National Bank - OLY Pakistan's Top Business Blog

advertisement

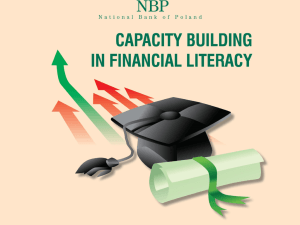

A project OF Management of NATIONAL BANK OF PAKISTAN Submitted by: Kashif Mehmood (09-ARID-910) University Institute of Information Technology (U A A R) 1 Internship/Employment Report (2013) Internship Report Bachelor of Business Administration Program Name:Kashif Mehmood Reg. No.: 09-Arid-910 Specialization: HR Telephone: 0334-5403469 E-Mail: kashipppp@yahoo.com University Institute of Management Sciences University of Arid Agriculture Rawalpindi Company Name: National Bank of Pakistan Industrial area Branch Islamabad (1531) Main Telephone Number(s):051-9258672-73 Fax Number: 9258671 Postal Address: National Bank of Pakistan Industrial area branch Islamabad Supervisor Name: Khalid Mahmood Abbasi(Manager Operation) Supervisor Telephone Number:0308-5163787 Start Date for Internship: 10 july 2012 End Date for Internship: 17 august 2012 Report Date: 21 feb 2013 2 Evaluation KASHIF MEHMOOD completed internship at <National Bank of Pakistan industrial area Branch Islamabad> Internship report submitted for the Final Evaluation in Partial Fulfillment of the requirements for the Degree of <Bachelors in Business Administration> It is certified that, the Internship report and the work contained in it conforms to all the standards set by the Institute for the evaluation of any such work. < Signature > 1. < Ali Haider > < Signature > 2. < Hafiz Hafeez > < Signature > 3. < Irfan-ullah Munir > University Institute of Management Sciences 3 DECLARATION I, student of University of Arid Agriculture Rawalpindi solemnly declare that the work presented in this report is my original work and no portion of it has been submitted for any other degree of qualification to this or any other university of learning. ACKNOWLEDGEMENT 4 All praise is to ALLAH ALMIGHTY, for giving us knowledge, insight, devotion and strength to accomplish this task. we immensely thankful to all the teachers and friends who helped me to complete the project. I am grateful to the staff of NBP as well, who supported me lot during this project and provided comprehensive knowledge of their products and services and banking practices. Specially Syed Hammad Raza Naqvi, Branch Incharge CAD, NBP Civil Lines Branch Jhelum & Syed Muhammad Fakhir Hassan Naqvi, Compliance Officer, NBP Civil Lines Branch Jhleum. Their guidelines have lead us to display a picture of NBP’s Management in this report. In the end I would like to thank all of my friends and family members for their support and encouragement. PREFACE 5 Banking sector pivotal importance in the econom y of any country through its vibrant functions. Moreover, the practice and familiarit y learned during this tenure would also attest very helpful and alleviating in th e awaiting proficient life. This report is an upshot of m y six weeks internship in NBP. NBP possess an imperative and historical importance in the banking sector of Pakistan. It always remains the center of hustles in business activities. It always endows with great covenant of reall y round in terms of funds and services at all epochs of its dynamism. Although, a derisory period of six weeks is not enough to learn the complex operations of NBP yet I made industrious efforts to converse them comprehensivel y in this report. Particularly, I have remunerated more accents on study of distinguishing features and services of NBP. I have made maximum venture to elaborate this report with the material read, listed and observed. Dear readers, I hope you will appreciate my report and sense that reading m y report is not like to waste the time in any respect because of the four principal reasons as under: I have made 100% realistic attempt to provide you the exact information about NBP. All the terms have been explained carefull y in a simple and comprehensive way. This report is wholl y up to date, equipping the information about currentl y prevailing functioning and services of the banking system of NBP. 6 EXECUTIVE SUMMARY The banking system in Pakistan has witnesses s ome evolutionary changes during the recent years and has made long -strides towards its goal of becoming a financiall y viable as well as firm arm of the econom y which in turn would promote not onl y growth but also prosperit y not onl y of the banking sector b ut of the econom y as a whole. As vibrant and dynamic banking sector is vital for the strong and prosperous econom y. Therefore, on realizing the inherent weakness of the financial structure that emerged after nationalization, government of Pakistan initiate d a broad based program of reforms in the financial sector. In this way Government’s commitment to banking reforms has made Pakistan’s financial sector stronger in the last four to five. The banking sector has shown remarkable performance in a number of ar eas which has helped in further strengthening of the whole process. Banking industry is presentl y facing a hyper turbulent situation where banks have to operate in increasingl y competitive and complex local and global markets. The ability to compete in th e fast paced global environment is of paramount importance – survival of the fittest being the name of the game. The competition has even become ever tough and challenging with the entry of many foreign world -class banks and other financial institutions. In this report i have explained the evolution of banking sector, the industry background which leads to different reforms. Then i have explained the background of NBP its different products and services. After doing all this We have explained the product s and services. Based on the data taken, i have done financial anal ysis, competitive anal ysis, ratio anal ysis, HR anal ysis. In the last I have explained the different problems at NBP AOC industrial area Branch and than suggestion. 