Taxation Systems - Erie Community College

advertisement

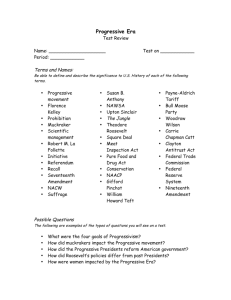

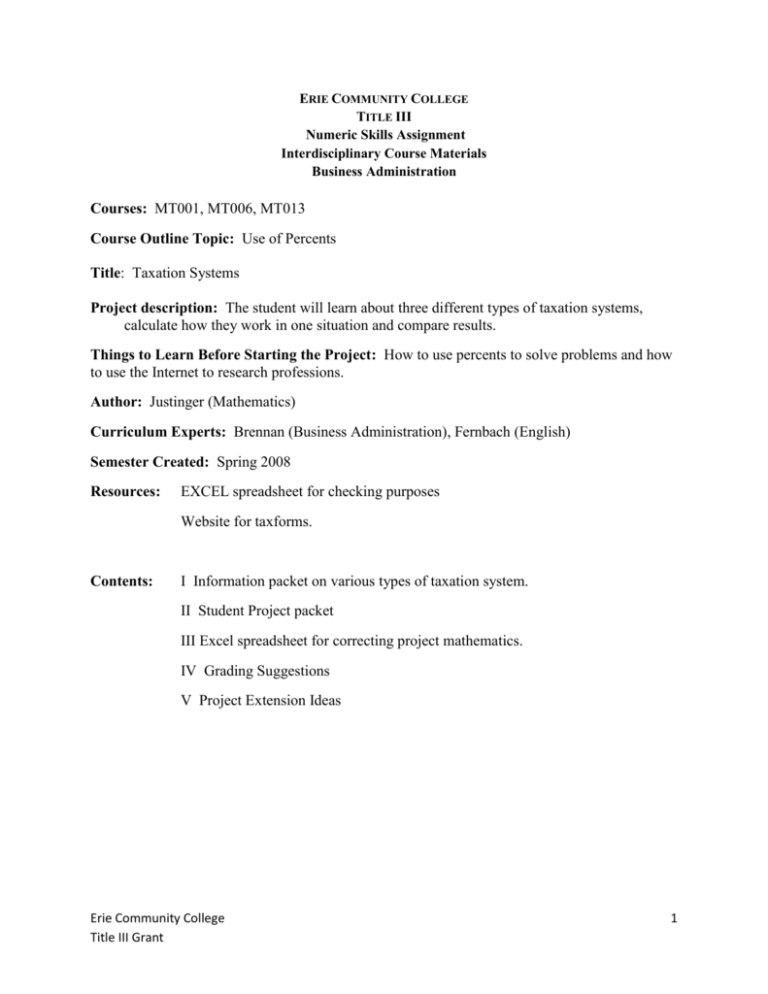

ERIE COMMUNITY COLLEGE TITLE III Numeric Skills Assignment Interdisciplinary Course Materials Business Administration Courses: MT001, MT006, MT013 Course Outline Topic: Use of Percents Title: Taxation Systems Project description: The student will learn about three different types of taxation systems, calculate how they work in one situation and compare results. Things to Learn Before Starting the Project: How to use percents to solve problems and how to use the Internet to research professions. Author: Justinger (Mathematics) Curriculum Experts: Brennan (Business Administration), Fernbach (English) Semester Created: Spring 2008 Resources: EXCEL spreadsheet for checking purposes Website for taxforms. Contents: I Information packet on various types of taxation system. II Student Project packet III Excel spreadsheet for correcting project mathematics. IV Grading Suggestions V Project Extension Ideas Erie Community College Title III Grant 1 Information Packet on Taxation Systems Collecting taxes is the way governments make money to provide services for the common good and to assist special needs. There are various systems for collecting taxes. We will investigate three of those systems. Section I: Types of Tax Systems A) Progressive Proportional Regressive Progressive Income Tax: Our present federal and state taxes are based upon a system where a higher percent of tax is imposed on higher levels of income. Following is an example: 2007 Federal Tax Rate Schedules Note: These tax rate schedules are provided so that you can compute your federal estimated income tax for 2007. To compute your actual income tax, please see the instructions for 2007 Form 1040, 1040A, or 1040EZ as appropriate when they are available. Schedule X — Single If taxable income is over-- But not over-- The tax is: $0 $7,825 10% of the amount over $0 $7,825 $31,850 $782.50 plus 15% of the amount over 7,825 $31,850 $77,100 $4,386.25 plus 25% of the amount over 31,850 $77,100 $160,850 $15,698.75 plus 28% of the amount over 77,100 $160,850 $349,700 $39,148.75 plus 33% of the amount over 160,850 $349,700 no limit $101,469.25 plus 35% of the amount over 349,700 Proportional Tax: A tax where higher levels of income or property are taxed at the same rate as lower levels of income. An example would be local property tax. If the property tax rate is 5%, then the following would apply. House Assessed Value $80,000 $180,000 Erie Community College Title III Grant Taxes Due at 5% Rate $4,000 $9,000 2 Regressive Tax: A tax where higher levels of income are taxed at lower tax rates. Example: Local and State sales taxes. Assume 5% tax rate. Income Amount Spent Taxes Effective Tax Rate $25,000 $25,000 $25,000 x .05 = $1,250 $1,250/$25,000 = 5% $60,000 $53,000 $53,000 x .05= $2,650 $2,650/$60,000 = 4.4% Section 2: Recently, some groups have suggested changes in the Federal Income Tax System. Some of the proposed change include the following plans. National Sales Tax: Replace the entire income tax system with a national sales tax. You would pay your federal taxes whenever you purchased a product or service. This means that the federal government would no longer withhold federal taxes from your paycheck - you get to keep more of what you make. You would no longer need to file federal income tax forms - the federal income tax system would be abolished. All families will