TMA 2001 Annual Conference - Turnaround Management Association

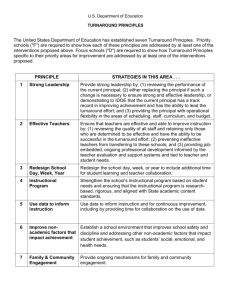

advertisement

Updated October 10,, 2005 How to register? Click http://www.turnaround.org/calendarDetail.asp?objectID=2230&curPage=1 to link to TMA’s on-line registration system or to access a printable registration form. Agenda Keynote Speakers Concurrent and General Sessions ACTP Sessions Registration Policies Cancellation/Substitution Notices Hotel Information Continuing Education Credit Attire Exhibit Hall Ground Transportation Questions Event Sponsors About Chicago AGENDA Tuesday, October 18 3:30 p.m. - 5:30 p.m. 7:00 p.m. Executive Committee Meeting TMA/ACTP Board Dinner Wednesday, October 19 8:00 a.m. - 10:00 a.m. 10:15 a.m. - 12:15 p.m. 12:15 p.m. - 1:00 p.m. 1:00 p.m. – 7:30 p.m. 1:15 p.m. - 3:15 p.m. 3:30 p.m. - 5:30 p.m. 5:00 p.m. - 6:00 p.m. 6:00 p.m. - 7:30 p.m. 10:30 p.m. – 12:00 a.m. ACTP Board of Directors Meeting TMA Board of Directors Meeting TMA/ACTP Board Lunch Registration Desk Open Chapter Presidents Meeting ACTP Advanced Educational Session “Revisions to the Bankruptcy Code—New Strategies for the Practitioner” ($95 fee required) Chapters' Boards of Directors Reception Opening Reception Co-sponsored in part by Back Bay Capital Funding LLC/Bank of America Business Capital/Bank of America Retail Finance Group and Conway MacKenzie & Dunleavy Midwest Chapters’ Reception Thursday, October 20 7:00 a.m. – 7:00 p.m. 7:00 a.m. – 7:45 p.m. 7:00 a.m. - 7:45 a.m. 8:00 a.m. - 9:30 a.m. 9:30 a.m. - 10:00 a.m. 10:00 a.m. - 11:00 a.m. 11:00 a.m. – 11:30 a.m. Registration Desk Open Exhibit Hall Open Continental Breakfast Co-sponsored by Morris-Anderson & Associates, Ltd; Rabin Worldwide Inc.; and SSG Capital Advisors, L.P. Convention Opening and Keynote Presentation by Tom Ridge Co-sponsored in part by ALTMA Group, LLC; Alvarez & Marsal, LLC; and Jefferies & Company, Inc. Coffee Break Sponsored by Great American Group Concurrent Session A A1: “Yankee Influence Overseas: Export of American Turnaround Expertise” A2: “Two Perspectives on the Economy” A3: “The World of Distressed Debt Investing – Pros and Cons of Investment Methodologies” A4: “Bank Workout Officers’ Views on Middle-Market Trends” Coffee Break Co-sponsored by Atlas Partners, LLC and The Nassi Group LLC Updated October 10,, 2005 11:30 a.m. - 12:30 p.m. 12:45 p.m. - 3:00 p.m. 3:00 p.m. - 3:30 p.m. 3:30 p.m. - 4:30 p.m. 5:15 p.m. - 6:15 p.m. 6:30 p.m. - 7:45 p.m. 9:30 p.m. – 12:00 a.m. Concurrent Session B B1: “Turnarounds in Public Education: A Textbook Example” B2: “How to Win the Valution Battle: An Overview of Critical Reorganization Valuation Issues” B3: “The Explosive Growth of China Outsourcing: Opportunities and Challenges” B4: “The Aggressive New Lenders: A Fundamental Shift in the Capital Markets?” B5: Ethics for the 21st Century: Real Issues for Real Professionals” Lunch; TMA Turnaround of the Year Awards Presentation; and Keynote Speaker Jim Craig, Olympic Gold Medalist Co-sponsored in part by Executive Sounding Board Associates Inc.; LBC Credit Partners, Inc.; Loughlin Meghji + Company; Mesirow Financial Consulting, LLC; and PNC Business Credit Coffee Break Co-sponsored by JPMorgan Chase Bank and Lake Pointe Partners, LLC Concurrent Session C C1: “Panel of Winners: TMA Turnaround of the Year Awards” C2: “Small Lender Forum: A Unique Opportunity to Meet Under $5 Million Troubled Company Lenders!” C3: “When Things Go Awry: How do Tranche B Lenders Get Repaid?” C4: “Out-of-Court Restructuring Solutions for Public Companies—Exchange Offers” C5: “Lender Response to the Revolving Door of Syndicated Loans” Professional Women's Networking Group Reception Sponsored by Gardner Carton & Douglas LLP Exhibitor Reception Wells Fargo Foothill Dessert Reception Friday, October 21 7:30 a.m. – 12:45 p.m. 7:00 a.m. – 6:30 p.m. 7:15 a.m. - 8:15 a.m. 8:15 a.m. – 9:45 a.m. 9:45 a.m. - 10:15 a.m. 10:15 a.m. - 11:15 a.m. 11:15 a.m. – 11:45 a.m. 11:45 a.m. – 12:45 p.m. Exhibit Hall Open Registration Desk Open Continental Breakfast Co-sponsored by Deloitte Financial Advisory Services LLP; LaSalle Business Credit, LLC; and SB Capital Group, LLC General Session – “Evolution of the Large Turnaround Firm” Coffee Break Sponsored by RSM McGladrey Concurrent Session D D1: “Pension and Retiree Health: The Legacy Overhang of American Industry” D2 : “The New Bankruptcy Law (Or What I Need to Learn All Over Again)” D3: “Managing the Asset Disposition Process for Maximum Strategic Return” D4: “Live from Chicago: Perspectives of Middle-Market Business Owners on the Turnaround Process” Coffee Break Sponsored by Merrill Lynch Capital Concurrent Session E E1: “Airline Industry Restructuring: An Industry Update” E2: “Is it Retails or Is It Real Estate” Updated October 10,, 2005 12:45 p.m. - 3:15 p.m. 3:30 p.m. - 4:30 p.m. 6:00 p.m. - 7:15 p.m. 7:30 p.m. - 9:45 p.m. 9:45 p.m. - 12:00 a.m. E3: “Controversial Issues in Large Company Restructurings” E4: “Troubed Business Buyers: The Private Equity Players” Lunch; TMA Transaction of the Year Awards Presentation; Carl Marks Student Paper Competition Prize Presentation; and Keynote Speakers Jon V. Rogers, Senior Automotive Analyst, Citigroup Smith Barney and Douglas Runte, Managing Director, Morgan Stanley U.S. Airlines Sector Co-sponsored in part by BBK, Ltd.; CIT; Giuliani Capital Advisors LLC; and Glass & Associates, Inc. Concurrent Session F F1: “Panel of Winners: TMA Transaction of the Year Awards” F2: “Automotive Industry in Flux: An Industry Update and Roundtable” F3: “Small Investor Forum: A First-Ever TMA Opportunity to Meet Under $5 Million Equity Investors in Troubled Companies!” Gala Reception Sponsored in part by XRoads Solutions Group Dinner, Butler-Cooley Excellence in Teaching Awards Presentation, Carl Marks Student Paper Competition Prize Presentation and Keynote Presentation by Cokie Roberts Co-sponsored in part by DLA Piper Rudnick Gray Cary US LLP Dessert Reception Please note that private company events may not conflict with any scheduled activity of the TMA 2005 Annual Convention KEYNOTE SPEAKERS Tom Ridge First Secretary of Homeland Security and Former Governor of Pennsylvania Thursday, October 20, 8:00 a.m. – 9:30 a.m. (time reflects entire convention opening session) As the United States’ first-ever Secretary of Homeland Security, Tom Ridge brought safety and security to a country threatened by terrorism. His primary tasks were to integrate 180,000 people from nearly twodozen agencies to create a culture of change within the new department and to lead a national effort to make America more secure. Secretary Ridge drew on his experience to forecast how a renewed emphasis on security would influence the way the U.S. responds to emergencies, disasters and threats to travel and transportation, as well as how security issues influence domestic policy on such questions as immigration, maintaining borders and issues of personal privacy. From working class origins, Secretary Ridge earned a scholarship to Harvard University, graduating with honors. During law school, he was drafted into the U.S. Army, where, as an infantry staff sergeant, he earned the Bronze Star for Valor. First elected to Congress in 1982, Secretary Ridge became the first congressman to have served as an enlisted man in the Vietnam War. Elected Pennsylvania governor in 1994, Ridge served nearly seven years, driving the state to become a leader among states and a competitor among nations. Secretary Ridge shares the insights learned on the frontlines of the War on Terror. He shows audiences exactly what and where the threat is and how this will affect the future of the United States and its people in the post September 11 world. Updated October 10,, 2005 Jim Craig President, Hat Trick Group and Gold Medalist, 1980 U.S. Men’s Ice Hockey Thursday, October 20, 12:45 p.m. – 3:00 p.m. (time reflects entire lunch program) Jim Craig is president of the Hat Trick Group and understands the marketing and team building needs of the business community. An intuitive marketer and promotion specialist, Craig is widely known for his inspirational lectures and athletic celebrity. Prior to becoming president of the Hat Trick Group, Craig was a marketing service consultant to Valassis Communications, a multi-national sales promotional firm, which, under his direction, was responsible for over $50 million in sales. Among these professional accomplishments, Craig was named “Salesman of the Year” by both Market Corporations of America and Valassis Communications and is a member of the ”Salesman Hall of Fame.” Craig’s athletic credentials are as significant as those earned in his professional career. In 1980, Craig became the principal goalie of the now legendary United States Men’s Ice Hockey team, which won the gold medal in the 1980 Winter Olympics in Lake Placid, New York. He has appeared twice on the cover of Sports Illustrated and is the author of the introductory dedication of the newly published book, The Boys of Winter. He has been inducted in the Hall of Fame of his alma mater, Boston University, the USA Hall of Fame, the International Ice Hockey Hall of Fame and the United States Ice Hockey Federation Hall of Fame, and was further distinguished as a Sports Illustrated “Sportsman of the