Document

advertisement

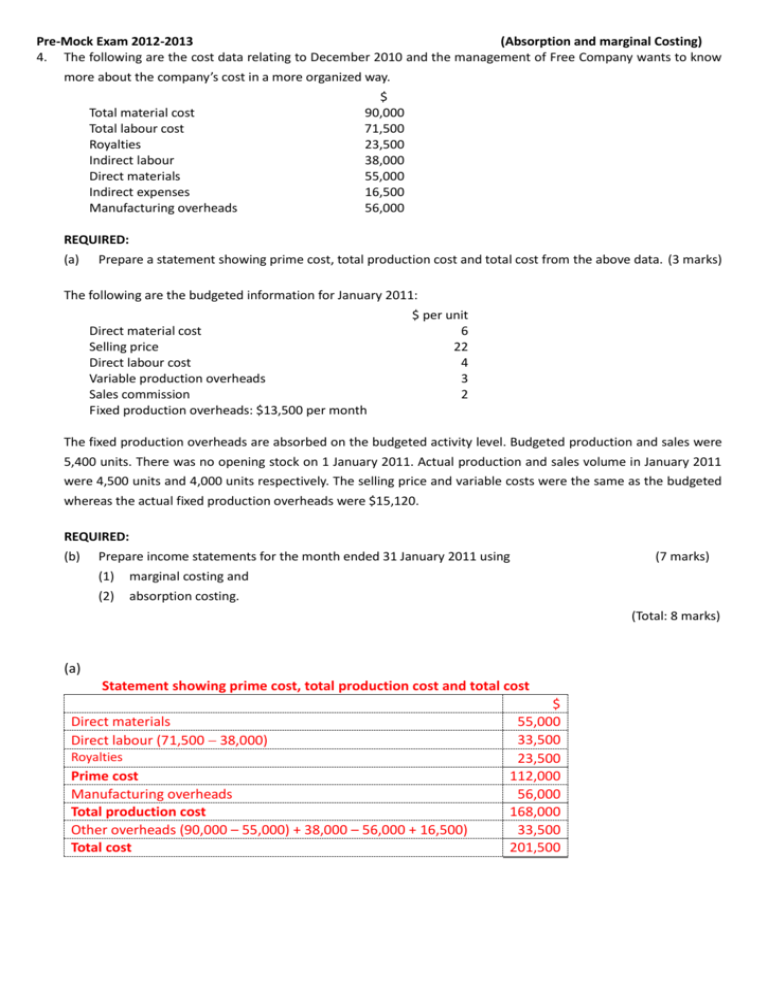

Pre-Mock Exam 2012-2013 (Absorption and marginal Costing) 4. The following are the cost data relating to December 2010 and the management of Free Company wants to know more about the company’s cost in a more organized way. Total material cost Total labour cost Royalties Indirect labour Direct materials Indirect expenses Manufacturing overheads $ 90,000 71,500 23,500 38,000 55,000 16,500 56,000 REQUIRED: (a) Prepare a statement showing prime cost, total production cost and total cost from the above data. (3 marks) The following are the budgeted information for January 2011: Direct material cost Selling price Direct labour cost Variable production overheads Sales commission Fixed production overheads: $13,500 per month $ per unit 6 22 4 3 2 The fixed production overheads are absorbed on the budgeted activity level. Budgeted production and sales were 5,400 units. There was no opening stock on 1 January 2011. Actual production and sales volume in January 2011 were 4,500 units and 4,000 units respectively. The selling price and variable costs were the same as the budgeted whereas the actual fixed production overheads were $15,120. REQUIRED: (b) Prepare income statements for the month ended 31 January 2011 using (1) marginal costing and (2) absorption costing. (7 marks) (Total: 8 marks) (a) Statement showing prime cost, total production cost and total cost Direct materials Direct labour (71,500 38,000) Royalties Prime cost Manufacturing overheads Total production cost Other overheads (90,000 – 55,000) + 38,000 – 56,000 + 16,500) Total cost $ 55,000 33,500 23,500 112,000 56,000 168,000 33,500 201,500 (b) (1) Free Company Income statement for the month ended 31 January 2011 $ Sales ($22 x 4,000) Less: Variable cost of goods sold Direct material cost ($6 x 4,500) Direct labour cost ($4 x 4,500) Variable production overheads ($3 x 4,500) Less: Closing inventory [58,500 / 4,500) x 500] Product contribution margin Less: Variable costs: Sales commission ($2 x 4,000) Contribution Less: Fixed production overheads Net profit 27,000 18,000 13,500 (6,500) $ 88,000 52,000 36,000 (8,000) 28,000 (15,120) 12,880 (b) (2) Free Company Income statement for the month ended 31 January 2011 $ Sales ($22 x 4,000) Less: Cost of goods sold Direct material cost ($6 x 4,500) Direct labour cost ($4 x 4,500) Variable production overheads ($3 x 4,500) Fixed production overheads [(13,500 / 5,400) x 4,500] Less: Closing inventory [(69,750 / 4,500) x 500] Gross profit Less: Under-absorption of fixed production overheads (15,120 – 11,250) Sales commission ($2 x 4,000) Net profit 27,000 18,000 13,500 11,250 (7,750) $ 88,000 62,000 26,000 (3,870) (8,000) 14,130 HKDSE (2012, 4) (Absorption and marginal Costing) Magic Company manufactures and sells a single product, Product X. For the purpose of preparing the budget for Product X for the month of November 2012, the following information is provided: (i) The budgeted production and budgeted sales for the month are 5000 and 4400 units respectively. (ii) The expected selling price is $300 per unit. (iii) The direct material cost of the production is $40 per unit. An additional transportation cost of $2 per unit is to be incurred for the purchase of the direct materials. (iv) Each unit of product requires 2 hours of direct labour. The hourly rate of direct labour is $60.5. (v) The production overheads of the product comprise a fixed and a variable element. It is the company’s policy to apportion variable production overheads in relation to the number of units produced. Assuming the monthly fixed production overheads of the company remain the same in 2012, the annual budgeted production overheads will be $1 159 000 if 58 000 units are produced each year, and $1 203 000 if 66 000 units are produced each year. (vi) Selling and distribution expenses consist of a sales commission of $8 per unit sold and a fixed monthly distribution expense of $50 000. REQUIRED: Magic Company adopts the marginal costing system. Assume it does not keep any inventories as at 31 October 2012, calculate the following for Product X for the month ended 30 November 2012: (a) the budgeted total value of closing inventories (b) the budgeted total amount of contribution (c) the budgeted total amount of net profit (a) Budgeted total value of closing inventories Direct materials cost per unit Transportation cost on direct materials per unit Direct labour cost per unit ($60.5 x 2) Variable production overheads per unit [($1 203 000 $1 159 000) / (66 000 – 58 000)] Total variable cost per unit Unit of closing inventories (5 000 – 4 400) (b) Budgeted total amount of contribution Sales price per unit Less Total variable cost per unit Sales commissions per unit Contribution per unit Number of unit sold (c) Budgeted total amount of net profit Total amount of contribution Less Fixed production overhead ($1 159 000 $5.5 x 58 000)/12 Fixed monthly distribution expense $ 40.0 2.0 121.0 5.5 168.5 600 101 100 $ 300 168.5 8 123.5 4 400 543 400 $ 543 400 70 000 50 000 423 400 (HKALE 2007, Paper 2, 2) (Cost classification, Absorption and marginal Costing) Starry Ltd had the following information for preparing the 2007 master budget for Product X. Selling price Direct material Direct labour $160 per unit 0.5 kg per unit at $48 per kg 5 hours per unit at $15 per hour In the production process, only the following three types of factory overheads are incurred, each of which demonstrating a different cost behavior. The maximum production capacity was 30,000 units. Information relating to factory overheads at different levels of production was shown as follows: Level of production (units) Factory overheads – Type 1 Type 2 Type 3 15,000 $ 180,000 240,000 355,000 775,000 18,000 $ 180,000 240,000 400,000 820,000 21,000 $ (i) 240,000 445,000 ? 