Discussion Paper_Architecture and Interior

advertisement

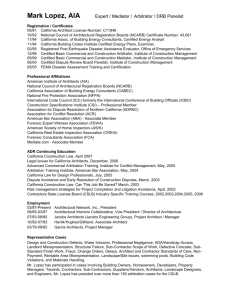

CARIFORUM-EU Business Forum Architecture & Interior Design November 2008 ARCHITECTURE AND INTERIOR DESIGN Perspectives of Caribbean - EU Business Developments The Caribbean Architectural Industry Within the Caribbean, trade in architectural services is being driven by a combination of the larger firms opening offices in other islands and sub-contracting or alliances with specialists based in other countries. The larger architectural practices are based in the Dominican Republic, Barbados, Jamaica and Trinidad. They have opened offices in other islands. In addition, in the OECS, there is evidence of a growing intra-regional trade in architectural services. As the CSME emerges, it is enabling greater movement of persons. Currently, each country has its own association of architects and the right to practice in that jurisdiction is linked to membership of the association by law. Reducing the barriers to mutual recognition of registration should not pose a problem. The Caribbean School of Architecture, at the University of Technology, Jamaica, is the only School of Architecture in the English-speaking Caribbean. Further, a large proportion of Caribbean architects are registered with the Royal Institute of British Architects (RIBA). This provides the basis for a common recognition of qualifications and registrations. Encouraging greater freedom to practice across the CSME would be helpful in developing the capability to provide architectural services to more attractive markets in the US and UK. It would enable larger firms to emerge that would have the capacity to supply services to these markets. And it would enable specialisation to increase and competitive advantage to develop in niche segments. Trade in Architectural Services International trade in architectural services is growing for many of the same reasons as engineering services. The globalisation of the construction industry, the growing importance of large, complex projects that require large or specialised architectural firms and growing cost differentials between architects from the rich developed countries and the rest of the world, are common to the growth of both types of service. However, global trade in architectural services is likely to be considerably lower in value than engineering services for a number of reasons: Foreign architects need to be registered locally to be able to practice architecture. Registration is considerably harder than for engineers (see the Qualification and Accreditation Section below) requiring foreign architects to practice as interns and pass exams, all but preventing the supply of services on a temporary basis (mode 4) unless the architect has registered previously. 2 Many countries specify who may apply for planning permission, limiting this key function to those who are registered to practice architecture in the country. The nature of architecture means that the types of work that may be subcontracted or outsourced is more limited than engineering. The large architectural firms are smaller and less globalised than their engineering counterparts and hence less able to drive international trade. International trade in architecture will grow rapidly, but will be driven mainly by the international expansion of large firms. Outsourcing will remain limited to a few labour-intensive processes such as draughtsmanship. This is borne out by the fact that the outsourcing of architectural services has received far less attention from within the profession than outsourcing of engineering services has. The market for architectural services is also fairly strongly contested. In the UK for instance, charges for an architect (not senior) range from US$85/hour to US$115/hour and for an architect’s assistant, US$65/hour to US$85/hour. Whether the difference in pricing is sufficient to compensate Caribbean architects for investing the time and money in developing a market overseas and still enables them to undercut domestic service providers remains to be determined. Qualifications and Accreditation in UK and EU To practice in the UK, architects must be registered with the Architects Registration Board (ARB). Britain is a world leader in architectural education, evidenced by a high enrolment rate by international students. In 2000/01, 15.4% of architecture students entering British universities were from overseas. The ARB does not recognise any qualifications obtained outside the UK (including international courses validated by the RIBA) except those covered by the European Commission Architects’ Directive 85/384/EEC. Appropriately-qualified architects from EU Member States registered in their own country are able to register in other Member States. Most UK architectural qualifications are recognised under the Directive and UK architects registered with ARB may register in other EU member countries. For architects qualified in other EU member countries via one of the academic programmes listed under Directive 85/384/EEC, s/he may register with the ARB following two years European professional experience and go on to practice as an architect within the UK. Statutory control over who may practice varies from one Member State to another. Whist countries such as Denmark, Ireland and Sweden exercise no state control, others reserve some functions for domestically registered architects or put in place various restrictions 3 such as who may make planning applications. In the UK, the sole professional body is RIBA. RIBA represents 24,000 architects in the UK and a further 3,000 overseas. Its main function is to promote the development of the profession in the UK, though it plays an important regulatory role with the ARB in registering architects. RIBA membership provides recognition of professional competence and is hugely important in the UK market. To be a RIBA member, one has to train for a minimum of seven years, which normally involves three key stages: A five-year degree programme, on a course that is recognised by the RIBA and the ARB. A minimum of two years Professional Experience in an architects' office or equivalent. This is followed by the RIBA Examination in Professional Practice and Management. For those who wish to apply for chartered membership of the RIBA, s/he must have completed five years professional experience since finishing listed qualification. In addition to individual membership, most of the UK’s architectural practices are also corporate members of