Year”. Following his outstanding Olympic performance, Craig played several seasons in the National Hockey League with the Atlanta Flames, Minnesota North Stars and the Boston Bruins. Craig recently served as script and format consultant to Walt Disney Studios during the production of the motion picture “Miracle,” which tells the story his and his teammates’ quest for the hockey gold in 1980. Jon V. Rogers Senior Analyst – Automotive, Citigroup Smith Barney Douglas W. Runte Managing Director, Morgan Stanley Friday, October 21, 12:45 p.m. – 3:15 p.m. (time reflects entire lunch program) Jon Rogers joined Smith Barney in 2004 from Wachovia Securities, where he was the senior automotive analyst. He has more than 10 years of experience in financial and economic research with a concentration in the automotive industry. Prior to joining Wachovia Securities in 2000, Rogers was vice president of Martha R. Seger & Associates, an investment banking and consulting firm. While at Seger, Rogers spent five years as managing director of a joint venture with J.D. Power and Associates, providing automotive research and consulting services to public and private investors in the automotive industry. Rogers began his career in business as an analyst at the Federal Reserve Bank of Chicago. Douglas W. Runte is a managing director at Morgan Stanley, where he is the senior coverage analyst for the U.S. airline sector (both equity and debt) and aircraft-backed securities such as Enhanced Equipment Trust Certificates (EETCs). Runte has covered the airline and aircraft markets for leading Wall Street firms for more than 15 years. Prior to joining Morgan Stanley in 1998, Runte worked at another investment bank as a fixed income research analyst, where his coverage areas included airport finance and airline special facility debt. Annually from 2000 to 2004, Institutional Investor has recognized Runte as the number one ranked analyst in the fixed income transportation sector (either investment grade, high yield or both) from its survey of institutional investors and has previously included him in its All America Research Analyst survey for his work in tax-exempt airport finance and airport special facility obligations. Updated October 10,, 2005 Cokie Roberts Political Analyst, ABC News and Former Co-anchor, This Week with Sam Donaldson & Cokie Roberts Friday, October 21, 7:30 p.m. – 9:45 p.m. (time reflects entire dinner program) Cokie Roberts is a political commentator for ABC News where, for fifteen years, she has covered Congress, politics and public policy. She also serves as senior news analyst for National Public Radio. From 1996-2002, she and Sam Donaldson co-anchored the weekly ABC interview program This Week. In her more than thirty years in broadcasting, Roberts has won countless awards, including two Emmys. She has been inducted into the Broadcasting and Cable Hall of Fame and was cited by the American Women in Radio and Television as one of the fifty greatest women in the history of broadcasting. In addition to her appearances on the airwaves, Roberts and her husband, Steven V. Roberts, write a weekly syndicated column and are contributing editors to USA Magazine. Together, the couple wrote From this Day Forward, an account of their more than thirty-five year marriage and other marriages in American history. Roberts has also authored We Are Our Mothers’ Daughters, an account of women’s roles and relationships throughout American history and Founding Mothers, which explores the wives, daughters, philosophers and others who influenced the men behind the Constitution and Declaration of Independence. Roberts peppers her speeches with insight and wisdom born of personal and professional relationships honed in the halls of Congress over four decades. With unmatched authority, she brings a practiced political eye and keen perspective to issues currently facing lawmakers in Washington, DC. EDUCATIONAL SESSIONS CONCURRENT SESSION A Thursday, October 20, 10:00 a.m. - 11:00 a.m. A1: “Yankee Influence Overseas: Export of American Turnaround Expertise” Moderator: Robert N. Dangremond, AlixPartners LLC Panel: N. Lynn Hiestand, Skadden, Arps, Slate, Meagher & Flom (UK) LLP; Lachlan Edwards, N M Rothschild & Sons Limited (London); Susan George, CIT This panel will discuss the impact of American restructuring ideas that have evolved internationally over the past few years as a result of the influx of American investment abroad and the impact of these profound changes on the offshore markets. Panel members are leaders in their investment banking, legal, lending and restructuring advisory segments. They are uniquely qualified to review this subject as they have each lived and worked with these changes in international markets over the past decade. A2: “Two Perspectives on the Economy” Co-Presenters: Diane C. Swonk, Chief Economist and Senior Managing Director, Mesirow Financial and Carl Tannenbaum, Chief Economist, LaSalle Bank/ABN AMRO The expansion is 50 months old. Will it continue? If and when the housing bubble bursts, who will get hurt the most? What structural changes in the economy are creating the new winners and losers? What about the Euro? Hear two of the nation’s most noted and quoted economists address these and other timely topics as they offer their unique perspectives on the state of the economy. A3: “The World of Distressed Debt Investing -- Pros and Cons of Investment Methodologies” Moderator: Christopher Jacobs, JPMorgan Chase & Co. Panel: Charles J. Burger, Summit Investment Management LLC; Salmon Kahn, Silver Point Capital, L.P.; Richard Latto, Longroad Asset Management, LLC; Lynn Tilton, Patriarch Partners, LLC Updated October 10,, 2005 Several distinct methodologies are currently being deployed to invest in distressed companies. Special opportunity funds look to buy debt securities at significant discounts and profit as companies work themselves out of the troubled situations. Financially focused investors concentrate on actively restructuring the balance sheet. Control investors look to not only restructure the balance sheet but take an active role in the management of the company. All strategies can be successful, but each has a different focus and employs different resources to achieve their return objective. This panel will compare and contrast the different approaches and highlight the keys to success regardless of the methodology employed. A4: “Bank Workout Officers' Views on Middle-Market Trends” Moderator: David L. Auchterlonie, CTP, ALTMA Group, LLC Panel: J. Matt McIver, Wachovia Securities; Mitchell B. Rasky, LaSalle Business Credit Inc.; Michael Sadilek, Wells Fargo Foothill; Michael Weil, Bank of America Will turnaround professionals ever see another lead from a bank work-out department? What will the future role of the work-out officer be? How different will it be dealing with a distressed debt fund manager? This panel of institution leaders from national workout departments will focus on the evolving nature of bank workouts and will explore the recent effects of hyper-liquidity in the markets and whether this is a temporary or permanent phenomenon. Learn first-hand how these lenders foresee market conditions over the next 12 to 18 months. CONCURRENT SESSION B Thursday, October 20, 11:30 a.m. - 12:30 p.m. B1: “Turnarounds in Public Education: A Textbook Example” Panel: Sajan P. George, Alvarez & Marsal LLC; William V. Roberti, Alvarez & Marsal LLC; Vincent C. Schoemehl Jr., St. Louis Board of Education Turnarounds in public education? Do they exist? Can the restructuring methodology, proven so effective in the private sector, be applicable in the public sector? A panel of experts will discuss a real-life case study of a public sector turnaround - the St. Louis Public School District. What led Vince Schoemehl, former mayor and newly elected school board member, to hire a corporate turnaround firm? Hear the answer from Vince Schoemehl and from the co-heads of Alvarez & Marsal’s Public Sector practice about this unique and unprecedented turnaround assignment. B2: “How to Win the Valuation Battle: An Overview of Critical Reorganization Valuation Issues” Moderator: Carl S. Lane; Deloitte Financial Advisory Services LLP Panel: Neil Augustine, Rothschild Inc.; Shez K. Bandukwala, ThinkEquity Partners, LLC; Michael Henkin, Jefferies & Company, Inc.; Bernard Pump, Deloitte Financial Advisory Services LLP This panel of seasoned experts will discuss the key valuation issues in bankruptcy and restructuring battles. The panelists will outline their “Top 5” valuation issues for which consensus is vital to a successful outcome. The panelists will also expose some of the common technical errors made by "valuation professionals.” This session is a must for both consultants called to testify on valuation and attorneys who must challenge and defend these valuations. B3: “The Explosive Growth of China Outsourcing: Opportunities and Challenges” Moderator: Frank R. Mack, CTP, Conway MacKenzie & Dunleavy Inc. Panel: Douglas Clark, Esq., Lovells (Shanghai); Brian P. Smith, Conway MacKenzie & Dunleavy Inc.; Mark R. Williams, Esq., DLA Piper Rudnick Gray Cary UK LLP (Shanghai) China has become the “factory of the world” as international companies flock to the “Land of the Dragon” in pursuit of low-cost manufacturing, access to an expanding Asian consumer market and premium returns on investment. This long-term trend presents extraordinary opportunities and challenges for professionals in the corporate renewal industry. Even if your current practice is primarily U.S.