7 CHAPTER # 1 HISTORY OF NBP 1. INTRODUCTION The NBP was established vide NBP O rdinance No. XIX of November 9 t h , 1949. British Govt. devalued its currency in September 1949, India devalued its rupees but Pakistan did not. It led to a crisis in trading between the two countries and India refused to lift the Pakistan Jute. To solve this problem i.e. to export jute NBP was established through an Ordinance of GOP. National Bank of Pakistan maintains its position as Pakistan's premier bank determined to set higher standards of achie vements. It is the major business partner for the Government of Pakistan with special emphasis on fostering Pakistan's economic growth through aggressive and balanced lending policies, technologicall y oriented products and services offered through its larg e network of branches locall y, internationall y and representative offices. The Bank in 1950 had one subsidiary ‘The Bank of Bahawalpur’ on December4, 1947 by the former Bahawalpur State. NBP was undertaking Treasury Operations and Managing Currency Chests or Sub Chests at 57 of its offices where the turnover of the business under the head amounted to Rs.2460 million. i) Deposits held by NBP constituted about 3.1% of total deposits of all Pakistani Banks in 1949, which rose to 38% in 1952. ii) Growth in Deposits was accompanied by increase in Bank portfolio in advances. NBP lent out to Textile, Yarn, Iron and Steel and played a pioneer role in support of agriculture and commerce. iii) NBP advances reached Rs.554.4 million by December 1959, 8 which was one third of the total schedule bank credit. 1.1 MISSION STATEMENT “To make the Bank complete and competitive with all international Standard in performing, qualit y of, operations, staff, financial strength and products and services To develop a culture of excellence in e very spare of activit y of the bank ” 1.2 GOALS AND OBJICTIVES “An organizational objective is the intended goal that prescribes definite scope and suggests direction to the panning efforts of a n organization” 1.3 GOALS AND OBJICTIVES NBP “To be the pre-eminent financial institution in Pakistan and achieve market recognition both in the qualit y and delivery of service as well as the range of product offerings.” 9 1.4 BOARD OF DIRECTORS NBP, Board of Directors list consist the following members and their designation. Table 1 NAME DISIGNATION Ali Raza Chairman & President Dr Waqar Masood Director Ifthikhar Ali Malik Director S i k a n d a r H a y a t J a ma l i Director A za m Fa ru q u e Director I b r a r A . Mu m t a z Director Mi a n K a u s a r H a m e e d Director 1.5 MANAGEMENT Management is a distinct process consisting of activities of planning, organizing, actuating and controlling performed to determine and accomplish stated objectives with the use of human being and other resources. The management has two t ypes. i) ii) Centralized. Decentralized. 10 Centralized Management tends to concentrate decision making at the top of the organization. Decentralized disperses decision -making and authority throughout and further down the organizational hierarchy. NBP have a centralized t ype of manag ement because the top management takes all the decisions. 1.6 SENIOR MANAGEMENT OF NBP Senior Management of NBP consists of following member and their respective designation. Table 2 Ma so o d K ar i m S he i k h SEVP & Gro up C h ie f, C o rp o rate & I n ve st me nt B an k i n g G ro up a nd C h ie f Fi n a nc ial O fficer S ha h id An war K ha n SEVP & Gro up c hi e f, cr ed it ma na g e me n t gro up . Dr. As i f A. B r o hi SEVP & Gro up C h ie f, O p erat io n Gr o up . I ma m B a k h s h B a lo c h SEVP & Gro up C h ie f, a ud i t a nd i n sp e ct io n gro u p . Zia u lla h K ha n SEVP & Gro up C h ie f, C o mp lai n ce Gro up . Aa mi r S id iq u e Mu h a m mad N u sr a t Vo h r a EVP & G ro up C hie f, co m me rc ial a nd re ta il b an k i n g Gro up . SEVP & Gro up C h ie f, T rea s ur y M a na ge me n t Gr o up . Ek laq Ah mad EVP & secr et ar y b o ard o f d irec to r. T aj a mma l h us s ai n EVP & G ro up C hie f, Sp e cia l a s se t M a na ge me nt B o k har i Gr o up . 11 Mrs. K h ur s h id Maq so o d EVP & D i vi s io na l H ead , e mp lo ye e s b e ne fit s, Ali Di sb ur se me n t & T r u ste e s D i vi s io n A mi m Ak h t ar EVP & P S O to t he P re si d en t Dr. M irz a Ab r ar B a i g T ahir Yaq o o b An war Ah ma d M ee na i Aa mi r S at tar As i f H us sa i n K ha n SEVP & Gro up c hi e f, h u ma n re so urc e ma n a ge me nt & ad mi n i stra tio n gro up . EVP & G ro up C hie f, O v ers ea s co o rd i nat io n & ma n a ge me n t Gro up . EVP & D i vi s io na l H ead , Is la mi c B a n k i n g D i vi s i o n Fina nc ia l co ntro l le r & Di v is io na l H ead , Fi n a nc ial co n tr o l D i vi sio n Gr o up C hi e f ( A) , IT Gro up (Source www.nbp.com.pk ) 1.7 Net Work of Branches: NBP have wide range of branches inside the country and outside the country. In Pakistan it has 28 regional offices, 1285Branches and 4 Subsidiari es. In overseas it has 24 overseas branches, 6 other offices. 1.8 Functions of NBP Since NBP is a commercial bank, it performs a variet y of functions.Like other commercial banks, NBP is engaged in financing international trade. Its other major functions i nclude receiving deposits, advancing loans and discounting of exchange. The functions performed by NBP are: 12 1.9.1 Accepting Deposits This function is important because banks largel y depend on the funds deposited with them by its customers. Deposits are of man y types: 1.9.2Current deposits Current deposits are also called demand liability on current deposits. NBP pays practically no interest on current deposits. Businessmen usually open current accounts. In NBP current account can be opened with a minimum amount of Rs.500/i) PLS saving deposit Profit and loss sharing deposits (PLS) are also called checking accounts. One can deposit and draw money easil y. Profit on PLS is calculated every month but paid after six months. P LS account can be opened with a min imum amount of Rs.500/ ii) PLS term deposits Fixed term deposits are deposits with the bank for certain fixed period before the expiry of which they cannot be withdrawn unless giving due notice. In this case the rates of profit will be different depending upo n the time peri od 13 Chapter# 2 PRODUCTS AND SERVICES 2.1 Major product lines market segmentation Services are outputs of the firm, which are in intangible form. Which are the backbones of any organization to earn profit? NBP offers the following services to the people. 2.2 DEMAND DRAFTS If you are looking for a safe, speedy and reliable way to transfer money, you can now purchase NBP’s Demand Drafts at very reasonable rates. An y person whether an account holder of the bank or not, can purchase a Demand Draft from a bank branch. 