MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Fund Overview

About the Fund

Key Information

The portfolio aims to provide a return higher than its benchmark (before fees

and tax) over 5 year periods.

MLC aims to achieve this by actively managing the portfolio. This includes

reducing risk in the portfolio if market risk is high. As a result, there may be

smaller losses than the benchmark in weak or falling markets and potentially

lower returns than the benchmark in strong markets.

The portfolio primarily invests in growth assets with a small exposure to

defensive assets. The allocations to these assets are actively managed within

defined ranges, in accordance with MLCs changing view of potential risks and

opportunities in investment markets.

APIR Code MLC0747AU

Status Onsale

Product Size as at 31 Aug 2014

$3,835.04M

Commencement Date

4 Dec 2006

The portfolio is broadly diversified across asset classes and investment managers from around the world. These

managers invest in many companies and securities in Australia and overseas.

For additional information on the portfolio and its benchmark please view our page for this portfolio.

Important Announcements

1 Jul 2014

Change to fee disclosure for MLC portfolios

From 1 July 2014, ASIC requires us to include the 'Indirect Costs' of investment strategies in the fee disclosure for our

investment options. Further information on Indirect Costs is available on our page to view

16 Jan 2014

Performance fee for Low Correlation strategy

The performance fee is included in the investment fee below. The actual performance fee charged in future periods may

vary from period to period. Further information on the Low Correlation strategy is available on mlc.com.au/lcs/