24,000 $ 180,000 300,000 (iii) ? 27,000 $ 180,000 (ii) 535,000 ? 30,000 $ 180,000 300,000 580,000 1,060,000 You are required to: (a) Find the missing figures (i) and (iii) in the table above. (b) Based on your answer to (a), identify and describe the cost behavior for each of the three types of factory overheads. (c) Calculate the contribution per unit of Product X and the total budgeted gross profit for year 2007 at the level of maximum capacity. (a) (i) $180,000 (ii) $300,000 (iii) $490,000 Variable cost per unit = ($580,000 – $535,000) / (30,000 – 27,000) = $15 Fixed cost element (15,000 level) = $355,000 – 15,000 x $15 = $130,000 Total cost (24,000 level) = $130,000 + 24,000 x $15 = $490,000 (b) Type 1 is fixed cost which does not change regardless of the level of production Type 2 is semi-fixed cost which does not change within a range of activity Type 3 is semi-variable cost. It consists of fixed and variable elements. The variable cost changes in direct proportion with the level of production. (c) Contribution per unit of Product X $ Selling price Variable costs Direct material (0.5 x $48) Direct labour (5 x $15) Factory overheads (from (a)(iii)) Contribution per unit 24 75 15 $ 160 114 46 Total budgeted gross profit Total contribution (30,000 x $46) Fixed factory overhead ($180,000 + $300,000 + $130,000) Budgeted gross profit $ 1,380,000 610,000 770,000 HKDSE Sample 2 (Paper 2A, 2) (Absorption and marginal Costing) Perry Ltd started producing Product A on 1 January 2012. The unit selling price and cost of Product A for the month of January 2012 were as follows: Selling price Direct material Direct labour Variable production overheads Variable selling and administrative expenses (i) ($/unit) 5.90 1.20 1.40 0.70 0.15 Fixed production overheads were budgeted at $308,000 per month and were absorbed based on the number of units produced. Actual fixed production overheads of Product A were the same as the absorbed fixed production overheads for the month. (ii) Budgeted production and budgeted sales were the same at 280,000 units per month. (iii) Actual production and actual sales of Product A for the month were 250,000 units and 220,000 units respectively. (iv) Actual fixed selling and administrative expenses were $110,000. (v) There were no closing direct materials and work-in-progress inventories of Product A as at 31 January 2012. REQUIRED: (a) Prepare the income statement for the month ended 31 January 2012 using absorption costing. (b) As compared with the absorption costing system, advise Perry Ltd two advantages of using the marginal costing system. (a) Perry Ltd Income Statement for the year ended 31 January 2012 using absorption costing $ Sales (220,000 $5.90) Less: Cost of goods sold: Direct materials (250,000 × $1.20) 300,000 Direct labour (250,000 × $1.40) 350,000 Variable production overheads (250,000 × $0.70) 175,000 Fixed production overheads absorbed (250,000 × $1.1) 275,000 1,100,000 Less: Closing inventory [(250,000 220,000) x $4.4] 132,000 Gross profit Less: Variable selling and administrative expenses (220,000 x $0.15) 33,000 Fixed selling and administrative expenses 110,000 Net profit $ 1,298,000 968,000 330,000 143,000 187,000 Unit fixed production overheads absorbed = $308,000 280,000 = $1.1 Unit production costs under absorption costing = ($1.20 + $1.40 + $0.70 + $1.1) or ($1,100,000 250,000) = $4.4 (b) Advantages: — inventory valuations will not be distorted by the changes in current year’s fixed costs — enables the company to concentrate on its controllable aspects by separating its fixed and variable costs — helps management to make production and sales decisions with the calculated marginal costs information HKDSE Sample 1 (Paper 2A, 9) (Absorption and marginal Costing) Mary is a fresh university graduate who has majored in marketing. She is enthusiastic about conducting a business of her own alongside her full-time employment. She borrowed a sum of $90,000 from a bank at an interest rate of 5% per annum on 1 January 20X7 to run a shop which sells free-sized T-shirts of her own design. Information relating to the shop is as follows: (i) The shop’s rental is $5,000 per month. The annual rates and insurance expenses are $3,600 and $4,500 respectively. (ii) A shop attendant is hired at a basic salary of $7,000 per month plus a commission of 5% of the sales value. (iii) All T-shirts are imported from factories based on the Mainland and are sold at 100% mark-up on cost. (iv) The budgeted sales volume is 500 shirts per month. Mary has made arrangements with the Mainland suppliers for the supply of 500 shirts each month. Then a logo sticker will be fixed on