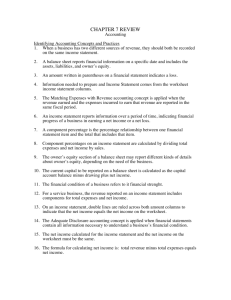

Step 3 - Prepare the Expense Section

advertisement

Accounting 10 Module 2 Lesson 9 Accounting 10 1 Lesson 9 Accounting 10 2 Lesson 9 Lesson Nine Preparing the Financial Statements Read pages 172 to 194 in the textbook. Topics: • • • • • • • • • • • Introduction The Income Statement The Balance Sheet Reviewing the Accounting Cycle Interpreting an Income Statement and a Balance Sheet Remember These Important Points Do You Understand? Conclusion Self Test Answers for Self Test Assignment 9 After studying Lesson 9, you should be able to • prepare an income statement in good form from a completed six-column worksheet. • prepare a classified balance sheet in report form and in account form from a completed six-column worksheet. • list each of the GAAPs studied to date and write a sentence indicating how each is involved in accounting theory. • examine several examples of income statement headings, identify any errors made in those headings, and rewrite any statement heading to correct those errors. Accounting 10 3 Lesson 9 • identify how much revenue was earned from a transaction showing the selling price and the cost price of the object which was sold. • calculate the "true profit" from a simple case describing the initial investments of owners, their personal withdrawals of cash during the life of their businesses, and the amounts of cash remaining to the owners after their businesses are sold. • identify errors made in a given balance sheet, prepare a correct balance sheet in good form, and answer specific questions about that balance sheet. Introduction Once the worksheet is completed, all the information needed for the preparation of financial statements is at the accountant's disposal. These statements summarize data and provide financial information about the business to the owners, management, creditors, and government for decision making. The two most important statements, the balance sheet and income statement, summarize the financial information contained in the ledger accounts. The balance sheet shows the assets, liabilities, and owner's equity at a particular date. The income statements presents the revenue, expenses, and net income or loss for a period of time. The income statement and the balance sheet are generally prepared at the end of a fiscal period. This fiscal period can be any period of time, for example monthly, semiannually, or yearly, where business activity has taken place. Accounting 10 4 Lesson 9 The Income Statement The income statement is prepared first, since it provides information that is required for the completion of the balance sheet. Revenue is the amount of money derived from business activities. Expenses are all the costs incurred in generating that revenue. An income statement shows the total expenses as compared to revenue acquired in a period. The expenses are matched with the revenue earned to determine whether there was a net income or loss for the fiscal period. The income statement for J. Emery Real Estate is prepared from information found in two parts of the worksheet. The first part, which is the Account Title column of the worksheet, includes the names of all accounts to be listed on the Income Statement. Secondly, the Income Statement columns of the worksheet include the amounts needed in preparing the income statement. Steps in Preparing the Income Statement In preparing the income statement you need to follow five basic steps. Study the steps closely by following the illustration on page 173 of the textbook. Step 1 - Prepare the Heading The heading is written on three lines centred at the top of the two-column form. Like the heading on the worksheet, the date is for a period of time. Step 2 - Prepare the Revenue Section The amounts for preparing the revenue section of the income statement are taken from the Income Statement Credit column of the worksheet. The heading of the revenue section of an income statement is the word Revenue. Revenue is written at the left-hand margin on the first line, followed by a colon. The title of the revenue account, Commissions Earned, is written on the second line, indented about 1.5 cm. The amount of the revenue account is written in the second column. Accounting 10 5 Lesson 9 Step 3 - Prepare the Expense Section The amounts for preparing the expenses section of the income statement are obtained directly from the Income Statement Debit column of the worksheet. The heading of the second section of the income statement is Expenses. Expenses is written at the left margin, followed by a colon. The account title of each of the expense items are written in the order they appear on the worksheet, indented about 1.5 cm from the left margin. The amounts of the expense items are listed in the first column. A single ruled line is drawn under the last number in the Expense column to indicate that the column is to be totalled. The words Total Expenses, indented l.5 cm, are written on the line beneath the last expense account title. The amount of the total expenses is written in the second amount column. Step 4 - The Net Income (or Net