-based, some aspect of future engagements will likely contain a China component. This panel of China experts Updated October 10,, 2005 will prepare you for the future by presenting both the practical elements, and the benefits and risks, of the China supply chain and the logistic outsourcing strategies now available. B4: “The Aggressive New Lenders: A Fundamental Shift in the Capital Markets?” Moderator: Andrew B. Miller, Houlihan Lokey Howard & Zukin Panel: Luke Gosselin Jr., Goldman Sachs & Co.; Kenneth Sands, Fortress Investment Group, LLC; Daniel E. Wolf, Cerberus Capital Management LP/Ableco Finance LLC The aggressive new lenders, hedge funds and CLOs are sitting on hoards of cash and looking for creative ways to deploy it. Borrowers can max-out their debt capacity and lower their cost of capital. This competition has resulted in new structures, higher debt levels, reduced covenants and lower capital costs. Our panel of premiere dealmakers will discuss the latest structures and techniques to provide borrowers an optimal capital structure as well as the opportunities for turnaround consultants. B5: “Ethics for the 21st Century: Real Issues for Real Professionals” Moderator: Howard Brod Brownstein, CTP, NachmanHaysBrownstein Inc. Panel: Robert D. Albergotti, Haynes & Boone, LLP; Gerald P. Buccino, CTP, Buccino & Associates, Inc.; Shaun K. Donnellan, CTP, Glass & Associates, Inc.; Scott Peltz, American Express Tax & Business Services In this Sarbanes-Oxley era, ethical and legal pitfalls require turnaround professionals to be more vigilant than ever. This panel of corporate renewal experts will review the latest ethical issues in the turnaround practice, including perspectives on the non-bankruptcy engagement agreement, the contractual scope of work, “zone of insolvency” issues when fraud or illegality is discovered and the representation of various parties in bankruptcy proceedings. CONCURRENT SESSION C Thursday, October 20, 3:30 p.m. - 4:30 p.m. C1: “Panel of Winners: TMA Turnaround of the Year Awards” Moderator: Lillian G. Stenfeldt, Sedgwick Detert Moran & Arnold LLP Each year, TMA honors recipients of its Turnaround of the Year Awards. The recipients of the Mega, Large, Mid-size, Small and International Company “Turnaround of the Year” awards will share the challenges they faced and the lessons they learned, as well as provide an understanding of what made the difference in achieving these outstanding outcomes. Discussion among the panelists will be followed by questions from the audience. C2: “Small Lender Forum: A Unique TMA Opportunity to Meet Under $5 Million Troubled Company Lenders!” Co-organizers: Jay H. Krasoff, Chiron Financial Group Inc. and Luis Salazar, Greenberg Traurig LLP This exciting, first-time-ever lender forum will showcase lenders who target loans less than $5 million (USD) to troubled companies. These are largely regional, smaller, hard-to-find lenders who offer loans, refinancings and DIP facilities in this difficult market segment. Each lender will personally present themselves and their specific product offerings. Attendees will receive a take-home Small Lender Guide outlining the loan offerings and parameters of each forum participant. This guide will serve as an invaluable resource in the coming year. Presenting firms will have collateral material on-hand and will be available for deal making after the presentations. C3: “When Things Go Awry: How do Tranche B Lenders Get Repaid?” Moderator: Theodore L. Koenig, Monroe Capital LLC Panel: Dennis J. Diczok, Fortress Investment Group, LLC; Michael J. Egan, Monroe Capital LLC; Eric F. Miller, Cerberus Capital Management LP/Ableco Finance LLC; Greg C. Walker, Silver Point Capital, L.P. Updated October 10,, 2005 There is a new breed of investor in town. Hear from the people who will be managing the next generation of workouts and restructurings. How do they plan to exit their investment positions? How will they make decisions whether to sell, refinance, restructure or liquidate? In protecting their positions, how will they choose their turnaround professionals, counsel, DIP lenders, investor partners and investment bankers? Learn this “must know” information directly from the decision makers. C4: “Out-of-Court Restructuring Solutions for Public Companies -- Exchange Offers” Moderator: Thomas A. Vanderslice Jr., Jefferies & Company, Inc. Panel: Lawrence A. Larose, Esq., King & Spalding LLP; Hyonwoo Shin, Jefferies & Company, Inc.; Edward J. Siskin, Bank of American Retail Finance Group; Thomas Steiglehner, Silver Point Capital Chapter 11 should be the last resort for companies facing obligations they cannot meet. There are numerous options available for cleansing a balance sheet while at the same time avoiding a prolonged bankruptcy filing, which often results in a dissipation of enterprise value. Central to this alternative approach is the use of an “exchange offer,” where a company seeks to renegotiate its bond obligations in a consensual process. This panel will discuss the techniques of both registered exchange offers and private (or SEC-exempt) methods such as 3(a)9 and 4-2 exchange offers. Two recent cases will be used to illustrate the value of this technique to successfully restructure the balance sheet outside of Chapter 11. C5: “Lender Response to the Revolving Door of Syndicated Loans” Moderator: Michael B. Solow, Esq., Kaye Scholer LLP Panelist: Paul V. Kennedy, Bank of America; Anthony Murphy, Citigroup The world of syndicated loans continues to evolve. These changes are having a dramatic impact on the workout of mid-to-large troubled borrowers. In many transactions, the agent no longer retains a significant economic stake and the original purchasers are long gone when the deal hits workout. Instead, a variety of new debt holders may be at the bargaining table; some may hold debt in several tranches and even trade in and out during the workout, creating even greater complexity. This distinguished panel will explore this ever-changing landscape and consider what may be next on the horizon in the senior debt market. CONCURRENT SESSION D Friday, October 21, 10:15 a.m. - 11:15 a.m. D1: “Pension and Retiree Health: The Legacy Overhang of American Industry” Moderator: Nell Hennessy, Fiduciary Counselors Inc. Panel: Gary M. Ford, Groom Law Group; James Gerber, Pension Benefit Guaranty Corporation; Joseph E. O'Leary, McDermott, Will & Emery LLP Pension and retiree health costs are threatening the solvency of companies across an increasing number of industries. The Pension Benefit Guaranty Corporation (PBGC) is awash in red ink, and Congress is considering legislation to increase pension funding and PBGC premiums. Hear from Bradley Belt, Executive Director of the PBGC, and lawyers directly involved in this crisis. Learn what to look for, what your options are and how to navigate through this minefield. D2: “The New Bankruptcy Law (Or What I Need to Learn All Over Again)” Moderator: Adam C. Rogoff, Esq., Cadwalader, Wickersham & Taft LLP Panel: Michael A. Dieber, Conway Del Genio Gries & Co. LLC; Judith Greenstone Miller, Jaffe, Raitt, Heuer & Weiss, P.C.; Richard B. Levin, Esq., Skadden, Arps, Slate, Meagher & Flom LLP; Kenneth Simon, Navigant Capital Advisors, LLC Learn about the sweeping changes to the Bankruptcy Code, which will affect numerous aspects of corporate reorganizations, including exclusivity, asset disposition, avoidance actions, KERPs, taxes, financial contracts and cross-border proceedings. How will the new law affect you? A dynamic panel Updated October 10,, 2005 discussion will address these changes from both a company viewpoint and creditors/committee perspective to help you understand the ways you will need to change your approach to turnarounds. D3: “Managing the Asset Disposition Process for Maximum Strategic Return” Moderator: David Peress, XRoads Solutions Group, LLC Panel: James C. Dykstra, DoveBid Inc.; Benjamin L. Nortman, Hilco Trading Co. Inc.; Thomas E. Pabst, Great American Group; William Weinstein, Gordon Brothers Group, LLC Dispel all the myths surrounding the disposition of excess assets by hearing from the top firms providing these services. Learn how to structure deals to meet your strategic goals, whether maximization of recovery value or protection of “brand” integrity. Understand how to forge partnerships with asset disposition firms and why they often result in best-case outcomes. See how strategic alliances between a 363 buyer and an asset disposition firm can make your client a winner. This is a session that every turnaround professional, restructuring advisor, asset based lender and distressed investor should attend. D4: “Live from Chicago: Perspectives of Middle-Market Business Owners on the Turnaround Process” Moderator: Daniel F. Dooley, CTP, Morris - Anderson & Associates, Ltd. Panel: J. Sherman Henderson III, Lighyar Network Solutions, LLC; Richard F. Joyce, Akerman Senterfitt; Richard Pulver Typically