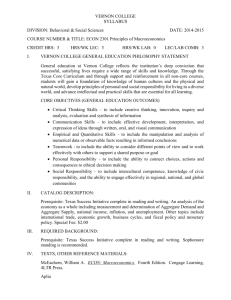

Econ 1010: Macroeconomics

advertisement

Econ 1010 Principles of Macroeconomics Fall 2008 Instructor: Dr. Kim Andrews Office Hours: TR 2:00-3:00, and by appointment e-mail: andrews@ucmo.edu Office: 307-C Dockery Office Phone: 543-4788 Text N. Gregory Mankiw, Principles of Economics, 4th Edition Aplia www.aplia.com This web site will be your source for practice and graded homework assignments. Course Description Principles of Economics 1010 is an introductory course in Macroeconomics. The course introduces the structure, operation, and performance of the U.S. economy. Our investigation of the economy will be both descriptive and analytical. Special emphasis will be given to the measurement of national economic performance, the national economic problems of inflation and unemployment, and the role of the government in conducting national economic policy. You will be introduced to basic concepts and methods of analysis which will be applicable in other courses in economics, business, social science, and humanities. Expected Student Outcomes Student Outcomes are the things that students should know and be able to do after taking a course. The student outcomes for this course are listed in Appendix B. This appendix is in the detailed syllabus posted to Black Board. HCBA Code of Conduct The HCBA Code of Conduct can be found at http://www.ucmo.edu/x9595.xml. This code provides a set of guiding principles that help to create a supportive and ethical educational environment. Please read and be familiar with the seven principles set forth in the code. Course Requirements: Course requirements consist of four exams – including the final exam, homework assignments, and four minimum proficiency quizzes. Each exam, including the final exam, will be worth 100 points. If you miss an exam, you must contact me IMMEDIATELY. If you have a university accepted excuse, the exam may be made up. The make-up exam must be taken within one week of the date the missed exam was given. If you do not have a university accepted excuse, you will take a comprehensive final exam during the time scheduled for this class’s final exam. The points on the comprehensive final will count for the missed exam and for the final exam. If you have a question as to whether your excuse is accepted by the university, please refer to your student planner. It defines absences recognized by the university. The Aplia website will be used for both practice and graded homework assignments. These will be online assignments worth a total of 100 points. Any homework not turned in on time will receive a score of zero. Please note that these assignments will be done online, and the computer is a strict enforcer of the completion deadline. In addition, recall that computers will occasionally experience some problems and downtime. To that end, use your time wisely. Procrastination may result in whining (not mine) and lost points. i.e. the computer being down is not a legitimate excuse for completing a homework assignment late. Please refer to the Aplia student registration sheet for details on how to access the website. Satisfactory completion of four Minimum Proficiency Exams (MPEs) is also required by the Department of Economics and Finance. MPE requirements and procedures are described in detail in Appendix A. Each MPE is worth 10 points, and you will be awarded the score you earn when you initially take the MPE with the class. Any MPE that is not taken initially with the class will receive only a pass or fail score. No points will be awarded. MPEs taken the last week of class will not be graded until finals week. Note: the competencies for each MPE are listed in Appendix C. This appendix is in the detailed syllabus posted to Black Board. Test 1: 100 points Test 2: 100 points Test 3: 100 points Final: 100 points MPEs: 40 points Homework: 100 points Total: 540 points Grades: Grades will be assigned according to the following scale: A 90 – 100% B 80 – 89% C 70 – 79% D 60 – 69% F below 60% Academic Honesty: Cheating of any kind will not be tolerated. If you are unclear as to what constitutes cheating then you should review Central’s policy on academic honesty found in the student planner. COURSE SCHEDULE: This outline is provided for general orientation and is subject to modification during the semester. All reading assignments refer to the course text. Additional readings may be suggested or required during the course. I. Introduction to Economic Analysis Introduction Chapter 1 Ten Fundamentals Chapter 1 Production Possibilities Chapter 2 Interdependence and Trade Chapter 3 