2.3 SWIFT SYSTEM The SWIFT system (Societ y for Worldwide Interbank Financial Telecommunication) has been introduced for speedy services in the area s of home remittances. The system has built -in features of computerized test keys, whi ch eliminates the manual application of tests that often cause delay in the payment of home remittances. The SWIFT Center is operational at National Bank of Pakistan with a universal access number NBP-APKKA. All NBP overseas branches and overseas corresp ondents (over 450) are drawing remittances through SWIFT. Using the NBP network of branches, you can safel y and speedil y transfer money for our business and personal needs. 14 2.4 LETTERS OF CREDIT NBP is committed to offering its business customers the wi dest range of options in the area of money transfer. If you are a commercial enterprise then our Letter of Credit service is just what You are looking for. With competitive rates, securit y, and ease of transaction, NBP Letters of Credit are the best way to do your business transactions. 2.5 TRAVELER'S CHEQUES Traveler’s cheques are negotiable instruments, and there is no restriction on the period of validit y of the cheques. Rupee traveler’s cheque is available at all 700 branches of NBP. This can be cashed i n all 400 branches of NBP. There is no limit on purchase of this cheque. It is one of the safest ways for carrying money. 2.6 PAY ORDER NBP provides another reason to transfer your money using our facilities. NBP pay orders are a secure and easy way to mov e your money from one place to another. And, as usual, NBP charges for this service are extremel y competitive. The charges of NBP are very low all over the Pakistan. It charges Rs 50/ - for NBP account holders on issuing one payment order. And charges Rs 1 00/- for NBP non -account holders on issuing one payment order. It charges Rs 25/ - for students on payment of fees of educational institutions. If someone want a duplicate of payment order they charges Rs 100/ - for NBP account holders and Rs 150/ - for non-account holders. 2.7 MAILTRANSFERS 15 Move your money safel y and quickl y using NBP Mail Transfer service. And NBP also offers the most competitive rates in the market. They charges Rs 50/- exchange rate and RS 75/ - postage charges on issuing mail transfer. 2.8 FOREIGN REMITTANCES: To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has taken a number o f measures to Increase home remittances through the banking system Meet the SBP directives/instructions for timel y and prompt delive ry of remittances to the beneficiaries. 2.9 SHORT TERM INVESTMENTS NBP now offers excellent rates of profit on all its short -term investment accounts. Whether you are looking to invest for 3 months or 1 year, NBP’s rates of profit are extremel y attractive, a long with the securit y and service onl y NBP can provide. 2.10 National Income Daily Account (NIDA) The scheme was launched in December 1995 to attract corporate customers. It is a current account scheme and is part of the profit and loss s ystem of accoun ts in operation throughout the country. 2.11 QUITY INVESTMENTS NBP has accelerated its activities in the stock market to improve its economic base and restore investor confidence. The bank is now regarded as the most active and dominant player in the develo pment of the stock market. 16 2.12 COMMERCIAL FINANCE NBP dedicated team of professionals trul y understands the needs of professionals, agriculturists, large and small business and other segments of the econom y. They are the customer’s best resource in making N BP’s products and services work for them. 2.13 TRADE FINANCE OTHER BUSINESS LOANS There are two t ypes of trade finance. 2.13.1 Agricultural Credit: The agricultural financing strategy of NBP is aimed at three main objectives: Providing reliable infrastructure for agricultural customers Help farmers utilize funds efficientl y to further develop and achieve better production Provide farmers an integrated package of credit with supplies of essential inputs, technical knowledge, and supervision of farming. 2.13.2 CORPORATE FINANCE NBP specializes in providing Project Finance – Export Refinance to exporters – Pre-shipment and Post -shipment financing to exporters – Running finance – Cash Finance – Small Finance – Discounting & Bills Purchased – Export Bills Purchased / Pre-shipment / Post Shipment Agricultural Production Loans 17 NBP provides financing for its clients’ capital expenditure and other long-term investment needs. By sharing the risk associated with such long -term investments, NBP expedites clients’ attem pt to upgrade and expand their operation thereby making possible the fulfillment of our clients’ vision. This t ype of long term financing proves the bank’s belief in its client's capabilities, and its commitment to the country. 2.14 NATIONAL BANK OF PAKISTAN OFFERS: The lowest rates on exports and other international banking products Access to different local commercial banks in international banking 2.14.1 Cash and Gold Finance. Cash and Gold finance means that loan is given against the gold. The gold is mortgaged with the bank and loan is taken. It is the area of consumer finance. And borrower can take loan for common use. 2.14.2 Advance salary loan This loan is given to those people who are Govt servants. They can get a loan up to the salary of fifteen months. 18 CHAPTER# 3 BUSINESS OPERATIONS AND DEPARTMENTS OF NBP Dividing an organization into different parts according to the functions is called department s. So NBP can be divided into the following main departments. 3.1 DEPARTMENT S OF NBP 3.1.1 CASH DEPARTMENT Cash department performs the following functions 3.1.2 Receipt The money, which either comes or goes out from the bank, its record should be kept. Cash department performs this function. The deposits of all customers of the bank are controlled by means of ledger accounts. Every customer has its own ledger account and has separate ledger cards. 3.1.3 Payments It is a banker’s primary contract to repay money received for this customer’s account usuall y by honoring his cheques. 3.1.4 Cheques and their Payment The Negotiable Instruments Act, 1881 “Cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. 19 3.1.5 Types of Cheques 3.1.5(i) Bearer Cheques Bearer cheques are cashable at the c ounter of the bank. These can also be collected through clearing . 