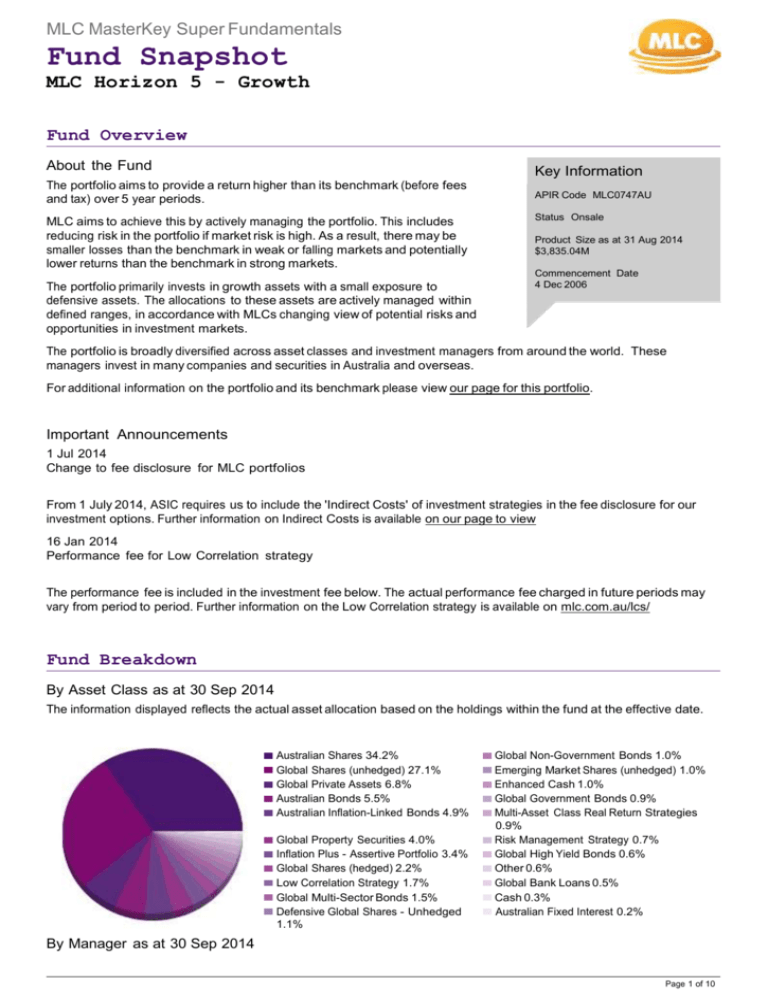

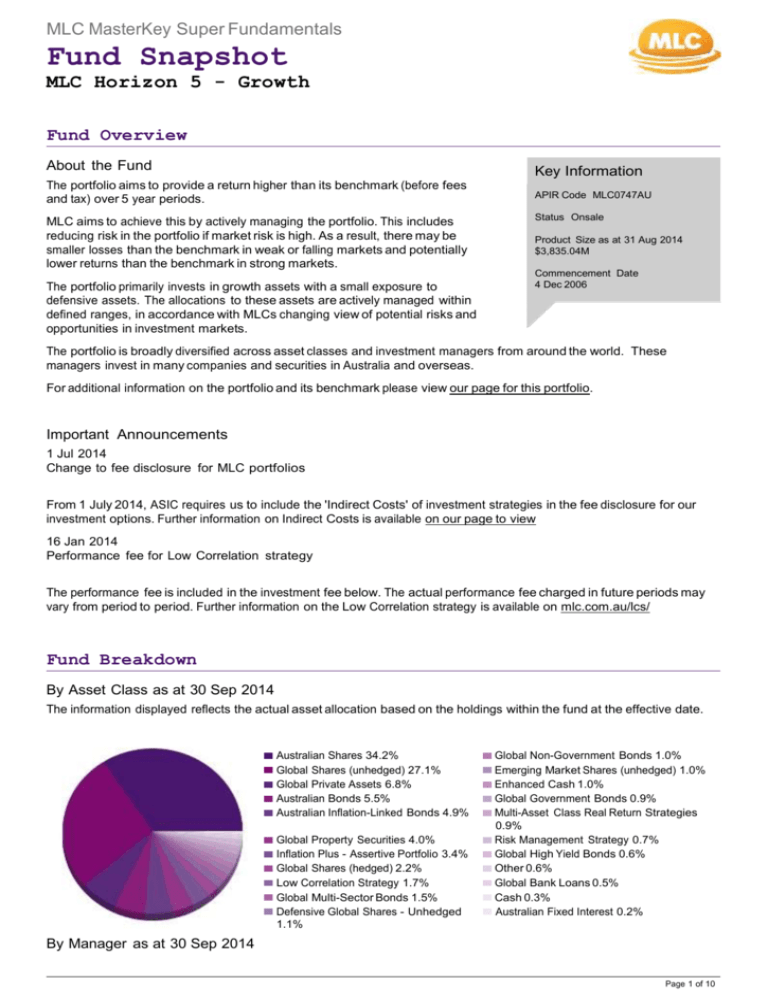

Fund Breakdown

By Asset Class as at 30 Sep 2014

The information displayed reflects the actual asset allocation based on the holdings within the fund at the effective date.

Australian Shares 34.2%

Global Shares (unhedged) 27.1%

Global Private Assets 6.8%

Australian Bonds 5.5%

Australian Inflation-Linked Bonds 4.9%

Global Property Securities 4.0%

Inflation Plus - Assertive Portfolio 3.4%

Global Shares (hedged) 2.2%

Low Correlation Strategy 1.7%

Global Multi-Sector Bonds 1.5%

Defensive Global Shares - Unhedged

1.1%

Global Non-Government Bonds 1.0%

Emerging Market Shares (unhedged) 1.0%

Enhanced Cash 1.0%

Global Government Bonds 0.9%

Multi-Asset Class Real Return Strategies

0.9%

Risk Management Strategy 0.7%

Global High Yield Bonds 0.6%

Other 0.6%

Global Bank Loans 0.5%

Cash 0.3%

Australian Fixed Interest 0.2%

By Manager as at 30 Sep 2014

Page 1 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Page 2 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Asset Class

Australian Bonds

Manager

Percentage

Investment Amount

Antares

2.7%

$271

UBS

2.8%

$280

Australian Fixed Interest

Antares

0.2%

$18

Australian Inflation-Linked Bonds

Antares

4.9%

$492

Australian Shares

Alphinity Investment Management

5.4%

$543

Antares

6.0%

$596

JCP

5.4%

$540

Northcape

4.0%

$397

Other

1.7%

$167

Redpoint

6.2%

$619

Vinva

5.5%

$553

Cash

Cash

0.2%

$23

Defensive Global Shares - Unhedged

International Value Advisors

1.1%

$111

Emerging Market Shares (unhedged)

