacher H/Os Agenda (for teaching purposes only) summary of activities: Activity 1: Students will research the concept of money and currency exchange Activity 2: Students will examine currencies from several countries and discuss how countries use money. Activity 3/4: Students will report on their findings (from handout) on currency exchange as main activity. Students will compare currency exchange rates and review vocabulary words relevant to the topic. Activity 5: (time permitting – if there are gifted students or for another learning experience to check for understanding) two case studies Case Study #1. ECONOMY-VENEZUELA: Buying Frenzy Follows Devaluation (attached handout) as an assignment and answer questions. Case Study #2 – Research Project Have students research in depth one drastic or dramatic revaluation of currency in recent times and its affect on the economy of that particular society and the global economy. Examples include: inflation in Brazil Argentina, five revaluations of the Yugoslav dinar from 1990-1994, 2009 “surprise” revaluation of Korean currency, and others. They can study the nature, causes, methods as well as the effects of revaluation. 2 Stage 1 MENTAL SET / SHARING EXPECTATIONS (Introductory hook for lesson) / In June 1998, the U.S. stepped into the foreign currency market, using billions of U.S. dollars to buy Japanese yen in an attempt to stabilize its value. Mexico faced a currency crisis in 1994. Argentina faced such a crisis in 2002. Why should we care about currency values of other nations? How do currency values affect us in Canada, the demand for the products we produce, and the prices of the products we buy? ***In our culminating activity, we will use the currency exchange rate between two different countries to help determine which country to buy a product and specific brand (bananas, sugar, rice, coffee, or fish) using the currency exchange between Canada and the country we will be importing the product from as one of the factors in our decision criteria in our culminating activity. We must first learn about currency exchange and how it impacts our everyday lives and the products we use. Stage 2 INPUT Students will discuss the Foreign exchange market based on four questions: 1. 2. 3. 4. What is the Foreign Exchange Market: What Is It? Who are the Foreign Exchange Market Participants? When do we Use Foreign Exchange Rates? How are Foreign Exchange Rate Determined? The teacher should read allowed to the students or discuss parts of Stage 2 on an overhead or handout. 1. What is the Foreign Exchange Market: What Is It? To buy foreign goods or services, or to invest in other countries, companies and individuals may need to first buy the currency of the country with which they are doing business. Generally, exporters prefer to be paid in their country’s currency or in U.S. dollars, which are accepted all over the world. When Canadians buy oil from Saudi Arabia they may pay in U.S. dollars and not in Canadian dollars or Saudi riyals, even though the United States is not involved in the transaction. The foreign exchange market, or the "FX" market, is where the buying and selling of different currencies takes place. The price of one currency in terms of another is called an exchange rate. The market itself is actually a worldwide network of traders, connected by telephone lines and computer screens—there is no central headquarters. There are three main centers of trading, which handle the majority of all FX transactions—United Kingdom, United States, and Japan. Transactions in Singapore, Switzerland, Hong Kong, Germany, France and Australia account for most of the remaining transactions in the market. Trading goes on 24 hours a day: at 8 a.m. the exchange market is first opening in London, while the trading day is ending in Singapore and Hong Kong. At 1 p.m. in London, the New York market opens for business and later in the afternoon the traders in San Francisco can also conduct business. As the market closes in San Francisco, the Singapore and Hong Kong markets are starting their day. The FX market is fast paced, volatile and enormous—it is the largest market in the world. In 2001 on average, an estimated $1,210 billion was traded each day—roughly equivalent to every person in the world trading $195 each day. 3 2. Who are the Foreign Exchange Market Participants? There are four types of market participants—banks, brokers, customers, and central banks. Banks and other financial institutions are the biggest participants. They earn profits by buying and selling currencies from and to each other. Roughly two-thirds of all FX transactions involve banks dealing directly with each other. Brokers act as intermediaries between banks. Dealers call them to find out where they can get the best price for currencies. Such arrangements are beneficial since they afford anonymity to the buyer/seller. Brokers earn profit by charging a commission on the transactions they arrange. Customers, mainly large companies, require foreign currency in the course of doing business or making investments. Some even have their own trading desks if their requirements are large. Other types of customers are individuals who buy foreign exchange to travel abroad or make purchases in foreign countries. Central banks, which act on behalf of their governments, sometimes participate in the FX market to influence the value of their currencies. With more than $1.2 trillion changing hands every day, the activity of these participants affects the value of every dollar, pound, yen or euro. The participants in the FX market trade for a variety of reasons: To earn short-term profits from fluctuations in exchange rates, To protect themselves from loss due to changes in exchange rates, and To acquire the foreign currency necessary to buy goods and services from other countries. 