each shirt by a sewing service provider nearby at the cost of $2 each. The purchase costs for the first quarter of 20X7 are as follows: $ 22,500 24,000 25,000 January 20X7 February 20X7 March 20X7 (v) In order to publicise her new brand, Mary will print some promotional leaflets to be distributed once a week in the neighborhood. The printing cost of the leaflets amounts to $500 per month and a part-time worker is hired at $1,000 per month for the distribution work. (vi) A point-of-sale system costing $30,000 was purchased to help keep inventory record and cash transactions. In addition, Mary furnished the shop with necessary furniture and fixtures by spending a further $60,000. Depreciation is to be calculated at 12% per annum on a reducing balance basis for the point-of-sale system and 10% on cost for the furniture and fixtures. (vii) The actual sales figures for the first quarter ended 31 March 20X7 are as follows: January 20X7 February 20X7 March 20X7 Number of shirts 350 420 400 REQUIRED: (a) Define direct costs and indirect costs and identify one example for each from the case above. (b) Compare marginal costing with absorption costing with respect to inventory valuation and income determination. (c) Prepare an income statement for the first quarter ended 31 March 20X7 using the marginal costing method, assuming the FIFO method is adopted in the valuation of unsold goods. (d) With the figures you have compiled in (c) above, calculate the breakeven point (in sales dollars) of the first quarter ended 31 March 20X7. Noting that there are several giant enterprises in the low-margin garment market, Mary’s father has always persuaded Mary to discontinue her small business which is unlikely to be competitive enough to survive. REQUIRED: (e) Discuss two possible reasons why Mary is still enthusiastic about running a business of her own. (a) Direct costs – costs that would be economical to trace their cost object e.g. purchase cost, cost of stickers, sales commission Indirect costs – costs that would not be economical to trace their cost object e.g. printing cost, salaries, rent and rates, insurance, depreciation (b) Inventory — Marginal costing Only variable costs are charged to units. — valuation Absorption costing Fixed costs are treated as product costs and can be carried forward to the next period in the value of each unit. Income determination — Fixed costs incurred will not be carried — A proportion of the fixed costs of the forward and the profit of the current current period will be carried forward to accounting period will be lower. the next accounting period and therefore the profit of the current accounting period will be higher. (c) Income statement for the first quarter ended 31 March 20X6 $ Sales [($22,500 + $24,000 + 170 x $50) x 200%] Opening inventories Purchases ($22,500 + $24,000 + $25,000) Logo stickers (1,500 x $2) Less Closing inventories [(500 – 170) x ($50 + $2)] Product contribution margin Less Variable costs: Commission ($110,000 x 5%) Contribution Less: Fixed costs Rent and rates ($5,000 x 3 + $3,600 x 3/12) Insurance ($4,500 x 3/12) Salaries ($7,000 x 3 + $1,000 x 3) Printing costs ($500 x 3) Depreciation [$30,000 x 12% x 3/12 + $60,000 x 10% x 3/12] Net profit (d) Total fixed costs = $44,925 Contribution margin ratio = $47,160 $110,000 Breakeven sales dollars = Fixed cost Contribution margin ratio = $44,925 / ($47,160 $110,000) = $104,787 — 71,500 3,000 (17,160) 15,900 1,125 24,000 1,500 2,400 $ 110,000 57,340 52,660 5,500 47,160 44,925 2,235 Longman Mock (2011, 8) (Absorption and marginal Costing) 8 Genius Ltd makes a single product. The production and sales information for the year ended 31 December 2012 is as follows: Production (units) Sales (units) Opening inventory (units) Selling price per unit Direct materials cost per unit Direct labour hours per unit Direct labour cost per hour Variable factory overheads per unit Variable distribution overheads per unit Fixed factory overheads Fixed administrative and distribution overheads 350,000 395,000 55,000 $130 $40 3 hours $15 $11.8 $14.5 $1,750,000 $5,485,600 The production volume and fixed factory overheads were the same in 2011 and 2012. Required: (a) Calculate the unit production costs for the year ended 31 December 2012 under absorption costing and marginal costing. (3.5 marks) (b) Calculate, under both absorption costing and margin costing, the following: (i) Manufacturing cost of goods completed (ii) Cost of goods sold (iii) Closing inventory (7 marks) (c) Prepare income statements for the year ended 31 December 2012 under both absorption costing and margin costing. (5 marks) (d) Reconcile the difference in net profit between the two costing approaches. (1.5 marks) (e) State the effects on the net profit calculated under absorption costing and marginal costing if: (i) the sales volume exceeds the production volume; (ii) the production volume exceeds the sales volume; and (iii) the sales volume equals the production volume. (3 marks) (Total: 20 marks) (a) Direct materials Direct labour (3 $15) Variable factory overheads Fixed factory overheads ($1,750,000 350,000) Unit production costs (b) (i) Absorption costing $ 40 45 11.8 5 101.8 Marginal costing $ 40 45 11.8 — 96.8 Manufacturing cost