convention panels focus exclusively on the perspectives of the professionals involved in a corporate renewal case. This panel is comprised of owners of middle-market businesses who have gone through the turnaround process with the help of experienced professionals. The intent is to give turnaround professionals (practitioners, lenders, attorneys, and other service providers) new insight and some valuable lessons learned in understanding the owner/stakeholder group. CONCURRENT SESSION E Friday, October 21, 11:45 a.m. - 12:45 p.m. E1: “Airline Industry Restructuring: An Industry Update” Moderator: Thomas J. Allison, CTP, Huron Consulting Group Panel: Timothy R. Coleman, The Blackstone Group; David S. Kurtz, Lazard Freres & Co. LLC; Todd R. Snyder, Rothschild Inc. Since 2001, airlines have accumulated losses of over $30 billion, numerous airlines have filed for bankruptcy protection, and many continue to struggle due to high fuel costs, legacy costs, and pricing pressures. During this time period, airlines both in and out-of-court have sought to reduce operating costs while trying to maintain market share and avoid labor strife. This panel of battle-weary turnaround practitioners and investment bankers advising this industry will review the most recent industry trends and developments. E2: “Is It Retail or Is It Real Estate?” Moderator: Andrew B. Graiser, DJM Asset Management LLC Panel: Emilio Amendola, DJM Asset Management LLC; Kevin P. Genda, Cerberus Capital Management LP/Ableco Finance LLC; Flip Huffard, The Blackstone Group; Joseph G. Stevens, Kimco Realty; Many turnaround professionals, investors and lenders have been left scratching their heads trying to understand the underlying motives driving recent announcements by retailers to place a “for sale” sign on their company and the diversity of buyers, ranging from other retailers to hedge funds. Are the investors buying a retail operation for the operation itself, or are they simply buying choice real estate? This panel of professionals and investors who have actively participated in many of these transactions have assembled to share with you their perspectives into what drives today’s largest retail acquisitions from both the acquirer’s and seller’s perspective. Updated October 10,, 2005 E3: "Controversial Issues in Large Company Restructurings” Moderator: Randall S. Eisenberg, CTP, FTI Consulting, Inc. Panel: Richard M. Cieri, Esq., Kirkland & Ellis LLP; Stephen Karotkin, Esq., Weil, Gotshal & Manges LLP; Timothy Morris, GE Corporate Financial Services Changing capital markets, global scope, shifting creditor constituencies, terminations of pension plans, modification of retiree healthcare benefits, treatment of critical vendors and venue selection are a sample of hot issues which have sparked debate among turnaround professionals. Add to this the recent change in the bankruptcy code, and one can see many strategies developed to aggressively advocate a client’s position. This distinguished panel will discuss and debate many of the controversial issues involved in larger company restructurings both today and in the future. E4: “Troubled Business Buyers: The Private Equity Players” Moderator: David S. Miller, Giuliani Capital Advisors LLC Panel: John P. Bolduc, HIG Capital - Bayside Capital; Michael H. Kalb, Sun Capital Partners, Inc.; Thomas J. Kichler, One Equity Partners; Scott B. Lavie, Galena Capital LLC This panel of experienced private equity investors and advisors will discuss current trends in the distressed market. How have hedge funds changed the market for distressed investing and how are they different from private equity funds? What are private equity funds looking for when they invest in a troubled company? What is the role of the turnaround professional versus the portfolio manager of the private equity funds? What are private equity funds looking for from a turnaround professional? Attendees should expect a candid and forthright discussion of investing in troubled businesses and the role of the turnaround professional. CONCURRENT SESSION F Friday, October 21, 3:30 p.m. - 4:30 p.m. F1: “Panel of Winners: TMA Transaction of the Year Awards” Moderator: Scott H. Lang, Brown Gibbons Lang & Company This year, the TMA introduces a new award, the Transaction of the Year. This award will recognize the TMA member, who along with a team of professionals, orchestrates a distressed financial transaction that, if not executed, would have most likely resulted in the failure of a business and lower recoveries to creditors. This panel features the four recipients of this new award, whose categories include Small, Midsize, Large, and Mega deal. Each award-winning recipient will discuss the salient features of their optimal exit strategy and participate in a roundtable discussion followed by questions from the audience. F2: “Automotive Industry in Flux: An Industry Update and Roundtable” Moderator: Hon. Steven W. Rhodes, U.S. Bankruptcy Court, Eastern District of Michigan Panel: Van E. Conway, Conway MacKenzie & Dunleavy Inc.; William G. Diehl, CTP, BBK, Ltd.; Daniel P. Pehrson, Standard Federal Bank; Kimberly Rodriguez, Stout Risius Ross Inc. Experts predict that by 2010, the number of Tier 1 auto industry suppliers will have shrunk by 66 percent and the Tier 2 suppliers will have decreased by 90 percent. How will this rationalization occur? With industry dynamics more complex and challenging than ever, how many will be forced to shut their doors? How many will restructure, strengthen and thrive? This session will take a closer look at automotive supplier restructurings from the perspectives of the OEMs, the lenders and the suppliers themselves. F3: “Small Investor Forum: A First-Ever TMA Opportunity to Meet Under $5 Million Equity Investors in Troubled Companies!” Co-organizers: Seth R. Freeman, EM Capital Inc./Freeman Partners and J. Scott Victor, SSG Capital Advisors, L.P. Updated October 10,, 2005 Every troubled company’s fondest dream is to find a suitable investor. This first-time-ever TMA investor forum will showcase investment groups interested in investing less than $5 million in troubled situations. Each investment group will personally introduce their firm and outline their investment criteria. Attendees will receive a take-home “Troubled Investors Guide” outlining the investment parameters of each of the Forum participants, an invaluable reference guide over the coming year. Presenting firms will have collateral material on-hand and will be available for deal making after the presentations. General Session: “Evolution of the Large Turnaround Firm” Friday, October 21, 8:15 a.m. - 9:45 a.m. Moderator: John Wm. Butler Jr., Skadden, Arps, Slate, Meagher & Flom LLP Panel: Gary Holdren, Huron Consulting Group; Brian P. Marsal, Alvarez & Marsal LLC; Frank Piantidosi, Deloitte Financial Advisory Services LLP; Dennis Shaughnessy, FTI Consulting, Inc.; James C. Tyree, Mesirow Financial ACTP SESSIONS The Association of Certified Turnaround Professionals (ACTP) is pleased to offer the following educational programs in conjunction with the 2005 Annual Convention. Notes on Program Venues All Body of Knowledge (BOK) courses listed below will be held at 150 S. Wacker Drive, Ste. 1060, Chicago. All exams listed below will be held at 150 S. Wacker Drive, Ste. 1060, Chicago. The ACTP Advanced Educational Session will be held during TMA’s Annual Convention at the Chicago Hilton & Towers. The meeting room name will be available in your on-site convention materials. Further details about the BOK courses and exams venues will be included in your confirmation letter. Annual convention registration is not required to register for the BOK courses or to sit for the exam but is required to participate in the ACTP Advanced Educational Session and any other convention activities. You may use the convention registration form to sign up for these courses or you may print a registration form from ACTP’s website, http://www.actp.org/cmaextras/RegistrationForm--AsOfJanuary2005.doc Body of Knowledge Courses 9:00 a.m. – 4:00 p.m. $400 per course Monday, October 17 Management Course Tuesday, October 18 Law Course Taught by a business school professor and a U.S. Bankruptcy Judge, these courses are open to all corporate renewal professionals seeking a comprehensive understanding or refresher on turnaround management. Additionally, these courses are perfect for individuals interested in attaining the Certified Turnaround Professional (CTP) designation. ACTP has defined a comprehensive body of knowledge in the areas of management, accounting & finance, and law upon which the certification exam is based. CTP Certification Exam Wednesday, October 19, 8:00 a.m. – 6:00 p.m. $250/exam section Exams Offered: Management, Law, and Accounting & Finance Exams are currently scheduled in the following order: Management (3.5 hours maximum); Law (2.5 hours maximum); and Accounting & Finance (2.5 hours maximum). A half-hour breakfast and lunch are included in the exam fee. Updated October 10,, 2005 Please note that the CTP exam may only be taken by those whose applications have already been accepted and approved by the ACTP Standards Committee and whose application fee has been received. An exam application may be printed from the ACTP