Loss) Section A single ruled line is drawn under the second amount column to indicate subtraction of the total expenses, $8 735, from the total revenue, $51 800. The result, $43 065, is written beneath the single ruled line in the second amount column. The words Net Income are written at the left margin. The amount of the net income shown on the income statement must agree with the amount of the net income recorded on the worksheet. Should a Net Loss occur parenthesis are placed around the amount: $( ). Step 5 - Ruling of the Income Statement Once the net income or net loss is calculated, a double ruled line is drawn across the second amount column to show that all work has been completed and is assumed to be correct. Remember to put dollar signs ($) in each amount column and in the final total. Accounting 10 6 Lesson 9 The Balance Sheet A balance sheet reports the financial position of assets, liabilities, and owner’s equity for a specific date. The data for the balance sheet is found in the Balance Sheet columns in the worksheet. Earlier you prepared an account form type of balance sheet. The assets were on the left side and the claims against them were on the right side--that is, liabilities and owner's equity. You will now use another method. The report form is a balance sheet with assets, liabilities, and owner's equity arranged vertically. In modern practice, balance sheets are prepared so that the assets and liabilities are reported in groups or classes. Such balance sheets are known as classified balance sheets. For now, you will divide assets into current assets and fixed assets. Liabilities will be classified only as current liabilities. Current Assets For now, Current Assets will consist of cash and other assets that, in the normal course of business operations, are expected to be converted into cash within one year from the date of the balance sheet. For more detail, study page 174 in the textbook. Fixed Assets Fixed Assets are not normally converted into cash. They are tangible, long-term assets such as land, buildings, and equipment held for use within the firm to support revenuemaking activities for several years beyond the balance sheet date. Accounting 10 7 Lesson 9 In the illustration on page 175 of the text, notice the words "at cost" after "Fixed Assets." They are put there because of an important GAAP called the cost principle. This principle states that all assets purchased by a business must be recorded as follows: (1) The cost of all assets is the original purchase price. This price is known as the cost price or cost value. (2) The original cost values of assets must be retained throughout the accounting cycle. Study the balance sheet for J. Emery Real Estate on pages 174 to 176 in the textbook. Current & Long-Term Liabilities Current Liabilities are the debts of the business which are expected to be paid within one year of the balance sheet date. Study further details on page 176. Long-term Liabilities represent the debts of the business that are not due within one year. An example is a mortgage payable which is a pledge of property to a creditor as security against a debt (the loan of money). For further details on how this account is handled, study page 178. Preparing the Balance Sheet For an example of a classified balance sheet in the report form, refer to page 175 in the text. For an example of a classified balance sheet in the account form, refer to page 177 in the text. The data for preparing the balance sheet are found under the Balance Sheet heading in the worksheet. Step 1 - Heading The three lines in the heading of a balance sheet are centered on the document. Line 1 is the name of the business. Line 2 is the name of the statement. Line 3 is the as at date on which the assets, liabilities, and owner's equity are reported. Accounting 10 8 Lesson 9 Step 2 - Assets The figures for the assets section are obtained from the Balance Sheet Debit column of the worksheet. The account titles are listed in the same order as they appear in the worksheet. The title, Assets, is centered on the left side of the balance sheet form. The title, Current Assets, is listed first at the left side of the balance sheet form. The individual accounts, such as Cash, are indented and their amounts are listed in the first amount column. Individual Accounts Receivables are indented and their amounts are listed in the margin to the left of the first amount column. The total of these is put in the first amount column. The heading, Total Current Assets, is indented and the amount is put in the second amount column. The title, Fixed Assets, is listed at the left side of the balance sheet form. The individual accounts are indented and their amounts are put in the first amount column. The total Fixed Assets is put in the second amount column. Total Current Assets and Total Fixed Assets are added together to arrive at the Total Assets figure. This figure is found in the second money column. Step 3 - Liabilities The amounts for the liabilities section of the balance sheet are taken from the Balance Sheet Credit column of the worksheet. The