receive a monthly tax rebate check if they overpay. This would be considered a regressive tax. For our purposes we will choose 20% as the National Sales Tax Rate. Flat Tax: A true flat tax would provide a greater degree of equity if all income regardless of source would be taxed equally. It would only provide that equity if income from labor, dividends, capital gains, or from any source would be considered taxable income. In additions, it would be necessary to eliminate all deductions or adjustments, credits, etc. without exceptions. A true flat tax is proportional. For our purposes we will choose 20% as the Flat Tax Rate. Progressive Tax: In this situation the tax rate increases as the amount to which the rate is applied increases. The term "progressive tax" describes a distribution effect, which can be applied to any type of tax system (income or consumption) that meets the definition. It is frequently applied in reference to income taxes, where people with more income pay a higher percentage of that income in tax than do those with less income. Our federal and state income tax codes were created in 1916 with a progressive tax structure. Section 3: How do these tax plans compare? Here is an example. John Doe is salaried and makes $60,000 annually. He earned $500 in interest from a savings account at HSBC during 2007. He did not serve in Afghanistan or Iraq and, therefore, received no combat pay. Nor is he eligible for the Earned Income Credit because his earned income is too high. His filing status is single and his tax liability is $8,371. He has already had $4,000 in withholding tax deducted from his pay during the year according to his W-2 form. Therefore, he owes the difference. In addition, of the $60,000 he earned, he calculated that he spent $53,000. The local and state sales tax rate combines to 6.75%. The market value of his home is $300,000 is assessed at 60% of its value at the tax rate of 12%. Under the current Progressive Tax (Federal) Plan: John’s sales tax rate is regressive and his property tax rate is proportional. What is his total tax liability for the year? Erie Community College Title III Grant 3 A. Income tax liability = $8,371 (Form 1040EZ) B. Sales Tax Liability (local and state) = $53,000 x .0675 = $3,578 (rounded) C. Property Tax = $300,000 x .60 = $180,000 x .05 = $9,000 D.Total Tax Liability = $20,949 ($8,371+$3,578+$9,000) Problem 2: What would be his tax liability if congress switched from the progressive tax system to A) Flat Tax or B) National Sales Tax? A) Flat Tax: Income Tax - $60,500 x .20 - $13,000 Property Tax - $9,000 (remains at 5% for local tax) Sales Tax (local and state) - $3,578 (remains at 6.75% for local tax) Total Tax = $24,578 B) National Sales Tax: Income Tax - $53,000 x .20 = $10,600 Property Tax - $9,000 (remains at 5% for local tax) Sales Tax – (local and state) - $3,578 (remains at 6.75 for local tax) Total Tax = $23,178 Summary of Tax Systems Progressive Tax Flat Tax National Sales Tax Income Tax $8,371 $13,000 $10,600 Property Tax $9,000 $9,000 $9,000 Sales Tax $3,578 $3,578 $3,578 Total Tax $20,949 $24,578 $23,178 Note: Difference is result of change at Federal Income Tax Level only Erie Community College Title III Grant 4 Section 4: Changing the tax system is serious business, if such a decision were made some serious questions need to be addressed. Some considerations are: A. B. C. D. E. F. G. H. Is it important to spread tax responsibility equitably? Should everyone pay the same tax rate or