of goods completed under absorption costing = 350,000 101.8 = $35,630,000 Manufacturing cost of goods completed under marginal costing = 350,000 96.8 = $33,880,000 (ii) Cost of goods sold under absorption costing = 395,000 101.8 = $40,211,000 Cost of goods sold under marginal costing = 395,000 96.8 = $38,236,000 (iii) Opening inventory (W1) Add Manufacturing cost of goods completed Cost of goods available for sale Less Cost of goods sold Closing inventory Absorption costing $ 5,599,000 35,630,000 41,229,000 (40,211,000) 1,018,000 Marginal costing $ 5,324,000 33,880,000 39,204,000 (38,236,000) 968,000 W1 Opening inventory under absorption costing = 55,000 101.8 = $5,599,000 Opening inventory under marginal costing = 55,000 96.8 = $5,324,000 (c) Under absorption costing: Genius Ltd Income Statement for the year ended 31 December 2012 $ Sales (395,000 $130) Less Cost of goods sold: Opening inventory Add Manufacturing cost of goods completed Cost of goods available for sale Less Closing inventory Gross profit Less Variable distribution overheads (395,000 $14.5) Fixed administrative and distribution overheads Net loss 5,599,000 35,630,000 41,229,000 (1,018,000) 5,727,500 5,485,600 $ 51,350,000 (40,211,000) 11,139,000 (11,213,100) (74,100) Under marginal costing: Genius Ltd Income Statement for the year ended 31 December 2012 $ Sales Less Variable cost of goods sold: Opening inventory Add Manufacturing cost of goods completed Variable cost of goods available for sale Less Closing inventory Product contribution margin Less Variable distribution overheads Contribution margin Less Fixed factory overheads Fixed administrative and distribution overheads Net profit 5,324,000 33,880,000 39,204,000 (968,000) 1,750,000 5,485,600 $ 51,350,000 (38,236,000) 13,114,000 (5,727,500) 7,386,500 (7,235,600) 150,900 (d) Difference in net profit = Net profit under absorption costing Net profit under marginal costing = $74,100 $150,900 = $225,000 (profit is lower under absorption costing) Difference in net profit = Fixed factory overheads included in closing inventory under absorption costing Fixed factory overheads included in opening inventory under absorption costing = (10,000 $5) (55,000 $5) = $225,000 (e) (i) When the sales volume exceeds the production volume, a higher net profit figure will be reported under marginal costing than under absorption costing. (ii) When the production volume exceeds the sales volume, a higher net profit figure will be reported under absorption costing than under marginal costing. (iii) When the sales volume equals the production volume, the net profit figure reported will be the same under both marginal costing and absorption costing. HKET Mock (2011, 8) (Absorption and marginal Costing) 8. Mr. Chan just opened a shop to sell mobile phones, and at the back of the shop there is a small factory to produce the products. He purchases electronic components from suppliers and then assembles as a mobile phone for sale. In order to start the business, he borrowed $100,000 from the bank at a nominal interest rate 4% compounded monthly on 1 January 20X1. Interest expense is paid quarterly. Information related to the shop is as follow: (i) The rent of the shop is $8,000 per month. Electricity and water expenses are $250 per month. And there is an annual property management fee for the building of $5,000. (ii) Mr. Chan owns this company and acts as a director. His director remuneration fee is $6,000 each month. He hires a technician to assemble the mobile phones, and the salary is $8,000 each month. (iii) Mr. Chan bought a computer that costs $5,000 for keeping records and an equipment that costs $3,600 for the technician to assemble the electrical components and make them into mobile phones. No salvage values are expected for these assets. Asset values will be totally depreciated in 5 years with straight-line method. (iv) Each month Mr. Chan purchased electronic components from suppliers. The costs are as follow: Jan 20X1: $5,800 Feb 20X1: $6,700 Mar 20X1: $8,200 (v) The sales figures for the first quarter ended 31 March 20X1 are as follows: Jan 20X1: $250,000 Feb 20X1: $230,000 Mar 20X1: $280,000 (vi) Mr. Chan classifies half of the rental payment of the shop, and 80% of the electricity and water expenses as manufacturing costs. (vii) For the first quarter of 20X1, the number of mobile phones produced: the number of mobile phones sold: REQUIRED: 350 304 (a) Identify TWO direct costs and TWO indirect costs from the case above. (b) Prepare separated income statements for the first quarter ended 31 March 20X1 using marginal costing method and absorption costing method respectively. (c) State ONE advantage of marginal costing method over absorption costing method. (d) Could Mr. Chan choose the method of costing by himself? Explain. (e) Mr. Chan would like to boost the net profit by extending the useful life of assets in the next quarter’s income statement. Is this acceptable in accounting principles and in ethics? (a) Direct costs: Direct materials – electronic components Direct labour – technician’s salaries Indirect costs: 80% of the monthly electricity and water expenses for manufacturing use 50% of the monthly rental expenses for manufacturing use Depreciation for equipment