4 3. When do we Use Foreign Exchange Rates? Most common contact with foreign exchange occurs when we travel or buy things in other countries. Suppose a U.S. tourist travelling in London wants to buy a sweater. Price tag is 100 pounds. Current exchange rate $1.45 to £1 $1.30 to £1 $1.60 to £1 Price of sweater in dollars 100 x 1.45 = $145.00 100 x 1.30 = $130.00 100 x 1.60 = $160.00 Pound falls Pound rises Thus, small changes in exchange rates may not seem significant. But when billions of dollars are traded, even a hundredth of a percentage point change in exchange rates becomes important. Stronger US dollar implies Weaker U.S. dollar implies 1. U.S. can buy foreign goods more cheaply è Cost of purchasing foreign goods falls 2. Foreigners find U.S. goods more expensive and demand falls è Does not help firms that produce for exports 1. Foreigners buy more U.S. goods è Helps firms that rely on exports 2. Foreign goods become more expensive è Demand for imports falls It would seem logical that if the dollar weakens, the trade balance will improve, as exports would rise. However, this does not always happen. U.S. trade balance usually worsens for a few months. The J–curve explains why the trade position does not improve soon after the weakening of a currency. Most import/export orders are taken months in advance. Immediately after a currency’s value drops, the volume of imports remains about the same, but the prices in terms of the home currency rise. On the other hand, the value of the domestic exports remains the same, and the difference in values worsens the trade balance until the imports and exports adjust to the new exchange rates. Exchange rates are an important consideration when making international investment decisions. The money invested overseas incurs an exchange rate risk. When an investor decides to "cash out," or bring his money home, any gains could be magnified or wiped out depending on the change in the exchange rates in the interim. Thus, changes in exchange rates can have many repercussions on an economy: Affects the prices of imported goods Affects the overall level of price and wage inflation Influences tourism patterns May influence consumers’ buying decisions and investors’ long-term commitments. 3. How are Foreign Exchange Rate Determined? Exchange rates respond directly to all sorts of events, both tangible and psychological— 5 Business cycles; Balance of payment statistics; Political developments; New tax laws; Stock market news; Inflationary expectations; International investment patterns; And government and central bank policies among others. At the heart of this complex market are the same forces of demand and supply that determine the prices of goods and services in any free market. If at any given rate, the demand for a currency is greater than its supply, its price will rise. If supply exceeds demand, the price will fall. The supply of a nation’s currency is influenced by that nation’s monetary authority, (usually its central bank), consistent with the amount of spending taking place in the economy. Government and central banks closely monitor economic activity to keep money supply at a level appropriate to achieve their economic goals. Too much money è inflation è value of money declines è prices rise Too little money è sluggish economic growth è rising unemployment Monetary authorities must decide whether economic conditions call for a larger or smaller increase in the money supply. Sources for currency demand on the FX market: The currency of a growing economy with relative price stability and a wide variety of competitive goods and services will be more in demand than that of a country in political turmoil, with high inflation and few marketable exports. Money will flow to wherever it can get the highest return with the least risk. If a nation’s financial instruments, such as stocks and bonds, offer relatively high rates of return at relatively low risk, foreigners will demand its currency to invest in them. FX traders speculate within the market about how different events will move the exchange rates. For example: News of political instability in other countries drives up demand for U.S. dollars as investors are looking for a "safe haven" for their money. A country’s interest rates rise and its currency appreciates as foreign investors seek higher returns than they can get in their own countries. Developing nations undertaking successful economic reforms may experience currency appreciation as foreign investors seek new opportunities. The students will get the following question? Why should we care about currency values of other nations? Discuss with class and move on to activity #1. 