Capital International

1.0%

$98

Enhanced Cash

Antares

1.0%

$97

Global Bank Loans

Shenkman Capital

0.5%

$47

Global Government Bonds

Goldman Sachs

0.9%

$91

Global High Yield Bonds

Oaktree

0.2%

$25

W.R. Huff

0.2%

$23

Amundi

0.4%

$36

Franklin Templeton

0.2%

$25

PIMCO

0.7%

$72

Peridiem

0.2%

$19

Loomis

0.5%

$52

Global Multi-Sector Bonds

Global Non-Government Bonds

Wellington Management

0.5%

$50

Global Private Assets

MLC Global Private Markets

6.8%

$680

Global Property Securities

Morgan Stanley

1.4%

$140

Other

0.2%

$24

Presima

0.9%

$92

Resolution Capital

1.4%

$140

Carnegie Asset Management

0.3%

$28

Dimensional

0.3%

$28

Harding Loevner

0.3%

$33

Jackson Square Partners

0.3%

$26

Kiltearn Partners

0.2%

$16

Sands Capital

0.3%

$28

Tweedy, Browne

0.3%

$31

Walter Scott

0.3%

$33

Carnegie Asset Management

3.5%

$354

Dimensional

3.2%

$319

Harding Loevner

3.8%

$375

Jackson Square Partners

2.9%

$295

Kiltearn Partners

2.0%

$199

Other

0.6%

$57

Sands Capital

3.2%

$323

Tweedy, Browne

3.6%

$362

Walter Scott

4.3%

$425

Inflation Plus - Assertive Portfolio

LTAR Multi-Manager Approach

3.4%

$340

Low Correlation Strategy

MLC Alternative Strategies

1.6%

$163

Global Shares (hedged)

Global Shares (unhedged)

Page 3 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Multi-Asset Class Real Return Strategies

Pyrford

0.3%

$29

Ruffer

0.6%

$61

Other

Other

0.9%

$87

Risk Management Strategy

MLC Investment Management

Total

0.7%

$68

100.0%

$10,000

Stock Holdings

Top Stocks for Fund as at 31 Aug 2014

The Top Stocks for Fund have a one month reporting delay.

Stock Description

Industry

Country

Percentage

Investment Amount

COMMONWEALTH BANK OF AUSTRALIA

Financials

Australia

3.0%

$300

BHP BILLITON

Materials

Australia

3.0%

$298

WESTPAC BANKING CORP

Financials

Australia

3.0%

$296

ANZ BANKING GROUP

Financials

Australia

2.6%

$257

TELSTRA CORP

Telecommunication Services

Australia

2.0%

$205

NATIONAL AUSTRALIA BANK

Financials

Australia

1.8%

$175

WOOLWORTHS LTD

Consumer Staples

Australia

1.0%

$96

RIO TINTO

Materials

Australia

1.0%

$96

WESFARMERS

Consumer Staples

Australia

0.9%

$88

QBE INSURANCE GROUP

Financials

Australia

0.7%

$71

Page 4 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Performance

Historical Performance

Absolute Fund Returns as at 30 Sep 2014

Returns for periods one year or greater are calculated on an annualised basis. All returns are calculated using end of

month redemption prices assuming all distributions are reinvested and are net of management fees which may include

administration fees, issuer fees and investment fees and prior to any individual tax considerations, and do not allow for

initial entry fees.

The returns outlined below represent historical performance only and is not an indication of future performance. The value

of an investment may rise or fall with changes in the market. Returns are calculated in accordance with FSC Standard No

6.

3 month

6 month

1 Year

2.1%

4.2%

9.5%

Fund Performance

3 Years

13.2%

5 Years

7.9%

10 Years

N/A

Since

Inception

4 Dec 2006

3.7%

Commentaries

Fund Commentary

As at 30 September 2014

The portfolio produced a return of 2.3% in the quarter and 11.3% in the year to 30 September 2014 (before fees and tax).

Contributors to performance

Key contributors to performance for the quarter and the year are in the following table. Returns are before fees and tax.

For the quarter

For the year

Page 5 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

The portfolios global shares (unhedged) strategy delivered a

very strong return of 5.6%. Global shares performed well in the

quarter despite market volatility beginning to increase in the

month of September. Improving economic data from the US

and accommodative monetary policy continued to push share

prices higher around the world.

The portfolios global private assets strategy produced a very

strong return of 6.0%.

The multi-asset real return strategy produced a return of 3.2%

over the quarter.

The portfolios return for the year was strong.

The portfolios investment in the global shares (unhedged)

strategy delivered a very strong return of 17.9%. Five of seven

managers underperformed the broader market for the year (the

eighth manager, Kiltearn, has been in the portfolio for less than

a year). Strong performance by Carnegie couldnt overcome the

drag caused by Jackson Square Partners and Walter Scott.