title, Liabilities, is centred on the left side of the balance sheet form. The title, Current Liabilities, is listed at the left side of the balance sheet form. The individual accounts are indented and their amounts are put in the first amount column. Individual Accounts Payable are indented and their amounts are put in the margin to the left of the first amount column. The total Current Liabilities are put in the second amount column. The title, Long-Term Liabilities, is listed at the left side of the balance sheet form. The individual accounts are indented and their amounts are put in the first amount column. The total Long-Term Liabilities are put in the second amount column. The total Current Liabilities and the total Long-Term Liabilities are added together. The total figure is put in the second amount column. Accounting 10 9 Lesson 9 Step 4 - Owner's Equity The amounts for the Owner's Equity section of the balance sheet are taken from the Balance Sheet Credit column of the worksheet. The amount of the net income is added to (or net loss is subtracted from) the capital. The amount of the drawings is subtracted from the capital. The title, Total Owner's Equity, is indented from the left side. The total figure is put in the second amount column. Total Liabilities and Owner's Equity are added together. The title, Total Liabilities and Owner's Equity, starts at the left side. The total figure is put in the second amount column. Step 5 - Totalling the Sections If the Total Asset figure is equal to the Total Liabilities plus Owner's Equity, put a double line under these two total figures in the second amount column as shown. This double line means that the work is completed and it is assumed to be correct. Remember to put dollar signs ($) in each amount column and individual section. This $ sign is also put beside the final totals. Reviewing the Accounting Cycle The 6 steps in the accounting cycle studied so far are: Accounting 10 10 Lesson 9 Interpreting an Income Statement and a Balance Sheet Study thoroughly the sections "Reviewing Generally Accepted Accounting Principles" and "Explaining Specific Accounting Principles" on pages 184 to 186 in the textbook. What An Income Statement Says • The heading of the income statement tells the reader the name of the business, the name of the financial statement, and the length of the accounting period. • Every income statement follows the matching principle: revenues earned for an accounting period are matched with the expenses incurred for the same period. • The income statement reports the main and secondary sources of revenue earned by the business during the accounting period. The main or primary source of revenue is regular operations of the business that bring in revenue. The secondary source of revenue is a source of revenue which is not part of the regular operations of the business, usually an investment. • Every income statement will report the expenses incurred by the business for the purpose of producing the revenue during an accounting period. Expired costs are expenses to be matched against revenue in the statement. • The last part of the income statement is the reporting of the net income or net loss for the accounting period. Net income consists of more revenue than matched expenses. To obtain net income, the business has increased the dollar amount of assets during the accounting period. Net loss results in more expenses than matched revenue. This means that the total dollar amount of assets must have decreased during the accounting period. For further details, study the material on pages 186 to 188 in the text. Accounting 10 11 Lesson 9 What An Income Statement Does Not Say • An income statement does not predict the net income for any future accounting period. The heading of the income statement reports a fiscal period that has ended. This means that revenue and expenses have already occurred for a past accounting period. • Even if it is well prepared, an income statement does not provide an exact measurement of net income for the period. The statement represents an approximation of net income for the accounting period. • As well, it does not report the so-called "true profit" of any business. Rather, it reports the profits for the accounting period. • Net income does not mean cash. Net income is always the excess of revenue over the related expenses for a specific accounting period. Cash has very little to do with the determination of net income. What A Balance Sheet Says • A balance sheet gives the reader the name of the business as well as the name of the financial statement. This statement also gives the date on which the statement is valid--"as at" a specific date. • A balance sheet summarizes assets, liabilities, and owner's equity as at a specific date. • This statement provides the reader with a view of the firm's financial position as to its ability to pay debts. You would relate current assets to current liabilities. • A balance sheet allows the reader to analyze those economic resources to be used that will bring in revenue for the firm. • This statement does reveal the relative strength