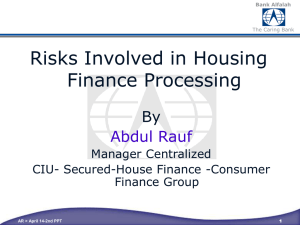

Internal Codes for Bank Alfalah Accounts

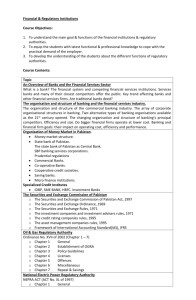

advertisement