6 Stage 3 Modelling In this activity students will pick a country and related currency. They will learn the names of various currencies and will explore what the currency look and feel like and how they are used in the global market. They will discuss the most popular currencies traded. Students can discover that some countries call their money by the same name, but they have different values. Canada, Australia, the United States, the Bahamas, New Zealand, and Hong Kong, for example, all have dollars Activity #1 International Currency Exchange game Yen, Euro, Dollar, Peso, Pound, Rupee, Ruble, Baht, and Yuan - Explore the world of international exchange rates Supplies: paper and coin money from around the world (can use fake paper money – but should use real coins) Magnifying glass, world map and poster board, 1. Have students look at coins and paper money from Canada with a magnifying glass. What do they see? List everything they find 2. Examine coins and paper money from two more countries in the same way. Are there enough different currencies in the world that each student can choose different coins? 3. Notice that each country uses symbols, images, letters, and numbers that are familiar to that culture and language. Locate all three of your coin's and paper money countries on a world map. 4. Each country has its own coins and paper money. The relationship of one country's currency (money) to another's changes every day, based on the country's economy. If a country has a strong economy, the money it makes is worth more in relation to the currency of a country with a weak economy. 5. The comparative value of any two currencies is rarely one to one. Have students look up "currency exchange" on the Internet. Research the coins of the three different countries for which you have coins (have students bring in coins from home). 6. Have students compare findings with other students. Students can discover that some countries call their money by the same name, but they have different values. Canada, Australia, the United States, the Bahamas, New Zealand, and Hong Kong, for example, all have dollars. 7. On poster board, make a chart showing the day's exchange rate for each currency relative to Canadian’s currency. 8. Have students draw a large world map on poster board. Place the coins and paper money all of you made on their correct countries. Stage 4 Check for UNDERSTANDING Stage 3 INPUT Global Picture – Money, currency exchange Attaching Value to Money Game Activity #2 Definitions Vocabulary - Exchange rates Activity #3 This lesson is designed to have students begin to think about the global picture, introduce students to the topic of the foreign currency exchange market. Check for understanding on the currency match to country will be discussed. The teacher will check for understanding by using formative assessment practices including raising hands with answers, pair/share with partners and having an informal class discussion. Students will first be introduced to the foreign exchange market in Toronto as follows: 7 The foreign exchange market is a big one. The net daily turnover in Toronto is over $50 billion. That's a lot of money! The exchange rate can also affect inflation (see the causes of inflation section for more detail on cost-push inflation). In fact, it has even been used as a target for monetary policy for a while. From all this we can see the importance of the foreign exchange market, and as a class we will look in more detail at theories associated with the exchange rate. Exchange rates - what determines the rate at which the Canadian dollar exchanges for other currencies? Check for understanding with classroom responses. Sharing Expectations As we have discussed, we have learned a lot about the economy—whether domestic, national, international, and global. Economy is a system of interaction or exchange and money is essential to it as we have learned. How much do you know about the concept of money and how money works? For example, can you define "money"? [List students’ definitions on the board.] The word money refers to two different concepts: Money refers to a standard of value: it is that abstract unit of account that we use to compare the value of goods, services, and obligations. So, for example, a culture could use a cow or an ounce of gold as a standard of value. This object is worth three cows or two ounces of gold. Money refers to a medium of exchange: it refers to anything that is widely established as a means of payment, and is called .currency. For example, this object is worth three cows, and I’ll give you these hundred shells for it. There are different ways to set the standard of value and the medium of exchange in a society. Money Game Activity #2 – Attaching value to money. **This is a discussion to test for understanding from Activity #1 All cultures value money in different ways. [Show the students the image of "Money from Around the World" or another image of different currencies.] Money from Around the World Modelling: (Classroom Discussion only – with overhead) How many different kinds of money can you find in this picture? [List them on board or projector.] Every culture has its own understanding of value and the medium of exchange, or