website, www.actp.org. Please use the convention registration form to sign up for the exam(s). However, please note that the exam application fee may not be paid using the registration form in this brochure. The application fee must be accompanied by a completed application. For more details about the courses and/or exams, please contact Nicole Gibby, Manager of ACTP Relations, at 1-312-242-6034 or ngibby@turnaround.org or visit www.actp.org ACTP Advanced Educational Session Wednesday, October 19, 3:30 p.m. – 5:30 p.m. $95/person “Revisions to the Bankruptcy Code—New Strategies for the Practitioner” Moderator: Anthony H.N. Schnelling, Bridge Associates, LLC Panel: James K. Seward, Ph.D., University of Wisconsin Madison Graduate School of Business Practitioners rely on a working knowledge of the bankruptcy law in order to effectuate successful reorganizations. Now, planning and timing are even more important than ever. The key developments for practitioners will be illustrated by presentation and discussion of several recent cases. Key participants in those cases will contrast how the new law would have changed their planning and timing. Topics to be covered include leases, exclusivity, utilities, reclamation, administrative claims, vendor rights, etc. You must be a registered attendee of the 2005 Annual Convention to attend this session. Please use the convention registration form to sign up for this session. For more information about the session, please contact Laura Ivaldi, TMA Director of Continuing Education Services, at 1-312-242-6030 or livaldi@turnaround.org General Information for ACTP Sessions Only The information below applies only to ACTP sessions. Similar information regarding the TMA convention may be found later in this document. Registration Policies Body of Knowledge Courses/Exams Registration forms must be mailed or faxed. Phone registration is not accepted. Your registration is not considered complete until payment is received and processed. Written confirmation of your registration and appropriate course materials will be sent by UPS Ground Service within three business days of receipt of your registration. The confirmation notice will contain complete details about the course/exam venue(s), hotel options, etc. The course materials are an integral part of the course experience and/or exam preparation. To ensure that you are adequately prepared for the course(s) and/or exam(s), ACTP encourages you to send a registration form in a timeframe that ensures adequate time to receive and review the materials. If you would like to receive the course materials in a timelier manner than UPS Ground Service will allow, please apply the appropriate surcharge to your total amount due as indicated in the payment section on the next page. If you do not receive your confirmation notice and materials within 10 business days of registering, please contact Nicole Gibby at ngibby@turnaround.org or 1-312242-6034. The exam application and application fee are required to be on file with ACTP before you may sit for an exam. For further details, please contact Nicole Gibby at ngibby@turnaround.org or visit www.actp.org, from where you may print an application form. Please use the convention registration form to sign up for the courses and exams. Updated October 10,, 2005 Advanced Educational Session You must be a registered attendee of the 2005 Annual Convention to attend this session. Please use the convention registration form to sign up. The CTP designation is not required to attend this course; the course is open to all corporate renewal professionals. Cancellation/Substitution Policies Body of Knowledge (BOK) Courses Notification of cancellation must be received in writing (e-mail is acceptable). Cancellations will not be reviewed or processed until they are received in writing. Phone cancellation is not accepted. If your written notification of cancellation is received up to ten business days prior to the start of the BOK course, you will be issued a full credit to be used for registration for any BOK course in the next 12month period. Cancellations received within ten business days of the start of the course will be issued a credit, less a $75 processing fee, to be used for registration for any BOK course in the next 12-month period. No refunds will be given. Substitutions for BOK courses are permitted at any time. Notification of substitution must be submitted in writing (e-mail is acceptable). Substitutions will not be reviewed or processed until they are received in writing. Phone substitution is not accepted. The substitute must be from the same firm as the original registrant, and the substitution notice should include accurate contact information for the substitute registrant. Exams Notification of cancellation must be received in writing (e-mail is acceptable). Cancellations will not be reviewed or processed until they are received in writing. Phone cancellation is not accepted. For each cancelled exam section, you will be issued a full credit to be used for the same exam section in the next 12-month period. Substitutions are not allowed for the exam. If your cancellation notice includes cancellation of the TMA Annual Convention, please note that TMA’s cancellations policies detailed later in this document will apply to the convention portion of your registration. ACTP’s policies outlined above will apply to the courses and exams. TMA’s policy regarding one cancellation processing fee for the total of all registered events will not apply if one or more of those registered events includes an ACTP BOK course or exam. Advanced Educational Session Notification of cancellation must be submitted in writing (e-mail is acceptable). Cancellation of this session only that is received before Wednesday, October 5, 2005, will be refunded less a $25 cancellation fee. Cancellation of the entire annual convention, including the ACTP Advanced Educational Session, received before Wednesday, October 5, 2005, will be refunded for the total amount paid less a $250 processing fee. Cancellations received after October 5, 2005, will not be refunded. Substitutions are permitted at any time and must be submitted in writing (e-mail is acceptable). Substitutions will not be reviewed or processed until they are received in writing. Phone substitutions are not accepted. The substitute must be from the same firm as the original registrant and must be a registered attendee of the 2005 Annual Convention. Payment Checks should be payable to ACTP, unless you are also registering for the 2005 Annual Convention, in which case, the check for all fees should be payable to TMA. ACTP and TMA accept Visa, Mastercard, and American Express. If you would like overnight delivery of your course materials, please apply the appropriate surcharge listed below: Within the United States $35 for one binder $45 for two binders Updated October 10,, 2005 Outside the United States $70 for one binder $90 for two binders Registration and payment may be completed on the convention registration form. Continuing Education Credit This information applies to ACTP sessions only. For details about continuing education credit for sessions that are part of the TMA convention program, please reference that section further in this document. Body of Knowledge Courses CPE—maximum 6.5 hours of CPE for accountants* CTPs—maximum 6.5 hours toward the CTP designation CLE —upon request, ACTP can apply for CLE credit to individual states for the law section only Advanced Educational Session CPE—maximum 1.5 hours of CPE for accountants* CTPs—maximum 1.5 hours toward the CTP designation CLE —this session is not eligible for CLE for attorneys *The Association of Certified Turnaround Professionals is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Nashville, TN, 37219-2417. Web site: www.nasba.org There is no prerequisite or advance study necessary to attend ACTP sessions or to qualify for continuing education credit. For more information regarding administrative policies such as complaint and refund, please contact ACTP at 1-312-578-6900. REGISTRATION POLICIES Registration Fees Unless otherwise indicated, registration fees include educational sessions, meals and social functions. Convention events are not pro-rated. To attend any portion of the convention, you must register for the entire convention at the appropriate fee. The registration fee allows admission for one individual only. Registrations may not be shared. All registered attendees will receive a name badge at the convention that must be worn for admittance into all sessions, meals, social events and the exhibit hall. Registration Categories Please register using the convention registration form. Registration fees are as follows: Category Member Nonmember Judge/Full-time Academic/ Government Employee Spouse/Guest Full Fee Spouse/Guest Friday Dinner Pass Only On or before August 26 $1145 $1345 $750 After August 26 $1345 $1545 $950 $520 $175 $520 $175 The member registration fee is for current, active TMA members. Please note that TMA membership is on an individual basis. Unless otherwise appropriate as defined below, all other attendees must pay the nonmember fee. If it comes to be that an individual registers at the member fee, but TMA has no