The following items are not related to manufacturing costs: 20% of the monthly electricity and water expenses not for manufacturing use 50% of the monthly rental income not for manufacturing use Depreciation for computer Loan interest expenses Director remuneration fee (b) Income Statement for the first quarter ended 31 March 20X1 using absorption costing $ $ Sales ($250,000 + $230,000 + $280,000) 760,000 Less: Cost of goods sold: Direct materials ($5,800 + $6,700 + $8,200) 20,700 Direct labour (3 × $8,000) 24,000 Manufacturing overhead cost Electricity and water expenses ($250 x 3 x 80%) 600 Rental expenses for manufacturing ($8,000 × 3 x 0.5) 12,000 Depreciation for equipment [$3,600 ÷ 5) / 4] 180 57,480 Less: Closing inventory [(350 304) x ($57,480 / 350)] 7,555 49,925 Gross profit 710,075 Less: Non-manufacturing overhead cost Electricity and water expenses ($250 x 3 x 20%) 150 Rental expenses for non-manufacturing ($8,000 × 3 x 0.5) 12,000 Depreciation for computer [$5,000 ÷ 5) / 4] 250 Loan interest [$100,000 x (1 + 4%/12)3 $100,000] 1,003 Management fee ($5,000 / 4) 1,250 Director remuneration fee ($6,000 x 3) 18,000 32,653 Net profit 677,422 Income Statement for the first quarter ended 31 March 20X1 using marginal costing $ $ Sales ($250,000 + $230,000 + $280,000) Less: Variable cost of goods sold: Direct materials ($5,800 + $6,700 + $8,200) 20,700 Direct labour (3 × $8,000) 24,000 Less: Closing inventory [(350 304) x ($44,700 / 350)] Contribution Less: Fixed manufacturing cost Electricity and water expenses ($250 x 3 x 80%) Rental expenses for manufacturing ($8,000 × 3 x 0.5) Depreciation for equipment [$3,600 ÷ 5) / 4] Fixed non-manufacturing cost Electricity and water expenses ($250 x 3 x 20%) Rental expenses for non-manufacturing ($8,000 × 3 x 0.5) Depreciation for computer [$5,000 ÷ 5) / 4] Loan interest [$100,000 x (1 + 4%/12)3 $100,000] Management fee ($5,000 / 4) Director remuneration fee ($6,000 x 3) Net profit 44,700 5,875 600 12,000 180 12,780 150 12,000 250 1,003 1,250 18,000 32,653 $ 760,000 38,825 721,175 45,433 675,742 (c) Fixed costs are sunk costs. They should not be considered when managers are going to make decisions. Any other reasonable answers. (d) Mr. Chan could choose either marginal costing or absorption costing. However, marginal costing is not acceptable if Mr. Chan is going to publish the financial statement to the public. (e) It is not acceptable for a professional accounting treatment. We have to keep consistency principle on preparing financial statements. Changing rules frequently will dampen the reliability of the financial information. Second, professional accountants should follow the Code of Ethics of being honest, straight forward and keeping objectivity. If the reason for extending the depreciation period is to boost up net profit, it is not an honest act. The integrity of the professional accountant will be in doubt. HKDSE Sample 1 (Paper 2A, 3) (Absorption and marginal costing) Lau Yan Manufacturing Company has extracted the following information as at 31 December 20X6 Inventories as at 1 January 20X6: Raw materials Work in progress Finished goods Royalties (based on the number of units produced) Depreciation charge for the year: Plant and machinery Delivery vehicles Office equipment Direct labour Purchase of raw materials Factory manager’s salary Rent and electricity Administrative and selling expenses Materials loss due to fire $ 40,800 35,000 180,000 89,000 90,200 897,560 65,377 60,800 170,000 57,000 112,500 87,300 50,000 Additional information: (i) At 31 December 20X6, inventories were valued as follows: $ Raw materials 77,000 Work in progress 52,000 Finished goods 175,000 (ii) It is the company’s policy to apportion two-thirds of the costs common to both the factory and the office to the cost of production. (iii) Finished goods are transferred to the sales department at cost plus 10%. REQUIRED: (a) Prepare the manufacturing account for the year ended 31 December 20X6 (b) Ascertain each of the following for the year ended 31 December 20X6 (i) Cost of raw materials consumed (ii) Prime cost (iii) Production cost of finished goods (iv) Transfer price of finished goods Answer: (a) Cost of raw materials consumed = $40,800 + $170,000 – ($77,000 + $50,000) = $83,800 (b) Prime cost = $83,800 + $89,000 + $60,800 = $233,600 (c) Production cost of finished goods = $233,600 + ($112,500 x 2/3 + $90,200 + $57,000) + $35,000 – $52,000 = $438,800 (d) Transfer price of finished goods = $438,800 x (1 + 10%) = $482,680 Answer: Lau Yan Manufacturing Company Manufacturing Account for the year ended 31 December 20X6 $ Opening inventory of raw materials Add: Purchases Less: Fire Loss Less Closing inventory of raw materials Cost of raw materials consumed Direct labour Royalties Prime cost Factory overheads: Rent and electricity ($112,500 x 2/3) Depreciation of Plant and machinery Factory manager’s salary Add Opening work-in-progress Less Closing work-in-progress Production cost of finished goods Mark up (10%) Transfer price of finished goods (a) Cost of raw materials consumed: $83,800 (b) Prime cost: $233,600 (c) Production cost of finished goods: $438,800 (d) Transfer price of finished goods: $482,680 75,000 90,200 57,000 $ 40,800 170,000 