1 200 500 1 200 100 5 000

advertisement

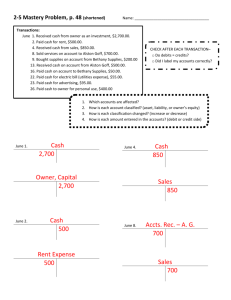

Accounting 10 Module 1 Lesson 4 Accounting 10 1 Lesson 4 Accounting 10 2 Lesson 4 Lesson Four - Using Accounts Read pages 73 to 90 in the textbook. Topics: • Introduction • Establishing Accounts • Recording Asset and Liability Changes in T-Accounts • Remember These Important Points • Do You Understand? • Conclusion • Self Test • Answers for Self Test • Assignment 4 After studying Lesson 4, you should be able to • open a T-account for each asset and liability element found on the opening balance sheet of a service firm that is owned and operated as a single proprietorship. • explain and use the rules for recording increases and decreases in asset and liability accounts. • calculate accurately the balance of any T-Account and indicate whether the balance is debit or credit. Accounting 10 3 Lesson 4 Introduction Recording changes directly on the accounting equation, or preparing a new equation, or a new balance sheet right after each transaction, are inefficient ways to record the daily changes to an asset like Cash, or to any other element in the accounting equation. What is clearly needed is some device to record each increase and decrease to every item under any element within the accounting equation. In the language of accounting, this device is known as the account. An account is a device for recording the effects of transactions under one title. Establishing Accounts Defining Debits and Credits The simplest form of an account is a T-account because it is shaped like a large T. In the language of accounting, the left side of every account is known as the debit side. The right side is known as the credit side. Account Title Debit Side (Dr.) Left Accounting 10 Credit Side (Cr.) Right 4 Lesson 4 Opening Accounts A separate T-account is set up for each element in the accounting equation. The first accounting equation for Stacom Travel follows: Assets = Liabilities + Owner's Equity Accts. Office Bk. Loan Accts. Rob, Ireland Cash Rec. Equip. Furn Payable Pay. Capital L.Baines $28 000 + $1 000 + $11 000 + $10 000 = $10 000 + $10 000 + $30 000 Cash 28 000 Office Equip. 11 000 Accts. Rec./ Lee Baines Bank Loan Pay. 1 000 Furniture 10 000 Accts. Pay. A&B Furn. Co. 10 000 6 000 Rob Ireland, Capital 30 000 Accts. Pay. Office Equip. Co. 4 000 Each account begins with amounts located on the same side as they appear in the beginning accounting equation. These are called opening balances. • All asset accounts will show their beginning balances on the left (debit) side. Assets are located on the left side of the accounting equation. • For the asset Accounts Receivable, the customer's name is written together with the title, Accts. Rec., the abbreviation for Accounts Receivable. • All liability accounts will show their beginning balances on the right (credit) side. Liability accounts are located on the right side of the accounting equation. Accounting 10 5 Lesson 4 • A separate account is opened for each creditor so that the amount that is owed to each can be quickly calculated. Furthermore, notice the abbreviation, Accts. Pay., is placed before the creditor's name to identify it as an account payable. • Since T-accounts are not formal financial reports, dollar signs are not required when recording dollar amounts. Opening the Ledger When accounts are opened for all assets, liabilities, and owner's equity, the entire group forms a record called the ledger. A ledger is defined as a file or a group of accounts. The ledger for Stacom Travel contains all of the accounts of the beginning accounting equation. These were in relation to their position in the accounting equation and the beginning balance sheet. The debit or left-side balances represent the assets in the equation, while the total credit or right-side balances represent the total liabilities plus owner's equity. The balances of the accounts in the ledger will always show that the total debits are equal to the total credits. Accounting 10 6 Lesson 4 Cash 28 000 Accts. Rec./ Lee Baines 1 000 Office Equip. 11 000 Bank Loan Pay. Rob Ireland, Capital 10 000 Accts. Pay. A&B Furn. Co. Furniture 10 000 30 000 Accts. Pay. Office Equip. Co. 6 000 Total Debit (left) Balances: 28 000 1 000 11 000 10 000 Total Credit (right) Balances: 10 000 6 000 4 000 30 000 50 000 (total debits) 50 000 (total credits) = 4 000 This may be shown in the Summary of Ledger Account Balances below: Stacom Travel Summary of Ledger Account Balances as at September 30, 20-Total Debit (Left) Balances Total Credit (Right) Balances Cash Accts. Rec./Lee Baines Office Equipment Furniture $28 000.00 1 000.00 11 000.00 10 000.00 Bank Loan Payable Accts. Pay./A & B Furn. Co. Accts. Pay./Office Equip. Co. Rob Ireland, Capital $10 000.00 6 000.00 4 000.00 30 000.00 Total Debits $50 000.00 Total Credits $50 000.00 Total Assets $50 000.00 Total Liab. + Owner's Equity $50 000.00 Accounting 10 = 7 Lesson 