should some pay less, some more? Should taxes be more the responsibility of the rich than the poor? Should businesses be taxed more or less than the individual? Are taxes too high? If taxes are lowered, is the amount of money taken in by government changed? If it is changed, how does the government deal with the shortfall? If taxes are too high, does it contribute to government waste? Erie Community College Title III Grant 5 Student Taxation Project Packet Name: __________________________________ Select a profession or career that you would like to pursue. Investigate the average salary for someone in this career. Use this salary to compute your tax liability under each of the three tax plans that were presented. Assume you have savings that earn $350 interest for the year. You have no other income and are not eligible for any earned income credits. You file your Federal Income Tax with single status, but have not had any withheld at work. The amount of income you spent on items that require sales tax is dependent on your income. If you earn between $1 and $20,000 you will spend 99% of your income. If you earn between $20,001 and $50,000 you will spend 92% of your income. If you earn between $50,001 and $100,000 you will spend 88% of your income. If you earn over $100,000 you will spend 85% of your income. The local and state combined sales tax rate is 8.75%. You own a home with a market value of $150000, which is assessed at 65% of its value with a tax rate of 13%. 1. What profession did you choose? _________________________ 2. What is the average salary for this career? _________________________ 3. In the space below give the citation of where you found this information. 4. What percent of your income do you spend on taxable items? _______________________ 5. Complete the tables below to illustrate your tax liability under the various plans. Erie Community College Title III Grant 6 A. Progressive Tax: Type of Tax Show work Income Tax Sales Tax Property Tax What is your tax liability? Total: B. Flat Tax: Type of Tax Income Tax Sales Tax Property Tax Show work What is your tax liability? Total: C. National Sales Tax: Type of Tax Show work Income Tax Sales Tax Property Tax What is your tax liability? Total: D. Summary: Progressive Tax Flat Tax National Sales Tax Income Tax Property Tax Sales Tax Total Tax 6. Which method of collecting tax is the best for you? ______________________ 7. Why? 8. What would be a situation where one of the other systems might be to your advantage? Select one of the other systems and explain under what circumstances it would be beneficial. (Use the back of this sheet or attach a seperate paper if necessary.) Erie Community College Title III Grant 7 Grading Suggestions Grading suggestions are given in percent of total points you wish to assign to this project. Selection a profession and finding the average salary: 5% Listing the citation from where this information was gathered: 10% Mathematical calculations for taxes: 50% Completing summary table: 5% Selecting best method and explaining: 10% Alternate situation: 20% TOTAL: a. b. c. d. 100% Possible Extensions to the Project Have each student give a presentation of their findings either as an oral presentation and/or in poster form. Have a class discussion of the issue. Have a class discussion of which system is most beneficial under which circumstances. Select one of the student projects and calculate at which point each plan is beneficial. Erie Community College Title III Grant 8