RIBA. The key criteria for RIBA Registered Practices include: A minimum of 80% of registered architects within the practice are RIBA Chartered Members The active Principal or Executive Company director of the practice is currently a RIBA Chartered Member. They have management systems in place to ensure their architects comply with RIBA Continuing Professional Development obligations. A RIBA registered practice may register overseas, following the requirements and process set up by the national registration body of that particular country. For architects qualified from outside the EU to register as an architect in the UK, s/he needs to apply for an assessment by the RIBA and the ARB through the ARB RIBA Assessment Panel to obtain recognition of her/his qualification and then sit the Professional Practice Examination run by the RIBA. For those who have their architectural education partially completed overseas and plan to complete studies within the UK, they will first need to have their international study assessed for equivalence to UK standards before undertaking further study on 4 RIBA ARB recognised courses in the UK. Hence, for those architects that have studied and qualified in non-EU countries, there are substantial barriers to supplying services to the EU. All that is open, for now, is to provide non-critical services such as producing drawings. The EPAs would change this substantially. The draft EPAs indicate that architects would benefit alongside engineers by having greater access to EU markets. Provisions in the EPA Entertainment/cultural industries have been central to CARIFORUM in the negotiating process of the EPA. In terms of liberalizations the following sectors are open to the EU market: model agency services, architects, interior design and other specialties design services, entertainment services (with some restrictions in a few EU member states). Restrictions are applied depending on the type mode of export as well as the EU member states. In total CARIFORUM has access to 90% of EU services sector. CARIFORUM opened 65% of the sector including entertainment. The following actions agreed as stated in Protocol III, will benefit the sector: the parties agree to exchange of information and cooperation on cultural and audiovisual matters through the ECCARIFORUM Dialogue Facilitation of entry including from CARIFORUM to the EU of artist and other cultural professionals and practitioners. The stay could be of up to 90 days. Technical assistance offered to CARIFORUM countries for the development of the cultural industries, development and implementation of cultural policies and in promoting the production and exchange of cultural goods and services. Cooperation will include training, exchange of information, expertise and experiences, counselling in elaboration of policies and technology transfer and know how. There will be specific collaboration in performing arts as well as the publishing industry and the protection of sites and historic monuments. 5 Actions to be implemented The proposals arising from the different regional meetings and study indicate four key areas for a possible regional work plan for cultural sector as a whole and the Architecture and Interior Design subsectors in particular: -Policy and enabling environment. This component will assist national governments to develop facilities and incentives to promote the export of creative industries. It is also assist through mechanism indicated above, to establish regional approach to the entire sector or the sub sectors. Institutional support for the establishment of national and regional associations from the different sub sectors as well as the development of inter-linkages support. Business Development Support to include training on different areas including intellectual property rights and technical support. This component would also give assistance to the establishment of clusters from the different industries or across industries like the suggested that links creative industries and ICT. Marketing Caribbean on its creative products. The marketing activities will include branding of the industry, participation in festivals and other international events, matchmaking, etc. Financial Resource Availability European Union 1. 9th EDF Caribbean Regional Indicative Programme: Caribbean Integration Support Programme: Support on standards to CROSQ and CRNM 9th EDF CTPSD Caribbean Trade and Private Sector Development ProgrammePhase 2 2. 10th EDF Caribbean Regional Indicative Programme which is currently being approved and operational zed. 3. PROINVEST: In its second phase will support larger sectoral projects from €500,000 up through call for proposals. 4. Centre for the Development of Enterprises (CDE): Offer technical assistance and Sectoral Support for selected creative industries sectors. CDE is an ACP-EU organizations 6 5. Institutional Support Programme for Regional Integration (ISPRI): €5 million project to assist the Dominican Republic to foster closer collaboration and integration with the rest of CARIFORUM. 6. BizClim: All ACP support to actions to improve the business environment. 7. Other EU individual member states have pledged support to EPA development related projects. However, this is being discussed at the level of the Regional Preparatory Task Force (RPTF) between CARIFORUM and EC. Other Donors: 1. CIDA’s CARICOM Trade and Development Project: Executed by the CARICOM Secretariat for CSME harmonisations activities 2. Case of Barbados The World Bank has support for e-commerce initiatives. (Source of information: “Strategic Marketing Plan for the Promotion of Professional Services Exports” , CEDA and EME, Barbados, January 2007) Market Positioning The size, quality and maturity of the Bajan industry give the country a competitive advantage in the CSME. Exporting to the region has already taken place and this market continues to present the best chance for increased exports. Trade negotiations should seek to open up the EU and the US to architects and if that is done, there may be long-term possibilities in those markets. At the moment, higher valueadded services are not outsourced, but if this were to change, Bajan architects could attempt to supply such services to UK and US firms via cross-border supply, which would allow them to avoid onerous registration requirements. Capability and Competitiveness Architecture is a smaller industry than engineering and this general pattern is reflected in the sizes of the two industries in Barbados. There are roughly 24 architecture firms in the country and the Barbados Institute of Architects (BIA) has 64 members. Most local firms are one or two person operations that lack export capacity. Although the industry lacks scale internationally, it matches up well on quality. The Bajan architectural industry is among the largest in the region and can rival any other country for standard of service. 