3.1.5(ii) Order Cheque These t ypes of cheques are also cashable on the counter but its holder must satisfy the banker that he is the proper man to collect the payment of the cheque and he h as to show his identification. It can also be collected through clearing. 3.1.5(iii) Crossed Cheque These cheques are not payable in cash at the counters of a banker. It can only be credited to the payee’s account. If there are two persons having acco unts at the same bank, one of the account holder issues a cross -cheque in favour of the other account holder. Then the cheque will be credited to the account of the person to whom the cheque was issued and debited from the account of the person who has act uall y issued the cheque. 3.1.6 Payment of Cheques It is a banker’s primary contract to repay money received for his customer’s account usuall y by honouring his cheques. It is a contractual obligation of a banker to honor his customer’s cheques if the fol lowing essentials are fulfilled. a) Cheques should be in a proper form: 20 b) Cheque should not be crossed: c) Cheque should be drawn on the particular bank: d) Cheque should not mutilated: e) Funds must be sufficient and available: f) The Cheque should not be postdated or stale: g) Cheque should be presented during banking hours 3.2 CLEARANCE DEPARTMENT A clearinghouse is an association of commercial banks set up in given localit y for the purpose of interchange and settlement of credit claims. The function of clearinghouse is performed by the central bank of a country by tradition or by law. In Pakistan, the clearing system is operated by the SBP. If SBP has no office at a place, then NBP, as a representative of SBP act as a clearinghouse. In practice the person receiving a Che que as rarel y a depositor of the cheque at the same bank as the drawer. He deposits the cheque with his bank other than of payer for the collection of the amount. Now the bank in which the cheque has been deposited becomes a creditor of the drawer’s bank. The depositor bank will pay his amount of the cheque b y transferring it from cash reserves if there are no offsetting transactions. The banks on which the cheques are drawn become in debt to the bank in which the cheques are deposited. At the same time, th e creditors’ banks receive large amounts of cheques drawn on other banks giving claims of payment by them. 21 The easy, safe and most efficient way is to offset the reciprocal claims against the other and receive onl y the net amount owned by them. This facilit y of net interbank payment is provided by the clearinghouse. 3.2.1 in-Word Clearing Books The bank uses this book for the purpose of recording all the cheques that are being received by the bank in the first clearing. All details of the cheques are rec orded in this book. 3.2.2 Out-Word Clearing Book: The bank uses outward clearing register for the purpose of recording all the details of the cheques that the bank has delivered to other banks. 3.3 ADVANCES DEPARTMENT Advances department is one of the most sensitive and important departments of the bank. The major portion of the profit is earned through this department. The job of this department is to make proposals about the loans. The Credit Management Division of Head Office directl y controls all the advances. As we known bank is a profit seeking institution. It attracts surplus balances from the customers at low rate of interest and makes advances at a higher rate of interest to the individuals and business firms. Credit extensions are the most impo rtant activit y of all financial institutions, because it is the main source of earning. However, at the same time, it is a very risky task and the risk cannot be completel y eliminated but could be minimized largel y with certain techniques. 22 Any individual or company, who wants loan from NBP, first of all has to undergo the filling of a prescribed form, which provides the following information to the banker. a) Existing financial position of a borrower at a particular branch. b) Accounts details of other banks (if any). c) Name & address of the borrower d) Securit y against loan. e) Exiting financial position of the company. (Balance Sheet & Income Statement). f) Signing a promissory note is also a requirement of lending, through this note borrower promise that he will be respo nsible to pay the certain amount of money with interest. 3.4 REMITTANCE DEPARTMENT Remittance means a sum of money sent in payment for something. This department deals with either the transfer of money from one bank to other bank or from one branch to an other branch for their customers. NBP offers the following forms of remittances. a) Demand Draft b) Telegraphic Transfer c) Pay Order d) Mail Transfer A) Demand Draft 23 Demand draft is a popular mode of transfer. The customer fills the application form. Application for m includes the beneficiary name, account number and a sender’s name. The customer deposits the amount of DD in the branch. After the payment the DD is prepared and given to the customer. NBP officials note the transaction in issuance register on the page o f that branch of NBP on which DD is drawn and will prepare the advice to send to that branch. The account of the customer is credited when the DD advice from originating branch comes to the responding branch and the account is debited when DD comes for cle arance. DD are of two t ypes. a) Open DD: Where direct payment is made. b) Cross DD: Where payment is made though account. B) Pay Order Pay order is made for local transfer of money. Pay order is the most convenient, simple and secure way of transfer of money. NBP takes fixed commission of Rs. 25 per pay order from the account holder and Rs. 100 from a non -account holder. C) Telegraphic Transfer Telegraphic transfer or cable transfer is the quickest method of making remittances. Telegraphic transfer is an order by telegram to a bank to pay a specified sum of money to the specified person. The customer for requesting TT fills an application form. Vouchers are prepared and sent by ordinary mail to keep the record. TT charges are taken from the customer. No excise dut y is charged on TT. The TT charges are: 24 Telegram/ Fax Charges on TT = Actual -minimum Rs.125. D) Mail Transfer When the money is not required immediatel y, the remittances can also be made by mail transfer (MT). Here the selling office of the bank sends instructions in writing by mail to the paying bank for the payment of a specified amount of money. Debiting to the buyer’s account at the selling office and crediting to the recipient’s account at the paying bank make the payment under this transfer. NBP taxes mail charges from the applicant where no excise dut y is charged. Postage charges on mail transfer are actual minimum Rs. 40/- if sent by registered post locall y Rs.40/ - if sent by registered post inland on part y’s request. 