Consumer Savvy Daycamp Lesson

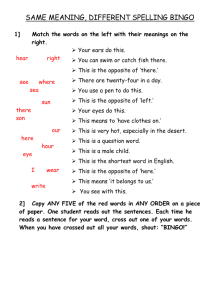

advertisement

Consumer Savy 4-H Adventure Developed by: Jonathan Schreck, Regional Consumer Education 4-H Summer Intern Carrie Ann Olson, Regional Extension Educator, 4-H Youth Development July, 2005 Objectives: 1. To help students learn techniques that will help them make financial decisions. 2. To learn about money saving strategies. 3. To learn to identify values and set financial goals. 4. To increase awareness of advertising techniques. Introduction Mixer Game: “To get to know more about each other we are going to play “2 Truths and a Lie”. When it is your turn please introduce yourself and share in random order 2 truths and a lie about yourself. Have the group try to figure out the lie.” Reflection: Advertisers often mix true and false information together to get you to buy their products. Today we hope you will increase your skills in figuring out what the messages are really telling you. Lesson #1 - How Do You Spend $100 - Tell the youth they have 5 minutes to make a list of things they would like to buy. - “Now you have a problem, you only have $100 what will you spend it on? Take your list and decide the items you want to keep and what you can live without.” - Discussion about what had to be taken out and why? Mixer Game #2 - Human Knot - Have the group form a Human Knot by standing in a close circle and holding hands with different people from across the circle. When all hands are held, have the group unwrap themselves without letting go of their hands. Reflection: Money can sometimes entangle us into some interesting situations, we want to help you learn how to keep your knots in check so you don’t let it get out of control like this human knot. Lesson #2 - Value Shield - Handout the value shield (Consumer Savvy Consumer Wise curriculum: Level 2 activity book on page 8). - “Your shield will be a collection of items that represent your personal values. Build your design by using words, drawings, or symbols. Add your favorite colors and write your name on it to take ownership of your values.” - Present your value shield to the group and explain how you make decisions based upon what is important to you. Game - Calculator Tag - Similar to Freeze Tag. When child gets “frozen”, have leader come around and ask them a math question to be done on a calculator. If they get it right they can be unfrozen, if they get it wrong they have to wait until the leader can come back to do another math problem. Lunch Game - Money Bingo - Play money bingo to learn terminology and discuss financial concepts. Format can be found in Consumer Savvy Helper’s Guide page 26. Terms and card examples are below. Lesson #3 – Goal Setting and Money - Lead a discussion. Ask: - What is a goal? - Why do we set goals? - What are some of your goals? (May include a guest speaker such as a local banker) Talk about saving and setting up bank accounts, credit cards, loans; a basic overview of how a bank works in all aspects. - What do we do with money? Earn, Spend, or Save - How can a bank help you earn, spend or save? Treasure Hunt Snack - Resembles a scavenger hunt; hide clues outside the building you are in. Have the clues hint to the location of the next clue, recommend 4 clues. It also works well if you have a treasure map drawn to go with the clues. With the last clue reveal the location of the treasure chest. Within the treasure chest, have an afternoon snack. The treasure chest can be any box, it’s fun to find an old wooden box to give it a more realistic feel. Lesson # 4 - Advertising - Explain how advertisers use commercials with catchy music and kids having fun to entice them into buying the product. - With wall projection play Advertising Appeal at the Consumer Savvy Action Arcade in 6-8 games. Accessible online at http://4hccsprojects.com/consumer/activities/index.html . - Have participants share how advertising affects them. What do they buy? Why? Wrap-Up - Review with participants and ask them to give their definition of a value, goal, money, commercial. Ask the group what they learned today. Resources Needed Paper, pencils, markers, Value Shield printed on paper Calculators Money Bingo cards, terms, pennies to cover card squares Treasure Chest and map with hidden clues Snack for Treasure Chest activity Computer and projector for online game Reference Consumer Savy, Consumer Wise, Level 2; National 4-H Cooperative Curriculum System, Inc. 4HCCS BU-08031, 2004. Consumer Savvy Daycamp Schedule (9:00-9:15) Registration (9:15-9:30) Mixer- 2 Truths 1 Lie (9:30-9:10:00) How Do You Spend $100 (10:00-10:15) Mixer- Human Knot (10:15-10:30) Value Shield (10:45-11:15) Calculator Tag (11:15-11:45) Lunch (11:45-12:15) Money Bingo (12:15-1:00) Goal Setting/Guest Speaker (1:00-1:30) Snack/Treasure Hunt (1:30-2:00) Advertising Lesson (2:00 – 2:30) Wrap-Up Money Bingo Terms (Cut these terms apart. Draw one at a time and read definition. Participants are asked to find