210,800 50,000 160,800 77,000 83,800 60,800 89,000 233,600 222,200 455,800 35,000 490,800 52,000 438,800 43,880 482,680 HKDSE Sample 1 (Paper 2A, 9) (Absorption and marginal costing) Mary is a fresh university graduate who has majored in marketing. She is enthusiastic about conducting a business of her own alongside her full-time employment. She borrowed a sum of $90,000 from a bank at an interest rate of 5% per annum on 1 January 20X7 to run a shop which sells free-sized T-shirts of her own design. Information relating to the shop is as follows: (i) The shop’s rental is $5,000 per month. The annual rates and insurance expenses are $3,600 and $4,500 respectively. (ii) A shop attendant is hired at a basic salary of $7,000 per month plus a commission of 5% of the sales value. (iii) All T-shirts are imported from factories based on the Mainland and are sold at 100% mark-up on cost. (iv) The budgeted sales volume is 500 shirts per month. Mary has made arrangements with the Mainland suppliers for the supply of 500 shirts each month. Then a logo sticker will be fixed on each shirt by a sewing service provider nearby at the cost of $2 each. The purchase costs for the first quarter of 20X7 are as follows: $ 22,500 24,000 25,000 January 20X7 February 20X7 March 20X7 (v) In order to publicise her new brand, Mary will print some promotional leaflets to be distributed once a week in the neighborhood. The printing cost of the leaflets amounts to $500 per month and a part-time worker is hired at $1,000 per month for the distribution work. (vi) A point-of-sale system costing $30,000 was purchased to help keep inventory record and cash transactions. In addition, Mary furnished the shop with necessary furniture and fixtures by spending a further $60,000. Depreciation is to be calculated at 12% per annum on a reducing balance basis for the point-of-sale system and 10% on cost for the furniture and fixtures. (vii) The actual sales figures for the first quarter ended 31 March 20X7 are as follows: January 20X7 February 20X7 March 20X7 Number of shirts 350 420 400 REQUIRED: (a) Define direct costs and indirect costs and identify one example for each from the case above. (b) Compare marginal costing with absorption costing with respect to inventory valuation and income determination. (c) Prepare an income statement for the first quarter ended 31 March 20X7 using the marginal costing method, assuming the FIFO method is adopted in the valuation of unsold goods. (d) With the figures you have compiled in (c) above, calculate the breakeven point (in sales dollars) of the first quarter ended 31 March 20X7. Noting that there are several giant enterprises in the low-margin garment market, Mary’s father has always persuaded Mary to discontinue her small business which is unlikely to be competitive enough to survive. REQUIRED: (e) Discuss two possible reasons why Mary is still enthusiastic about running a business of her own. (a) Direct costs – costs that would be economical to trace their cost object e.g. purchase cost, cost of stickers, sales commission Indirect costs – costs that would not be economical to trace their cost object e.g. printing cost, salaries, rent and rates, insurance, depreciation (b) Inventory — Marginal costing Only variable costs are charged to units. — valuation Absorption costing Fixed costs are treated as product costs and can be carried forward to the next period in the value of each unit. Income determination — Fixed costs incurred will not be carried — A proportion of the fixed costs of the forward and the profit of the current current period will be carried forward to accounting period will be lower. the next accounting period and therefore the profit of the current accounting period will be higher. (c) Income statement for the first quarter ended 31 March 20X6 $ Sales [($22,500 + $24,000 + 170 x $50) x 200%] Opening inventories Purchases ($22,500 + $24,000 + $25,000) Logo stickers (1,500 x $2) Less Closing inventories [(500 – 170) x ($50 + $2)] Product contribution margin Less Variable costs: Commission ($110,000 x 5%) Contribution Less: Fixed costs Rent and rates ($5,000 x 3 + $3,600 x 3/12) Insurance ($4,500 x 3/12) Salaries ($7,000 x 3 + $1,000 x 3) Printing costs ($500 x 3) Depreciation [$30,000 x 12% x 3/12 + $60,000 x 10% x 3/12] Net profit (d) Total fixed costs = $44,925 Contribution margin ratio = $47,160 $110,000 Breakeven sales dollars = Fixed cost Contribution margin ratio = $44,925 / ($47,160 $110,000) = $104,787 — 71,500 3,000 (17,160) 15,900 1,125 24,000 1,500 2,400 $ 110,000 57,340 52,660 5,500 47,160 44,925 2,235 AAT 2011 (Pilot Paper 2, 5) (Absorption and marginal costing) 5. i-M Limited has provided the following data concerning last month’s manufacturing operations. Purchases of raw materials $53,000 Indirect materials used in manufacturing $8,000 Direct labour ($25 per hour) $62,000 Manufacturing overhead incurred (excluded indirect materials) $32,000 Inventories: Beginning $ 24,000 41,000 86,000 Raw materials Work in process Finished goods Ending $ 6,000 38,000 93,000 Annual budgeted manufacturing overhead is $360,000 which is based on 30,000 budgeted direct labour hours. REQUIRED: (a) Prepare a Schedule of Cost of Goods Manufactured for last month. (b) Prepare a Schedule of Cost of Goods Sold for last month. (c) What is the purpose of the job cost sheet in a job costing? 