Demand Chapter 4 Supply Chapter 4 Market Equilibrium Chapter 4 Applications of the Market Model Chapter 6 (pp. 113-124) Role of Government Lecture 1st HOUR EXAMINATION II. All previous Measuring National Economic Performance National Economic Objectives Lecture Measuring National Economic Performance Chapter 23 Gross Domestic Product (GDP) Chapter 23 Prices and Inflation Chapters 24 & 30 (pp. 675-684) Economic Growth Chapter 25 Unemployment Chapter 28 Long term trends and Business Cycles Lecture 2nd HOUR EXAMINATION All previous III. Elementary Macroeconomic Theory A Simple Macroeconomic Model Chapter 33 Aggregate Demand/Aggregate Supply Chapter 33 Macroeconomic Equilibrium Chapter 33 3rd HOUR EXAMINATION All previous IV. Money and Financial Markets Money Chapter 29 The Federal Reserve System Chapter 29 Monetary Policy Chapter 29 Quantity Theory of Money Chapter 30 (pp. 668-670) V. Stabilization Stabilization Policy Chapters 30 and 34 VI. International Sector International Trade Chapter 9 FINAL EXAMINATION All previous Appendix B Student Outcomes for Econ 1010 Upon completion of each section of material, students should be able to perform the specific tasks listed below. I. 1. 2. 3. 4. 5. 6. Introduction to Economic Analysis Describe the nature and purpose of economic theory and economic models. Identify the relationship between scarcity and various economic problems. Apply the Production Possibilities Model to explain scarcity, opportunity cost, efficiency, and economic growth. Apply the competitive market model to: a. Identify causes of changes in prices and output levels. b. Predict the impact of various changes on prices and output levels. c. Explain the concepts of “market” price and production levels. Identify and evaluate sources and effects of “market failure”. Evaluate the role of government and identify the economic benefit of specified governmental activities. II. Measuring National Economic Performance 1. Explain the economic benefits derived from full employment, general price level stability, economic growth, and stability in the international balance of payments. 2. Describe, interpret, and calculate the following measures of national economic performance: gross national product (real and nominal) unemployment rates inflation rates real and nominal growth rates 3. Explain the behavior of the measures of national economic performance over the business cycle. 4. Use the measures of national economic activity to evaluate the performance of the U.S. economy. 5. Explain and interpret U.S. measures of inflation and unemployment, and explain the consequences of these phenomena from a national economic perspective. III. 1. 2. 3. 6. Elementary Macroeconomic Theory Explain the assumptions and structure of the Aggregate Supply-Aggregate Demand model. Find equilibrium price and income/output using the graphical specification of the Aggregate Supply-Aggregate Demand model. Use the graphical specification of the Aggregate Supply-Aggregate Demand model to evaluate the causes and effects of changes in national economic conditions. Apply the Aggregate Supply-Aggregate Demand and Quantity Theory models to explain the causes of inflation and unemployment. Describe considerations for undertaking macroeconomic stabilization policy IV. 1. 2. 3. 4. 5. Money and Financial Markets Define “money” and explain the process of money creation in the U.S. money and banking system. Describe the structure and operation of the Federal Reserve System. Explain the role and processes of the Federal Reserve System in controlling the U.S. money supply. Evaluate the efficacy of selected monetary policy instruments in controlling the U.S. money supply. Explain the assumptions and structure of the Quantity Theory model. 4. V. Stabilization 1. Describe the tools of fiscal policy and the use of fiscal policy tools to stabilize the national economy. 2. Describe the tools of monetary policy and the use of monetary policy tools to stabilize the national economy. VI. International Sector 1. Use the demand/supply model and the concepts of consumer and producer surplus to describe the impact of trade and trade restrictions on the economy Appendix C MPE Competencies Minimum Proficiency Exam #1 ECON 1010 COMPETENCY: Opportunity Cost/Production Possibilities BACKGROUND: Opportunity cost--the real economic cost of any decision--is fundamental to economic analysis. The Production Possibilities Model portrays opportunity cost in an easily-managed framework to depict and evaluate economic alternatives. To understand more advanced economic concepts, a student must be able to recognize and apply the concept of opportunity cost. Opportunity cost is a real-world phenomenon. The ability to recognize and articulate opportunity cost is essential to understanding individual, business, and public policy decisions. REQUIREMENTS: Read a brief case or vignette which involves production or consumption trade-offs. Apply opportunity cost and Production Possibilities concepts to analyze the reading. PERFORMANCE CRITERIA: 1. Graphically depict production (or consumption) trade-offs in the Production Possibilities framework. 