of the owner's claim against total assets of the business. • A balance sheet shows whether the investment of the owner has increased or decreased. For further details on these points, study pages 190 and 191 in the text. Accounting 10 12 Lesson 9 What The Balance Sheet Does Not Say • A balance sheet does not report the details of how profits were made by the business. • A balance sheet does not show the claims of creditors and the claims of the owner against specific assets. • The word "Capital" under the owner's equity must not be interpreted as cash. Rather it refers to the owner's claim against total assets through her/his investment. • A balance sheet does not report the market value or "worth" of any business. The "value" of fixed assets is stated in the "cost principle." For further details, study pages 192 and 193 in the text. Remember These Important Points •The worksheet lists all account balances necessary for the preparation of the financial statements. •Balance sheet accounts are all accounts reported in the balance sheet. These include the owner's Drawing account because the owner's withdrawals during the accounting period must be subtracted in the Owner's Equity section of the balance sheet. • Every income statement reports the matching of revenues and expenses for the same accounting period. The net result of this matching is a net income or a net loss for the accounting period that has ended. • Most businesses will have two sources of revenues. The first source is the main one and consists of revenue earned from basic operations. Accounting 10 13 Lesson 9 Many businesses will have secondary-type revenues. These secondary sources of revenue come largely from earning money by holding investments. For example, interest is earned by investing in Government of Canada Bonds. • In the Owner's Equity section of the balance sheet, the Net Income is always added to the Capital before the owner's Drawings are deducted. • Published balance sheets are usually prepared in classified form. • Two common classes of Assets are Current Assets and Fixed Assets. Current assets consist of cash and other assets that are normally converted into cash within one year of the date of the balance sheet. Fixed Assets are those tangible assets which will be used over a long period of time to support the daily operations of the business. They are not intended to be converted into cash. • Two common classes of Liabilities are Current Liabilities and Long-Term Liabilities. Current liabilities are those business debts which are normally paid within a year of the balance sheet date. Long-Term liabilities are those business debts which are normally paid after a period of more than one year from the balance sheet date. • The most common form of reporting balance sheets is the account form because most published balance sheets place Assets on the left page of a report, while Liabilities and Owner's Equity are placed on the right side of the report. • The report form of balance sheet is commonly used when the statement is prepared by hand or by a computer. This form reports the three elements of the accounting equation one below the other. Assets are reported first; followed by Liabilities and finally, by Owner's Equity. • A balance sheet does report the strength of the firm as to its ability to pay off current debts. This "strength" is obtained by comparing the total of current assets with current liabilities. • All fixed assets are reported on a balance sheet on the basis of the dollars used to acquire these assets. Therefore, the "value" of all fixed assets must be at their "cost value" when purchased, and not on the basis of what they are "worth" in the market place. Accounting 10 14 Lesson 9 • Accountants insist on showing the phrase "at cost" opposite the reporting of fixed assets to make sure that readers know that these assets are reported at their cost value. • Two groups of persons are interested in analyzing published financial statements. One group is known as "insiders". These are persons working inside the business as managers. The other group consists of persons outside the business management called "outsiders". Financial statements for outsiders are general in nature. These statements do not report details of every item in the income statement and balance sheet. Do You Understand? Account form - a balance sheet with assets on the left side and the claims against them on the right. Report form - a balance sheet with assets, liabilities, and owner's equity arranged vertically. Classified balance sheet - one in which assets and liabilities are reported under meaningful groups or classes. Current assets - assets which can be converted into cash within one year of the balance sheet's date. Fixed assets - tangible, long lived assets held for use within the firm to support revenuemaking activities for several years beyond the balance sheet date. GAAP for the Cost Principle - all assets purchased by a business must be recorded as follows: (1) The cost of all assets is the original purchase price which is originally agreed upon by the buyer and seller. This