the term that matches the definition on their bingo card & cover it up with a marker, such as a penny or piece of corn.) Needs & Wants & Goals Wants: A desire or longing. Needs & Wants & Goals Peer pressure: Influence exerted upon people by others in their age group. Needs & Wants & Goals Trade-offs: Exchanges that occur as compromises. Needs & Wants & Goals Alternative: Other choices that satisfy a want or need. Needs & Wants & Goals Decision-making process: A series of actions toward selecting a particular result or end. Needs & Wants & Goals Goal: The end toward which your focus your effort. Needs & Wants & Goals Short-term goal: A goal to achieve in less than a year. Needs & Wants & Goals Values: What is important, highly regarded; an underlying principle or quality that you hold desirable. Needs & Wants & Goals Value conflict: When two or more beliefs/values are in disagreement. Needs & Wants & Goals Criteria: A standard to use to make decisions. Needs & Wants & Goals Need: Something that is necessary. Needs & Wants & Goals Long-term goal: A goal to achieve in a year or more. Needs & Wants & Goals Prioritize: To decide what comes first by order of importance. Savings Savings Account: A bank account that permits you to make deposits & withdrawals in various amounts at any time; you earn interest on this account. Savings Principle: The amount of money upon which interest is calculated. Savings Savings: Putting away money for a short-term goal. Savings Savings goal: Something you wish you could have. Savings Simple interest – This is figured only on your initial amount you started saving. Savings Time value of money: A concept applied in the comparison of the value of money over time. Savings Rate of return (interest): A percentage over a certain period of time, usually a year, which is paid to you for the use of your money. Economics Durable (or hard good): A product bought by a consumer that tends to last more than one year. Examples are cars, furniture and appliances. Economics Service: Work done for another, such as a haircut or oil change. Savings Compound interest: Figured on your initial account you started saving and the accumulated earned interest from each year you save that amount. Economics Cost: The amount charged for a good or service. Economics Goods: Items that you buy and use. Economics Global Economy: An economic interconnectedness of countries ‘throughout the world. Economics Supply: The quantity of a particular product that producers are able and willing to make available for sale at a given price. Economics Import: A product brought into a country to be sold there. Economics Economic system: The way a society uses its resources to satisfy peoples’ needs and wants. Economics Labor force: Workers engaged in a specific activity or enterprise; all available workers in a country. Economics Export: A product sent to a foreign country for sale there. Savings Deposit: To put in a bank. Economics Scarcity of resources: Limited resources make it necessary to chose among relatively unlimited wants. Consumerism Bargain: Something sold at a price favorable to the buyer. Economics Demand: How much of a product or service consumers want to purchase. Economics Product: Something produced by humans, mechanical effort, or by nature. Consumerism Savvy shopper: A consumer who makes wise choices of goods and services. Consumerism Shopper: To examine goods or services with intent to buy. Consumerism Retailers: Businesses that sell in small quantities directly to consumers. Consumerism Impulse buying: Making purchases without enough thought. Consumerism Comparison shopping: Researching price and other variables of several similar products or services to make a wiser purchasing decision. Consumerism Store brands: Items bearing the name of the retailer that sells them; these products often cost less than comparable namebrand items. Consumerism Commercials: Messages sponsored by an advertiser. Consumerism Sales receipt: written record of purchase at time of sale includes: name of the item/ service purchased, date, price & name of the business. Consumerism Opportunity cost: Giving up something to gain something else. Consumerism Price: The amount of money required for a sale. Consumerism Manufacturer: The company that produces the product or item. Budgets Expenses: Paying out money to buy needs and wants. Budgets Income: Money one can use to make purchases. Budgets Money management: Use of money responsibly. Budgets Spending pattern: A usual distribution. Budgets Resource management: Wise use of available time, money, materials, peoples’ talents, and energy. Budgets Income: Money received. Budgets Spending plan: Assigning to each item an amount of money from the total available to provide for goods and services. Budgets Irregular income: No pattern or schedule of payment. Budgets Cancelled check: A check that has been paid by the financial institution on which it was drawn. Budgets Financing: Paying cash or