5 (a) i-M Limited Schedule of Cost of Goods Manufactured Opening inventory of raw materials Add: Purchases of raw materials Total raw materials available Less: Closing inventory of raw materials Direct manufacturing costs Less Indirect materials included in actual manufacturing overhead Direct labour Prime cost Manufacturing overhead absorbed ($360,000/30,000 x $62,000/25) Add: Work in process inventory, beginning $ 24,000 53,000 77,000 6,000 71,000 8,000 Indirect manufacturing costs including indirect materials Less: Work in process inventory, ending Manufacturing cost of goods completed $ 63,000 62,000 125,000 29,760 154,760 41,000 195,760 38,000 157,760 (b) i-M Limited Schedule of Cost of Goods Sold Finished goods inventory, beginning Add: Manufacturing cost of goods completed Goods available for sale Less: Finished goods inventory, ending excluding indirect materials Add: Under-absorbed manufacturing overhead [($32,000$8,000)$29,760] Cost of goods sold $ 86,000 157,760 243,760 93,000 150,760 10,240 161,000 (c) — The job cost sheet is used to record all costs that are assigned to a particular job. These costs include direct materials and direct labour costs traced to the job and manufacturing overhead cost applied to the job. — When a job is completed, the job cost sheet is used to compute the unit product cost. — The job cost sheet is also a control document for determining (1) how many units have been sold and the cost of these units and (2) how many units are still in inventory at the end of a period and the cost of these units on the statement of financial position. (HKALE 2008 P2 4) (Absorption and marginal costing) Sun Ltd commenced the production of Product X in March 2008. It has the following information relating to March 2008: Sales Raw material Direct labour Production overheads Budgeted at 50,000 units $ 1,500,000 400,000 500,000 380,000 Budgeted at 80,000 units $ 2,400,000 640,000 800,000 518,000 REQUIRED: (a) Using the marginal costing approach, prepare for Sun Ltd an income statement of 70,000 units. (b) Explain two advantages of using absorption costing approach for stock valuation. (a) Trading account for the month ended 31 March 2008 (flexed at 70,000 units) Sales ($30 70,000) Raw material (70,000 x $8) Labour (70,000 x $10) Variable production overhead (70,000 x $4.6) Contribution Fixed production overheads Profit $ 2,100,000 560,000 700,000 322,000 518,000 150,000 368,000 Selling price per unit = $1,500,000 / 50,000 = $2,400,000 / 80,000 = $30 Raw material per unit = $640,000 / 80,000 = $400,000 / 50,000 = $8 Labour per unit = $800,000 / 80,000 = $500,000 / 50,000 = $10 Variable production overhead per unit = ($518,000 $380,000) / (80,000 – 50,000) = $4.6 Fixed production overhead = $380,000 – 50,000 x $4.6 = $150,000 (b) — Including both fixed and variable manufacturing costs in inventory valuation can better reflect the costs incurred to produce goods. — Distinguishing between manufacturing and non- manufacturing costs is easier than distinguishing between fixed and variable costs. HKCEE (2007, 6) (Absorption and marginal costing) Ernest and Fred are in partnership sharing profit and losses in the ratio of 3:2 respectively. The following balances were extracted from the books as at 31 March 2007: Machinery, at cost Office equipment, at cost Accumulated depreciation, 1 April 2006 Machinery Office equipment Stock, 1 April 2006 Raw materials Work in progress Finished goods Sales Trade debtors Trade creditors Carriage inwards Returns inwards Wages and salaries Purchases of raw materials Administrative expenses Selling expenses Provision for doubtful debts, 1 April 2006 Cash at bank Capital accounts, 1 April 2006 Ernest Fred Current accounts, 1 April 2006 Ernest Fred Drawings Ernest Fred 8% loan – Fred (borrowed on 1 October 2006) Interest on 8% loan Repairs to machinery Rent and rates (factory 1/4; office 3/4) Carriage outwards $ 751,500 502,800 333,160 254,800 81,100 46,610 163,750 2,741,200 136,400 196,670 19,020 26,120 675,240 1,005,600 120,930 92,690 3,760 72,540 180,000 150,000 20,000 30,000 (Dr) 15,000 12,000 150,000 3,330 5,320 275,800 13,840 Additional information: (i) Stock as at 31 March 2007: Raw materials Work in progress Finished goods $ 67,490 52,140 170,300 A damaged and worthless item with a cost of $280 was included in the finished goods. (ii) Depreciation is to be charged as follows: Machinery – 20% per annum on a straight-lines basis Office equipment – 10% per annum on a reducing-balance basis (iii) Interest on partners’ capital is to be calculated at 5% per annum. (iv) Cash purchases of raw materials for the partnership at a cost of $5,200 had been recorded as Ernest’s drawings. (v) No entries had been made in respect of a cash sale of $1,000, of which the proceeds were retained by Fred. (vi) The following adjustments were to be made on 31 March 2007: $ Accrued rent and rates 4,200 Prepaid wages to direct labour 2,500 Bonus to Fred 50,000 Provision for doubtful debts was to be maintained at 5% of trade debtors. (vii) Analysis of the wages and salaries revealed: Direct labour Indirect labour Factory