3.5 HUMAN RESOURCE DEPARTMEN T Human Resource plays a vital role in the success of every service organization. They interact between man and machine. Their attitude can win or lose the customer. The positive attitude could onl y be created in a conductive environment, which can make th e staff dedicated towards the organizational objectives Main objectives of my study were to see following area s 1. Working Environment of NBP 2. HR Department o f NBP . Functions of HR Department . MAJOR FUNCTIONS Following are the functions of HR Management and Administration department, National Bank of Pakistan. 1. Human Resource Planning Human Resource Planning is condu cted by the HR department. They assess the existing number and nature of staff and then place / post them 25 at needy branches accordin g to the requirement of that branch. For example, if the load on cash counter is increasing, one new cashier will be posted at the Branch. 2. Recruitment of Staff Another important function of HR depart ment is recruitment of staff as per availabilit y of vacancies. At NBP, recruitment of permanent staff is centralized and all recruitments are made by their Head Officer Karachi. However, in near past limited authorit y has been given to regional offices to hire the services of outsourced staff i.e staff provided by the employment companies. This t ype of recruitment is being made in following areas: a.Securit y Guards b.Janitorial Services c.Sale & Marketing staff for retail products. 3. Transfer of Employee The regional office controls fift y five (55) branches. All transfer and posting of employees among these branches is made by HR department keeping in view the staff requirement at different branches. 4. Job Rotation Function of Job rotation is also per formed by regi onal office. Normall y when an employee completes three years at a particular seat, he rotates to another seat. This rotation is very important for internal control, to prevent fraud and forgery and to enhance the employee’s skills for different duties. 5. Human Resource Development & Trainin g H.R Department analyzes the day to day requirement of SBP regulation for different Banking activities, and plans for training and development of staff .This training may also be based upon introduction of new Banking produces and competition with rival B anks. 6. Performance Appraisal H.R Department also performs the function of performance appraisal of employees on yearl y basis .At the close of every year annual confidential report (ACR) of each and every employee is written by HR department. This ACR contains subjective and objective evaluation as well as personal traits of an employee. 7. Promotion of employees NBP HR department performs the function of promotion. Normall y NBP promotes its employees after every three yours on the basis of their past performance, availabilit y of vacancies in each grade/cadre and quota approved by the Ministry of Finance, for each grade/cadre. 26 8. Lay Off Lay off function is also performed by HR department. NBP is a govt. owned organization and its employees retire at the attainment of age of 60 years. However, in 1998 and 2002 the NBP announced the Golden Hand Shakeschemes and almost 5000 and 3500 employees separated from Bank services in these respective years. 9. Health & Safety H R department arranges for medical f acilities to its employees. There are several hospitals on Banks panel and employees can avail medical facilities from these hospitals. Hospitals bills are being paid by HR department after proper verification. NBP extend medical facilit y to employees, their spouse (wife ) and children as well as parents of the employee. Brother or sister or any other relation is not entitled for this medical facilit y. 10. Disciplinary Cases HR department deals with all disciplinary cases of employees. These disciplinary cases include: a. afraid & Forgery b. Unauthorized leaves c. Insubordination d. Misconduct of finances e. Violation of procedure & policy 11. Retirement Benefits HR department also manages pensions an d group life insurance. Pension is allowed to all empl oyees after retirement and when the employee dies and his widow can avail this facilit y till death. Even if the widow dies, the and daughter/son of employee can avail pension till she/he attain the age of majorit y i.e. 18years or she/he married, whichever is happened earlier. 12. Personnel Information System HR department is responsible to keep and maintain complete data of Each and every employees this data includes his personal data as well as professional data and being used to place right person for t he right job. 13. Equal Employment Chance NBP provides equal employment chanc e to men & women. HR department is responsible to implement this policy, too. 14. Salary & Loan Administration HR department performs the function of disbursement of Salary and administration of Staff Loans. Salary is being disbursed in last week of 27 the month. NBP allows house building loan, Motor car loan and computer loan toits employees. Period of house building loan is 20 years, Car loan is 10 years and computer loan is 5 yea rs. Mark up on HBL is 3% and car/computerloanis4%. HR department pays salaries to employees after deduction of monthl y installments of loans, already availed by them. 3.6. DEPOSIT DEPARTMENT It controls the following activities: 3.6.1 Account opening The opening of an account is the establishment of banker customer relationship. Before a banker opens a new account, the banker should determine the prospective customer’s integrit y, respectabilit y, occupation and the nature of business by the introductory r eferences given at the time of account opening. Preliminary investigation is necessary because of the following reasons. i. ii. Avoiding frauds Safe guard against unintended over draft. iii. Negligence. iv. Inquiries about clients. There are certain formalities, which ar e to be observed for opening an account with a bank. Formal Application Introduction 28 Specimen Signature Minimum Initial Deposit Operating the Account 3.6.2 Types of Accounts Following are the main t ypes of accounts 1) Individual Account 2) Joint Account 3) Basic Banking Accounts 4) Profit support Accounts 5) Pensioner Accounts 6) Accounts of Special Types Partnership account Joint stock company account Accounts of clubs, societies and associations Agents account Trust account Executors and administrators accounts Pak rupee non-resident accounts Foreign currency accounts 29 3.6.3 Issuing of cheque book: This department issue cheque books to account holders. Requirements for issuing cheque book a) The account holder must sign the requisition slip b) Entry should be made in the ch eque book-issuing book c) Three rupees per cheque should be recovered from a/c holder if not then debit his/her account. 