price is known as the cost price or cost value. (2) The original cost values of assets must be retained throughout the accounting cycle. Current liabilities - debts owing which will fall due within one year of the balance sheet date. Long-term liabilities - debts which, in the ordinary course of business, are not liquidated within one year of the balance sheet date. Accounting 10 15 Lesson 9 Basic accounting principles - broad accounting guidelines followed by professional accountants in all countries. Specific accounting principles - more specific guidelines followed by accountants in a particular country. CICA Handbook - published by the Canadian Institute of Chartered Accountants, containing specific accounting guidelines for use in Canada. Main or primary source of revenue - regular operations of the business that bring in revenue. Secondary source of revenue - a source of revenue which is not part of the regular operations of the business, usually an investment. Auditors - specialized accountants who conduct an examination of the accounting records and other supporting evidence of a business. Expired costs - expenses to be matched against revenue in the income statement. An income statement - is a historical statement reporting the matching of revenues with related expenses for a period that has ended. The statement reports only a fair approximation of net income for an accounting period. Budgeted income statement - a statement estimating future revenues matched with future expenses in order to predict net income or net loss for some future accounting period. True profit - the difference between total funds invested over the life of the business and funds realized from sale of the business. Accounting entity - the business as a unit distinct from its owner(s), for accounting purposes. Unexpired costs - assets carried forward in the balance sheet to be expired in some future accounting period. Accounting 10 16 Lesson 9 Conclusion The daily transactions of a business are recorded in the journal. They are then classified in the ledgers according to what type of transaction they are. At the end of a financial period, the ledgers are summarized on a 6-column worksheet. The data on the worksheet is finally reported on the financial statement to managers and other decision makers. Self Test 1. P 5-8, page 179 of the text. Use the completed worksheet you did for Problem 5-4 in the Self Test section of Lesson 12 2. MC 5-5, page 180 of the text 3. P 5-10, page 194 of the text 4. MC 5-7, page 196 of the text Accounting 10 17 Lesson 9 P 5-8 Accounting 10 18 Lesson 9 P 5-8 (continued) • Key Figure to Check: Total Assets is $16 243. Accounting 10 19 Lesson 9 MC 5-5b Key Figure to Check: Net Income is $23 145. Accounting 10 20 Lesson 9 Accounting 10 21 Lesson 9 P 5-10a ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── Key Figure to Check: analyze each of the three lines in the given heading. P 5-10b ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── Key Figure to Check: analyze each of the three lines in the given heading. Accounting 10 22 Lesson 9 P 5-10c ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ─────────────────────────────────────────────────────────── ────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── ──────────────────────────────────────────────────── Key Figure to Check: analyze each of the three lines in the given heading. Accounting 10 23 Lesson 9 MC 5-7b Accounting 10 24 Lesson 9 Answers For Self Test P 5-8 J. Edgar Consulting Services Income Statement For the Month Ended November 30, 20__ Revenue: Consulting Fees Earned ............. ............. ............ ............. ............. Expenses: Telephone Expense ..................... ............. ............ ............. ............. Rent Expense ... .......................... ............. ............ ............. ............. Advertising Expense ................... ............. ............ ............. ............. Utilities Expense ......................... ............. ............ ............. ............. Total Expenses .............. ............. ............ ............. ............. Net Income Accounting 10 ............ .......................... ............. ............ ............. ............. 25 $6 300.00 $ 67.00 700.00 350.00 440.00 1 557.00 $4 743.00 Lesson 9 J. Edgar Consulting Services Balance Sheet As at November 30, 20__ Assets Current Assets: Cash ............ .......................... ............. ............ ............. ............. Accounts Receivable: Lambton Industries Ltd. ............ ............ ............. $1 200.00 A. Lee .. .......................... ............. ............ ............. 450.00 Office Supplies . .......................... ............. ............ ............. ............. Total Current Assets .... ............. ............ ............. ............. Fixed Assets (at cost): Office Equipment ........................ ............. ............ ............. ............. Total Assets $9 993.00 1 650.00 1 600.00 $13 243.00 $3 000.00 ............ .......................... ............. ............ ............. ............. Liabilities Current Liabilities: Bank Loan Payable ..................... ............. ............ ............. ............. Accounts Payable: G. Health Suppliers ...... ............. ............ ............. $ 600.00 D. Moyer Computers Ltd. ........... ............ ............. 3 000.00 $16 243.00 $5 000.00 3 600.00 Total Liabilities ............. .......................... ............. ............ ............. ............. Owner's Equity J. Edgar, Capital ............ .......................... ............. ............ ............. ............. Add: Net Income for November................ ............. ............ ............. ............. Less: Withdrawals for November ............ ............. ............ ............. ............. Total Owner's Equity .................. ............. ............ ............. ............. Total Liabilities and Owner's Equity ...... ............. ............ ............. ............. $8 600.00 $3 150.00 4 743.00 7 893.00 250.00 7 643.00 $16 243.00 MC 5-5a A variety of accounting records will enable you to reproduce the worksheet. From the easiest to the most difficult these are: 1. If a formal trial balance was prepared and can be found, then you can transfer that information to the worksheet and complete the worksheet from that point. 2. If no trial balance can be found, then you must go to the ledger and prepare a trial balance. The most efficient method of doing this would be directly to the worksheet that you wish to prepare. Accounting 10 26 Lesson 9 3. If no ledger accounts can be found, then you have a serious problem. You will have to locate a copy of the most recent income statement and balance sheet and reconstruct a ledger from those balances and then post the journal entries again from the last statement date to the present. Now you can prepare a trial balance and complete the worksheet. Because financial statements are typically prepared from the worksheet, as soon as you have the worksheet in place, you will be able to prepare the financial statement. MC 5-5b, c ABC Company Income Statement For the Three Months Ended July 31, 20__ Revenue: Fees Earned ......... .......... .......... .......... ......... .......... Expenses: Heat Expense ........ .......... .......... .......... ......... $4 500.00 Telephone Expense .......... .......... .......... ......... 200.00 Wages Expense ..... .......... .......... .......... ......... 3 750.00 Utilities Expense .. .......... .......... .......... ......... 690.00 Supplies Expense.. .......... .......... .......... ......... 1 315.00 Rent Expense ........ .......... .......... .......... ......... 12 000.00 Total Expenses ..... .......... .......... ......... .......... Net Income (Loss).. ......... .......... .......... .......... ......... .......... Accounting 10 27 $45 600.00 22 455.00 $(23 145.00) Lesson 9 MC 5-5b, c (continued) ABC Company Balance Sheet As at July 31, 20__ Assets Current Assets: Cash .......... ......... .......... .......... .......... ......... $ 3 580.00 Accounts Receivable: P. Bowen .... .......... .......... $350.00 R. McCarty . .......... .......... 895.00 .... 1 245.00 Supplies on Hand . .......... .......... .......... ......... 770.00 Total Current Assets ....... .......... ......... .......... Fixed Assets (at cost): Office Equipment .. .......... .......... .......... ......... $ 6 500.00 Machinery ... ......... .......... .......... .......... ......... 25 900.00 Truck .......... ......... .......... .......... .......... ......... 11 600.00 Total Fixed Assets .......... .......... ......... .......... Total Assets .......... ......... .......... .......... .......... ......... .......... $ 5 595.00 44 000.00 $49 595.00 Liabilities Current Liabilities: Bank Loan Payable ......... .......... .......... ......... Accounts Payable: K W Suppliers....... .......... .......... ......... $13 000.00 2 250.00 Total Liabilities ..... ......... .......... .......... .......... ......... .......... $15 250.00 Owner's Equity Roy Hassen, Capital ........ .......... .......... .......... ......... $16 000.00 Add: Net Income .... ......... .......... .......... .......... ......... 23 145.00 .... ......... 39 145.00 Less: Withdrawals. ......... .......... .......... .......... ......... 4 800.00 Total Owner's Equity ...... .......... .......... ......... .......... Total Liabilities and Owner's Equity ... .......... ......... .......... Accounting 10 28 34 345.00 $49 595.00 Lesson 9 P 5-10a The three-line heading should answer the questions who, what, and when and in that specific order. Who - the name of the company; what - with what type of statement you are dealing; when - some form of date. In this example, all three components are correct. Note that "Statement of Financial Position" is an acceptable substitute for "Balance Sheet" even though this name is not as common. P 5-10b The company name and the name of the statement appear correct in this example. The date line of a Balance Sheet should reflect a point in time. Therefore, it should read "As at January 31, 