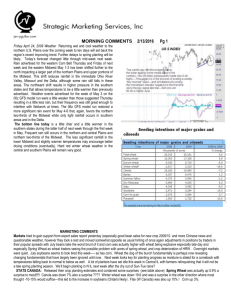

USA - A bumper grain harvest

advertisement