3.6.4 Current account These are payable to the customer whenever they are demanded. When a banker accepts a demand deposit, he incurs the obligation of paying all cheques etc. drawn against him to the extent of the balance in the account. Because of their nature, these deposits are treated as cu rrent liabilities by the banks. 3.6.5 Saving account Savings Deposits account can be opened with v ery small amount of money, and the depositor is issued a cheque book for withdrawals. Profit is paid at a flexible rate calculated on six -month basis under the Interest-Free Banking S ystem. There is no restriction on the withdrawals from the deposit accoun ts but the amount of money withdrawn is deleted from the amount to be taken for calculation of products for assessment of ., profit to be paid to the account holder. 3.6.6 Cheque cancellation: This department can cancel a cheque on the basis of; a) Post dated cheque 30 b) Stale cheque c) Warn out cheque d) Wrong sign etc 31 CHAPTER # 4 COMPANY ANALYSIS 4.1 SWOT ANALYSIS To carryout the SWOT and Financial Anal ysis of NBP through the help of calculating necessary ratios in this section. SWOT anal ysis is an acronym that stands for strengths, weakness, opportunities, and threats SWOT anal ysis is careful evaluation of an organization’s internal strengths and weakness as well as its environment opportunities and threats. “SWOT analysis is a situational which includes s trengths, weaknesses, opportunities and threats that affect organizational performance.” “The overall evaluation of a company strengths, weaknesses, opportunities and threats is called SWOT analysis.” In SWOT anal ysis the best strategies accomplish an or ganization’s mission by: a) Exploiting an organizations opportunities and strength. b) Neutralizing it threats. c) Avoiding or correcting its weakness. SWOT anal ysis is one of the most important steps in formulating strategy using the organization mission as a con text; managers assess internal strengths distinctive competencies and weakness and external opportunities and threats. The goal is to then develop good strategies and 32 exploit opportunities and strengths neutralize threats and avoid weaknesses. 4.1.1 STRENGTH (i) OLDEST INSTITUTION: NBP is one of the oldest bank of Pakistan and first nationalized bank Hence its customer base is strength from this plus point as customers have more confidence in the bank. The additional value services as the privilege for the bank. (ii) ALTERNATE DUTIES IN SBP ABSENCE The NBP performs additional services for its customers as well as the other bank customer in the absence of SBP. (iii) MORE DEPOSITS THAN OTHER BANKS NBP has the relative competence in having more deposits than the other bank. This is because of the confidence the customer have in the bank. The bank being the privileged and oldest bank in banking sector of Pakistan enjoys this edge over all others, lacking it. (iv) EMPLOYEE BENEFITS The employers at NBP are offered reasonable monetary benefit. Normally two bonuses are given Eid-Ul-Fitar & Eid-Ul-Azha. This serves as an additional benefit and competency for the bank and a source of motivation for the employees. (v) BROAD NETWORK 33 The bank has another competency i .e. it has broad -basses network of branches throughout the country also more than one branch in high productive cities. The customers are provided services at their nearest possible place to confirm customer satisfied. (vi) STRICTLY FOLLOWED RULES & REGUL ATION: The employees at NBP are strict followers of rule & regulation imposed by bank. The disciplined environment at NBP bolsters its image and also enhances the over all out put of the organization. (vii) PROFESSIONAL COMPETENCE The employees at NBP here have a good hold on their descriptions, as they are highly skilled Professionals with background in business administration, banking, economics etc. These professional competencies enable the employees to understand and perform the function and operation in better way. (viii) HEALTHY ENVIROMNMENT The working conductive condition and in favorable the for NBP branch here is very better output. The informal environment affects the performance of the employees in a positive way. (ix)RELATION BETWEEN STAFF A ND OTHER EMPLOYEES The bank enjoys a good plus point when it comes to the employee manager relationship the hearing as removing of discrepancies if any, between the employees, and between the manager and employees. 34 (x) NBP ADVANCE SALARY The product of th e year 2008,2009. the product was developed by NBP Credit Group, their basic t arget is salaried Govt Employees. This has increased NBP’s Credit portfolio with a major boost. With minimum default ratio, its been the success story of NBP. Still its a good pr oduct than their competitors personal loans. The interest rate charged to this loan is SBP Discount Rate + 5%. (xi) NO panelty on Late Payment or Early Settlement of Loans NBP is one of those banks, who donot impose any panelt y to their customers regardin g late payment of installments or markup and earl y settlement of laons or balloon payments in case of credits. In case a customer wants to make balloon payments will not b charged to any panelt y in any advances case of NBP. It’s a strength of NBP against i ts competitors. (xii) NBP Premium Aaamdani This is the onl y product of any commercial bank in the countr y which is competing with the NATIONAL SAVINGS CENTER’s products. NBP is offering rates to the customers who deposits money in multiples of Rs 50,000/ - with them till five years. At first year 7.5% At second year 8.5% At third