The Australian shares strategy delivered a return of 5.4%. The

Australian economy continues to expand at a moderate pace,

despite continued weakness in mining investment. There are

signs that the non-mining economy is improving: housing

activity is picking up, business investment outside of the mining

industry is starting to grow, and private sector credit growth has

been accelerating. However, whether this pick-up in

non-mining activity will be sufficient to offset weaker mining

investment is still unclear.

Global private assets delivered an extremely strong return of

21.6%.

Performance relative to the benchmark

The portfolio has achieved its return objective to provide a return higher than its benchmark (before fees and tax) over 5

year periods. Over the 5 years to 30 September 2014, the portfolio has outperformed its benchmark by 0.3% pa. And by

applying the Investment Futures Framework MLC continues to reduce risk in the portfolio when market risk is high, as

explained below.

Portfolio positioning

These are currently the main positions in the portfolio. In the September quarter, we made small changes to increase the

portfolios defensive positioning, relative to its benchmark, before the Australian share market decline in September.

In recent quarters, several factors have combined to increase the risk of a further market correction. These include the

prospect of more normal monetary policy in the US, slowing global growth and the possibly of renewed recession in

Europe, the spread of Ebola, and a worrying mix of other geopolitical factors. While none of these factors is new, the risk

of each has intensified. Because of these factors, along with stretched market valuations, the portfolio had been

positioned more defensively before the September market decline. So far, the decline in share prices has not been

enough to offset the rise in risk, which meant that at the end of the September quarter the portfolio remained defensively

positioned.

Page 6 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Portfolio position compared with

benchmark

Why we have the position

Impact on performance

Below benchmark exposure to

growth assets

We have implemented this position by:

The portfolio has a large exposure to shares to generate

long-term returns. However, because shares can be volatile,

weve increased the portfolios diversification over time to

manage risk and generate more robust returns. These

risk-controlled exposures include multi-asset real return

strategies, the Low Correlation Strategy, a multi-asset emerging

markets strategy and the defensive global shares strategy.

During the September quarter, these strategies helped reduce

exposure to declining share markets.

As these strategies were introduced to the portfolio, we

reduced allocations that invest in the broader Australian and

global share markets.

For the last few years share market returns, supported by

unusually low interest rates, have been strong and have tended

to run ahead of actual company earnings. When market returns

have been strong for a long period, there is increased risk that

share valuations become stretched, and that markets may fall.

In the September quarter, there were signs of a change in the

share markets behaviour, with higher volatility and the US

Federal Reserve being less able to soothe market concerns.

As a result, during the quarter there was a limited reversal of

strong share market returns. However, our assessment remains

that the decline in share prices has not been enough to offset

the rise in the risk of a market correction. Potential negative

scenarios for growth assets (such as shares) include

Developed market austerity, Recession, Stagnation and

China hard landing.

The portfolio will continue to benefit from strong returns in

positive scenarios for growth assets, such as a Mild

inflationary resolution or an Early re-leveraging scenario. In

these scenarios, growth assets should perform strongly

compared to bonds.

Another positive scenario for growth assets is Extended

quantitative easing. This scenario is starting to emerge in

Europe due to weak economic data. In this scenario market

expectations of more monetary stimulus could push growth

assets higher.

Our below benchmark exposure to growth assets is consistent

with the views of a number of our investment managers that the

risk of a negative environment for growth assets has risen.

By further reducing the allocation to

Australian shares before the market

decline in September, the portfolio

benefited from the strong share

market performance of previous

months.

This position may mean the portfolios

returns will be slightly lower if share

markets rebound from Septembers

decline. However, we consider the

position is appropriate given the

current risk level and the increased

protection it will provide if negative

scenarios occur.

While government bond yields (interest rates on bonds) could

decline from their already low levels, the potential for further falls

is less than the potential for yields to rise. Rising yields means

bond prices fall and there is the potential for negative returns.

By reducing the duration, weve reduced the risk of negative

returns if yields rise, such as in a Sovereign yield re-rating

scenario.

Shortening the duration of our government bond strategy will

also give the portfolio some protection if inflation eventually

rises. In a Rising inflation or Inflation shock scenario,

traditional bonds would perform poorly and could deliver

negative returns.

We also recently increased the portfolios exposure to

inflation-linked bonds to benchmark level. Although the yields

on these bonds are quite low, their returns move with inflation

(unlike traditional bonds). This means they can help protect

against the risk of rising inflation.

Global government bond yields rose

in September, benefiting

performance. However, yields fell

earlier in the year, reducing the

portfolios one year returns.

reducing the Australian shares

allocation and

1. increasing exposure to the

Low Correlation Strategy.

