Print - Montana State University Billings

advertisement

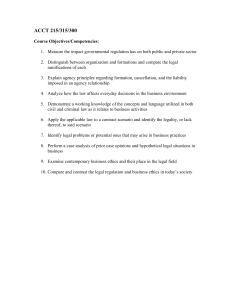

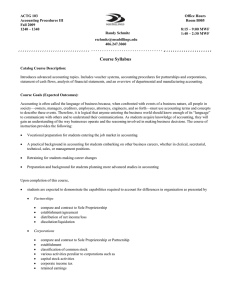

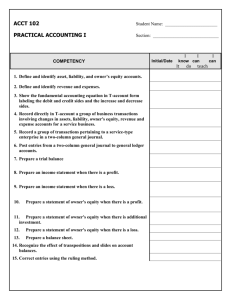

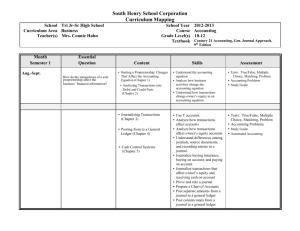

ACTG 101 Accounting Procedures I Fall 2009 1020 – 1120 Office Hours Room B005 Randy Schmitz 8:15 – 9:10 MWF 1:40 – 2:30 MW rschmitz@msubillings.edu (406) 247-3060 Room B007 Course Syllabus Catalog Course Description: Introduces fundamental double-entry accounting concepts and terminology. Emphasis on analyzing and recording business transactions and completing, adjusting, and closing entries for the accounting cycle of a service business. Includes procedures for banking, cash funds, and calculating and recording payroll. Course Goals (Expected Outcomes): This course is designed to help students begin to understand the role of accounting as the language of business in our free enterprise system. It examines accounting procedures and methods as they apply to a service enterprise. As students acquire a knowledge of accounting, they will gain an understanding of the way businesses operate and the reasoning involved in making business decisions. The course of instruction provides the following: Vocational preparation for students entering the job market in accounting A practical background in accounting for students embarking on other business careers, whether in clerical, secretarial, technical, sales, or management positions. Retraining for students making career changes Preparation and background for students planning more advanced studies in accounting Upon completion of this course, students are expected to demonstrate the capabilities required to complete an accounting cycle for single owner, service oriented, professional businesses, including— The fundamental accounting equation Books of original and secondary entry Financial statements Work sheet Adjusting and closing entries Combined journal Bank accounts and cash funds Employee and employer components of Payroll Course Objectives Outline (Competencies): I. Introduction A. Define accounting B. Explain the importance of accounting information II. Accounts A. Define and identify assets, liability, and owner’s equity accounts B. Record a group of business transactions, in column form, involving changes in assets, liabilities, and owner’s equity C. Define and identify revenue and expense accounts D. Record a group of business transactions, in column form, involving all five elements of the fundamental accounting equation. III. Debits/Credits, T accounts, Trial Balance, Financial Statements A. Present the fundamental accounting equation with the T account form and label the debit and credit sides as well as the plus and minus sides B. Record directly in T accounts C. Determine balances of T accounts having entries recorded on both sides of the accounts D. Prepare a Trial Balance E. Prepare financial statements IV. General Journal, General Ledger A. Record a group of transactions pertaining to a service enterprise in a two-column general journal B. Post entries from a two-column general journal to general ledger accounts C. Prepare a trial balance from the ledger accounts V. Adjusting Entries, Work Sheet A. Complete a work sheet for a service enterprise, involving adjustments B. Prepare financial statements from the completed work sheet C. Journalize and post adjusting entries VI. Closing Entries, Post-Closing Trial Balance A. Journalize and post adjusting entries B. Prepare a post-closing trial balance VII. Combined Journal A. Record transactions for both a professional and a service enterprise in a combined journal B. Post from the combined journal C. Record adjusting and closing entries in a combined journal VIII. Bank Accounts, Cash Funds A. Reconcile a bank statement B. Record the required entries directly from the bank reconciliation C. Record journal entries to establish and replenish a Petty Cash Fund D. Record the journals entries to establish a Change Fund E. Record journal entries for transactions involving Cash Short and Over IX. Employee Earnings and Deductions A. Calculate total earnings based on an hourly, piece-rate, or commission basis B. Determine deductions from tables of employees’ income tax withholding C. Complete a payroll register D. Journalize the payroll entry from a payroll register E. Maintain employees’ individual earnings records X. Employer Taxes, Payments, and Reports A. Calculate the amount of payroll tax expense and journalize the related entry B. Journalize the entry for the deposit of employees’ federal income taxes withheld and FICA taxes