year 9.5% 35 At fourth year 10.5% At fifth year 11.5% 36 4.2 WEAKNESSES a) LACK OF MARKETING EFFORT: The bank does not promot e its corporate image, services etc on a competitive way. Hence lacks far behind in marketing effort .A need for aggressive marketing in there in the era marketing in now becoming a part of every organization. b) NBP UNDER POLITICAL PRESSURE The strong political hold of some parties and government and their domin ance is affecting the bank in a negative way. The y sometime have to provide loan under the pressure, which leads to uneven and adjusted feeling in the bank employees.4.3.3 c) FAVORITISM AND NEPOTIS The promotions and bonuses etc in the bank are often powered by senior’s favoritism or depend upon their wills and decision. This adds to the negative factors, which denominate the employees thus resulting in affecting their performance negativel y. d) LACK OF FINACIAL PRODUCT The bank falls far behind when the innovative and new schemes are consider . It has not been involved in the tug of war between the competitors to the accounts and strengthens the existing customer base. This stands out to be the major incompetence and weakness of the banks. 37 e) INEFFICIENT COUNTER SERVICES IN THE RUSH HOURS During the rush hours, the bank is founded out to be a total flop to handle the mob of people peaking from windows and doors. The bank has deficiency to operate in the stages of rush hours where the people find them serv ices entangled in a situation of nowhere because they are not well served. f) LACK OF COMPUTERIZED NETWORK The bank lack the strength of being powered by the network of computers, which have saved time, energy and would have lessened the mental stress, the employees have currentl y. This would add to the strength if it were powered by network of computers. g) LACK OF MODERN EQUIPMENT The bank lacks the modern Equipment that is note counting machine computers. Even if there is any equipment they lack to fall in the criteria of being rearmed as update and upgraded. h) UNEVEN WORK DISTIBUTION. The workload in NBP is not evenl y distributed and the workload tends to be more on some employees while others abscond away from their responsibilities, which server as a demonization factor for employees performing above average work. i) OLD employee awareness 38 Computer awareness to old Staff of NBP is a weakness. The y should develop employee development & training programme to effectivel y update their employees regarding c omputer applications & upcoming CORE BANKING SOFTWARE of bank. 4.3 OPPORTUNITIES a) ELECTRONIC BANKING The world today has become a global village because of advancement in the technologies, especiall y in communication sector. More emphasis is now given to avail the modern technologies to better the performances. NBP can utilize the electronic banking opportunit y to ensure on line banking 24 hours a day. This would give a competitive edge over others. b) MICRO FINANCING Because of the need for micro financin g in the market, there are lot of opportunities in this regard. Other banks have already initiated, now the time has arrived when the NBP must realize it and take on step to cater an ongoing demand. c) CAR FINANCING This is the major area where NBP has not competed with private banks. As per repute of NBP they must enter in personal & car financing products. d) CORE BANKING SYSTEM 39 Implementation of the CORE BANKING SYSTEM is still an opportunit y, as till now none of the banks operating in Pakistan is using this most updated & famous banking application. It will lead NBP to smooth sailing environment as a leading bank in technology as well as competing between other banks. This will upgrade NBP from paper & ledger era to the smooth & sophisticated computer a pplication. 4.4 THREATS a) EMERGENCE OF NEW COMPETITORS The bank is facing threats with the emergence of new competitor especiall y in terms of foreign banks. These foreign banks are equipped with heavy financial power with excellent and innovative ways of promoting and performing their services. The bank has to take initiative in this regard or will find itself far back in competition. b) POLITICAL PRESSURE BY ELECTED GOVERNMENT The ongoing shift in power in political arena in the country effects the pe rformance of the bank has to forward loans to politicall y powerful persons which create a sense of insecurit y and demoralization in the customer as well as employees. c) DOWNSIZING The bank is currentl y acting upon the policy of downsizing which threaten t he environment of the bank Employees feel 40 insecurit y in doing their jobs and work, hence affecting the over all performance of employees negativel y. d) CUSTOMERS COMPLAINTS There exists no regular and specific system of the removal of customer complaints. Now a day a need for total customer satisfaction is emerging and in their demanding consequences customer's complaints are ignored. CHAPTER # 5 ANYLASIS After proper anal ysis of the organization I divided it into in four parts. This anal ysis is mainl y based on practical experience of NBP Staff, anal ysis is as under: Problems at the branch. Function anal ysis. Administrative anal ysis. Personal management’s anal ysis. 5.1 PROBLEMS AT THE BRANCH Customer Satisfaction Poor record management and filing system Unequal distribution of work 41 Marketing visits 5.2 FUNCTIONAL ANALYSIS Formal Organization Difference between theory and practice Bank dut y to maintain secrecy. Excessive paper work More accounts fewer deposits. Delegation of authorit y 5.3 ADMINISTRAT IVE ANALYSIS Job anal ysis is not effective Carelessness in opening of account Lack of specialized training Low Profit Rates Poor job rotation. Delays in Loan Advancement Lack of appreciation 5.4 PERSONAL MANAGEMENT ANALYSIS Need for better training progra m Developing Managerial Leadership Recruitment policy Promotions 42 Transfer Marketing at desk Lack of business communication 43 CHAPTER # 6 CONCLUSION INTRODUCTION NBP is an effectivel y operating and profit making organization and carrying out its activities under a specified system of procedure. The main regulatory body is State Bank of Pakistan, which provides policy guidelines and ensures that the money market opera tes on sound professional basis while the head office specifies the whole procedure of function and operations. Here I am giving some suggestions, which in m y view can add some input for efficiency and better performance of NBP as an organization in general and Cit y branch in particular. The recommendations are as follows: 6.1 Professional train ing NBP staff lacks professionalism. They lack the necessary training to do the job efficientl y and properl y. Although staff colleges in all major cities but they are not performing well. Banking council of Pakistan should also initiate some programs to eq uip the staff with much needed professional training. 