4 Recording Asset and Liability Changes in T-Accounts Rule for Increasing All Accounts: an increase in an account is recorded on the same side that the account appears in the accounting equation. To record increases in asset accounts: an increase in an asset account is recorded on the debit side because assets appear on the left side of the beginning accounting equation. In the language of accounting, recording an amount on the left side is known as debiting the account. To record increases in liability accounts: an increase in a liability account is recorded on the credit side because liabilities appear on the right hand side of the beginning accounting equation. In the language of accounting, recording an amount on the right side is known as crediting the account. Rule for Decreasing All Accounts: a decrease in an account is recorded on the side opposite to that on which the account appears in the beginning accounting equation. To record decreases in asset accounts: a decrease in asset accounts is recorded on the opposite side where the account is placed in the beginning accounting equation. Therefore, use the credit side to record decreases in all asset accounts. + Cash (Debit side) (Credit side) 800 Decrease Increase Accounting 10 - 8 Lesson 4 To record decreases in liability accounts: a decrease in liability accounts is recorded on the opposite side where the account is placed in the beginning accounting equation. Therefore, use the debit side to record decreases in all liability accounts. - Accounts Payable + (Debit side) 100 Decrease (Credit side) Increase Rule for Showing a Normal Balance in an Account: the balance of an account will normally appear on the same side where it is shown in the beginning accounting equation. The difference between the total debits and the total credits is called the account balance. + 10 000 2 000 12 000 Cash 800 200 1 000 - - Accounts Payable + 100 400 $300 credit balance $11 000 debit balance You should know and understand thoroughly the basic rules for increasing and decreasing assets and liabilities shown on page 84 in the textbook. Accounting 10 9 Lesson 4 Illustrating Asset and Liability Changes in T-Accounts For the October transactions for Stacom Travel, the opening balances are recorded in T-accounts. Transaction 1: October 1 - Stacom Travel receives a cheque for $1 000 from Lee Baines in payment of his debt owing to the business. Debit entry: What Happens: The asset Cash increases by $1 000 in the accounting equation. Accounting Rule: To increase an asset, debit the account. Reason: Assets increase on the side where they appear in the accounting equation--the debit side. Accounting Entry: Debit: Cash, $1 000 Credit entry: What Happens: The asset Accts. Rec./Lee Baines decreases by $1 000 in the accounting equation. Accounting Rule: To decrease an asset, credit the account. Reason: Assets decrease on the opposite side where they appear in the accounting equation--the credit side. Accounting Entry: Credit: Accts. Rec./Lee Baines, $1 000 + Cash Dr. (Left) 19__ Sept. 30 28 000 Oct. 1 1 000 Accounting 10 Cr. (Right) - Accounts Receivable + Dr. (Left) Cr. (Right) 19__ 19__ Sept. 30 1 000 Oct. 1 Ø 10 1 000 Lesson 4 Analysis: Two asset accounts are affected. The Cash account must be increased, so the amount must be recorded on the debit side. Since Baines has mailed a cheque to eliminate his debt to Stacom Travel, his asset account must be decreased. Following the rule of decreasing all accounts, the dollar amount of the cheque must be recorded on the credit side of Baines' accounts receivable account. Transaction 2: October 2 - Stacom Travel purchases furniture for $1 000 cash. Debit entry: What Happens: The asset Furniture increases in the accounting equation by $1 000. Accounting Rule: To increase an asset, debit the account. Assets are increased on the same side where they appear in the accounting equation. Accounting Entry: Debit: Furniture, $1 000 Credit entry: What Happens: The asset Cash decreases by $1 000 in the accounting equation. Accounting Rule: To decrease an asset, credit the account. Assets are decreased on the opposite side where they appear in the accounting equation. Accounting 10 11 Lesson 4 Accounting Entry: Credit: Cash, $1 000 + 20__ Sept. 30 Oct. 2 Furniture 10 000 1 000 - + Cash 20__ Sept. 30 28 000 Oct. 1 1 000 + Oct. 2 1 000 Analysis: Two asset accounts are affected by this transaction. Furniture is debited because it is increased; cash is credited because it is decreased. Transaction 3: October 3 - Stacom Travel buys additional equipment costing $1 400 from Nelson Equipment Co. on 60 days' credit. Debit entry: What Happens: The asset Office Equipment increases in the accounting equation by $1 400. Accounting Rule: To increase an asset, debit the account. Assets always increase on the same side where A (assets) appear in the accounting equation. Accounting Entry: Debit: Office Equipment, $1 400 Credit