Below benchmark exposure to

interest rate risk

We have implemented this position by:

reducing the duration

(exposure to changes in bond

interest rates) of our

government bond strategy,

and

tilting the portfolio away from

global bonds and towards

cash and Australian bonds.

Page 7 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Above benchmark exposure to

foreign currencies

We have implemented this position by:

reducing the allocation to

global shares whose foreign

currency exposure is hedged

to the Australian dollar

increasing exposure to

unhedged global shares, and

maintaining unhedged

exposures in most global

growth assets.

When designing the portfolio, we aim to combine assets and

strategies which perform differently in different scenarios. Global

share markets and the Australian dollar (AUD) tend to move in

the same direction. So by having an exposure to foreign

currencies (that is, not hedging some of our overseas assets to

the AUD) we can help insulate our portfolios against losses

when share markets fall.

Foreign currency exposure is therefore an important diversifier

of risk for the portfolio. We expect that it will help generate more

robust returns, even though the Australian dollar (AUD) has

declined from its highest point. Our above benchmark position

is intended to reduce the portfolios exposure to negative returns

in a number of negative scenarios, including China hard

landing.

Its important to note that our portfolio positioning doesnt

assume that the AUD will decline. We also consider scenarios in

which the AUD rises, including Extended quantitative easing

and Sovereign yield re-rating. However, in many scenarios we

expect the AUD to fall further, particularly if share prices fall

sharply. These scenarios include China hard landing.

The AUD and global share markets

fell in September. Our foreign

currency exposure worked well this

quarter, offsetting the negative

market returns.

During the year the overweight

foreign currency exposure has helped

to reduce the volatility of returns.

Changes to the portfolio

To reflect the positions outlined in the table above, during the quarter we:

reduced the allocation to Australian shares by 1%,

increased the allocation to the low correlation strategy by 1%,

reweighted our global property securities managers, and

appointed Loomis as a global non-government bonds manager and removed Rogge. The global non-government

bonds manager allocations in our fixed income strategies have delivered strong returns over the last three years.

We believe we can further improve the returns and risk control of these allocations by replacing Rogge with

Loomis. Thats because Loomis investment approach, which is based on bottom-up relative value research, is

different from and complementary to the top-down approach of Wellington (the other manager in the allocation).

Note:

- Please refer to the Market commentary for an overview of what happened in domestic and global markets over the

quarter.

- Fund commentary for this fund will be updated two to three weeks after the end of the month

Page 8 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Market Commentary

As at September 2014

Returns to 30 September 2014*

Asset class

3 mth (%)

1yr (%)

3yr (%)

5yr (%)

10yr (%)

Cash

0.7

2.6

3.4

3.9

4.9

Australian bonds

1.0

6.0

5.8

6.7

6.3

Global investment grade bonds (hedged)

1.8

8.1

7.1

8.0

7.6

A-REITs

1.1

12.2

18.9

8.6

1.9

Global REITs (hedged)

-1.3

12.0

19.8

15.8

na

Australian shares

-0.6

5.9

14.8

6.8

8.4

Global shares (hedged)

2.0

18.3

22.0

14.3

9.6

Global shares (unhedged)

5.5

19.6

21.4

10.8

5.8

Sources: Datastream, MLC Investment Management. *Annualised returns except for 3 month.

Benchnark data include UBS Bank Bill Index (Cash), UBS Composite Index (Aust bonds) Barclays Global Aggregate hedged to A$ (Global bonds),

S&P/ASX200 A-REIT Accumulation Index (A-REITs), MLC Global property strategy benchmark hedged to A$ (Global REITs), S&P/ASX200

Accumulation index (Aust shares) and MLC global equity strategy benchmark (MSCI All Country Indices hedged and unhedged in A$).

World share markets managed to post solid gains over the September quarter, despite declines in US and UK share

prices and some key emerging markets during September. Unhedged global share returns were boosted by a sharply

lower Australian dollar, which fell below US90c in September.

The Australian share market had a disappointing quarter. Bank shares fell on concerns about the possibility of regulatory

intervention in lending markets (particularly housing) and possible changes to capital requirements, which could impede

the banks future profitability. Mining shares also dropped sharply as the price of iron ore fell to five-year lows.

Government bond yields were little changed in the US, but declined in most other world bond markets, allowing bond

investors to enjoy reasonable gains during the quarter.