membership record, the individual will be charged the nonmember fee unless s/he can produce proof of membership. Updated October 10,, 2005 For the judge/full-time academic/government employee registration fee, a full-time academic is defined as a student enrolled in at least 12 credit hours per term at an accredited university or an instructor employed on a full-time basis by an accredited university. Please submit appropriate documentation with your registration form. The spouse/guest registration fee is for family members, friends and/or non-industry related individuals. TMA members and individuals who practice in the corporate renewal industry and who are not TMA members are not eligible for this fee. Spouse/guest registration includes entrance to all meals, social functions, keynote presentations and the exhibit hall. Spouses/guests will receive a name badge at the convention that must be worn for admittance into these events. Except for the Friday Night Spouse/Guest Pass, all meals and social functions are not available on a pro-rated basis. To attend any of the sessions included in the spouse/guest registration, you must register your spouse/guest at the full spouse/guest rate. The Friday Night Spouse/Guest Pass is for family members, friends and/or non-industry related individuals. Only one pass per registered attendee is allowed. TMA members and individuals who practice in the corporate renewal industry and who are not TMA members are not eligible for this pass. This pass allows entry into the Gala Reception, Dinner and Dessert Reception on Friday, October 21 only. The Friday night pass may be picked up at the TMA registration desk beginning at 3:30 p.m. on Friday, October 21. Under no circumstances may the pass be picked up earlier than 3:30 p.m. on Friday, October 21. On-site registration for members, non-members, and judges/full-time academics/government employees will be subject to an additional $100 fee (added to the post-August 26 fees). This fee does not apply to the ACTP sessions, spouse/guest registration fee, or Friday Night Spouse/Guest Pass. Submitting Your Registration Registration forms must be mailed or faxed to TMA. Complete contact information may be found on the registration form. You may also register on-line at http://www.turnaround.org/calendarDetail.asp?objectID=2230&curPage=1 Phone registration is not accepted. Registrations are not considered complete until payment is received. Individuals who register at the early registration fee but fail to provide payment before the Friday, August 26, 2005, deadline will be charged the regular registration fee (note: payment must be received, not postmarked, by August 26; postmarks will not be considered). Registered attendees will receive written confirmation of their registration by mail. Please carefully review this confirmation notice for accuracy. Changes must be submitted in writing by fax to 1-312-5788336 or e-mail to Nicole Gibby at ngibby@turnaround.org or Catherine Cram at ccram@turnaround.org. Because of necessary processing and mailing time, please note that TMA cannot guarantee that you will receive a written confirmation notice prior to the start of the convention if your registration form is received after Friday, October 7, 2005. A written confirmation is not required for admittance into the convention. Only on-site registration forms will be accepted after Friday, October 14. TMA will not accept any registration forms in advance of the convention after Friday, October 14. Please note that there is an onsite surcharge for certain registration categories. Please consider submitting your registration prior to Friday, October 14 Registration List To ensure your inclusion in the registration list distributed on-site, your registration form, with payment, must be received at TMA’s international headquarters office by 5:00 p.m. Central on Friday, October 7, 2005. TMA cannot guarantee that individuals who submit registration forms after this date will be included in the registration list. Updated October 10,, 2005 HOTEL INFORMATION The Chicago Hilton & Towers overlooks Grant Park and Lake Michigan and is in the heart of Chicago’s cultural core, located near the Art Institute, Field Museum of History, Shedd Aquarium, Adler Planetarium, Symphony Hall and the Opera House. It is also just minutes from Chicago Magnificent Mile, with numerous shopping and dining possibilities. Reserve your room at the Chicago Hilton & Towers by calling 1-800-HILTONS (1-800-445-8667) or 1312-922-4400. Mention TMA to receive the specially negotiated room rate of $235 per night (Main House), single or double occupancy or $275 per night (Towers), single or double occupancy. These rates are only guaranteed through Friday, September 9, 2005. TMA cannot guarantee that the room block or hotel will not sell out before then. Please make your reservation soon. The Chicago Hilton & Towers is located at 720 S. Michigan Avenue, Chicago, IL 60605. The guest fax number is 1-312-922-5240. Due to strong interest in this convention, TMA requires that a convention registration form (which includes payment) be received within ten business days of making a hotel reservation. TMA reserves the right to terminate the hotel reservation of any individual who does not comply with this policy. CANCELLATION AND SUBSTITUTION POLICIES The policies below do not apply to ACTP sessions. Details about cancellation or substitution of ACTP sessions may be found on previous pages of this document. CANCELLATION POLICY Notification of cancellation must be submitted in writing (e-mail is acceptable). Cancellations will not be reviewed or processed until they are received in writing. Phone cancellations are not accepted. Cancellations received on or before Wednesday, October 5, 2005, will be refunded as follows: Entire Convention Cancellation: Attendee will receive a refund for the total cost of convention registration and additional individual events (if applicable) less a $250 processing fee. If the cancellation also includes cancellation of a full spouse/guest fee, the refund will be for the total of all registrations less the $250 processing fee. Individual Spouse/Guest (full fee) Cancellation: Attendee will receive a refund for the total cost of spouse/guest registration less a $250 processing fee. Individual Event(s) with Registration Fees of $100 of more: Attendee will receive a refund less a $50 processing fee. This processing fee will apply for the cancellation of a single event with a registration fee of $100 or more and/or the cancellation of multiple events whose total is $100 or more. In the latter case, the $50 processing fee will apply to the total cost of all cancelled events. Cancellations received after Wednesday, October 5, 2005, will not be refunded. This includes the entire convention registration, spouse/guest registration and individual event(s) fees. Individual events will not be refunded regardless of whether or not the individual still plans on attending the entire convention. TMA does not issue credits for future conferences. Please note that if you register for the convention after these cancellation dates have passed, you will not be eligible for any type of refund or credit. These cancellation policies apply to all individuals, regardless of when the registration form is submitted. Note regarding TMA Membership Renewal: Unless otherwise indicated in your cancellation notice, TMA will not cancel the membership renewal portion of any registration. If you would like to cancel the membership renewal portion of your registration, please indicate that on your cancellation notice. Cancelled membership renewals will be refunded in full at any time. Updated October 10,, 2005 SUBSTITUTION POLICY Substitutions are permitted at any time. Substitutions must be submitted in writing (e-mail is acceptable). Substitutions will not be reviewed or processed until they are received in writing. Phone substitutions are not accepted. The substitute must be from the same firm as the original registrant, and the substitution notice must contain accurate contact information for the new registrant; otherwise, TMA cannot guarantee an accurate listing in the registration list. Substitutions must be of the same membership status (e.g., nonmember) and/or registration category (e.g., academic); otherwise, the substitute will be invoiced for the difference in registration fees. Entire Convention Substitution: Substitution of an entire convention registration includes all registration options, such as spouse/guest (full fee) registration and individual events. If the substitute does not wish to utilize these events/registrations, refunds will be issued in accordance with the cancellation policies previously highlighted, or the substitution policy below may be implemented. Individual Event(s) Substitution: Substitutions are allowed for individual registration options provided that the substitute is a member of the same firm as the original registrant and is a registered attendee of the 2005 Annual Convention. In the case of the substitution of a spouse/guest (full fee or Friday Pass only), the individual must be a spouse/guest of a member of the same firm Note regarding Membership Renewal: Membership renewals are non-transferable. In