2. Use your graphical depiction to identify opportunity cost, efficient alternatives, inefficient alternatives, and unattainable alternatives. 3. Show shifts in the Production Possibilities Curve that may arise from various possible causes. 4. Recognize and describe opportunity cost from a case scenario. Minimum Proficiency Exam #2 ECON 1010 COMPETENCY: Demand and Supply BACKGROUND: Most economic outcomes in a market oriented economy are determined by the interaction of buyers and sellers. The competitive market model provides a simple yet sound analytical framework for evaluating market outcomes, predicting the impact of policy decisions on market outcomes, and forecasting the influence of changes in buyer and seller behavior on market outcomes. The competitive market model provides a simple tool for evaluating real-world changes in economic activity and for assessing policy changes. Understanding the competitive market model is a prerequisite to understanding other types of market structures. REQUIREMENT: Read a brief case or vignette which involves changes in buyer behavior, seller behavior, or economic policy. Apply the competitive market model to analyze the reading. PERFORMANCE CRITERIA: 1. Recognize and list factors leading to a change in market demand and/or market supply. 2. Graphically depict the market in competitive equilibrium. 3. Graphically depict the impact of the changes described in the reading on the market. 4. Verbally summarize the impact of the changes described in the reading on the market. Minimum Proficiency Exam #3 ECON 1010 COMPETENCY: Inflation and Unemployment BACKGROUND: Inflation and unemployment are the two most significant recurring national economic problems that we try to ameliorate using national economic policy. To understand national economic policy, one must understand the causes, effects, and measurement of inflation and unemployment. REQUIREMENT: Read a brief case or vignette which involves inflation and unemployment. Identify the cause (or type) of inflation (or unemployment) described in the reading. Identify appropriate measures of inflation (or unemployment) that are appropriate to the case. Describe the potential impact of inflation (or unemployment) on national economic wellbeing. Identify changes in inflation and unemployment rates in the context of the business cycle. PERFORMANCE CRITERIA: 1. Identify the cause (or type) of inflation or unemployment. 2. Identify measures of inflation or unemployment appropriate to the case. 3. Identify "economic costs" of inflation and unemployment. 4. Identify parts of the business cycle and describe the behavior of inflation and unemployment rates during each part of the cycle. 5. Calculate inflation and unemployment rates from basic data. Minimum Proficiency Exam #4 ECON 1010 COMPETENCY: Aggregate Demand-Aggregate Supply BACKGROUND: The Aggregate Demand-Aggregate Supply model is a simple yet surprisingly powerful framework for evaluating the causes and effects of long-run and short-run changes in national economic conditions. The model is also well adapted to the analysis of inflation, unemployment, and economic policy. The Aggregate Demand-Aggregate Supply model can be applied to analysis of many national economic issues or modified to accomplish more advanced levels of economic analysis. REQUIREMENT: Read a brief case or vignette which involves national economic performance and/or policy. Use the Aggregate Demand-Aggregate Supply model to evaluate causes and/or effects of changes in national economic conditions as described in the case. PERFORMANCE CRITERIA: 1. Recognize and list factors leading to a change aggregate demand, short-run aggregate supply, and/or long-run aggregate supply. 2. Graphically depict initial national economic conditions (long run and/or short run) using the Aggregate Demand-Aggregate Supply model. 3. Graphically depict the long run and/or short run impact of the changes, including policy impacts, using the Aggregate DemandAggregate Supply model. 4. Verbally summarize the impact of the changes described in the reading on the national economy.