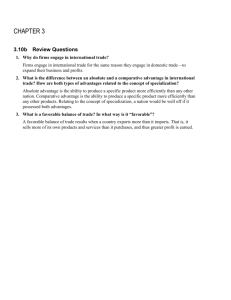

III. trade policies and practices by measure

advertisement