the currency it uses for transactions between people. What do these different currencies in this picture tell us about the cultures that created them? [Hold up a dollar bill.] How much is the paper on which this dollar is printed worth? Many countries today use paper money. Paper money has little inherent worth, so what gives paper money its value? Can the value of money change? In this activity we are going to try to answer these and other questions. You will research the concept and the history of money, examine currencies from several countries, and compare their current exchange rates. Activity #3: Definitions and Vocabulary words for currency exchange (as overhead and 8 handout) Now I would like to introduce words that will help us learn about exchange rate and currency Vocabulary Exchange rate: In finance, the exchange rate (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies specifies how much one currency is worth in terms of the other. For example an exchange rate of 123 Japanese yen (JPY, ¥) to the United States dollar (USD, $) means that JPY 123 is worth the same as USD 1. The foreign exchange market is one of the largest markets in the world. By some estimates, about 2 trillion USD worth of currency changes hands every day Currency A currency is a unit of exchange, facilitating the transfer of goods and/or services. It is one form of money, where money is anything that serves as a medium of exchange, a store of value, and a standard of value. A currency is the dominant medium of exchange. To facilitate trade between currency zones, there are exchange rates, which are the prices at which currencies (and the goods and services of individual currency zones) can be exchanged against each other. Currencies can be classified as either floating currencies or fixed currencies based on their exchange rate regime. In common usage, currency sometimes refers to only paper money, as in coins and currency, but this is misleading. Coins and paper money are both forms of currency. Foreign exchange market: The foreign exchange (currency or forex or FX) market exists wherever one currency is traded for another. It is by far the largest financial market in the world, and includes trading between large banks, central banks, currency speculators, multinational corporations, governments, and other financial markets and institutions. The average daily trade in the global forex and related markets currently is over US$ 3 trillion.[1] Retail traders (individuals) are a small fraction of this market and may only participate indirectly through brokers or banks, and are subject to forex scams. Stage 5 PRACTICE Activity #4: Understanding Money and Currency Exchange Assignment (Handout attached) Main activity for understanding money and currency exchange that should be introduced on Day 1, work on in class Day 2 and Day 3 if necessary and for homework Student Handout includes Step 1, "Explore the nature and history of money," Step 2, "Create your report," and Step 3, "Present your findings”. Activity #5: (Homework- handout and copy as overhead) ECONOMY-VENEZUELA: Buying Frenzy Follows Devaluation by Humberto Márquez • Questions 1. How will the devaluation of the Bolivar impact foreign businesses in Columbia; for example the Spanish company Telefonia? 2. How will the devaluation of the Bolivar impact local store owners in Columbia, businesses and consumers? 3. Consider the short-terms and long term implications for the future of Columbia on their economy and for the people? 4. What would you suggest for the government of Columbia? Stage 4 CLOSURE (any questions) Students will form an inside/outside circle (assumed: students know this Kagan structure) and teacher will pose review questions from various activities. The questions posed are directed at the knowledge/comprehension and interest level only in this closure activity. 9 Part D: i. Planning Considerations: Accommodations/Special Needs: During the “Exchange Rate” worksheet it may be necessary to form partnerships for so that students feels comfortable and no ELL or other students are left behind (refer to Unit Plan on Rationale for lessons) Additional accommodations can be made for the currency trading group activity so that identified learning disability or ELL students affected by such an assignment may complete it in other ways (i.e. in groups). Teachers should refer to exceptional students Individual Education Plans and work with special education teachers for specific information. Economics has a very specialized language; therefore the use of the vocabulary in Activity #3 in the lesson will assist most students in the course. Modifications can easily include extra time, providing scaffolding for performance expectations, the use of visuals, and oral interviews. There are also two additional assignments – Dramatic Devaluation of Currency and a research project on revaluation of currency at the end of the lesson for gifted students or if there is time permitting. ii. Lesson Assessment: will be formative throughout the lesson. Summative assessment will be completed at the end of the unit using the culminative activity rubrics and assessments outlined. Part E: Teacher Reflection on Lesson: I Aspects that worked: II Changes for next time: 10