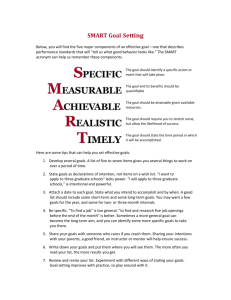

Budgeting and Goal Setting

advertisement

1 Saving – Pay Yourself First A 20 minute lesson on reducing spending and saving money. Discussion: 5 minutes Today we are going to talk about the choices you make with your money. Do you ever spend all your money but then not really know where it went? Do you find yourself running out of money before your next paycheck or allowance arrives? Well, today I am going to give you $100 and send you on a trip to the mall with your friends. It’s a virtual trip – and a virtual $100 - so get out a sheet of paper and see if you can keep track of how you spend your money. Read the following scenario to students only once. Then ask the questions that follow. You’re hungry when you first get to the mall so you get pizza and a soda in the food court, and then you go to a movie. After the movie, you stop in the t-shirt shop where you buy two new shirts on sale, and then you head next door to the music store for a 3-for-1 sale on CDs, where you buy 6 CDs. You buy a new sketchbook at the art shop and some new color pencils, then head to the card store to buy a birthday card for your friend in another town. The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 2 You and your friends feel like getting a snack, so you go to the ice cream store for some cones. There is a great pair of sneakers on sale at the sports outlet, so you buy them and decide to wear them home that day. Soon it’s time to go home and since you are tired from walking all day, you and your friends decide to take the bus home. The ride costs $1.50 but you dig in your pocket and find that you only have $1.10! How did that happen? Where did all your money go? Give students about two minutes to list everything they spent money on during the trip to the mall. Write their responses on the board. Where did we spend money? Food court (pizza and soda) Movie T-shirt shop (2 t-shirts) Music/CD store (6 CDs) Art store (sketchbook/pencils) Card store (birthday card) Ice cream shop (cones) Sports outlet (sneakers) It is common for people to spend all the money they make and not have anything left over to save for their goals. Are you putting money aside to save for anything? . Let’s take a look at the conversation between the two girls on the screen. Show PPT slide “Would you Spend it or Save it?”. The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 3 Would you Spend it or Save it? 4 What do you think? Is it a good idea to save some of the money she got? Why or why not? What would you do if you got a generous gift of money? Pay Yourself First: 3 minutes If I really did have $100 to give you, what would you do with it? Discuss. Would you consider paying yourself first? What do you think it means to pay yourself first? Acknowledge student responses. Show PPT slide “Pay Yourself First”. The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 4 Pay Yourself First • Put some of the money from your paycheck in a savings account • Save before paying bills 5 Paying yourself first means that when you get a paycheck, or a gift of money, you put some of that money in a savings account before you pay your bills or buy things that you want. Why would you want to pay yourself first before paying bills or making a purchase? Write student responses on the board. There are several benefits to paying yourself first Show PPT slide “Benefits of Paying Yourself First”. The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 5 Benefits of Paying Yourself First • Learn to manage money better • Save money toward your goals • Improve your standard of living • Have money for emergencies 6 What are some things that people save money for? Write student responses on the board. If the following are not mentioned, add Unexpected events – loss of job, car repair, hospitalization Down payment for a house or a car College Vacation Retirement Now that we have looked at some reasons to save, let’s apply some of those reasons to your own personal circumstances. Activity: 2 minutes Give students the PAY YOURSELF FIRST WORKSHEET The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 6 Take a little time to think about and write down your goals for the future for which you need to save money. Or, just write down some things you would like to have, but can’t afford. For now, fill in the top half of the worksheet only. Give students a little time to write down their goals. This will probably take less than a minute. Ask for one or two volunteers to share their goals with the class. How are you going to achieve your goals or purchase the things you want? Will you need to save some money? Many people believe they do not have enough money to start saving. But most people actually CAN save money somewhere, even if it is only a small amount. Saving money example: 5 minutes (If you prefer, you can substitute the “What If” worksheet here and have students work in small groups) Take a minute to write down 5 things you spend money on almost every day. Ask for someone to volunteer an example of an item that they spend money on almost every day (coffee, lunch, music, etc.). Ask them to estimate how much they spend per day on this item. Write the amount on the board. Multiply the amount times the number of days per week they purchase this item. Multiply this amount times 4 (number of weeks in a month) Then multiply this amount times 12 (number of months in a year).. Example: coffee @ $1.50 a cup X 5 days a week = $7.50 a week. $7.50 X 4 = $30 $30 X 12 = $360 In one year, you spent over $__________ on __________ (use your student example here) The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 7 What if you cut that spending by just one day a week? What if you cut it in half and saved the money instead? Have students do the actual calculations here. At the end of the year, you would have saved $__________! What are some things you can think of right now that you can do to start saving money? Write student responses on the board. Write some of your ideas to save money on the bottom half of your “Pay Yourself First Worksheet”. Other ideas: 3 minutes Let’s look at some other ideas for saving money. (you may eliminate these worksheets and discussion if pressed for time.) Distribute Activity 2: SAVINGS TIPS and “Ways to Reduce Spending” Briefly discuss the bullet points under GENERAL TIPS and WHEN YOU ARE ON YOUR OWN. Although we do not have time to discuss investing today, you will see tips for investing on the bottom of the second page of “Savings Tips”. Once you start saving, you may want to even consider investing! Have students look at “Ways to Reduce Spending.” Discuss a few. Conclusion: 2 minutes Give students a copy of the worksheet titled “Action Plan” as a take-home activity. Challenge them to think about their savings goals and to write down an action plan. So what do you think happened with our friend? Did she buy a new purse? The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life. 8 Show PPT slide “Conclusion: Would you Spend it or Save it?” CONCLUSION: Would you Spend it or Save it? 30 End of Lesson The information provided in this lesson may consist of materials from any or all of the following resources: FDIC Money Smart, the National Endowment for Financial Education, and Practical Money Skills for Life.