Share prices continued to benefit from extraordinarily easy monetary policy, despite the impending end of the US Federal

Reserves quantitative easing program, and a stronger global economy, largely due to a clear improvement in US growth.

Indications of renewed weakness in the eurozone have prompted the European Central Bank to adopt further monetary

measures to boost growth.

Geopolitical concerns continued to periodically trouble financial markets. The Ukrainian crisis remains unresolved, even

though there have been efforts to secure a ceasefire. The so-called Islamic State remains in control of large swathes of

Syria and north-western Iraq, despite the commencement of US and allied airstrikes against it.

The Australian economy continues to expand at a moderate pace in spite of continued weakness in mining investment.

There are signs that the non-mining economy is improving: housing activity is picking up, business investment outside the

mining industry is starting to grow, and private sector credit growth has been accelerating. However, whether this pick-up

in non-mining activity will be sufficient to offset weaker mining investment is still unclear.

The Reserve Bank of Australia kept interest rates on hold over the quarter and has signalled its intention to leave rates

unchanged for some time to come. At just 2.5%, the official cash rate remains at its lowest level in living memory. While

Australias economic growth is far from spectacular, the economy does not appear weak enough to reduce rates further,

particularly given concerns about a potentially overheated property market. However, the economy not is strong enough

to warrant higher interest rates at this point.

Page 9 of 10

MLC MasterKey Super Fundamentals

Fund Snapshot

MLC Horizon 5 - Growth

Portfolio

Information in this report does not take into account your objectives, financial situation or needs. Before acting on the information you should consider

whether it is appropriate to your situation. You should consider the relevant Product Disclosure Statement before making a decision about the product.

Past performance is not a reliable indicator of future performance. Please also see Advice Warning and Important Information.

MLC Limited (ABN 90 000 000 402 AFSL 230694) is the issuer of:

MLC MasterKey Investment Bond

MLC Nominees Pty Ltd (ABN 93 002 814 959 AFSL 230702 Trustee of The Universal Super Scheme ABN 44 928 361 101) is the issuer of:

MLC MasterKey Business Super (including MLC MasterKey Personal Super), MLC MasterKey Superannuation, MLC MasterKey Super, MLC MasterKey

Super Fundamentals, MLC MasterKey Allocated Pension, MLC MasterKey Pension, MLC MasterKey Pension Fundamentals, MLC MasterKey Term

Allocated Pension

MLC Investments Limited (ABN 30 002 641 661, AFSL number 230705) is the issuer or operator of:

MLC Investment Trust, MLC MasterKey Investment Service, MLC MasterKey Investment Service Fundamentals, MLC MasterKey Unit Trust, MLC

Investments Limited also trades as MLC Private Investment Consulting.

NULIS Nominees (Australia) Limited (ABN 80 008 515 633 AFSL 236465):

trustee of the MLCS Superannuation Trust ABN 31 919 182 354 is the issuer of Navigator Eligible Rollover Fund ABN 32 649 704 922;

trustee of the MLC Superannuation Fund ABN 40 022 701 955 is the issuer of MLC Wrap Super and MLC Navigator Retirement Plan.

Navigator Australia Limited (ABN 45 006 302 987 AFSL 236466) is the Operator and issuer of:

MLC Wrap Investments, MLC Wrap Self Managed Super and MLC Navigator Investment Plan.

© You are only authorised to use the data and content for the purpose of research, validation and monitoring of your personal investments. You may not

redistribute the data and content to any other person under any circumstances.

2013 Morningstar, Inc. All rights reserved. The data and content contained herein are not guaranteed to be accurate, complete or timely. Neither

Morningstar, nor its affiliates nor their content providers will have any liability for use or distribution of any of this information. To the extent that any of the

content above constitutes advice, it is general advice that has been prepared by Morningstar Australasia Pty Ltd ABN: 95 090 665 544, AFSL: 240892

(a subsidiary of Morningstar, Inc.), without reference to your objectives, financial situation or needs. Before acting on any advice, you should consider the

appropriateness of the advice and we recommend you obtain financial, legal and taxation advice before making any financial investment decision. If

applicable investors should obtain the relevant product disclosure statement and consider it before making any decision to invest. Some material is

copyright and published under licence from ASX Operations Pty Limited ACN 004 523 782 ("ASXO"). DISCLOSURE: Employees may have an interest in

the securities discussed in this report. Please refer to our Financial Services Guide (FSG) for more information at http://www.morningstar.com.au/fsg.asp

Page 10 of 10