19__. The correct version should read: Green Thumb Garden and Lawn Comp. Balance Sheet As at January 31, 20__ P 5-10c Statement of Asset Worth is not an acceptable substitute for Balance Sheet. However, you may omit the "As at" in the date line. The correct version should read: Beau's Banquet Business Balance Sheet September 30, 20__ MC 5-7a • The Balance Sheet is not classified. As a result, there is no distinction between current and fixed assets or current and long-term liabilities. • No detail is given regarding how the mortgage is secured and what the rate of interest per annum is. • No detail appears in the Owner's Equity section outlining the net income or net loss for the period. Furthermore, there is no detail on the personal withdrawals of the owner. • Since the Bank Loan Payable account represents a demand loan, this account should be the first liability listed. Accounting 10 29 Lesson 9 MC 5-7b Fantastic Fishing Balance Sheet As at August 31, 20__ Assets Current Assets: Cash .......... ......... .......... .......... .......... ......... .......... Accounts Receivable ........ .......... .......... ......... .......... Office Supplies on Hand .. .......... .......... ......... .......... Total Current Assets ....... .......... ......... .......... Fixed Assets (at cost): Fishing Tackle and Equipment . .......... ......... .......... Fishing Boat (security for mortgage payable) . ......... .......... Total Fixed Assets .......... .......... ......... .......... $ 3 500.00 1 400.00 250.00 $16 200.00 98 000.00 Total Assets .......... ......... .......... .......... .......... ......... .......... $ 5 150.00 114 200.00 $119 350.00 Liabilities Current Liabilities: Bank Loan Payable ......... .......... .......... ......... .......... Accounts Payable.. .......... .......... .......... ......... .......... Current portion of mortgage payable ... ......... .......... Total Current Liabilities . .......... ......... .......... Long Term Liabilities: Mortgage Payable (secured by fishing boat) .. .......... Less: current portion ....... .......... .......... ......... .......... Total Long-Term Liabilities....... ......... .......... Total Liabilities ..... ......... .......... .......... .......... ......... .......... $8 500.00 2 700.00 2 200.00 $13 400.00 $82 000.00 2 200.00 79 800.00 $93 200.00 Owner's Equity M Suzuki, Capital . ......... .......... .......... .......... ......... .......... Add: Net Income .... ......... .......... .......... .......... ......... .......... .......... ......... .......... .......... .......... ......... .......... Less: Withdrawals. ......... .......... .......... .......... ......... .......... Total Owner's Equity ...... .......... .......... ......... .......... Total Liabilities and Owner's Equity ... .......... ......... .......... Accounting 10 30 $15 850.00 12 600.00 28 450.00 2 300.00 26 150.00 $119 350.00 Lesson 9 MC 5-7c i) M. Suzuki is the owner of the business. ii) Yes. Since this is a single proprietorship, the owner is totally responsible for that which the business owns, the assets; and that which it owes to outsiders, the liabilities. iii) The claim of the creditors is equal to the total liabilities, $93 200. This represents 78.8% of the total economic resources of the firm. (93 200/$119 350) iv) The single largest asset by dollar cost is the boat, $98 000. v) The fishing boat has been financed with a mortgage. vi) No. The business has only $4 900 (Cash $3 500 and Accounts Receivable, $1 400) of liquid assets to pay $11 200 of current liabilities (Bank Loan of $8 500 and Accounts Payable of $2 700). If the bank were to call the loan, Suzuki could be in serious financial difficulty. vii) The owner's claim on the economic resources (assets) is equal to $26 150 or 21.9% ($26 150/$119 350). Currently, the owner's claim is weak since 78% of the dollar value of the business belongs to outsiders. viii) The owner's equity section of the balance sheet should disclose the net income (loss) for the last period of time that the related income statement measured. The balance sheet is not designed to show any details regarding the calculation of the net income (profit) of the business. ix) A demand loan means that the bank has the legal right to demand payment at any time that it wishes. The length of time for which the loan was arranged is not a factor if the bank decides to exercise the demand feature and requests that the loan be paid back early. x) No. The Balance Sheet does not report the true worth of the business. To avoid any misunderstanding of the interpretation of a business Balance Sheet, the accounting profession has set out broad guidelines called Generally Accepted Accounting Principles. One basic guideline, followed by accountants throughout the world, is the cost principle. This principle forces readers to realize that assets are reported on the basis of the dollar amounts used to acquire them and not on their present value or so-called worth. Furthermore, the CICA Handbook requires that Fixed Assets be reported at their "cost" to eliminate any misunderstanding. Accounting 10 31 Lesson 9