entry: What Happens: Liabilities increase by $1 400 in the accounting equation. Since Nelson Equipment Co. is a new liability, an account must be set up for this creditor. Accounting Rule: To increase a liability, credit the account. Liabilities always increase on the same side where L (liabilities) appear in the accounting equation. Accounting 10 12 Lesson 4 Accounting Entry: Credit: Accts. Pay./Nelson Equipment Co., $1 400 + Office Equipment - - Accts. Pay./Nelson Equip. Co. + 20__ Sept.30 11 000 Oct. 3 1 400 20__ Oct. 3 1 400 Analysis: Office Equipment is debited to record the increase as an asset. Accts. Pay./Nelson Equipment Co. is credited to record the increase to a liability account. Double Entry Principle: for every transaction, the debit entry must be equal to the credit entry. Transaction 4: October 4 - Stacom Travel returns one piece of office equipment costing $400 to Nelson Equipment Co. because the equipment arrived in damaged condition. The creditor has accepted the return of the damaged equipment. Debit entry: What Happens: The liability, Accts. Pay./Nelson Equipment Co. decreases in the accounting equation by $400. Accounting Rule: To decrease a liability, debit the account. All liabilities decrease on the opposite side where L appears in the accounting equation. Accounting Entry: Debit: Accts. Pay./Nelson Equipment Co., $400 Accounting 10 13 Lesson 4 Credit entry: What Happens: The asset Office Equipment decreases in the accounting equation by $400. Accounting Rule: To decrease an asset, credit the account. All assets decrease on the opposite side where A appears in the accounting equation. Accounting Entry: Credit: Office Equipment, $400 - Accts. Pay./Nelson Equip. Co.+ 20__ Oct. 4 400 + Office Equipment 20__ Sept. 30 11 000 Oct. 3 1 400 Oct. 3 1 400 _ 20__ Oct. 4 400 Analysis: The liability, Accts. Pay./Nelson Equipment Co., is decreased; therefore it is debited. The asset, Office Equipment, is decreased; therefore, it is credited. Transaction 5: October 5 - Stacom Travel writes a cheque for $4 000 to Office Equipment Co., an account payable. Debit entry: What Happens: The liability Accts. Pay./ Office Equipment Co. decreases by $4 000 in the accounting equation. Accounting Rule: To decrease an asset, credit the account. All assets decrease on the opposite side where A appears in the accounting equation. Accounting Entry: Debit: Accts. Pay./Office Equipment Co., $4 000 Accounting 10 14 Lesson 4 Credit entry: What Happens: the asset Cash decreases by $4 000 in the accounting equation. Accounting Rule: To decrease an asset, credit the account. All assets decrease on the opposite side where A appears in the accounting equation. Accounting Entry: Credit: Cash, $4 000 Accts. Payable/ - Office Equipment Co. 20__ Oct. 5 4 000 + + 20__ Sept. 30 4 000 Cash - 20__ Sept. 30 28 000 Oct. 1 1 400 20__ Oct. 2 1 000 Oct. 5 4 000 Analysis: The liability, Accts. Pay./Office Equipment Co., is decreased; therefore, it is debited. The asset, Cash, is decreased; therefore, it is credited. Here are four basic rules that will help you to analyze business transactions: 1. Each transaction affects at least two accounts. 2. If only two accounts are affected by a transaction, the debit entry in one account must be equal to the credit entry in the other account. 3. If more than two accounts are affected by a transaction, the total debits must equal the total credits. 4. The debit part of an entry always comes before the credit part. Accounting 10 15 Lesson 4 Remember These Important Points • Since asset accounts are found on the left (debit) side of the accounting equation, an increase to any asset must be recorded by placing the dollar amount on the debit (left) side of the asset account. Any decrease to an asset account must be recorded on the opposite side--the credit side of the asset account. • Since liability accounts are found on the right (credit) side of the accounting equation, an increase to any liability must be recorded by placing the dollar amount on the credit (right) side of the liability account. Any decrease to a liability account must be recorded on the opposite side--the debit side of the liability account. • The difference between debits and credits in any account will result in an amount called the account balance. • The balance of an account will normally appear on the same side where it is shown in the accounting equation. Thus, the normal balance of an asset account will show a debit balance. The normal balance of a liability account will show a credit balance. • Every business transaction will have at least one debit entry and one credit entry. • Debits must always equal credits for every business transaction. Accounting 10 16 Lesson 4 Do You Understand? Account - a device for recording the effects of transactions under one title. Debit - the left side of an account. Credit - the right side of an account. Ledger - a file or group of accounts. Debiting - recording an amount on the left side. Crediting - recording an amount on the right side. Account Balance - the difference between the total debits and the total credits. Double-Entry System - for every transaction, the debit entry or entries must equal the credit entry or entries. Conclusion You learned how to increase and decrease asset and liability accounts. Normal balances were also determined. A very important concept--Double-Entry Accounting--cannot be stressed enough! Self Test 1. P 3-2, page 79 of the text The required balance sheet from P 2-3 follows on page 126. 