the case of a substitution for an entire convention registration, the membership renewal will stay with the original registrant. Registrants who fail to attend the convention and do not notify TMA in accordance with these policies and deadlines are responsible for full payment. GENERAL INFORMATION Continuing Education Credit This information applies to all educational sessions NOT preceded by “ACTP.” For details about continuing education credit for ACTP sessions, please see the previous pages of this document. CPAs*—maximum 8.5 hours CTPs—maximum 8.5 hours toward their CTP designation Attorneys—CLE applications are pending. Completed details will be available in your on-site convention materials, or you may contact Nicole Gibby at ngibby@turnaround.org for updates. *The Turnaround Management Association is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Nashville, TN, 37219-2417. Web site: www.nasba.org There is no prerequisite or advance study necessary to attend the 2005 Annual Convention or to qualify for continuing education credit. For more information regarding administrative policies such as complaint and refund, please contact TMA at 1-312-578-6900. Drink Tickets Each registered attendee (including individuals registered at the full spouse/guest registration fee) of the 2005 Annual Convention will receive six complimentary drink tickets with their registration materials. These tickets may be used at the Opening Reception on Wednesday, the Exhibitor Reception on Thursday, and/or the Gala Reception on Friday. The tickets are for alcoholic beverages only (includes beer, wine and liquor). Soft drinks, juice and water are available at no charge. Please note that these tickets are not necessary at any other receptions listed in the agenda, including the Professional Women’s Networking Group Reception, the Chapters’ Receptions and the two Dessert Receptions. Individuals registered for the Friday Night Spouse/Guest Pass will receive two complimentary drink tickets. The bars at the receptions requiring drink tickets will not take cash. Additional drink tickets may be purchased at the TMA registration desk. Tickets will be sold in books of six for $40 per book. Updated October 10,, 2005 Cyber Cafe Stay connected while away from the office! New this year, TMA is pleased to offer a Cyber Café. Connect to the Internet, check e-mail, or update and print documents on one of several computer workstations. The Cyber Café is located in the exhibit hall and will be open during the following hours: Thursday, October 20, 7:00 a.m. - 7:45 p.m. Friday, October 21, 7:15 a.m. – 12:45 p.m. Attire Educational Sessions: Business Casual Receptions: Business Business Casual/Nice Business Casual: For men, includes cotton pants such as khakis, polo-type or button-down collared shirts, sweaters. For women, includes slacks or cotton pants, button-down shirts or top. Business (After Five Attire): For men, includes collared, button-down shirts, suit and tie. For women, includes, pants or skirt suits or dresses. Additional Convention Sponsors Event sponsors provide financial support for TMA’s international conferences. In addition to those sponsors listed in the agenda, the following sponsors have also generously provided support for the TMA 2005 Annual Convention. AlixPartners, LLC (Cyber Café) CapitalSource (Room keys) Edward Hostmann, Inc. (Audio CDs) FTI Consulting, Inc. (Program Book/CD-Rom) Getzler Henrich & Associates LLC (lanyards) Huron Consulting Group (convention bags) Skadden, Arps, Slate, Meagher & Flom LLP (Program Book/CD-Rom) Stout Risius Ross, Inc. (Cyber Café) Midwest Chapters Reception Wednesday, October 19 10:30 p.m. - 12:00 a.m. Continental Ballroom Kick off your TMA convention experience with a Chicago original – The Second City! The Chicago, Detroit, Cleveland, Minneapolis and St. Louis chapters invite you to join them for a cocktail and live, late-night entertainment featuring comedic improv from Chicago’s very own Second City tour group. GROUND TRANSPORTATION The Chicago Hilton & Towers is located approximately 20 miles from O’Hare International Airport (ORD) and 12 miles from Midway International Airport (MDW). Taxi, Shuttle and Driving Directions O’HARE INTERNATIONAL AIRPORT (ORD) Taxicab Service Taxicabs are available on the lower level curb front of all terminals. Shared ride service is available. There are no flat rates into downtown Chicago. Taxicab fare to downtown Chicago is approximately $40 (depending on traffic), and depending on traffic, the ride may take from 30 minutes to more than one hour. Updated October 10,, 2005 Shuttle Service Continental Airport Express provides service between ORD and the Chicago Hilton & Towers. Shuttles depart from the lower level of the airport every 10-15 minutes. Shuttles depart the Hilton every 15 minutes, starting at the top of the hour. Reservations are not necessary for shuttle use between the hours of 6:15 a.m. and 5:45 p.m.; reservations are required at all other times. The shuttle cost is $23 each way. You may contact Continental Airport Express by calling 1-888-284-3826 or visit www.airportexpress.com. Sedan Service To arrange private car service, please contact the concierge desk at the Chicago Hilton & Towers by calling the hotel at 1-312-922-4400. Driving from ORD to the Chicago Hilton & Towers Follow signs that say I-190E or “Exit to City.” Merge onto I-190 East, which will become I-90 East/Kennedy Expressway. Follow the Kennedy Expressway for approximately 20 miles. Follow signs to the Eisenhower Expressway East (I-290) toward the Chicago Loop. I-290E becomes Congress Parkway. Follow Congress Parkway for one mile to Michigan Avenue. Turn right onto Michigan Avenue. The Hilton will be approximately two blocks north on your left. MIDWAY AIRPORT (MDW) Taxicab Service Taxicabs are available outside the main terminal building. Taxicab fare to downtown Chicago is approximately $30 (depending on traffic), and depending on traffic, the ride may take between 30 minutes and one hour. Shuttle Service Continental Airport Express provides service between MDW and the Chicago Hilton & Towers. Shuttles depart from outside the main terminal building of the airport every 10-15 minutes. Shuttles depart the Hilton every 30 minutes, at :15 and :45 after the hour. Reservations are not necessary for shuttle use between the hours of 6:15 a.m. and 5:45 p.m.; reservations are required at all other times. The shuttle cost is $18 each way. You may contact Continental Airport Express by calling 1-888-284-3826 or visit www.airportexpress.com. Sedan Service To arrange private car service, please contact the concierge desk at the Chicago Hilton & Towers by calling the hotel at 1-312-922-4400. Driving from MDW to the Chicago Hilton & Towers Follow signs out of the airport to Cicero Avenue (IL-50). Proceed north on Cicero Avenue to I-55 North/Stevenson Expressway North. Follow I-55 for approximately six miles. Exit on Lakeshore Drive North (US-41). Follow Lakeshore Drive to Balbo Drive and turn left. Follow Balbo Drive two blocks to Michigan Avenue. The Hilton is at the intersection of Michigan Avenue and Balbo Drive. Parking at the Chicago Hilton & Towers Valet parking is available for $37/night with unlimited in/out service. Self-parking for guests and visitors of the hotel is available on a first-come, first-served basis for $32/day. VISIT THE EXHIBIT HALL Annual convention exhibitors provide critical services to corporate renewal professionals. Don’t miss this opportunity to learn how more than sixty service providers, including asset-based lenders, accounts receivable outsourcing professionals, appraisers, real-estate consultants, liquidators and investment bankers, among others, will benefit your business. For questions about exhibiting at the 2005 Annual Convention, please contact Joe Karel at 1-312-242-6039 or jkarel@turnaround.org Updated October 10,, 2005 Exhibit Hall Hours Thursday, October 20, 7:00 a.m. - 7:45 p.m. Friday, October 21, 7:15 a.m. – 12:45 p.m. Exhibitor Grand Prize Drawing Registered attendees will receive an exhibitor grand prize drawing ticket with their convention materials. Spouses/guests and individuals registered as exhibitors will not receive a drawing ticket. To enter the drawing, attendees must drop their ticket into the drawing bin located in the exhibit hall. The Exhibitor Grand Prize Drawing will be held on Thursday evening, October 20, during the Exhibitor Reception. The reception begins at 6:30 p.m. and the prize drawing will be held shortly thereafter. Past Exhibitors ABF Journal AccuVal Associates, Inc./LiquiTec Industries, Inc. American Bankruptcy Institute (ABI) ARG Recovery, LLC Association of Certified Turnaround Professionals (ACTP) Association of Insolvency and Restructuring Advisors (AIRA) Atlas Partners, LLC Bank of America Business Capital BIDITUP Brown Gibbons Lang & Co. Buxbaum Century LLC CapitalSource Commercial Finance Association (CFA) Commercial Law League of America (CLLA) Compensation Master Congress Financial Corporation DoveBid, Inc. EMCC, Inc. Emerald Technology Valuations LLC GE Commercial Finance GMAC Commercial Finance GMAC-RFC Health Capital Gordon Brothers Group, LLC Great American Group Hunt Special Situations Group LP Keen Consultants, LLC Koster