C. Journalize the entries for the payment of employer’s state and federal unemployment D. Journalize the entry for the deposit of employees’ state income taxes withheld E. Complete the Employer’s Quarterly Federal Tax Return F. Complete year-end tax forms and returns G. Determine and record end-of-the-year adjustments for workers’ compensation insurance and accrued salaries. Specific Instructional Materials, References & Text List: College Accounting, 9th Edition, McQuaig, Douglas J. and Bille, Patricia A., Houghton-Mifflin, 2008 Working Papers to Accompany College Accounting, 9th Edition, McQuaig, Douglas J. and Bille, Patricia A., HoughtonMifflin, 2008 Outcomes Assessment and Grading Procedures: Homework is due at the beginning of the class period and is accepted on the due date only. Daily assignments that are collected are worth five points each when handed in complete and will be averaged into each student’s individual grade for the course. An application exam will be given after each unit. Each test is worth 100 points and will be given at the scheduled time only. The final grade will consist of the average of the unit test scores and the homework grade. Satisfactory completion of this course requires consistent classroom attendance and active participation. Grading: 92–100 82–91 70–81 60–69 Below 60 A B C D F Classroom Policy: Students’ rights and responsibilities, as well as the Code of Conduct are outlined in the Montana State University Billings Student Handbook. Students should be familiar with the rights and responsibilities of students in the Academic Community. Students with disabilities, whether physical, learning or psychological, who believe that they may need accommodations in this class are encouraged to contact Disability Support Services as soon as possible to ensure that such accommodations are implemented in a timely fashion. Please meet with DSS staff to verify your eligibility for any classroom accommodations and for academic assistance related to your disability. Disability Support Services is located in A030, COT, 247-3029. Cheating, plagiarism, and other acts of academic dishonesty are regarded as serious offenses. Instructors have the responsibility to submit, in a written report to the Associate Vice President of Student Life, any such incident that cannot be resolved between the instructor and student. Depending on the nature of the offense, serious penalties may be imposed, ranging from loss of points to expulsion from the class or college. Student rights and responsibilities can be located in the MSU-Billings Student Handbook. Instructors have the responsibility to set and maintain standards of classroom behavior appropriate to the discipline and method of teaching. Students may not engage in any activity which the instructor deems disruptive or counterproductive to the goals of the class. Students that have a concern regarding any inappropriate conduct should bring it to the attention of their instructor, advisor, or Department Chair immediately. Inappropriate conduct situations will be reviewed immediately. Cellular phones, pagers, CD or various media players, and similar devices can be a nuisance and are prohibited in the classroom and laboratory facilities. Turn them off before entering the classroom. Each use will result in a 20 point deduction from your final grade. Instructors have the right to remove offending students from class. Repetition of the offense may result in expulsion from the course. The use of a cell phone as a calculator is not acceptable. Children represent a disruptive element for the classroom. They also increase the risk of accidents occurring in the laboratory. For those reasons, children should not be brought to either the classroom or the laboratory Free tutoring services for students are available in the Academic Support Center at the COT, A035, Monday through Friday, 8 a.m. – 5 p.m. The Academic Support Center on the other campus is open from 8 a.m. – 8 p.m. Monday – Thursday, 8 a.m. – 5 p.m. Friday, and 9 a.m. – noon Saturday. Tutors specialize in math, writing, anatomy and physiology, and other specialty areas for specific majors. See http://www.msubillings.edu/asc/ for more information or call 247-3022 (COT) or 657-1641 (other campus). MSU Billings supports a drug free environment. Any student who demonstrates a pattern of behavior that suggests drug or alcohol abuse will be asked to leave class and must participate in a counseling program prior to continued attendance. Continued abuse may result in reprimand, probation, restriction, suspension or expulsion. Rev. September 2, 2009