2. MC 3-1, page 80 of the text 3. P 3-4, page 90 of the text Accounting 10 17 Lesson 4 P 3-2a • T-Account Ledger for Radio Station CHJK Accounting 10 18 Lesson 4 P 3-2b Radio Station CHJK Accounting 10 19 Lesson 4 P 3-4a Cash 5 000 200 300 Accts. Rec./Forrester 700 1 800 500 600 100 Balance _____________ Dr or Cr ____________ 200 Balance_________________ Dr or Cr _______________ Accts. Payable Chayka Corp. Equipment 1 200 000 1 800 300 Balance _____________ Dr or Cr ____________ 200 500 1 200 Supplies 700 200 Balance______________ Dr or Cr_____________ Dale Green, Capital 100 5 600 Balance_________________ Dr or Cr _______________ Balance______________ Dr or Cr_____________ Key Figure to Check: Cash balance is $1 800 debit. P 3-4b Proof of Accounting Equation: Assets $______________ = Liabilities $_____________ + Owner's Equity $_______________ Accounting 10 20 Lesson 4 Answers to Self Test P 3-2a • T-Account Ledger for Radio Station CHJK Cash Land 20__ Nov. 30 20 300 20__ Nov. 30 43 000 Building Transmitter 20__ Nov. 30 68 000 20__ Nov. 30 55 000 Broadcast Equipment Compact Disc Library 20__ Nov. 30 2 825 20__ Nov. 30 Accounts Payable Dwelling Development Bank Loan Payable 20__ Nov. 30 30 000 20__ Nov. 30 40 000 Accounts Payable Ferris Music Centre 20__ Nov. 30 5 500 Accounts Payable Radio Specialty Ltd. 20__ Nov. 30 39 500 5 125 E. Greenwood, Capital 20__ Nov. 30 80 000 Accounting 10 21 Lesson 4 P 3-2b Radio Station CHJK Summary of Ledger Account Balances as at November 30, 20__ Total Debit (Left) Balances Cash ............................ $20 300 Transmitter .................. 55 000 Broadcast Equipment .... 2 825 Compact Disk Library .... 5 500 Building ........................ 68 000 Land .............................. 43 000 Total Credit (Right) Balances Bank Loan Payable................................ $30 000 Accts.Pay./Dwelling Development .......... 40 000 Accts.Pay./Ferris Music Centre ................. 5 125 Accts.Pay./Radio Specialty Ltd. .............. 39 500 E. Greenwood, Capital ............................. 80 000 Total Debits .............. $194 625 Total Credits ........................................ $194 625 Total Assets .............. $194 625 Total Liabilities + Owner's Equity...... $194 625 P 2-3c Radio Station CHJK Balance Sheet as at November 30, 20__ Assets Cash .................................$20 300 Transmitter .......................55 000 Broadcast Equipment .........2 825 Compact Disk Library .........5 500 Building .............................68 000 Land ...................................43 000 Liabilities Bank Loan Payable .......................... $30 000 Accounts Payable: Dwelling Dev. .............. $40 000 Ferris Music Centre......... 5 125 Radio Specialty Ltd. ...... 39 500 ........ 84 625 Total Liabilities............................ $114 625 ________ Total Assets ...................$194 625 Owner's Equity E. Greenwood, Capital ..................... 80 000 Total Liabilities + Owner's Equity . $194 625 Accounting 10 22 Lesson 4 MC 3-1a No. Julian understands that the term debit means left and that the term credit means right. But, he is applying the terminology incorrectly. Using the rule that he has stated, Julian will not be successful in recording business transactions at least half of the time. MC 3-1b The term debit in accounting means left or an entry placed on the left side of an account. The term credit in accounting means right or an entry placed on the right side of an account. MC 3-1c A transaction that will work for Julian would be as follows: The firm bought office supplies on account. The entry for this transaction would be debit Office Supplies and credit Accounts Payable. MC 3-1d A transaction that will not work for Julian would be as follows: Suppose the firm paid an outstanding liability in full by cheque. The entry for this transaction would be debit Accounts Payable and credit Cash. Accounting 10 23 Lesson 4 P 3-4a Cash 5 000 200 300 Accts. Rec./Forrester 700 1 800 500 200 Supplies 200 700 200 600 100 Balance 1800 Dr or Cr Debit Equipment 1 200 1 800 Balance 0 Dr or Cr Nil Balance 500 Dr or Cr Debit Accts. Payable Chayka Corp. Dale Green, Capital 500 600 Balance 3 000 Dr or Cr Debit 1 200 Balance 100 Dr or Cr Credit 100 5 000 300 Balance 5 200 Dr or Cr Credit Proof of Accounting Equation: A = $5 300 = Accounting 10 L + OE $100 + $5 200 24 Lesson 4