arranging for credit to make a purchase. Budgets Allowance: An amount of money given regularly to a child. Budgets Spending diary: Record of money spent. Consumerism Brand name: A well-known quality label or identified product. Consumerism Consumer: One who purchases goods and services to use. Consumerism Shoplifting: Stealing merchandise from stores. MONEY Bingo N M O E Y NEEDS WANTS & GOALS SAVINGS ECONOMI CS CONSUME RISM BUDGETS Wants Savings Account Durable Savvy Shopper Expenses Peer Pressure Savings Cost Bargain Income Trade-offs Savings Goal Scarcity of Resources Shopper Principle Service Retailers Alternative DecisionMaking Process Simple Interest M O NEEDS WANTS & GOALS SAVINGS Prioritize Savings MONEY Bingo N Resource Managemen t Y ECONOMI CS CONSUME RISM BUDGETS Product Store Brands Spending Diary Brand Name Allowance Opportunity Cost Income Sales Receipt Financing Shoplifting Cancelled Check Simple Interest Import Need Compound Interest Goods Rate of Return Supply Savings Goal Labor Force Value Conflict Spending Pattern E Long-term Goal Criteria Impulse Buying Demand Money Managemen t M O MONEY Bingo N E Y NEEDS WANTS & GOALS SAVINGS ECONOMI CS CONSUME RISM BUDGETS Values Compound Interest Product Shoplifting Expenses Wants Deposit Durable Savvy Shopper Spending Diary Alternative Time Value of Money Global Economy Bargain Allowance Value Conflict Rate of Return Cost Commercial s Resource Managemen t Goal Savings Account Service Consumer Cancelled Check M O NEEDS WANTS & GOALS SAVINGS DecisionMaking Process MONEY Bingo N E Y ECONOMI CS CONSUME RISM BUDGETS Timed Value of Money Goods Sales Receipt Resource Managemen t Goal Rate of Return Demand Brand Name Spending Plan Short-term Goal Simple Interest Labor Force Store Brands Irregular Income Values Compound Interest Supply Impulse Buying Income Value Conflict Deposit Global Economy Comparison Shopping Cancelled Check M NEEDS WANTS & GOALS DecisionMaking Process Goal Need Wants Trade-offs M MONEY Bingo N O M E Y SAVINGS ECONOMI CS CONSUME RISM BUDGETS Time Value of Money Cost Bargain Income Savings Goal Deposit Savings Simple Interest O Service Retailers Spending Pattern Goods Comparison Shopping Spending Plan Labor Force Brand Name Economic System Opportunity Cost MONEY Bingo N Financing ECONOMI CS CONSUME RISM BUDGETS Trade-offs Principle Labor Force Consumer Allowance Wants Savings Account Scarcity of Resources Brand Name Money Managemen t Peer Pressure Simple Interest Global Economy Impulse Buying Spending Plan Long-term Goal Rate of Return Export Bargain Irregular Income DecisionMaking Process Savings Goods Shopper Spending Diary M O CONSUME RISM BUDGETS SAVINGS Demand Store Brands Money Managemen t Peer Pressure Principle Scarcity of Resources Sales Receipt Expenses Value Conflict Deposit Durable Impulse Buying Alternative Savings Demand Peer Pressure Time Value of Money Service ECONOMI CS Criteria Compound Interest Short-term Goal Y SAVINGS NEEDS WANTS & GOALS SAVINGS E NEEDS WANTS & GOALS Y NEEDS WANTS & GOALS E Income O MONEY Bingo N MONEY Bingo N E Y ECONOMI CS CONSUME RISM BUDGETS Compound Interest Import Commercial s Spending Diary Alternative Rate of Return Product Manufactur er Allowance Income Value Conflict Principle Export Price Irregular Income Shopper Resource Managemen t Values Savings Account Supply Shoplifting Cancelled Check Savvy Shopper Income Prioritize Deposit Global Economy Consumer Resource Managemen t M O NEEDS WANTS & GOALS MONEY Bingo N M E Y SAVINGS ECONOMI CS CONSUME RISM Prioritize Rate of Return Economic System Comparison Shopping Expenses Criteria Simple Interest Supply Store Brands Spending Pattern Product Commercial s Cancelled Check Short-term Goal Alternative Wants M NEEDS WANTS & GOALS Deposit Compound Interest Savings O Savvy shopper Import Cost Retailers MONEY Bingo N E BUDGETS O MONEY Bingo N E Y NEEDS WANTS & GOALS SAVINGS ECONOMI CS CONSUME RISM BUDGETS Long-term Goals Savings Account Demand Comparison Shopping Allowance Values Savings Goal Labor Force Opportunity Cost Spending Diary Alternative Simple Interest Export Impulse Buying Irregular Income Wants Rate of Return Goods Store Brands Resource Managemen t Short-term Goals Principle Supply Manufactur er Income Financing Income Y SAVINGS ECONOMI CS CONSUME RISM BUDGETS Goal Compound Interest Service Retailers Spending Pattern Value Conflict Time Value of Money Global Economy Savvy Shopper Resource Managemen t Long-term Goal Principle Economic System Shopper Irregular Income Prioritize Savings Product Sales Receipt Income Goal Deposit Cost Bargain Spending Diary M O NEEDS WANTS & GOALS SAVINGS Peer Pressure MONEY Bingo N E Y ECONOMI CS CONSUME RISM BUDGETS Time Value of Money Scarcity of Resources Sales Receipt Spending Plan DecisionMaking Process Savings Account Goods Opportunity Cost Financing Values Savings Goal Supply Price Expenses Need Principle Import Manufactur er Money Managemen t Trade-offs Savings Goal Durable Shoplifting Cancelled Check