6.2 Delegation of Authority Employees of the bank should be given a task and authorit y and they should be asked for their responsibilit y. 6.3 Performance Appraisal 44 The manager should strictl y monitor th e performance of every staff member. All of them should be awarded according to their performance and result in the shape of bonuses to motivated and incite them to work more efficientl y. 6.4 Changes in Policies There should not be any abrupt policies chan ge by the upper management, as this practice hurts the customer confidences in the bank. Government should make long -term policies. 6.5 Utility Bill Charges Bank gets Rs. 5 to 8 to processes a utility bill, and it is very tire, tough and hard job despite t his working resulting in a loss to then Rs 5 to 8 per transaction. These charges should be increased to RS 10 per bill to enable the branch to cover their handling costs and make some profit. 6.6 Link with the Head Quarter 160 major branches of NBP should established a direct link with the, head quarter in Karachi, through Internet or Intranet. This will make the functions and decision making of the management easier and convenient. 6.7 Credit Card National bank of Pakistan should start its operation in cre dit card. These cards were very helpful for the ordinary customer in general and the business people in particular. To make it mores secure and to eliminate the misuse of it, the management is required to keep proper securit y against the card. But as NBP is a GOVT bank so most of the customer 45 gets defaulted and do not want to repay the CREDIT CARDS amounts. Effective involvement of Collection officers for the repayment of credited amount rather than treating and provisioning them as NPL. 6.8 Cash Financin g In this mode of financing the amount of credit not utilized by the borrower is remained tax -free. It is recommended that a small amount of interest should be charge on this amount as well because the bank gas kept -aside the amount for that borrower and c an not advance it anywhere. 6.9 Decreasing Administrative Expenses Bank should their administrative expenses. This was Rs 8 billion in the year 200 9. That can be done by l ying off the surplus pool of employee with golden handshakes scheme. The branches that are not much used could also be closed. Employee can also be how to control the bank expenses. That will give positive results in the future. 6.10 Needs to be Flexible in credit Policy As mentioned earlier, NBP is very conservative in advances and loans policy. It reduces the investment opportunities. Also loans should be given to the small businessmen and the agriculture sector at the low markup rate. It should adopt flexible credit policy while giving credit to the agriculture sector. 46 Not onl y it will be economical but will also reduce the extra burden of work of the bank. It will also help in reducing the use of excessive paper work. 6.11 Improper Distribution of Work Proper distribution organization. Proper work leads to distribution of success work in every prevents the employee from over and under work situation. So for a smooth running of an organization proper distribution of work is the hint to be followed. During m y internship I observed that there was no proper distribution of work in the bank. I saw that some of the employee worked like ants other sat idle starting here and there. So this created a lot of over work situation for while relaxation for other. 6.12 Inter Departmental Transfer I watched during my internship that, there is number of employee who have worked on one seat for many a year. It can have negative effects motivation of employee who is hard working and intelligent. Take the example of advances section. In advance section if the employee is transfer after sixth month or seven m onth, how can he be able to show his performances and how can he be able to know the bank customer in a short period of time. 6.13 Complaints of Customer 47 There should be an information desk to provide the information and to receive the complaints of the cu stomer in the bank. There is no complaint box available in the branch and not any person appointed to hear the complaints. Every person cannot go to the manager for the complaint because most of the people are hesitant. So I suggest management to install a compliant box in the branch, and recruit a special person for that guidance of the customer when they are unable to manage some difficulties in banking matters. 6.14 Organizational Commitment It is suggested that employees working on dail y wages basis should be given some benefits, which the other employees are getting. Their salaries must increase according to efficiency, performance and service. 6.15 Managerial Leadership In the anal ysis, we have discussed the difficulties of the assistant in taking any initiative; therefore it is recommended that the assistants should he given special training to make them ready for the leadership. 6.16 Housing and House Hold Goods loans Bank should initiate these loans because most of bank’s customers are middle class a nd they cannot afford to buy house or household goods at once by their own. 48 6.17 SOME MORE Solutions / Improvements suggested After the completion of m y internship in the NBP I am able to give some suggestions for the betterment of the organization. During the internship we had discussions with different persons like manager, operational manager different officers employees and customers. In the light of these discussions we are able to give some suggestions which are given below. Use of modern technology. Training and Development of Employees Frequent Communication Promotion on the basis of Abilit y 49 AREFERENCES NBP annual report (2010 ) NBP annual report (2011 ) NBP annual report (2012 ) ONLINE RESOURCES www.dawn.com. pk www.sbp.or g.pk www.nbp.com.pk www.onlinewbc.gov/docs/finance/fs.ratio 50