The Companies ordinance - six

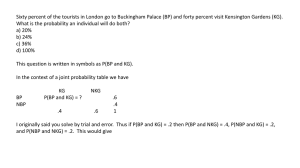

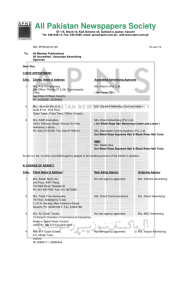

advertisement