Industries, Inc. Libra Securities, LLC Merrill Lynch Capital Mesirow Financial Michael Fox International Northern Healthcare Capital, LLC Prime Locations, LLC Rabin Worldwide Inc. Receivables Outsource Management Republic Financial Corporation Retail Consulting Services SB Capital Group Summit Investment Management, LLC Textron Financial Asset Based Lending Group The Atwell Companies The Daley-Hodkin Group The Deal, LLC Updated October 10,, 2005 The Dickerson Group The Gordon Company The Hilco Organization The Nassi Group LLC The Ozer Group Tranzon LLC Turnaround Management Association (TMA) UCC Direct Services Wells Fargo Business Credit, Inc. Wells Fargo Foothill Wilmington Trust Winternitz, Inc. ABOUT CHICAGO Known as the home of the Bears and the Bulls, for its cross-town baseball rivalry, and among other things, for its windiness, what can we write about Chicago that hasn't already been written? Always bustling with activity, this city has something for everyone, whether it's a new restaurant, an exciting sporting event or a cultural celebration. While we can't list everything going on in Chicago during your stay, we've provided a "taste" of Chicago on these pages. For more information on Chicago sights and sounds, be sure to visit www.metromix.com, www.timeoutchicago.com or www.meetinchicago.com MUSEUMS The Art Institute of Chicago Founded in 1879 as both a museum and school, the Art Institute of Chicago's collection encompasses more than 5,000 years of human expression from cultures around the world. For more information, visit www.artic.edu/aic Museum of Contemporary Art Located in the heart of the Magnificent Mile, the Museum of Contemporary Art offers exhibitions of the most thought-provoking art created since 1945. The MCA documents the art of our time with paintings, sculptures, photography, video and film, and performance. For more information, visit www.mcachicago.org The Museum of Science and Industry provides visitors with an opportunity to not only view displays and artifacts, but to also interact with the exhibits. Be sure to visit such exhibits as Robots Like Us; Apollo 8 Command Module; The U-505 Submarine; and the Whispering Gallery. For more information, visit www.msichicago.org ATTRACTIONS Millennium Park With its unprecedented combination of architecture, monumental sculpture and landscape design, the 24.5 acre Millennium Park features the Frank Gehry-designed Jay Pritzker Pavilion, the most sophisticated outdoor concert venue of its kind in the United States; the interactive Crown Fountain; the contemporary Lurie Garden; and Anish Kapoor's hugely popular Cloud Gate sculpture, fondly referred to as "The Bean". For more information, visit www.millenniumpark.org Buckingham Fountain Modeled after - but twice the size of - the Latona Fountain at Versailles, the Buckingham Fountain is composed of pink Georgia marble and serves as the centerpiece of Grant Park. From April through October, the fountain spurts columns of water up to 150 feet in the air every hour on the hour. Shedd Aquarium Updated October 10,, 2005 Opened in 1929, the Shedd Aquarium is one of the oldest public aquariums in the world. Featuring exhibits such as Amazon Rising: Seasons of the River; Wild Reef-Sharks at Shedd; and CRABS!, the Aquarium lets you experience some of the world's richest environments and "meet" a wide variety of creatures. For presentation times and event calendars, visit www.sheddaquarium.org ESPN Zone When you enter ESPN Zone, you enter a world where sport is king! Relax one evening after the day's activities by watching High Definition TV on the 16-ft big screen. For details, visit www.espnzone.com/chicago THEATER Steppenwolf Theater Steppenwolf has redefined the landscape of acting and performance by spawning a generation of America's most gifted artists. Founded in 1976 as an ensemble of nine actors, Steppenwolf has grown into an internationally renowned company whose founders include Gary Sinise, John Malkovich, and Laurie Metcalf. For more information, visit www.steppenwolf.org Goodman Theater Nurturing the talents of solo artists such as John Leguizamo and the late Spalding Gray, and hosting acclaimed actors such as Denzel Washington, William Hurt, Sigourney Weaver, Chita Rivera and Rip Torn, the Goodman Theater produces both original and familiar productions. For more information, visit www.goodmantheater.org COMEDY Second City The theatre that launched the careers of such comic greats as John Belushi, Mike Myers, Bill Murray and Gilda Radner offers nightly comedy shows. For information, call 1-312-337-3992 or visit www.secondcity.com Zanie's Comedy Club One of the few traditional comedy clubs left in Chicago, Zanie's often draws its headliners straight off The Late Show with David Letterman and The Tonight Show. Zanie's has hosted nationally known comedians such as Jerry Seinfeld, D.L. Hughley, Jeff Foxworthy and Wanda Sykes. For information, call 1-312-337-4027 or visit www.zanies.com MUSIC Buddy Guy's Legends A legend himself, the gifted guitarist plays to sold-out crowds at his club. Buddy Guy's is known for its jam sessions featuring such artists as Eric Clapton, Pete Townsend and Otis Rush, who drop by every now and then to take in a show. For more information, visit www.buddyguys.com Green Dolphin Street is a sophisticated retro, 1940's-style nightclub and restaurant that offers live jazz of every style, with shows playing every night. Patrons of the Green Dolphin fine-dining restaurant can move onto jazz after dinner without paying the cover charge. For more information, visit www.jazzitup.com Green Mill Best known for serving as a gangster hangout and speakeasy during Prohibition, the Green Mill has the distinction of being the oldest, continuously running jazz club in the country. The Green Mill offers jazz most nights, beginning about 9:00 p.m. and winding down just before closing at 4:00 a.m. For a calendar of performances, visit www.greenmilljazz.com DINING Chinatown Updated October 10,, 2005 With over 50 restaurants and a variety of grocery stores, Chinatown not only serves up an excellent dining experience for its residents; it provides an introduction to the Chinese culture and cuisine to the other residents of Chicago. For a list of restaurants in Chinatown, visit www.chicago-chinatown.com Updated October 10,, 2005 Little Italy Comprised of four predominantly Italian neighborhoods, Little Italy offers a host of time-honored, traditional Italian restaurants. For more information, visit www.littleitalychicago.com Greektown In the mood for gyros, saganaki, or spanokopita? Take a walk along Halsted, between Van Buren and Washington streets, and choose from Greektown's restaurants, which offer a variety of appetizing Greek specialties. For more information, visit www.chicagogreektown.com Is your sweet tooth getting the best of you? Visit Vosges Haut-Chocolat for an unforgettable chocolate fix. With inventive chocolate creations, Vosges Haut-Chocolat, located at 520 N. Michigan Avenue, is becoming a leader in the elite chocolate world. Visit www.vosgeschocolate.com for details. SHOPPING From the Gap to Gucci, window shoppers and shop-a-holics alike will find plenty to appease their fancy while strolling up and down the Magnificent Mile, from Oak Street to the Chicago River along Michigan Avenue. Visit www.themagnificentmile.com EVENT SPONSORS AlixPartners, LLC ALTMA Group, LLC Alvarez & Marsal, LLC Atlas Partners, LLC Back Bay Capital Funding LLC Bank of America Business Capital Bank of America Retail Finance Group BBK, Ltd. CapitalSource Carl Marks Advisory Group LLC CIT Conway MacKenzie & Dunleavy Deloitte Financial Advisory Services LLP DLA Piper Rudnick Gray Cary US LLP Edward Hostmann, Inc. Executive Sounding Board Associates Inc. FTI Consulting, Inc. Gardner Carton & Douglas LLP Getzler Henrich & Associates LLC Giuliani Capital Advisors LLC Glass & Associates, Inc. Great American Group Huron Consulting Group Jefferies & Company, Inc. JPMorgan Chase Bank Lake Pointe Partners, LLC LaSalle Business Credit, LLC LBC Credit Partners, Inc. Loughlin Meghji + Company Merrill Lynch Capital Mesirow Financial Consulting, LLC Morris-Anderson & Associates, Ltd. The Nassi Group LLC PNC Business Credit/Steel City Capital Funding RSM McGladrey Updated October 10,, 2005 Rabin Worldwide Inc. SB Capital Group, LLC Skadden, Arps, Slate, Meagher & Flom LLP SSG Capital Advisors, L.P. Stout Risius Ross, Inx. Wells Fargo Foothill XRoads Solutions Group QUESTIONS? Executive Director Linda Delgadillo, CAE 1-312-578-6900 or ldelgadillo@turnaround.org Convention Registration, Substitution, Cancellation Catherine Cram 1-312-242-6036 or ccram@turnaround.org Nicole Gibby 1-312-242-6034 or ngibby@turnaround.org Overall Convention, Speakers, Awards and Competitions Laura Ivaldi 1-312-242-6030 or livaldi@turnaround.org ACTP Nicole Gibby 1-312-242-6034 or ngibby@turnaround.org Event Sponsorship, Exhibit Hall, Cornerstone Program Joe Karel 1-312-242-6039 or jkarel@turnaround.org Press Cecilia Green, CAE, APR 1-312-242-6031 or cgreen@turnaround.org Chapter Relations Dale West 1-312-242-6038 or dwest@turnaround.org Membership Mary Carravallah 1-312-242-6040 or mcarravalah@turnaround.org

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)