Lowes Worksheet

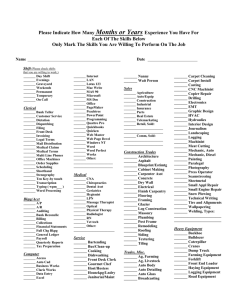

advertisement

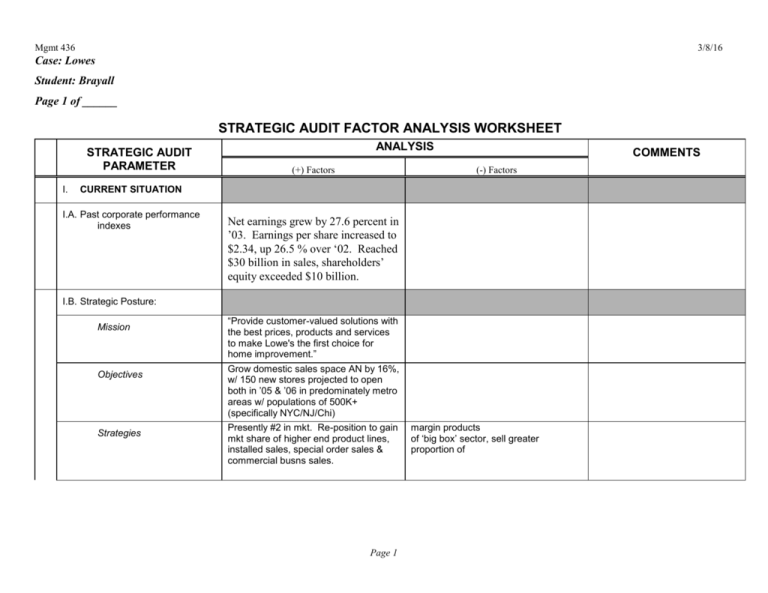

Mgmt 436 3/8/16 Case: Lowes Student: Brayall Page 1 of ______ STRATEGIC AUDIT FACTOR ANALYSIS WORKSHEET STRATEGIC AUDIT PARAMETER I. ANALYSIS (+) Factors COMMENTS (-) Factors CURRENT SITUATION I.A. Past corporate performance indexes Net earnings grew by 27.6 percent in ’03. Earnings per share increased to $2.34, up 26.5 % over ‘02. Reached $30 billion in sales, shareholders’ equity exceeded $10 billion. I.B. Strategic Posture: Mission Objectives Strategies “Provide customer-valued solutions with the best prices, products and services to make Lowe's the first choice for home improvement.” Grow domestic sales space AN by 16%, w/ 150 new stores projected to open both in ’05 & ’06 in predominately metro areas w/ populations of 500K+ (specifically NYC/NJ/Chi) Presently #2 in mkt. Re-position to gain mkt share of higher end product lines, installed sales, special order sales & commercial busns sales. Page 1 margin products of ‘big box’ sector, sell greater proportion of Mgmt 436 3/8/16 Policies Divisions of responsibility, established policies and procedures which include a code of conduct to foster a strong ethical climate enhanced w/ internal audits & improvement suggestions rpt’d to mgmt & the board. Careful selection, training and development of its people & msn, obj & strat are coherent & directed to the same goal. II. Corporate Governance SWOT Begins II.A. Board of Directors Robert L. Tillman Chairman of the Board and Chief Executive Officer, Lowe’s Companies, Inc., Mooresville, NC Robert Niblock named chairman and chief executive officer to take the helm in ’04. Leonard L. Berry, Ph.D. Distinguished Professor of Marketing and M.B. Zale Chair in Retailing and Marketing Leadership, Texas A&M University, College Station, TX Peter C. Browning Non-Executive Chairman of the Board, Nucor Corporation, Dean of McColl Graduate School of Business at Queens University of Charlotte, NC Paul Fulton Chairman of the Board, Bassett Furniture Industries, Bassett, VA Dawn E. Hudson President, PepsiCola Company, Purchase, NY Robert A. Ingram Chairman, OSI Page 2 Mgmt 436 Pharmaceuticals, Inc., Vice Chairman Pharmaceuticals, GlaxoSmithKline, Research Triangle Park, NC Richard K. Lochridge President, Lochridge & Company, Boston, MA 3/8/16 Claudine B. Malone President and Chief Executive Officer, Financial & Management Consulting, Inc., McLean, VA Robert A. Niblock President, Lowe’s Companies, Inc., Mooresville, NC Stephen F. Page Vice Chairman and Chief Financial Officer, United Technologies Corporation, Hartford, CT O. Temple Sloan, Jr. Chairman and Chief Executive Officer, General Parts, Inc., Raleigh, NC II.B. Top Management III. EXTERNAL ENVIRONMENT: [External Factor Analysis Summary, or EFAS] III.A Societal Environment Natural Environment Store expansion strategy may be impacted by environmental Page 3 Mgmt 436 3/8/16 regulations, local zoning issues and delays, availability and development of land, and more stringent land use regulations than we have traditionally experienced as well as the availability of sufficient labor to facilitate our growth. Sociocultural Environment Low mortgages, higher turnover in real state mkt, Do It Your-Selfer’s; ownership and fix-up trends Task Environment (Industry Analysis) #2 in national mkt. Serves appx 10M customers a week at more than 950 home improvement stores in 45 states. III.B. Task/Industry Environment Threat of Entry Threat of Substitution Low to medium national threat due to Home Depot & its mkt share. High costs prohibitive. Highly competitive mkt- Lowes provides over 40,000 products in stock and hundreds of thousands more by special order. Cost & convenience are the factors most Page 4 Mgmt 436 3/8/16 Power of Suppliers easily substituted. reliable supply of inventory at competitive prices and our ability to effectively manage our inventory- Power of Customers “How-To” clinics - “do-it-yourself” expands to more “do-it-for-me” projects, Stakeholders Rivalry Comprehensive employee training, enhanced ‘03, - in service and execution of fundamentals of retailing- financial assistance to attend colleges- diversity