7 The cost of services in Barbados is competitive with the UK. The hourly fee for a drawing technician in Barbados ranges from US$20$55. Whereas an architect’s assistant in the UK, a position that involves drawing, can cost between US$65 and $85 per hour. So a competitive advantage exists in this area. However, the current accreditation scheme makes it difficult for architects to supply services to the UK through mode 4. And since outsourcing in the industry is limited to labour-intensive activities such as draughtsmanship, these activities are more likely to go to lower cost destinations with the ability to handle high volumes of work. Accessing the UK and the rest of the EU market will be dependent on easing of registration requirements through the EPA negotiations. Similarly, outsourced work from the US is not likely to be sent to Barbados, and the registration regime will have to be eased through trade negotiations before mode 4 service supply becomes feasible. Therefore, the primary opportunity for exports in this market segment lies within the CSME. Case of Saint Lucia (Source of information: “Strategic Marketing Plan for the Promotion of Professional Services Exports” , CEDA and EME, Saint Lucia, January 2007) Market Positioning The quality and cost structure of the Saint Lucian industry give the country a competitive advantage in the CSME. This market continues to present the best chance for increased exports. Trade negotiations should seek to open up the EU and the US to architects and if that is done, there may be long-term possibilities in those markets. At the moment, higher value-added services are not outsourced, but if this were to change, St. Lucian architects could attempt to supply such services to UK and US firms via cross-border supply, which would allow them to avoid onerous registration requirements. Capability and Competitiveness Architecture is a small industry in Saint Lucia with 27 registered architects and only two larger firms, although there are others practicing who have not registered as yet. Most local firms are thus one or two person operations that lack export capacity. Although the industry lacks scale internationally, it matches up well on quality. The cost of services in St Lucia is competitive with the UK, so a competitive advantage exists in this area. However, the current accreditation scheme makes it difficult for architects to supply services to the UK through mode 4. And since outsourcing in the industry is limited to labour-intensive activities such as draughtsmanship, these activities are more likely to go to lower-cost destinations with the ability to handle high volumes of work. Accessing the UK and the rest of the EU market will be dependent on easing of registration requirements through the EPA negotiations. 8 Similarly, outsourced work from the US is not likely to be sent to Saint Lucia and the registration regime will have to be eased through trade negotiations before mode 4 service supply becomes feasible. Therefore, the primary opportunity for exports in this market segment lies within the CSME. Case of Trinidad and Tobago Source of information: “Strategic Marketing Plan for the Promotion of Professional Services Exports” , CEDA and EME, Trinidad and Tobago, January 2007) Market Positioning The size, quality and maturity of the Trinidad and Tobago architectural industry give the country a competitive advantage in the CSME. Exporting to the region has already occurred and this market continues to present the best chance for increased exports. Trade negotiations should seek to open up the EU and the US to architects and, if that is done, there may be long-term possibilities in those markets. Trinidad and Tobago will not be able to compete with lowcost destinations for labour intensive outsourcing. At the moment, higher value-added services are not outsourced, but if this were to change, local architects could attempt to supply such services to UK and US firms via cross-border supply, which would allow them to avoid onerous registration requirements. Capability and Competitiveness The local architectural industry has a similar structure to the engineering sector, but on a smaller scale, which reflects the relative size of the two industries. The Board of Architecture of Trinidad and Tobago, the local authority charged with registering architects, recognises about 40 practices. Roughly 8 of these are considered large by local standards, which mean they have at least 5 architects. There are a few two professional firms, but the majority is singleperson operations; even the small firms do work on large projects. The Trinidad and Tobago Institute of Architects (TTIA) has 84 qualified architects as members. The quality of services is internationally-competitive, but the industry has a low profile outside of the region. Firms offer a full range of services, including design, technical drawings and project management. As a result of the petroleum industry, particular capabilities exist in areas such as efficient energy design and terrorist protection design. Costs are competitive with the UK and the TTIA provides recommended fee bands that charge a percentage based on the cost of the project, the classification of the building and whether it is a new building or work on an existing structure.30 These vary widely, from 4.8%-15.65%, but some firms charge between 6% and 10%. 9 While there is a cost advantage, the current accreditation scheme makes it difficult for architects to supply services to the UK through mode 4. And since outsourcing in the industry is limited to labourintensive activities such as draughtsmanship, these activities are more likely to go to lower-cost destinations with the ability to handle high volumes of work. Accessing the UK and the rest of the EU market will be dependent on easing of registration requirements through the EPA negotiations. Similarly, outsourced work from the US is not likely to be sent to Trinidad and Tobago, and the registration regime will have to be eased through trade negotiations before mode 4 service supply becomes feasible. The exporting that has taken place has been regional. 10