supervisor Office staff Salaries to Ernest Salaries to Fred $ 200,000 80,040 72,000 143,200 80,000 100,000 675,240 (viii) A sale of office equipment on credit for $30,000 on 31 March 2007 had not yet been recorded. The office equipment had a cost of $84,000 and an accumulated depreciation of $56,000 at 1 April 2006. You are required to: Prepare the following accounts of the partnership for the year ended 31 March 2007: (a) the manufacturing account, showing clearly the cost of raw materials consumed, the prime cost and the production cost of finished goods; (a) Ernest and Fred Manufacturing account for the year ended 31 March 2007 $ Opening stock Add: Purchases ($1,005,600 + $5,200) Carriage inwards Less Closing stock Raw materials consumed Direct labour ($200,000 – $2,500) Prime cost Factory overheads Indirect labour Salaries to factory supervisor Repairs to machinery Rent and rates [($275,800 + $4,200) x 1/4] Depreciation – machinery ($751,500 x 20%) Add Opening work-in-progress Less Closing work-in-progress Production cost of finished goods 1,010,800 19,020 80,040 72,000 5,320 70,000 150,300 $ 81,100 1,029,820 1,110,920 67,490 1,043,430 197,500 1,240,930 377,660 1,618,590 46,610 1,665,200 52,140 1,613,060 (HKALE 2005, Paper 2, 2) (Absorption and marginal Costing) Yellow Stone Manufacturing Ltd commenced business in 2004 producing cleaning liquid Product X. Each bottle of Product X contains 1 litre of raw materials. The production budget for the year ended 31 December 2004 on the basis of 100,000 bottles is shown below: $ Raw materials ($10 per litre) 1,000,000 Direct labour ($2 per labour hour) 800,000 200,000 Factory overheads fixed Other budget information: Selling and distribution expenses: Fixed Variable Administrative expensesfixed Selling price Sales volume $150,000 $1 per bottle $400,000 $30 per bottle 90,000 bottles Required: (a) (i) Prepare the budgeted income statement for Product X based on absorption costing to show the budgeted net profit for the year ended 31 December 2004. (ii) How will the budgeted net profit differ if marginal costing is used instead? Answer: (a) (i) Product X Budgeted income statement for the year ended 31 December 2004 $ Sales (90,000 × $30) Less Cost of goods sold: Raw materials Direct labour Factory overheads Less Closing stock ($2,000,000 x 10,000/100,000) Expenses Selling and distribution expenses ($150,000 + 90,000 x $1) Administrative expenses Budgeted net profit (ii) 1,000,000 800,000 200,000 2,000,000 (200,000) 240,000 400,000 $ 2,700,000 (1,800,000) 900,000 640,000 260,000 Under marginal costing, the fixed factory overheads will not be absorbed into the closing stock but are written off as expenses. The value of closing stock will therefore be lower to $180,000 ($1,800,000 x 10,000/100,000), resulting in a corresponding reduction of budgeted net profit by $20,000. During the year 2004, $240,000 was incurred for the research and development of a new Product Y. The variable production costs for each bottle of Product Y are: Raw materials Direct labour $11 $24 The experience in 2004 shows that the company has spare capacity to deal with additional production. If the company maintains the production level of Product X at 120,000 bottles in 2005, it will be able to produce and sell 50,000 bottles of Product Y, and the following additional expenses are required for 2005: Selling and distribution expenses Fixed Variable Administrative expenses $70,000 $2 per bottle of Product Y $80,000 An engineer would be redeployed from another unit to supervise the production of Product Y, if any, in 2005. He would be paid at the current salary of $150,000 per annum and would return to his original post when Product Y ceases production. Product Y can be sold at $44 per bottle. However, Product Y will be sold for one year only because another new product will be launched in 2006. The whole amount of the development cost will be written off in 2005. Required: (b) Calculate the contribution per unit of Product Y. (c) Indicate whether each of the following items is a relevant cost or an irrelevant cost: (i) The research and development costs (ii) The additional expenses (iii) The engineer’s salary (d) As Product Y will be sold for one year in 2005 only, analyse the costs above and advise with supporting calculations whether the company should produce Product Y in 2005. (b) Contribution per unit of Product Y $ 44 (11) (24) (2) 7 Selling price per unit Raw materials Direct labour Variable selling and distribution expenses Contribution per unit (c) (i) Irrelevant cost: The $240,000 research and development is sunk cost and should be ignored for decision making. (ii) Relevant cost: The additional expenses will be incurred when Product Y is produced. (iii) Irrelevant cost: The engineer’s salary of $150,000 is irrelevant to the decision as it does not represent incremental cost to the company. (d) Additional profit of producing Product Y Total contribution (50,000 bottles x $7) Additional overheads Fixed selling and distribution Administrative expenses Additional profit $ 350,000 (70,000) (80,000) 200,000 As product Y will generate an additional profit of $200,000, the company should produce and sell product Y even it has a product life of one year only.