and inclusion. CRS - community outreach w/ victims of the disasters Home Depot on ‘Big Box’ scale and local and regional competition in smaller mkts e.g., Building Materials Holdings, House 2 Home. Electronic order placement, Other IV. INTERNAL ENVIRONMENT IV.A. Corporate Structure IV.B. Management Page 5 well-staffed, organized stores and knowledgeable employees who stand ready to provide exceptional customer service Mgmt 436 3/8/16 IV.B. Corporate Culture IV.C. Corporate Resources MC1 Marketing MC2 Finance well-staffed, organized stores and knowledgeable employees who stand ready to provide exceptional customer service “How-To” clinics - “do-it-yourself” expands to more “do-it-for-me” projects. Lowe’s targets three key specialty sales areas: Installed Sales, the Commercial Business Customer and Special Order Sales (SOS). HGTV network. Lowe’s #48 NASCAR. Home Safety Council. Credit programs- driving traffic & purchases. In-store design assistance- Website usability- design help, order & tracking CRS victims of the disasters- 40 in ‘03 Habitat for Humanity- Lowe’s Charitable and Educational Foundation awarded ten $100,000 grants in ’03. Net earnings 2003 increased 28% to $1.9 billion or 6.1% of sales compared to $1.5 billion or 5.6% of sales for 2002. Net earnings for 2002 increased 44% to $1.5 billion or 5.6% of sales compared to $1.0 billion or 4.7% of sales for 2001. share were $2.34 for 2003 compared to $1.85 for 2002 and $1.30 for 2001.Return on beginning assets, defined as net earnings divided by beginning total assets, was 11.7% for 2003, compared to 10.7% for 2002 and 9.0% for 2001, and return 22.6% for 2003, compared to 22.0% for 2002 and 18.6% for 2001.Return on invested capital, defined as net earnings plus The Company’s major market risk exposure is the potential loss arising from the impact of changing interest rates on long-term debt. The Company currently only has fixed rate debt. Has leverage w/ vendors due to volume buys, and better Supply Chain Mgmt (SCM) greater inventory mgmt drove down cost of goods sold. Page 6 Mgmt 436 3/8/16 after-tax interest divided by the sum of beginning debt and equity, was 16.5% for 2003, compared to 15.1% for 2002 and 13.8% for 2001. MC3 Research and Development MC4 Operations & Logistics MC5 Human Resources MC6 Information Systems (IT) Prices low requires us to make substantial investment in new technology & processes whose benefits could take longer than expected and could be difficult to implement. Special Order Service – electronic ordering & ability for customers to monitor until delivery. Nine state-of-the-art regional distribution centers. 50% of goods sold went through these centers- rest were direct shipped. Vendor relationships: 7000 world-wide. Working to direct purchase (cutting out re-purchaser). Efficient distribution is the key to profitably serving small markets and vital to flowing product to high-volume, large markets to maximize sales. Customer oriented that direct their efforts to range of customers- home owners to contractors. Website Kiosks Instore Design Centers / Comp based aides Page 7 Mgmt 436 3/8/16 V. ANALYSIS OF STRATEGIC FACTORS (Strategic Factor Analysis Summary, or SFAS) . V.A S.W.O.T Key Internal and External Strategic Factors. (+) Factors (-) Factors Opportunities Abel to sell related products in different markets all linked by common technology Dominate player in the market Threats Big competition Take over candidate Threat of substitution Communicate better within the organization Integration of sub cultures Leverage real estate and currency rate exchanges Weaknesses Slow to Asia Strengths Little threat of entry Dealing with large competitors Currently growing at 12%-15% Mission statement Vertically integrated Objectives statement Strong management team V.B. Review of Mission and Objectives Mission statement needs to be supported by objectives and actions of the company Page 8 Mgmt 436 3/8/16 STRATEGIC RECOMMENDATIONS VI. STRATEGIC ALTERNATIVES & RECOMMENDED STRATEGY VI.A. Strategic Alternatives Pro/Con ADVANTAGES DISADVANTAGES Alt.1 Alt.2 Alt.3 VI.B. Recommended Strategy Page 9 Mgmt 436 3/8/16 VII. IMPLEMENTATION VIII. EVALUATION AND CONTROL (ASSESSMENT) NOTES: Page 10